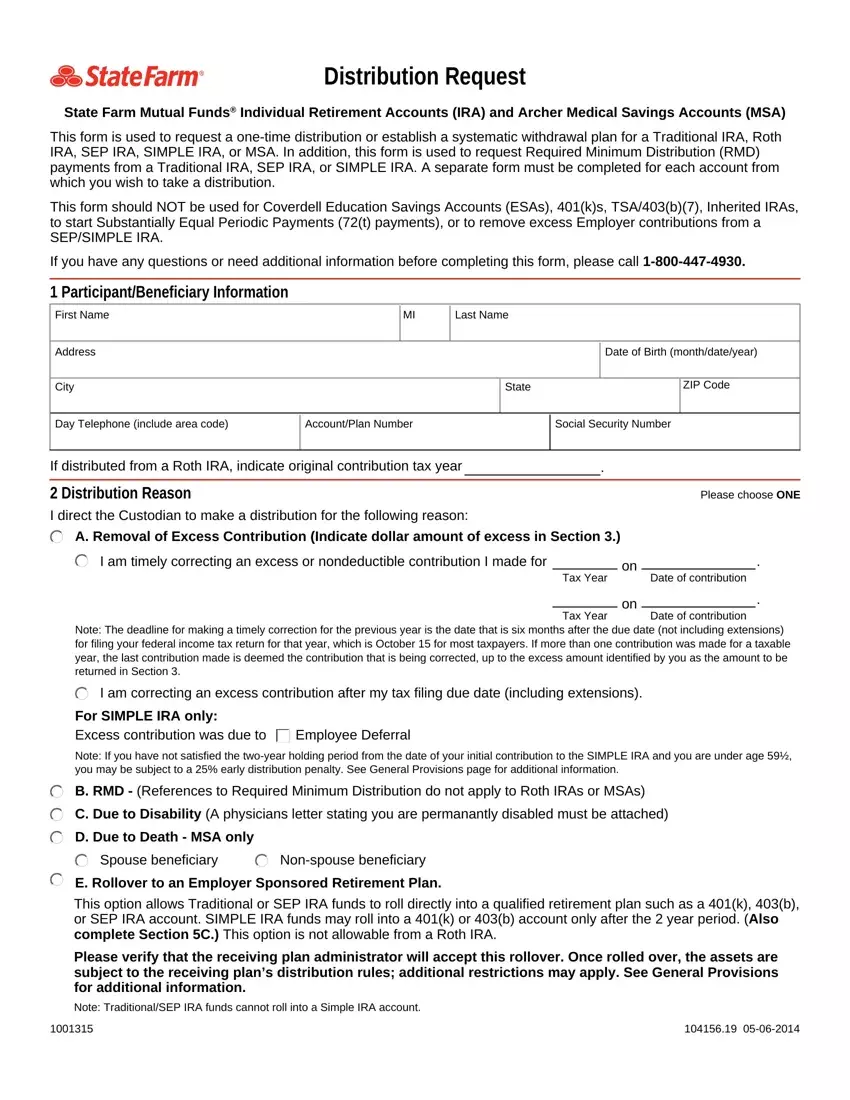

Distribution Request

State Farm Mutual Funds® Individual Retirement Accounts (IRA) and Archer Medical Savings Accounts (MSA)

This form is used to request a one-time distribution or establish a systematic withdrawal plan for a Traditional IRA, Roth IRA, SEP IRA, SIMPLE IRA, or MSA. In addition, this form is used to request Required Minimum Distribution (RMD) payments from a Traditional IRA, SEP IRA, or SIMPLE IRA. A separate form must be completed for each account from which you wish to take a distribution.

This form should NOT be used for Coverdell Education Savings Accounts (ESAs), 401(k)s, TSA/403(b)(7), Inherited IRAs, to start Substantially Equal Periodic Payments (72(t) payments), or to remove excess Employer contributions from a

SEP/SIMPLE IRA.

If you have any questions or need additional information before completing this form, please call 1-800-447-4930.

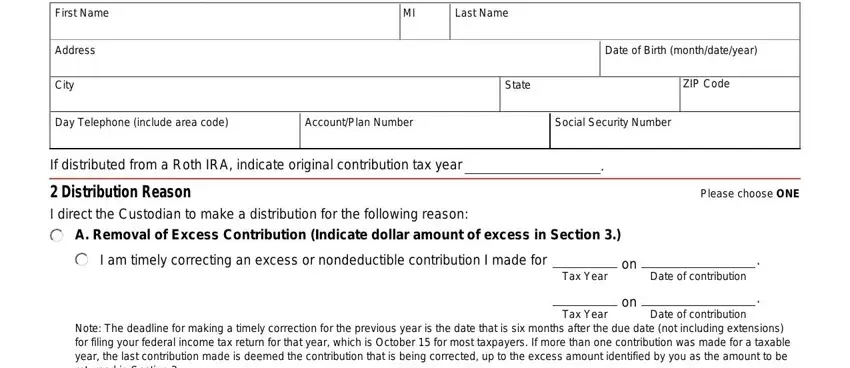

1 Participant/Beneficiary Information

First Name |

|

MI |

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

Date of Birth (month/date/year) |

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

|

ZIP Code |

|

|

|

|

|

|

|

|

Day Telephone (include area code) |

Account/Plan Number |

|

|

|

Social Security Number |

|

|

|

|

|

|

If distributed from a Roth IRA, indicate original contribution tax year |

. |

|

|

|

|

|

|

|

|

|

|

2 Distribution Reason |

|

|

|

|

|

|

|

Please choose ONE |

I direct the Custodian to make a distribution for the following reason:

A. Removal of Excess Contribution (Indicate dollar amount of excess in Section 3.)

I am timely correcting an excess or nondeductible contribution I made for |

|

on |

|

. |

|

Tax Year |

Date of contribution |

|

|

on |

|

. |

|

Tax Year |

Date of contribution |

Note: The deadline for making a timely correction for the previous year is the date that is six months after the due date (not including extensions) for filing your federal income tax return for that year, which is October 15 for most taxpayers. If more than one contribution was made for a taxable year, the last contribution made is deemed the contribution that is being corrected, up to the excess amount identified by you as the amount to be returned in Section 3.

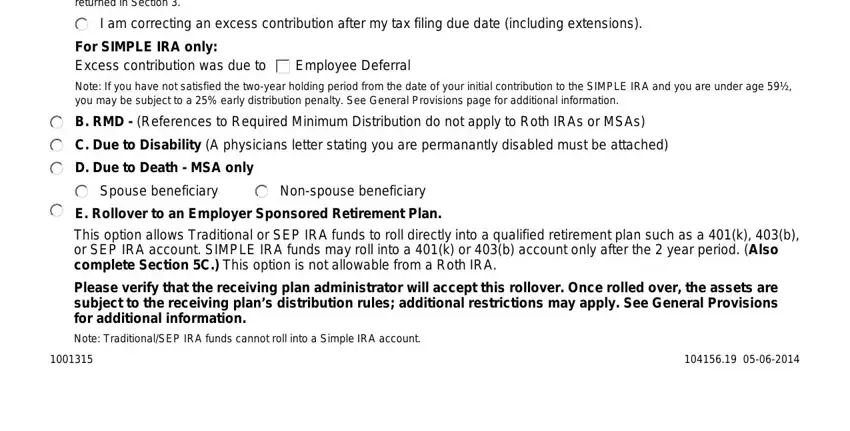

I am correcting an excess contribution after my tax filing due date (including extensions).

For SIMPLE IRA only:

Excess contribution was due to  Employee Deferral

Employee Deferral

Note: If you have not satisfied the two-year holding period from the date of your initial contribution to the SIMPLE IRA and you are under age 59½, you may be subject to a 25% early distribution penalty. See General Provisions page for additional information.

B. RMD - (References to Required Minimum Distribution do not apply to Roth IRAs or MSAs)

C. Due to Disability (A physicians letter stating you are permanantly disabled must be attached)

D. Due to Death - MSA only

Spouse beneficiary |

Non-spouse beneficiary |

E. Rollover to an Employer Sponsored Retirement Plan.

This option allows Traditional or SEP IRA funds to roll directly into a qualified retirement plan such as a 401(k), 403(b), or SEP IRA account. SIMPLE IRA funds may roll into a 401(k) or 403(b) account only after the 2 year period. (Also complete Section 5C.) This option is not allowable from a Roth IRA.

Please verify that the receiving plan administrator will accept this rollover. Once rolled over, the assets are subject to the receiving plan’s distribution rules; additional restrictions may apply. See General Provisions for additional information.

Note: Traditional/SEP IRA funds cannot roll into a Simple IRA account. |

|

1001315 |

104156.19 05-06-2014 |

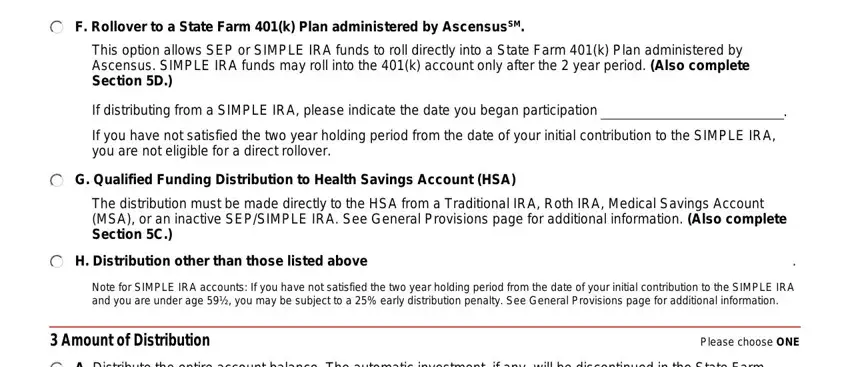

F. Rollover to a State Farm 401(k) Plan administered by AscensusSM.

This option allows SEP or SIMPLE IRA funds to roll directly into a State Farm 401(k) Plan administered by Ascensus. SIMPLE IRA funds may roll into the 401(k) account only after the 2 year period. (Also complete

Section 5D.)

If distributing from a SIMPLE IRA, please indicate the date you began participation |

|

. |

If you have not satisfied the two year holding period from the date of your initial contribution to the SIMPLE IRA, you are not eligible for a direct rollover.

G. Qualified Funding Distribution to Health Savings Account (HSA)

The distribution must be made directly to the HSA from a Traditional IRA, Roth IRA, Medical Savings Account (MSA), or an inactive SEP/SIMPLE IRA. See General Provisions page for additional information. (Also complete

Section 5C.)

H. Distribution other than those listed above |

. |

Note for SIMPLE IRA accounts: If you have not satisfied the two year holding period from the date of your initial contribution to the SIMPLE IRA and you are under age 59½, you may be subject to a 25% early distribution penalty. See General Provisions page for additional information.

A. Distribute the entire account balance. The automatic investment, if any, will be discontinued in the State Farm Mutual Funds account you are distributing from. To continue your current automatic investment or change the amount and/or fund, please call 1-800-447-4930.

OR

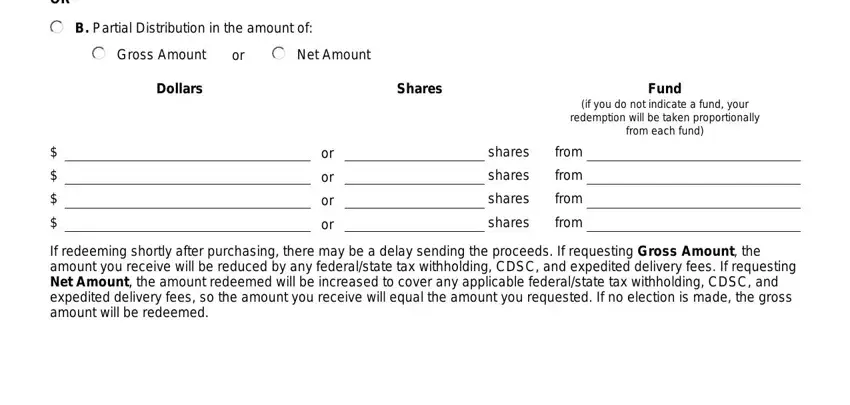

B. Partial Distribution in the amount of:

Gross Amount |

or |

Net Amount |

|

Dollars |

|

Shares |

Fund |

(if you do not indicate a fund, your

redemption will be taken proportionally

from each fund)

$ |

|

or |

|

shares |

from |

$ |

|

or |

|

shares |

from |

$ |

|

or |

|

shares |

from |

$ |

|

or |

|

shares |

from |

If redeeming shortly after purchasing, there may be a delay sending the proceeds. If requesting Gross Amount, the amount you receive will be reduced by any federal/state tax withholding, CDSC, and expedited delivery fees. If requesting Net Amount, the amount redeemed will be increased to cover any applicable federal/state tax withholding, CDSC, and expedited delivery fees, so the amount you receive will equal the amount you requested. If no election is made, the gross amount will be redeemed.

1001315 |

104156.19 05-06-2014 |

4 Instructions for Systematic Withdrawals

You must own shares of the Fund indicated with a current value of at least $5,000 before establishing this service. The $5,000 balance requirement does not apply if you are withdrawing your required minimum distribution or systematically exchanging between funds within the same account. We will begin your systematic withdrawal as soon as possible upon receipt of this form.

Please indicate if you have an Automatic Investment Plan (AIP) or payroll deduction.

I understand it will be stopped once the systematic withdrawal plan is established.

New Request |

or |

Change Existing Systematic Withdrawal to the following: |

Frequency: (choose one) |

Monthly |

Quarterly |

Semi-Annually |

Annually |

|

|

|

(Jan., April, July, Oct.) |

(Jan. and July) |

Indicate Month |

Day of the month to withdraw

Note: Unless specified, withdrawals will be made on the 10th calendar day of the month. If the 10th or the day you select is a non-business day, withdrawals will be made the prior business day unless the day selected falls on the first day of the period. In these circumstances withdrawals will be processed the following business day. Payment method is check or EFT.

Installment Type (Choose all that apply):

A. Installments for the amount of the RMD calculated by State Farm Investment Management Corp. (SFIMC), on

behalf of State Farm Bank® for each fund position beginning in |

|

|

, |

|

|

|

|

. |

|

Month |

|

Year |

|

|

|

|

|

|

|

B. Distribute the entire account over a period of |

|

years beginning in |

|

|

|

|

, |

|

|

. |

|

|

|

|

|

Month |

|

|

|

Year |

C. NON-RMD withdrawal plans or withdrawal plans in addition to your RMD:

|

Installments beginning on |

|

|

|

, |

|

in the amount of ($100 minimum): |

|

|

Month |

|

Year |

|

|

|

Dollars |

|

Shares |

|

Fund |

$ |

|

|

or |

|

|

|

shares |

from |

|

$ |

|

|

or |

|

|

|

shares |

from |

|

$ |

|

|

or |

|

|

|

shares |

from |

|

$ |

|

|

or |

|

|

|

shares |

from |

|

5 Method of Payment |

|

|

Please choose ONE |

A. Invest proceeds into my State Farm Mutual Fund Account # |

Fund |

B. Cash Distribution |

|

|

|

Make check payable to Participant and mail to address of record. Allow 10 days to receive check using standard mail.

Express mail to address of record - available for distributions of $1,000 or more. Delivery is generally within 2-3 business days. A $15 fee will be deducted from your redemption proceeds. Not available for systematic withdrawals.

Make check payable to a third party (For this method a signature guarantee is required in Section 8)

Make check payable to:

Mail check to:

Electronic Funds Transfer (EFT) redemption proceeds are usually deposited to designated bank account within 2 or 3 business days after processing the redemption request. (The electronic funds transfer will not be granted unless a voided check is attached or is on file.) Please tape voided check on the following page.

Wire Transfer - available for distributions of $1,000 or more. Redemption proceeds are usually deposited to designated bank account within 1-2 days after receipt of request. A $15 fee will be deducted from your redemption proceeds. Your bank may also charge a fee for the incoming wire transfer. If you provide inaccurate or incomplete information, your proceeds will be delayed. State Farm® will not be responsible for reimbursement of overdraft fees which result from wire delays due to missing or incomplete information. The wire transfer will not be granted unless a voided check is attached or is on file. Not available with systematic withdrawals. Please tape voided check on the following page.

1001315 |

104156.19 05-06-2014 |

You must contact your bank to obtain correct wire instructions, including your bank account number and special wire transfer routing number (this may be different than the routing number for your account).

Name of Bank |

Wire Transfer Routing Number |

Payee Account Number |

For Further Credit to (if applicable) |

By signing this form, I authorize State Farm Investment Management Corp. (“SFIMC”), on behalf of State Farm Bank, to transfer funds from the above mentioned mutual fund account/plan number to my bank/credit union (“Depository”) account via electronic funds transfer (if so selected). I also authorize SFIMC to initiate (if necessary) adjustments with a debit or credit to my Depository account and/or mutual fund account/plan number for any previous transfers made in error. The EFT remains in effect until SFIMC receives written notification from the Participant/Beneficiary completing this form of its revocation at a time that affords SFIMC a reasonable opportunity to implement the request, or until cancelled by SFIMC or Depository.

|

|

|

Checking Account |

Savings Account |

|

|

|

|

|

|

One Time Use Only. This account will |

Replace any bank account |

Add this bank account and do not |

not be retained for future use. |

already on file |

delete any on file pre-existing bank |

|

|

|

|

|

account (default) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5302 11st St. |

|

000 |

|

|

|

|

|

|

Joe Doe |

|

|

|

|

|

|

|

|

|

|

Anywhere, USA 12345 |

VOID |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Please tape your voided check here.

STARTER AND COUNTER CHECKS WILL BE REJECTED

Important: For checking accounts, a voided check is required. For savings accounts, a deposit slip with information necessary to complete electronic

funds transfers including: routing number, account number and account registration is required or documentation with complete information on your bank’s letterhead.

Note: If the Mutual Fund Account owner(s) and the Depository account owner(s) are different, please have each Mutual Fund account owner and at least one Depository account owner sign below and have all signatures notarized; otherwise, the Applicant’s/Mutual Fund account owner’s signature at the end of this form authorizes the EFT.

Mutual Fund Account Owner’s Signature |

|

Depository Account Owner’s Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Fund Account Owner’s Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

State of |

|

|

County of |

|

|

|

|

|

|

|

|

Subscribed and sworn to before me this |

day of |

, |

. |

|

|

|

|

|

|

|

|

|

Month |

|

|

|

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notary Public |

|

|

|

|

|

|

|

|

|

|

|

|

|

My Commission Expires: |

, |

|

|

|

. |

|

|

|

|

|

|

|

Month, Day |

|

|

|

|

Year |

|

|

|

|

|

|

|

1001315 |

|

|

|

|

|

|

|

|

|

|

|

|

104156.19 05-06-2014 |

C. Rollover to Qualified Retirement Plan sponsored by your employer. Also complete for a Roth/Traditional IRA qualified funding distribution to your HSA account. This check will be made payable to the new Financial Institution or Plan FBO Participant Name and will be sent directly to the new institution or plan. Please provide the required information below. (For this method a signature guarantee is required in Section 8.)

Receiving Financial Institution or Plan Name

FBO

Participant Name |

New Account Number (if known) |

Receiving Financial Institution or Plan mailing address:

D. Rollover to State Farm 401(k) Plan administered by Ascensus. This check will be made payable to Frontier Trust Company FBO Participant Name and will be sent directly to the plan sponsor. (Signature guarantee is not required.) Please provide the required mailing information below:

Plan Sponsor mailing address:

6 Withholding Election - Does not Apply to MSAs

The taxable portion of your proceeds may be subject to federal income tax withholding, at a rate of at least 10%, and state income tax withholding, if applicable to your state of residence, unless you elect for federal and state withholding not to apply. If you elect not to have withholding apply or do not have enough tax withheld, you may be responsible for payment of estimated taxes, and there may be tax penalties if your withholding and estimated payments are not sufficient. You may change this withholding election by checking the appropriate box below. This election will remain in effect on distributions taken according to the systematic withdrawal plan from your IRA until revoked by you, if applicable.

Federal Income Tax Withholding – If you do NOT check one box, State Farm Bank* is required to withhold 10% of the distribution from all IRAs except MSAs and Roth IRAs. If you want withholding on a Roth IRA the box must be completed.

Choose One

Do not withhold federal income tax.

Skip to Section 7. Some states require state withholding even if federal is not withheld.

Withhold federal income tax at a rate of |

|

% (not less than 10%) |

State Income Tax Withholding — If you have questions regarding state withholding, contact your tax advisor or your state’s taxing authority. If federal tax is withheld, State Farm Bank will withhold at least the minimum amount required by your state unless you specify a higher amount below. Some states require state withholding even if federal is not withheld. (Note: State Farm Bank will only withhold if you live in a state that requires us to withhold.)

Choose One (Complete only if you elected to have federal income tax withheld.)

Do not withhold state income tax. I understand this election will not apply in states that do not permit persons to elect out of withholding.

Withhold my state’s minimum requirement. |

|

Withhold this amount $ |

. (We will withhold at least your state’s minimum requirement.) |

*State Farm Investment Management Corp. (“SFIMC”) withholds taxes on behalf of State Farm Bank.

1001315 |

104156.19 05-06-2014 |

7 Signature

I certify that I am the proper party to receive distributions from this account. All decisions regarding this withdrawal are my own. I understand that it is my sole responsibility to ensure compliance with the distribution regulations governing my account(s).

By signing below, I/we, my/our agents, heirs, executors, administrators and assigns (each an “Indemnifying Party”) agree to jointly and severally indemnify and hold harmless State Farm Investment Management Corp., State Farm VP Management Corp., State Farm Mutual Fund Trust, State Farm Associates’ Funds Trust, State Farm Variable Product Trust, all affiliated companies, all assigns, and their officers, directors, representatives, employees and agents from and against any claim, liability, expense, tax ramification, or loss incurred by a third party which in any way arises out of an Indemnifying Party’s misrepresentation, negligent or intentional act, or omission in any way connected with this Account/ Plan.

By signing below, I/we, my/our agents, heirs, executors, administrators and assigns (each a “Releasor”) agree to release and discharge State Farm Investment Management Corp., State Farm VP Management Corp., State Farm Mutual Fund Trust, State Farm Associates’ Funds Trust, State Farm Variable Product Trust, all affiliated companies, all assigns, and their officers, directors, representatives, employees and agents from and against any and all claims of any kind whatsoever a Releasor has which may in any way arise out of a Releasor’s misrepresentation, negligent or intentional act, or omission in any way connected with this Account/Plan.

Participant or Beneficiary Signature |

Date |

8 Signature Guarantee

A signature guarantee is required if the distribution is over $100,000 or if the check is made payable to someone other than the shareowner or mailed to an address other than the address of record. A signature guarantee is written representation signed by an officer or authorized employee of the guarantor, showing that the signature of the shareowner is genuine. Your Registered State Farm Agent can assist with providing a signature guarantee. Or, you may take this form to a bank, broker-dealer or other authorized guarantor to have your signature guaranteed. A notary cannot be accepted.

Note: Signature guarantee requirements are waived if State Farm is the receiving company for the direct rollover.

Authorized Guarantor’s Signature |

Date |

1001315 |

104156.19 05-06-2014 |

General Provisions

You may want to seek tax advice regarding your particular distribution situation.

Tax Penalties for Early Distributions - Because IRAs are intended to be used for income during retirement years, withdrawals that you make from your IRA before you reach age 59½ are generally subject to a federal income tax penalty. The penalty is 10% of the taxable portion of your distribution. The penalty tax may not apply in limited situations. Please see your State Farm Mutual Funds IRA Disclosure Statement and consult your tax advisor to determine the tax consequences, if any, of this distribution.

SIMPLE IRA - If you have not satisfied the 2 year holding period from the date of your initial contribution to the SIMPLE IRA to the date of the distribution and you are under age 59½, you may be subject to a 25% early distribution penalty. In addition, if you elect to rollover a SIMPLE IRA to another employer sponsored retirement plan and you have not satisfied the 2 year holding period from the date of your initial contribution to the SIMPLE IRA, you are not eligible for the direct rollover. A transfer from a SIMPLE IRA to another SIMPLE IRA before the 2 year period qualifies as a tax-free transfer.

MSA - A withdrawal from your MSA for non-qualified medical expenses prior to disability, death, age 65, or Medicare eligibility is subject to income tax and a 20% penalty tax. Upon disability, death, age 65, or Medicare eligibility, funds can be withdrawn for non-qualified medical expenses without penalty, but are still subject to income tax. See your State Farm Mutual Funds MSA Disclosure Statement and consult your tax advisor for further information and to determine whether expenses are qualified medical expenses.

Removal of Excess Contribution - State Farm will calculate Net Income Attributable (NIA) per Internal Revenue Service (IRS) regulations. The amount withdrawn will be more or less than the original contribution, depending on investment gain/loss.

RMD - You must take an RMD in each calendar year following the year you attain age 70½. If the installment amount is less than the RMD, State Farm Bank as Custodian shall not be responsible for any tax penalties or other damages that result from a failure to make distributions in accordance with minimum distribution rules. You may, at any time, increase or decrease your installment payments. Your request to change your distribution method must be made to SFIMC, on behalf of State Farm Bank, in a form acceptable to SFIMC.

IRA or MSA Qualified Funding Distribution to HSA - Generally only one qualified funding distribution is allowed during the lifetime of an individual. The distribution amount is limited to your HSA maximum contribution for the current year. See your tax advisor or review IRS Publication 969 for additional important information.

Additional Information

Further information concerning distributions can be obtained by contacting the Internal Revenue Service directly or at www.IRS.gov. Helpful IRS publications include Publication 590 – Individual Retirement Arrangements (IRAs), IRS Publication 560 – Retirement Plans for Small Business (SEP, SIMPLE, and Qualified Plans), and IRS Publication 969 – Health Savings Accounts and Other Tax-Favored Health Plans.

Instructions

This form may be faxed (816-471-4832) only if the following conditions are met:

1.The check is made payable to the participant and mailed to the address of record, or if requesting the EFT option in Section 5 and these privileges have already been established.

2.This distribution is for $100,000 or less and a signature guarantee is not required.

3.Notarized signatures are not required in Section 5.

Mail completed form to:

State Farm Mutual Funds

PO Box 219548

Kansas City, Missouri 64121-9548

State Farm Mutual Funds are not insurance products and are available through State Farm VP Management Corp., 1 State Farm Plaza, Bloomington, Illinois 61710-0001,1-800-447-4930 (1-800-447-0740 for Associates). Securities products are not FDIC insured, are not guaranteed by any bank and are subject to investment risk, including possible loss of principal.

1001315 |

104156.19 05-06-2014 |

Employee Deferral

Employee Deferral