Using the online PDF tool by FormsPal, it is easy to fill in or modify state of hawaii form hw 4 2019 here. Our tool is constantly evolving to present the very best user experience attainable, and that's because of our dedication to constant development and listening closely to customer comments. To start your journey, take these easy steps:

Step 1: Click the "Get Form" button at the top of this webpage to access our editor.

Step 2: The editor will let you modify PDF files in a variety of ways. Enhance it by writing your own text, adjust existing content, and put in a signature - all readily available!

It is actually simple to fill out the document using this practical guide! Here's what you must do:

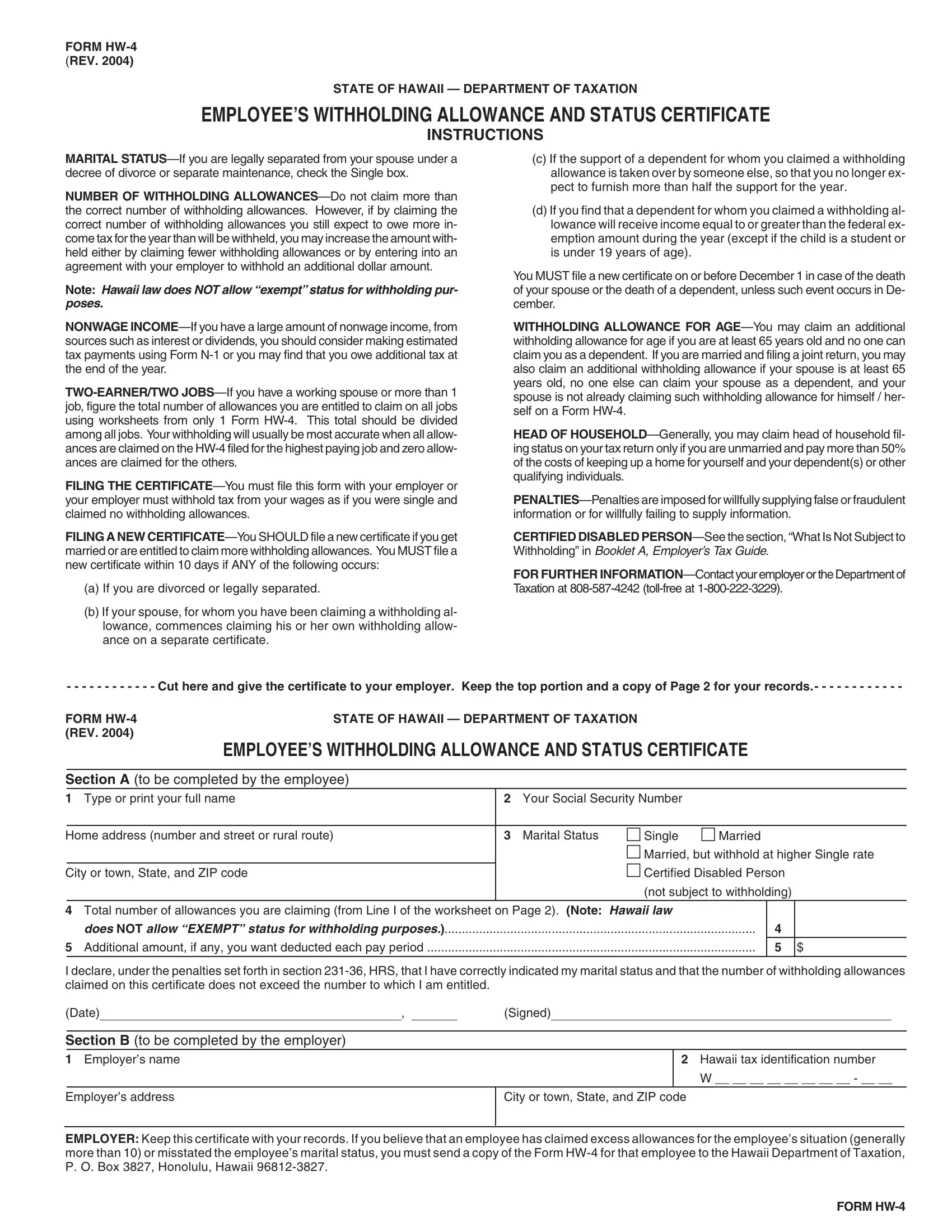

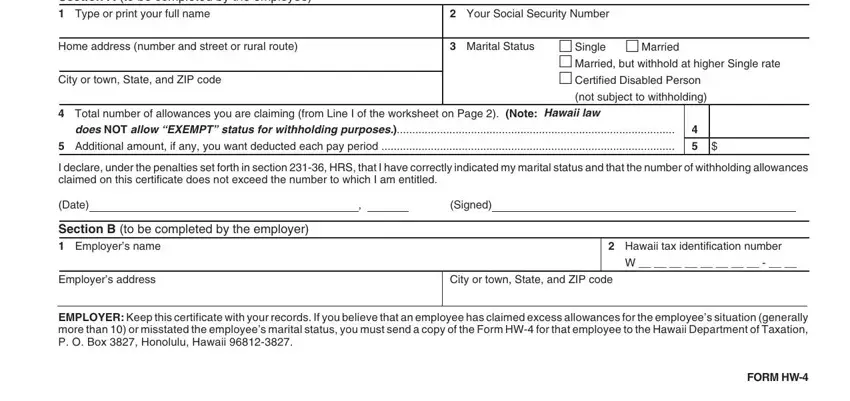

1. You have to complete the state of hawaii form hw 4 2019 correctly, so be careful when filling out the areas that contain these particular blanks:

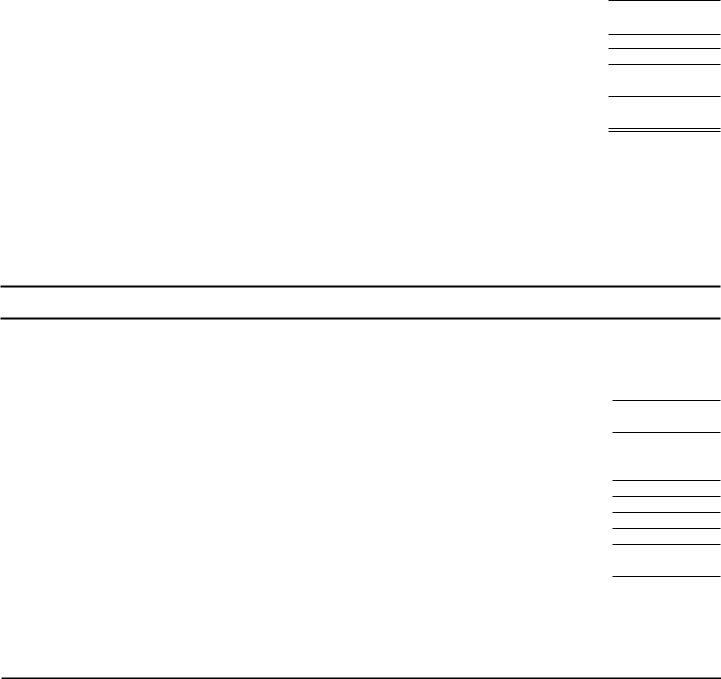

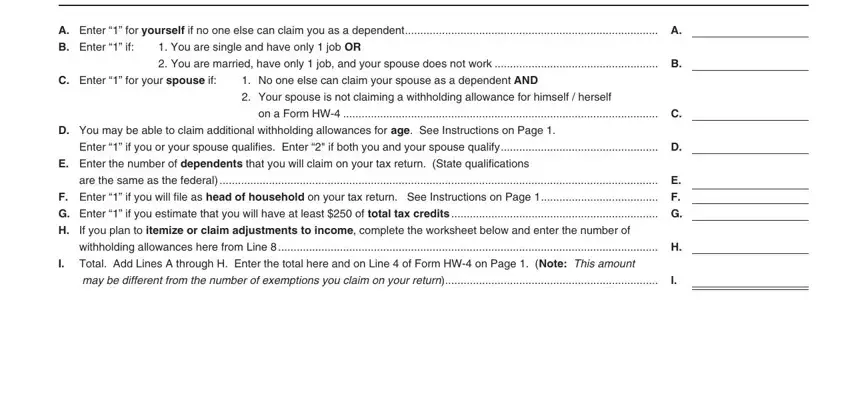

2. Immediately after the previous part is completed, go on to type in the relevant information in all these: A Enter for yourself if no one, B Enter if, You are single and have only job, C Enter for your spouse if, No one else can claim your spouse, You are married have only job, Your spouse is not claiming a, on a Form HW C, D You may be able to claim, Enter if you or your spouse, E Enter the number of dependents, are the same as the federal E, F Enter if you will file as head, G Enter if you estimate that you, and If you plan to itemize or claim.

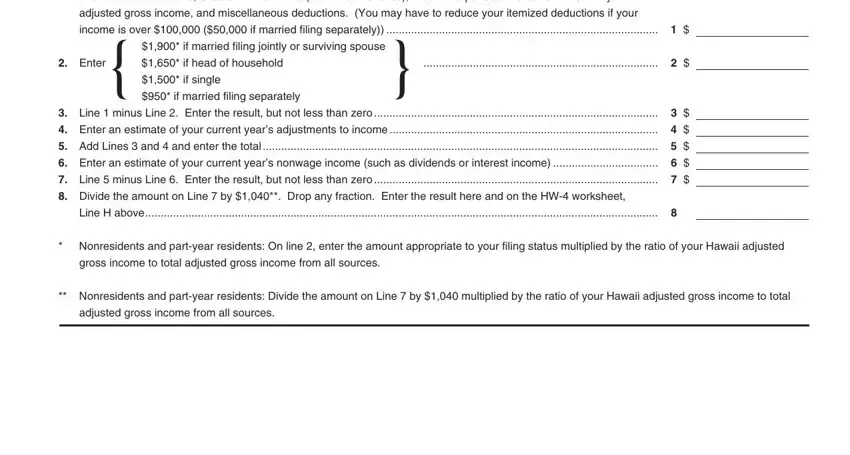

3. Completing charitable contributions State and, adjusted gross income and, income is over if married filing, Enter, if single, if married filing jointly or, if head of household, if married filing separately, Line minus Line Enter the, Enter an estimate of your current, Add Lines and and enter the, Enter an estimate of your current, Line minus Line Enter the, Divide the amount on Line by, and Line H above is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Many people frequently make some mistakes while completing Line minus Line Enter the in this section. Remember to re-examine whatever you enter right here.

Step 3: Check what you've typed into the blanks and then press the "Done" button. Obtain the state of hawaii form hw 4 2019 once you join for a free trial. Instantly access the pdf within your FormsPal account, together with any modifications and changes being conveniently preserved! We don't share or sell any details you type in whenever working with documents at FormsPal.