hardship request can be completed in no time. Simply try FormsPal PDF tool to accomplish the job quickly. To keep our tool on the leading edge of efficiency, we strive to put into action user-oriented features and enhancements on a regular basis. We're at all times looking for suggestions - play a pivotal role in revampimg PDF editing. If you're seeking to start, here is what it requires:

Step 1: First of all, open the pdf editor by clicking the "Get Form Button" at the top of this webpage.

Step 2: With the help of our advanced PDF editing tool, you could do more than simply fill in forms. Edit away and make your docs appear perfect with customized textual content incorporated, or adjust the file's original input to perfection - all comes along with an ability to insert any photos and sign it off.

Completing this PDF needs attentiveness. Make sure each and every field is filled out properly.

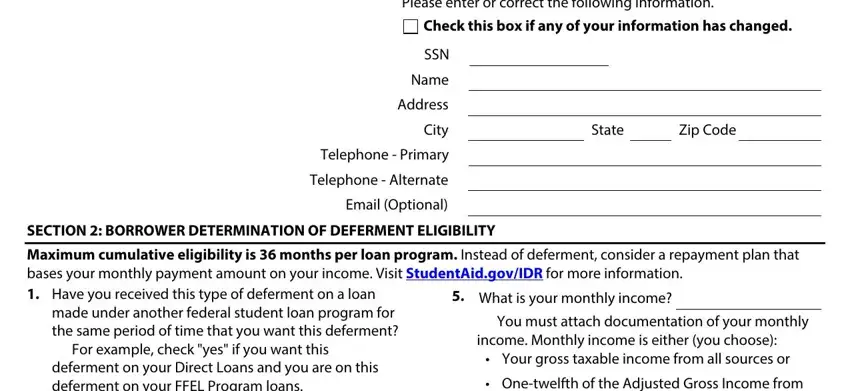

1. Whenever completing the hardship request, make sure to include all of the needed blank fields in its relevant part. It will help to expedite the process, enabling your information to be handled without delay and properly.

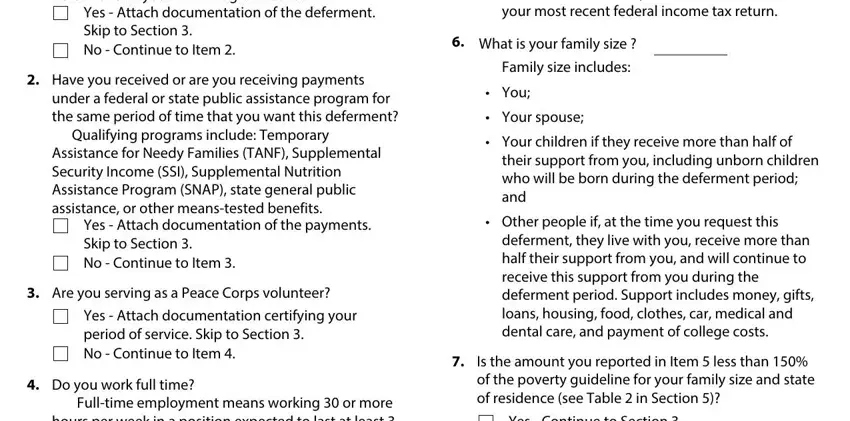

2. Given that this array of fields is done, you have to include the essential specifics in deferment on your Direct Loans and, Yes Attach documentation of the, Have you received or are you, under a federal or state public, Qualifying programs include, Assistance for Needy Families TANF, Yes Attach documentation of the, Are you serving as a Peace Corps, Yes Attach documentation, Do you work full time, Fulltime employment means working, Onetwelfth of the Adjusted Gross, your most recent federal income, What is your family size, and Family size includes so that you can proceed to the third part.

When it comes to Onetwelfth of the Adjusted Gross and Fulltime employment means working, make certain you take another look here. These two are thought to be the most significant ones in this document.

3. The following section is mostly about Fulltime employment means working, Yes Continue to Item, No You are not eligible for this, Page of, Yes Continue to Section, and No You are not eligible for this - fill in all these fields.

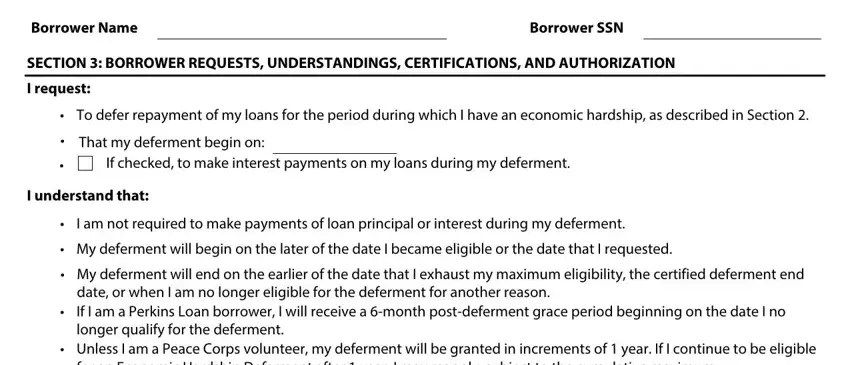

4. To go ahead, the next step will require filling in a few empty form fields. These comprise of Borrower Name, Borrower SSN, SECTION BORROWER REQUESTS, I request, To defer repayment of my loans, That my deferment begin on, If checked to make interest, I understand that, I am not required to make payments, My deferment will begin on the, My deferment will end on the, Unless I am a Peace Corps, and for an Economic Hardship Deferment, which are crucial to carrying on with this particular document.

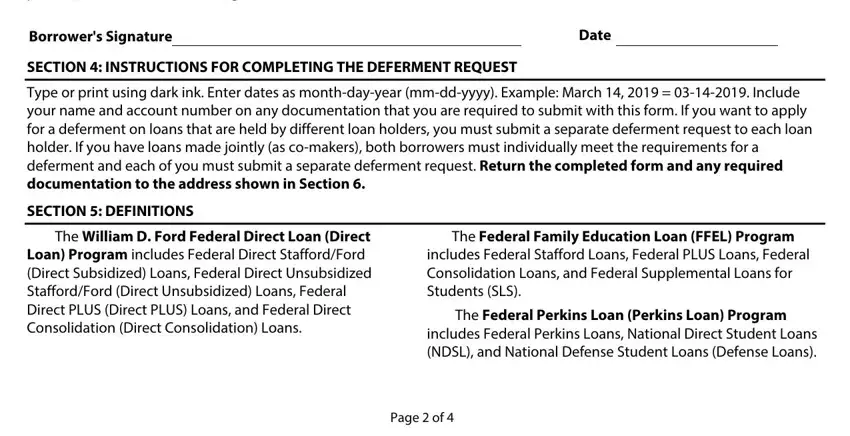

5. To conclude your document, this final part incorporates a few additional blanks. Entering I authorize the entity to which I, Borrowers Signature, Date, SECTION INSTRUCTIONS FOR, Type or print using dark ink Enter, SECTION DEFINITIONS, The William D Ford Federal Direct, The Federal Family Education Loan, includes Federal Stafford Loans, The Federal Perkins Loan Perkins, includes Federal Perkins Loans, and Page of will certainly wrap up everything and you'll be done in a snap!

Step 3: When you've reviewed the information in the blanks, click on "Done" to complete your document creation. Make a 7-day free trial option with us and get direct access to hardship request - which you'll be able to then work with as you would like from your FormsPal cabinet. FormsPal guarantees secure form tools with no personal information recording or sharing. Rest assured that your information is in good hands with us!