It is possible to prepare the 401k change form form using this PDF editor. These actions will help you immediately create your document.

Step 1: The first step will be to click the orange "Get Form Now" button.

Step 2: You're now ready to update 401k change form. You possess a wide range of options thanks to our multifunctional toolbar - you can add, remove, or change the content, highlight the selected areas, as well as conduct similar commands.

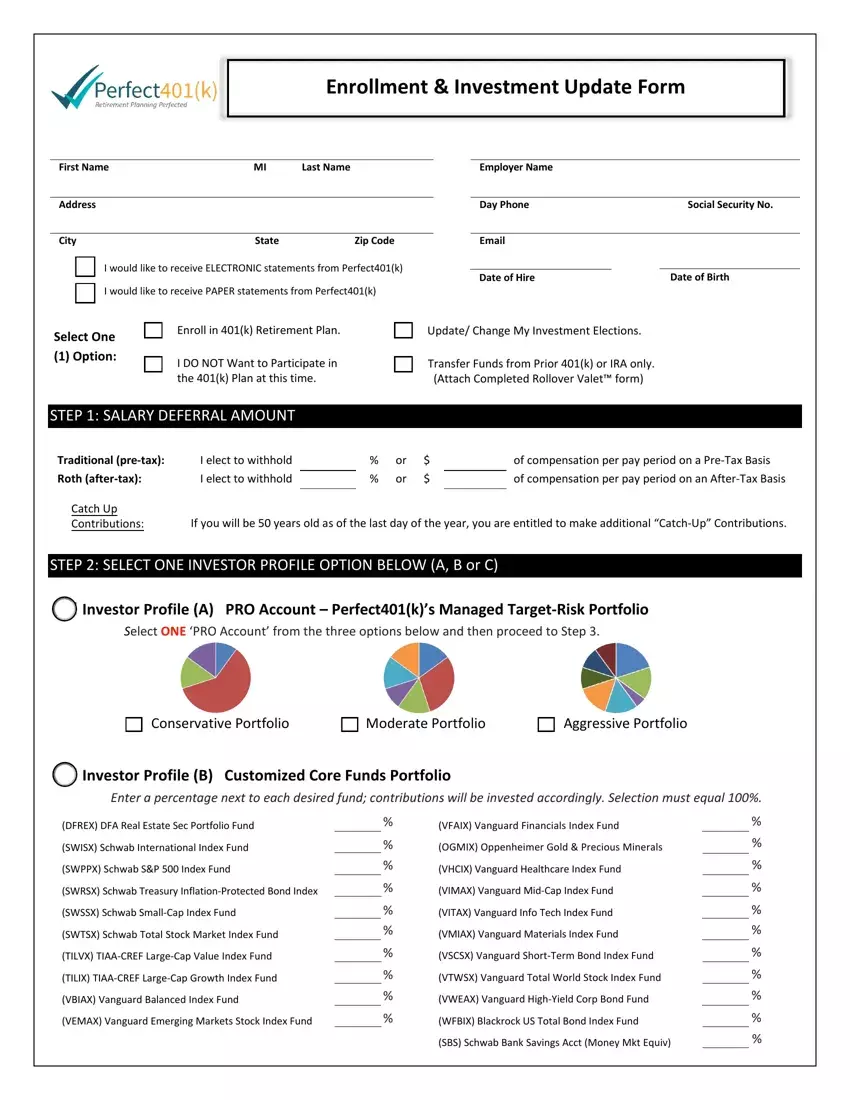

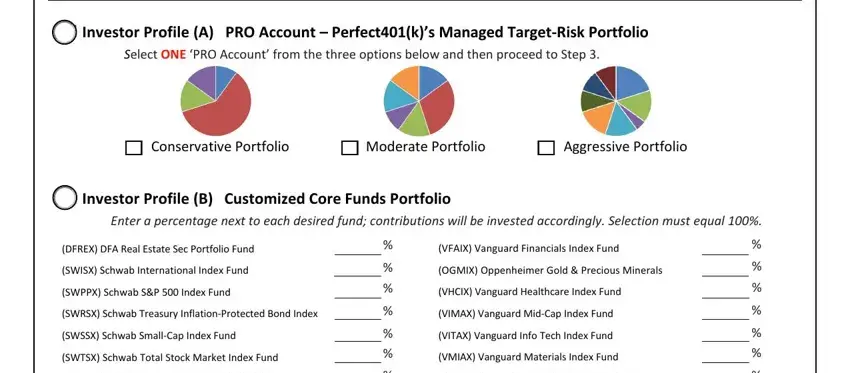

You should provide the following details to fill out the 401k change form PDF:

Write down the information in Investor Profile A PRO Account, Conservative Portfolio, Moderate Portfolio, Aggressive Portfolio, Investor Profile B Customized, Enter a percentage next to each, DFREX DFA Real Estate Sec, SWISX Schwab International Index, SWPPX Schwab SP Index Fund, SWRSX Schwab Treasury, SWSSX Schwab SmallCap Index Fund, SWTSX Schwab Total Stock Market, VFAIX Vanguard Financials Index, OGMIX Oppenheimer Gold Precious, and VHCIX Vanguard Healthcare Index.

In the field dealing with TILVX TIAACREF LargeCap Value, TILIX TIAACREF LargeCap Growth, VBIAX Vanguard Balanced Index Fund, VEMAX Vanguard Emerging Markets, VSCSX Vanguard ShortTerm Bond, VTWSX Vanguard Total World Stock, VWEAX Vanguard HighYield Corp Bond, WFBIX Blackrock US Total Bond, and SBS Schwab Bank Savings Acct Money, you need to put down some vital particulars.

The Investor Profile C Participant, Open your own BrokerageWindow, For more information about any of, STEP SIGN DATE, and As a participant I hereby segment allows you to indicate the rights and responsibilities of both parties.

End by reading these fields and filling out the appropriate particulars: Signature, Date, EMPLOYEES Submit completed forms, and EMPLOYERS Submit forms to.

Step 3: Click the "Done" button. At that moment, you can transfer your PDF file - download it to your electronic device or deliver it by means of email.

Step 4: In order to avoid probable forthcoming risks, ensure that you get at least two copies of any file.