Contact Information & Claims Submission:

888-599-1515 ~ 856-470-1200

800-238-0876 (Fax)

flexclaims@iaatpa.com

IAA - PO Box 5082

Mt. Laurel, NJ 08054

|

|

|

|

www.iaatpa.com |

|

|

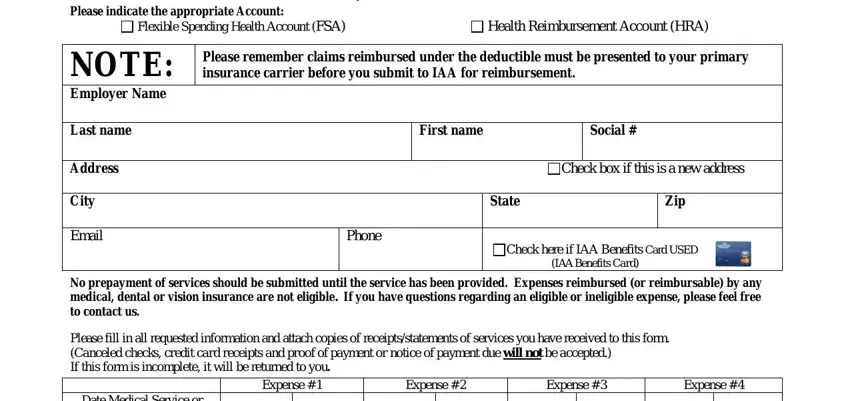

FSA/HRA Claim Form |

|

Please indicate the appropriate Account: |

|

|

|

Flexible Spending Health Account (FSA) |

Health Reimbursement Account (HRA) |

|

|

|

|

|

|

|

NOTE: |

Please remember claims reimbursed under the deductible must be presented to your primary |

insurance carrier before you submit to IAA for reimbursement. |

|

Employer Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Last name |

|

|

First name |

|

Social # |

|

|

|

|

|

|

|

|

Address |

|

|

|

Check box if this is a new address |

|

|

|

|

|

|

City |

|

|

|

State |

Zip |

|

|

|

|

|

|

Email |

|

Phone |

Check here if IAA Benefits Card USED |

|

|

|

|

|

|

|

|

(IAA Benefits Card) |

|

No prepayment of services should be submitted until the service has been provided. Expenses reimbursed (or reimbursable) by any medical, dental or vision insurance are not eligible. If you have questions regarding an eligible or ineligible expense, please feel free to contact us.

Please fill in all requested information and attach copies of receipts/statements of services you have received to this form. (Canceled checks, credit card receipts and proof of payment or notice of payment due will not be accepted.)

If this form is incomplete, it will be returned to you.

|

Expense # 1 |

Expense # 2 |

Expense # 3 |

Expense # 4 |

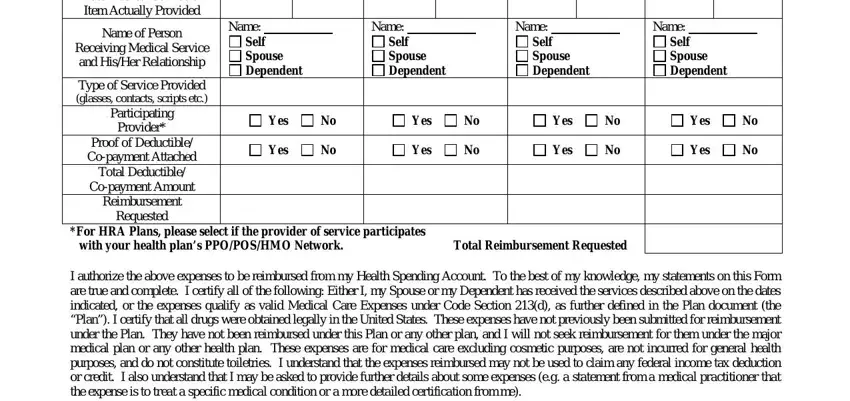

Date Medical Service or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item Actually Provided |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Person |

Name: |

|

|

|

Name: |

|

|

|

Name: |

|

|

|

Name: |

|

|

|

Self |

|

|

Self |

|

|

Self |

|

|

Self |

|

|

Receiving Medical Service |

|

|

|

|

|

|

|

|

Spouse |

|

|

Spouse |

|

|

Spouse |

|

|

Spouse |

|

|

and His/Her Relationship |

|

|

|

|

|

|

|

|

Dependent |

|

|

Dependent |

|

|

Dependent |

|

|

Dependent |

|

|

|

|

|

|

|

|

|

|

|

Type of Service Provided |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(glasses, contacts, scripts etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Participating |

|

Yes |

No |

|

Yes |

No |

|

Yes |

No |

|

Yes |

No |

Provider* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proof of Deductible/ |

|

Yes |

No |

|

Yes |

No |

|

Yes |

No |

|

Yes |

No |

Co-payment Attached |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Deductible/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Co-payment Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reimbursement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Requested |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*For HRA Plans, please select if the provider of service participates |

|

|

|

|

|

|

|

|

|

|

|

|

with your health plan’s PPO/POS/HMO Network. |

|

|

|

Total Reimbursement Requested |

|

|

|

|

|

I authorize the above expenses to be reimbursed from my Health Spending Account. To the best of my knowledge, my statements on this Form are true and complete. I certify all of the following: Either I, my Spouse or my Dependent has received the services described above on the dates indicated, or the expenses qualify as valid Medical Care Expenses under Code Section 213(d), as further defined in the Plan document (the “Plan”). I certify that all drugs were obtained legally in the United States. These expenses have not previously been submitted for reimbursement under the Plan. They have not been reimbursed under this Plan or any other plan, and I will not seek reimbursement for them under the major medical plan or any other health plan. These expenses are for medical care excluding cosmetic purposes, are not incurred for general health purposes, and do not constitute toiletries. I understand that the expenses reimbursed may not be used to claim any federal income tax deduction or credit. I also understand that I may be asked to provide further details about some expenses (e.g. a statement from a medical practitioner that the expense is to treat a specific medical condition or a more detailed certification from me).

Employee Signature: ____________________________________________________ |

Date: |

(Employee Signature must be provided in order to process this form) |

|

1934 Olney Avenue * Suite 200 * Cherry Hill, NJ 08003

FSAclmfrm-Rev.03/2011

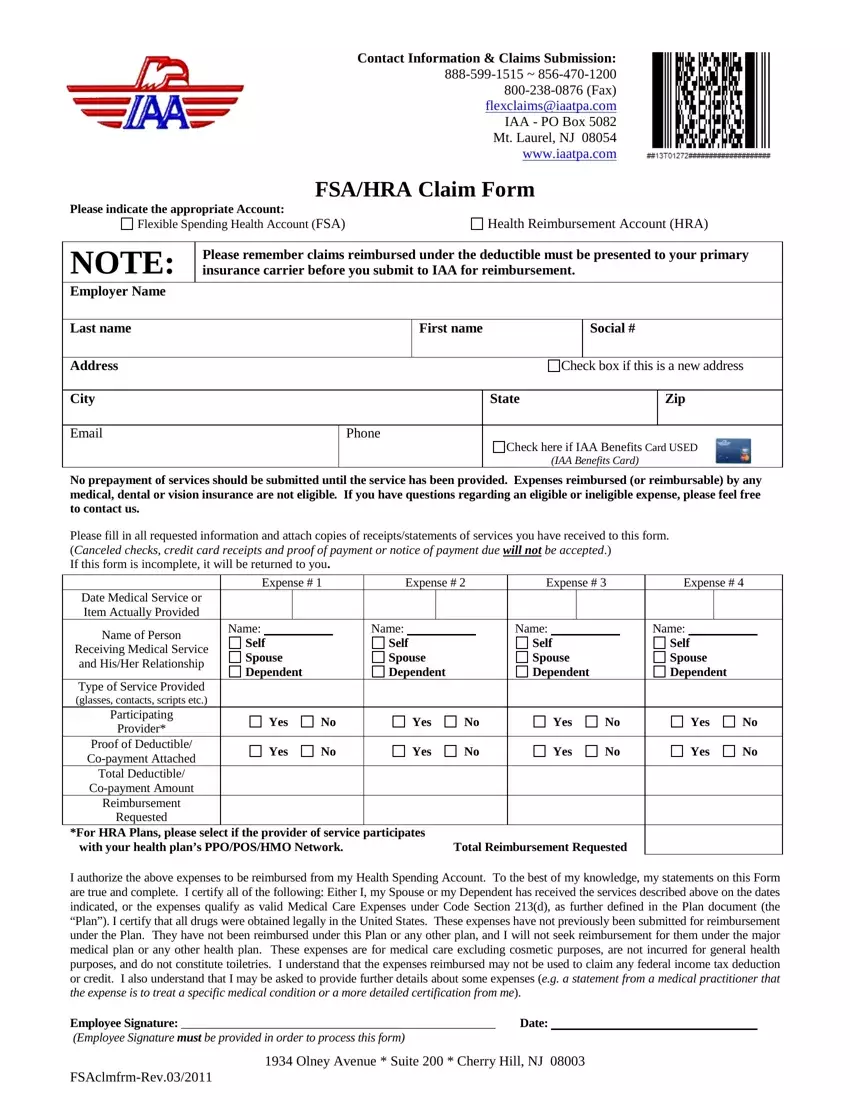

Contact Information & Claims Submission: 888-599-1515 ~ 856-470-1200 800-238-0876 (Fax) flexclaims@iaatpa.com IAA - PO Box 5082 Mt. Laurel, NJ 08054 www.iaatpa.com

FSA/HRA Claim Form Documentation

Medical Payments

All documentation should show date of service, procedure performed and should prove the claim was initially processed by your health care carrier. Acceptable documentation includes: a copy of the Explanation of Benefits (EOB) from your health care carrier and/or an itemized bill indicating services received for that person have been applied to the applicable deductible.

Dental and Vision

All documentation should show date of service, procedure performed or item(s) purchased and name of person receiving services/items.

The submission should include: copy of statement, itemized bill, or detailed receipt.

Prescription Drugs (Rx)

Provide a copy of the pharmacy receipt for the prescriptions(s). Usually, this is stapled to the bag containing your prescription(s). This will provide details, such as prescription name, price and fill date. In some Plans, the prescription benefits are subject to a calendar year deductible, before co-pays are applied. These should be submitted as well.

Over-the-Counter Purchases (OTC)

All documentation should include the itemized register receipt from the store of purchase. If your register receipt prints abbreviated product names, please provide unabbreviated product name to quicken processing time. All medication purchases incurred after 12/31/2010 must be accompanied by a doctor’s prescription.

This plan is governed by IRS guidelines. In order to satisfy IRS requirements documentation is needed to process your claim(s). When submitting for reimbursement, please complete and provide necessary documentation. This will quicken the processing time of your claim(s). Please visit our website www.iaatpa.com for additional forms.

1934 Olney Avenue * Suite 200 * Cherry Hill, NJ 08003

FSAclmfrm-Rev.03/2011