You can certainly prepare forms taking advantage of our PDF editor. Updating the 92900a form is not hard in case you adhere to these actions:

Step 1: This web page has an orange button that says "Get Form Now". Click it.

Step 2: Now you will be on your form edit page. You can add, adjust, highlight, check, cross, add or erase areas or phrases.

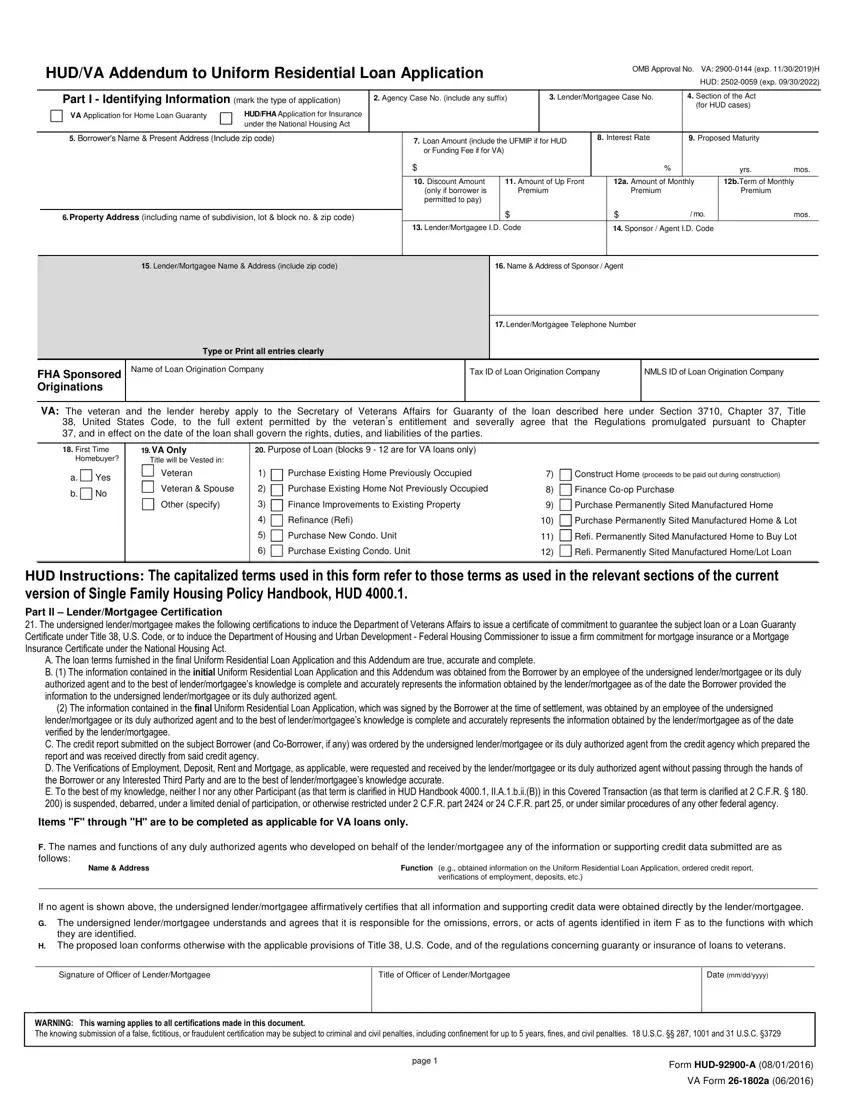

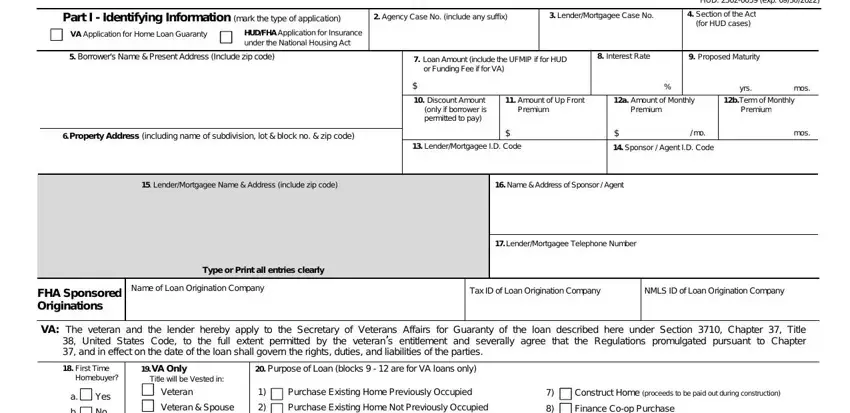

It is important to type in the next details so that you fill out the document:

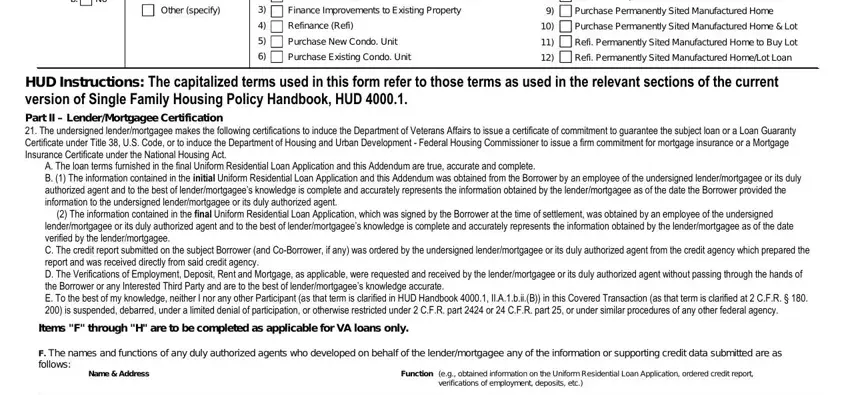

Include the requested details in the Other specify, Finance Improvements to Existing, Refinance Refi, Purchase New Condo Unit, Purchase Existing Condo Unit, Finance Coop Purchase, Purchase Permanently Sited, Purchase Permanently Sited, Refi Permanently Sited, Refi Permanently Sited, Purchase New Condo Unit, HUD Instructions The capitalized, A The loan terms furnished in the, Items F through H are to be, and F The names and functions of any segment.

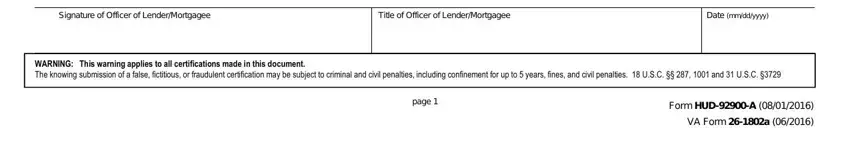

Inside the segment dealing with Signature of Officer of, Title of Officer of LenderMortgagee, Date mmddyyyy, WARNING This warning applies to, page, Form HUDA, and VA Form a, it's important to jot down some necessary particulars.

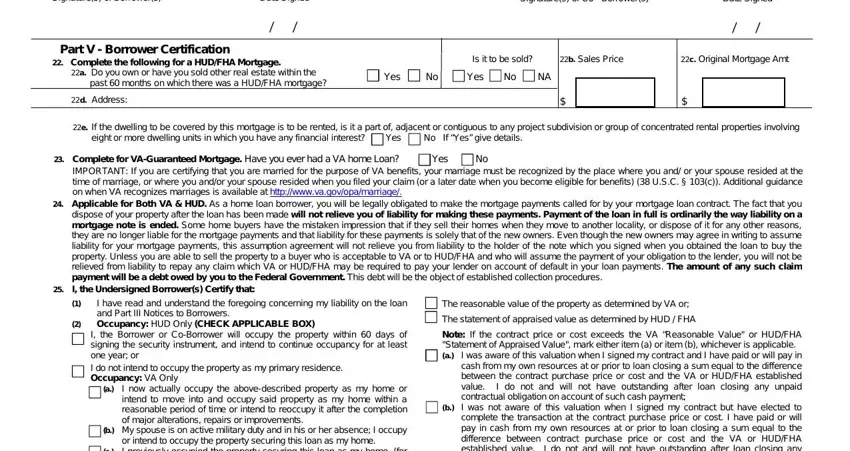

The Signatures of Borrowers, Date Signed, Signatures of Co Borrowers, Date Signed, Part V Borrower Certification, Complete the following for a, a Do you own or have you sold, past months on which there was a, d Address, Is it to be sold, b Sales Price, c Original Mortgage Amt, Yes, Yes, and e If the dwelling to be covered by field is the place to insert the rights and obligations of each party.

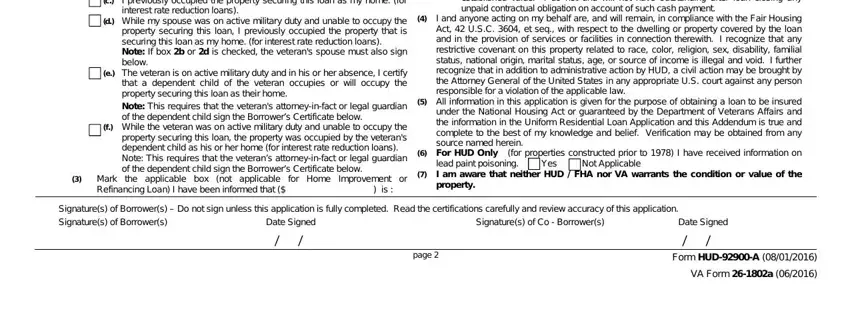

Finalize by reviewing the following fields and preparing them correspondingly: or intend to occupy the property, d While my spouse was on active, e The veteran is on active, f While the veteran was on active, Improvement or, for Home, Mark, Refinancing Loan I have been, b I was not aware of this, I and anyone acting on my behalf, All information in this, For HUD Only for properties, lead paint poisoning Yes Not, Signatures of Borrowers Do not, and Signatures of Borrowers.

Step 3: Choose the Done button to be certain that your completed form could be exported to any electronic device you prefer or mailed to an email you specify.

Step 4: Prepare duplicates of your document. This may save you from possible future misunderstandings. We cannot read or reveal the information you have, for that reason be assured it's going to be secure.