We have used the efforts of the best programmers to make the PDF editor you are going to make use of. Our software allows you to create the wage statement ga document with ease and don’t waste time. Everything you should do is keep up with the following easy tips.

Step 1: Choose the button "Get Form Here".

Step 2: You are now free to edit wage statement ga. You possess many options thanks to our multifunctional toolbar - you'll be able to add, eliminate, or alter the information, highlight its selected parts, as well as undertake other sorts of commands.

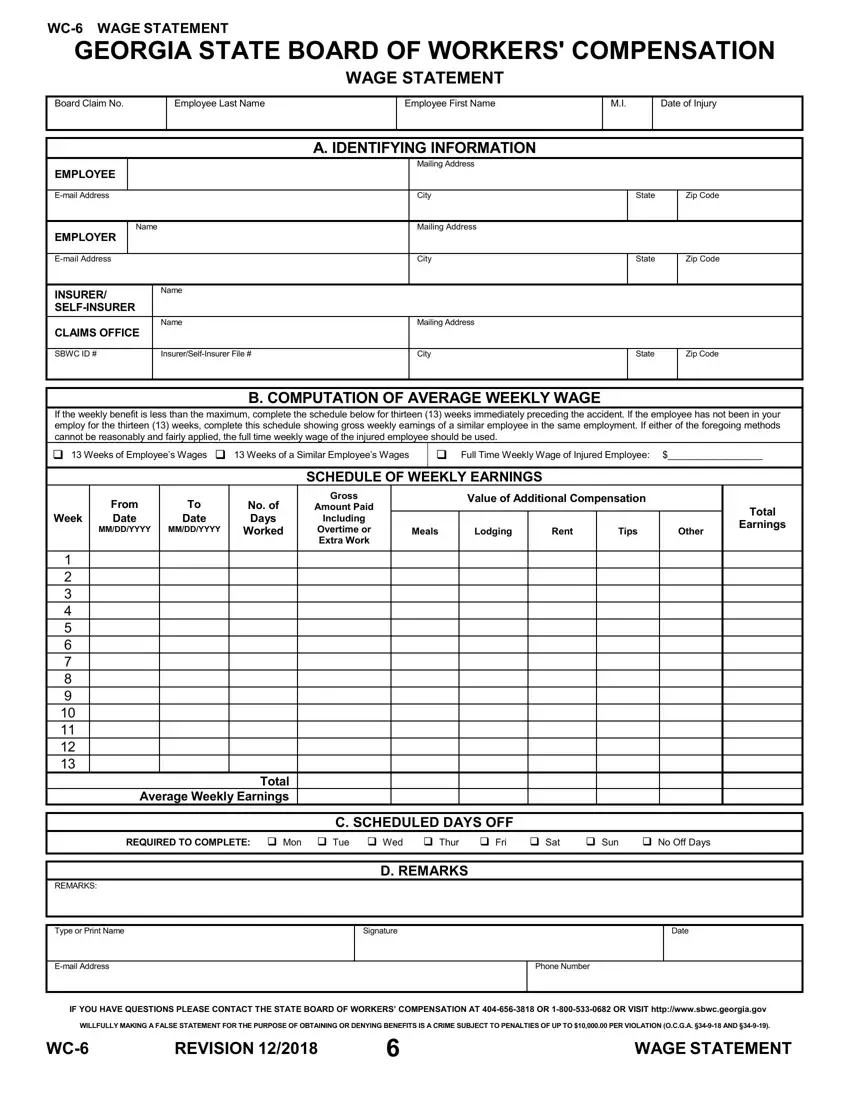

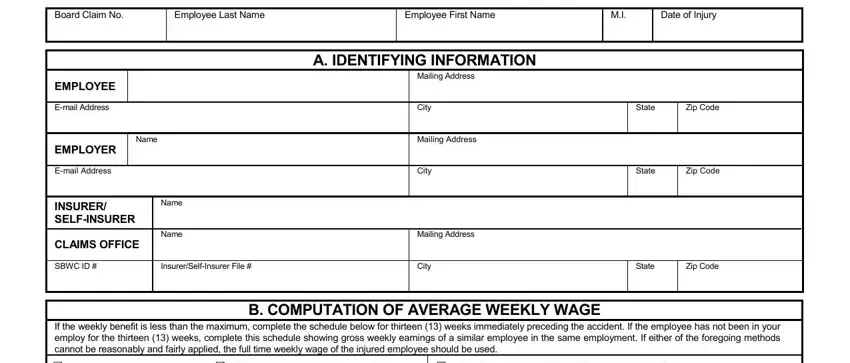

The next areas are within the PDF template you will be filling in.

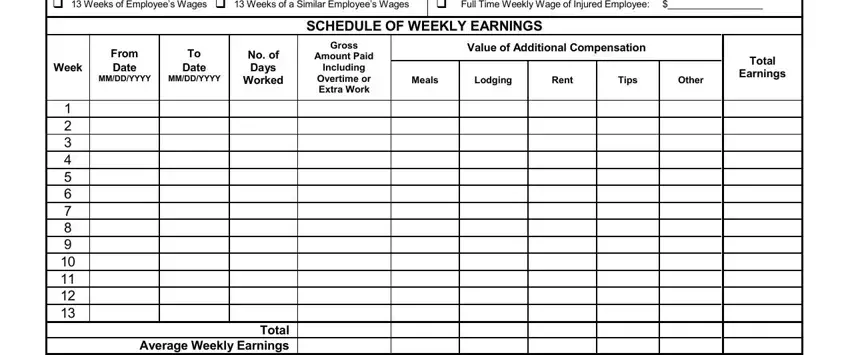

The application will require you to submit the Full, Time, Weekly, Wage, of, Injured, Employee SCHEDULE, OF, WEEKLY, EARNINGS Gross, Amount, Paid Including, Overtime, or, Extra, Work Week, From, Date MM, DD, YYYY To, Date MM, DD, YYYY No, of, Days, Worked Total, Average, Weekly, Earnings Value, of, Additional, Compensation Meals, and Lodging area.

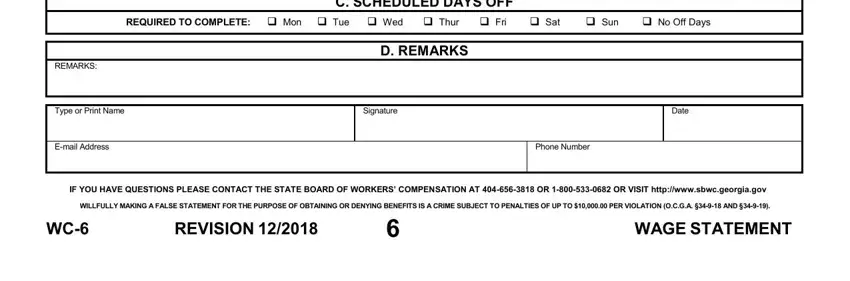

Note the main information in Sun, No, Off, Days C, SCHEDULED, DAYS, OFF REMARKS, Type, or, Print, Name, Email, Address D, REMARKS Signature, Date, Phone, Number REVISION, and WAGE, STATEMENT part.

Step 3: As you hit the Done button, your finalized form may be exported to all of your gadgets or to email provided by you.

Step 4: Make sure you stay away from forthcoming complications by making at least a pair of duplicates of your form.