If you wish to fill out georgia pdf search, you won't have to install any kind of applications - simply try our online tool. FormsPal development team is always endeavoring to enhance the tool and make it even better for people with its multiple functions. Take your experience to another level with constantly improving and unique opportunities we provide! Starting is easy! All you have to do is adhere to the following easy steps below:

Step 1: First, open the editor by pressing the "Get Form Button" at the top of this webpage.

Step 2: The tool provides the opportunity to customize PDF files in a variety of ways. Change it with customized text, correct existing content, and place in a signature - all possible within a few minutes!

It will be straightforward to fill out the document with our helpful tutorial! Here's what you should do:

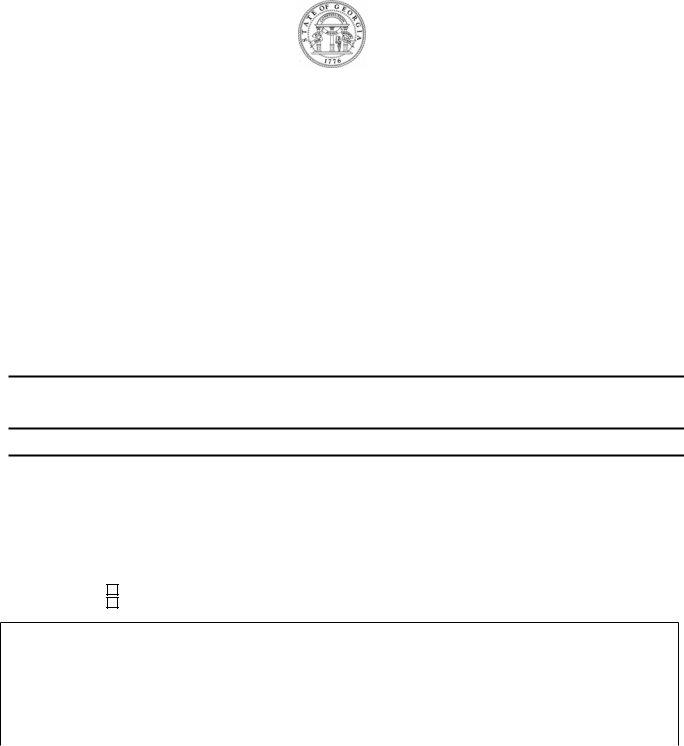

1. Start completing the georgia pdf search with a selection of necessary blanks. Gather all of the necessary information and ensure there is nothing overlooked!

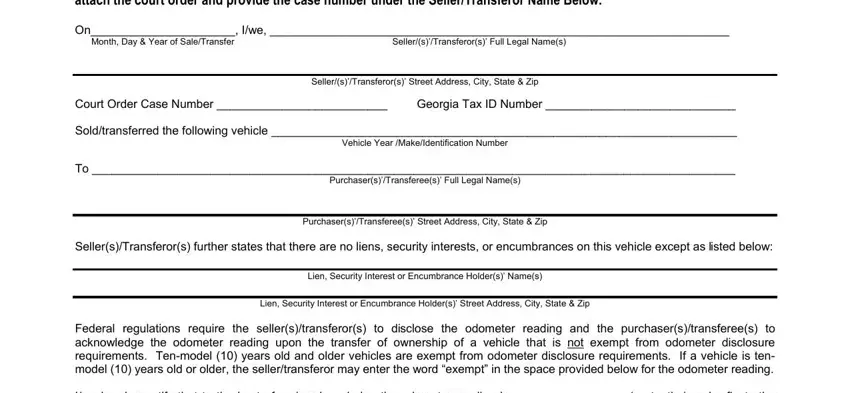

2. Once your current task is complete, take the next step – fill out all of these fields - Iwe hereby certify that to the, The mileage on the vehicle is in, The Information in this Section is, Purchase Price Cash price plus, PurchasersTransferees Signatures, Sellers Transferors Signatures, PurchasersTransferees Printed, SellersTransferors Printed Names, Sellers GEORGIA Sales Tax Number, and Effective January a Georgia with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

When it comes to SellersTransferors Printed Names and PurchasersTransferees Printed, be sure you get them right in this section. Both of these could be the key ones in this PDF.

Step 3: Once you have glanced through the information entered, just click "Done" to finalize your form at FormsPal. After registering afree trial account here, you will be able to download georgia pdf search or email it right off. The PDF file will also be at your disposal in your personal account page with your adjustments. FormsPal guarantees your information privacy by using a protected method that never saves or distributes any personal information used in the form. Be assured knowing your paperwork are kept confidential any time you work with our editor!