Our skilled web developers have worked together to develop the PDF editor that you're going to go with. This specific app allows you to obtain good faith estimate gfe forms instantly and efficiently. This is certainly everything you should conduct.

Step 1: The first step will be to select the orange "Get Form Now" button.

Step 2: Now you will be within the document edit page. You can include, alter, highlight, check, cross, insert or remove fields or phrases.

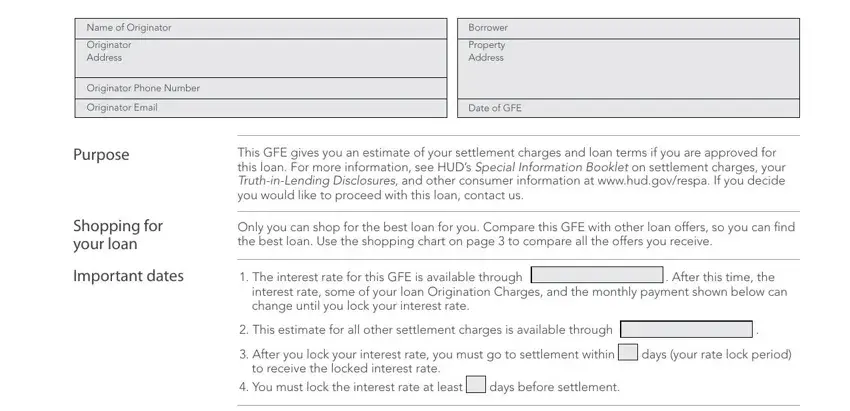

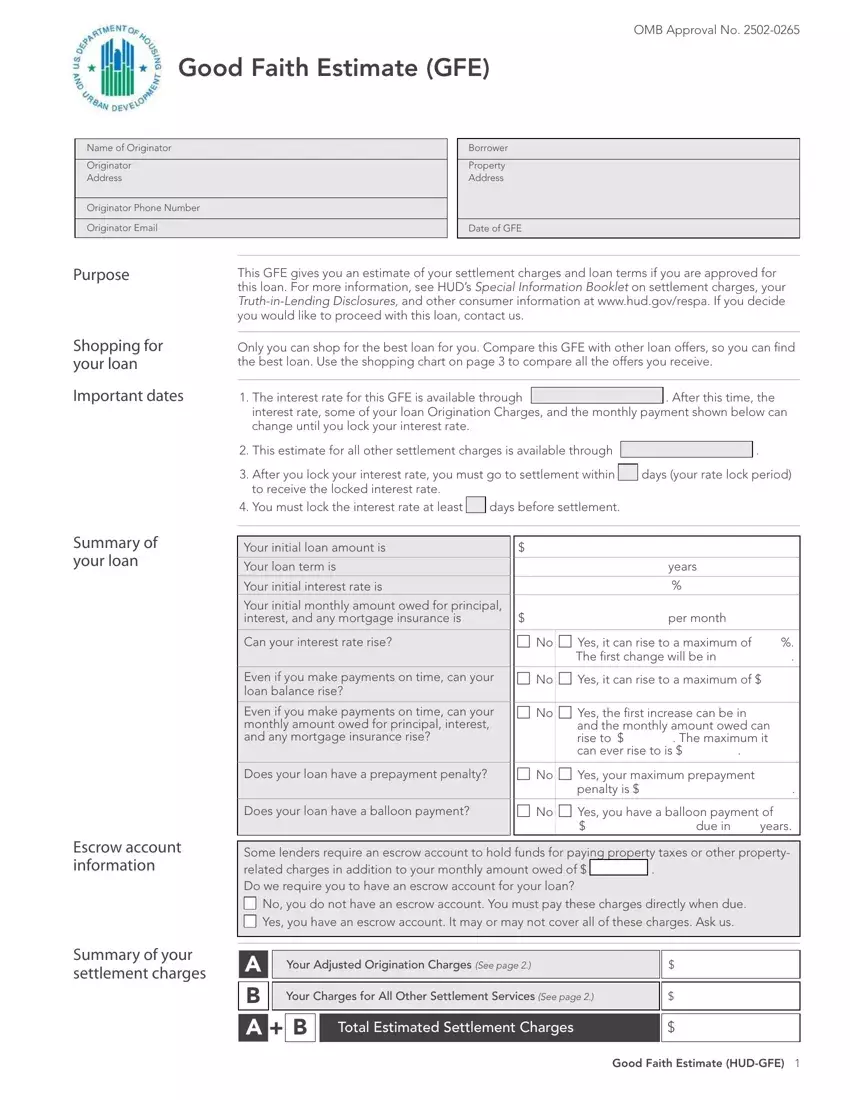

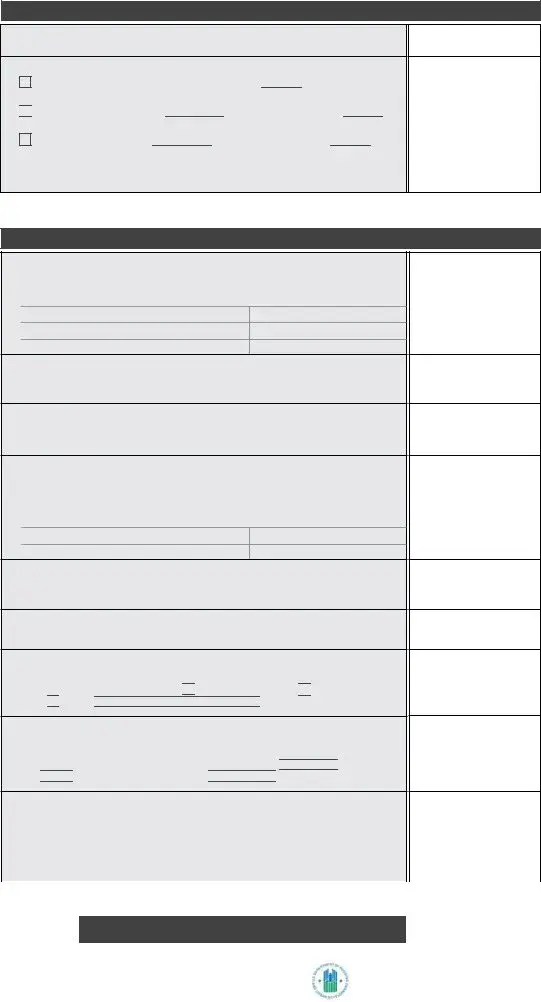

The following areas are within the PDF document you'll be creating.

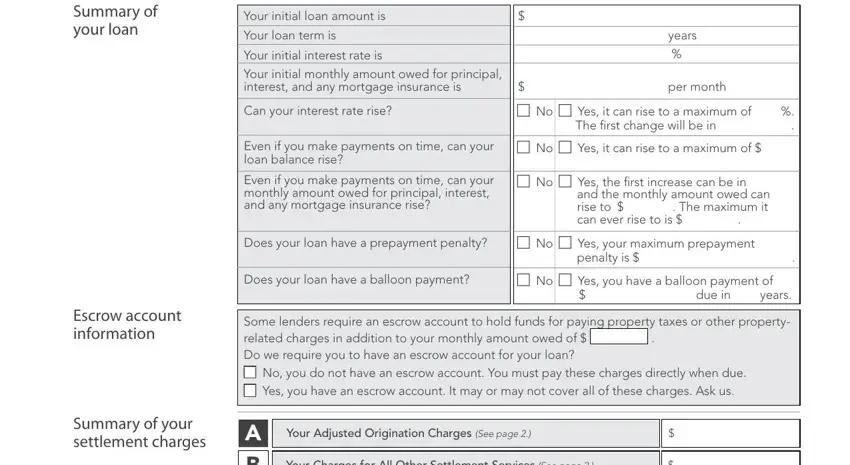

Make sure you note the essential information in the Summary of your loan, Escrow account information, Summary of your settlement charges, Your initial loan amount is, Your loan term is, Your initial interest rate is, years, Your initial monthly amount owed, per month, Can your interest rate rise, Even if you make payments on time, Even if you make payments on time, c No c Yes it can rise to a, c No c Yes it can rise to a, and c No c Yes the first increase can area.

In the Your Charges for All Other, A B A B, Total Estimated Settlement Charges, and Good Faith Estimate HUDGFE part, focus on the important details.

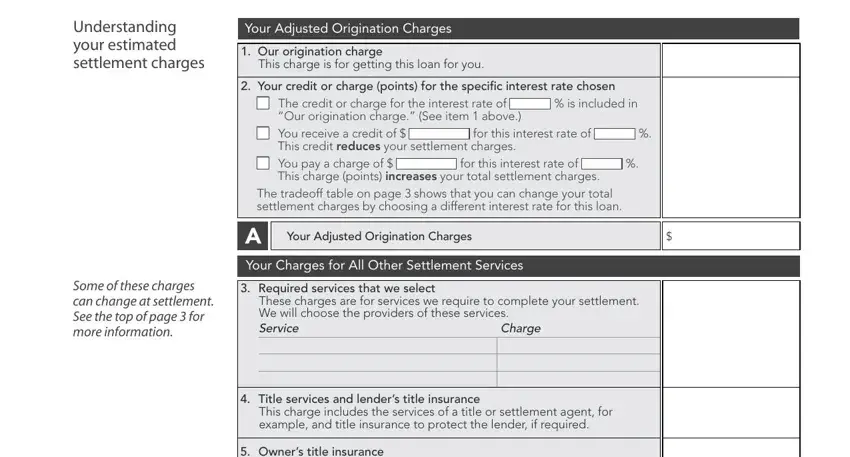

The Understanding your estimated, Your Adjusted Origination Charges, Our origination charge, This charge is for getting this, Your credit or charge points for, c The credit or charge for the, Our origination charge See item, is included in, c You receive a credit of, for this interest rate of, This credit reduces your, c You pay a charge of, for this interest rate of, This charge points increases your, and Your Adjusted Origination Charges segment allows you to identify the rights and obligations of both parties.

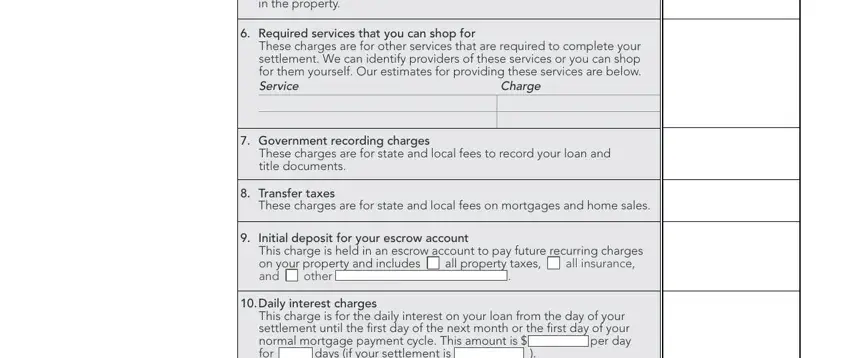

Finalize the template by checking the next sections: Owners title insurance You may, Required services that you can, These charges are for other, Charge, Government recording charges, These charges are for state and, Transfer taxes These charges are, Initial deposit for your escrow, This charge is held in an escrow, Daily interest charges, and This charge is for the daily.

Step 3: Click the Done button to save the file. At this point it is at your disposal for export to your gadget.

Step 4: In order to avoid any type of issues in the long run, try to have no less than a few duplicates of your file.

. After this time, the interest rate, some of your loan Origination Charges, and the monthly payment shown below can change until you lock your interest rate.

. After this time, the interest rate, some of your loan Origination Charges, and the monthly payment shown below can change until you lock your interest rate.

.

.

days (your rate lock period) to receive the locked interest rate.

days (your rate lock period) to receive the locked interest rate.

days before settlement.

days before settlement.

. Do we require you to have an escrow account for your loan?

. Do we require you to have an escrow account for your loan?

No, you do not have an escrow account. You must pay these charges directly when due.

No, you do not have an escrow account. You must pay these charges directly when due.

Yes, you have an escrow account. It may or may not cover all of these charges. Ask us.

Yes, you have an escrow account. It may or may not cover all of these charges. Ask us.

% is included in “Our origination charge.” (See item 1 above.)

% is included in “Our origination charge.” (See item 1 above.)

You receive a credit of $

You receive a credit of $  for this interest rate of

for this interest rate of

%. This credit reduces your settlement charges

%. This credit reduces your settlement charges for this interest rate of

for this interest rate of  %. This charge (points) increases your total settlement charges

%. This charge (points) increases your total settlement charges

all property taxes,

all property taxes,

other

other

.

.

per day

per day

days (if your settlement is

days (if your settlement is

).

).