It is simple to fill out forms through our PDF editor. Improving the ifta 21 application document is simple for those who keep to the following steps:

Step 1: Search for the button "Get Form Here" on the site and next, click it.

Step 2: Right now, you are able to edit your ifta 21 application. This multifunctional toolbar allows you to add, remove, adapt, highlight, and undertake several other commands to the content and areas within the file.

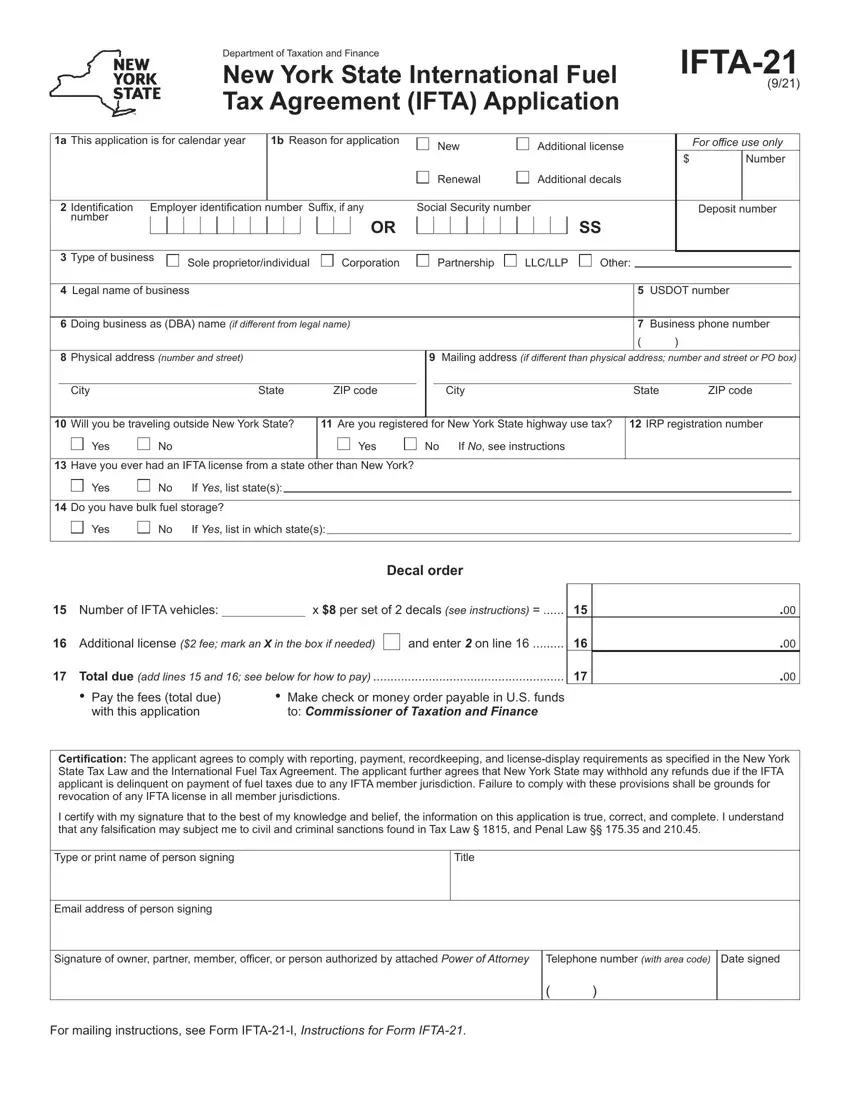

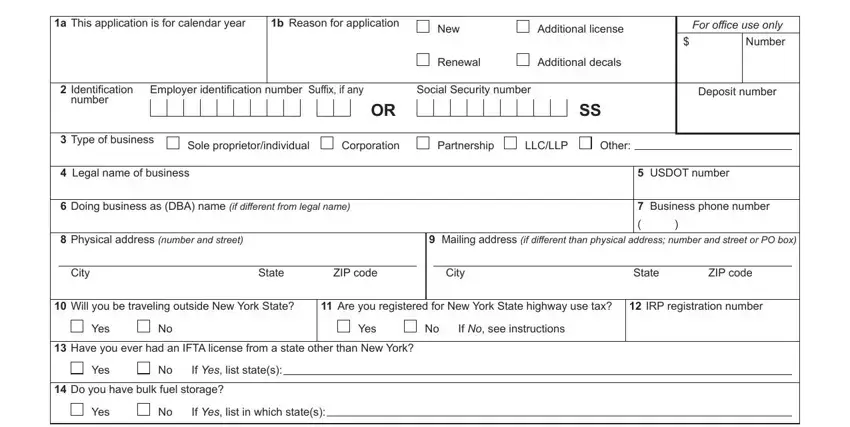

Make sure you enter the following details to prepare the ifta 21 application PDF:

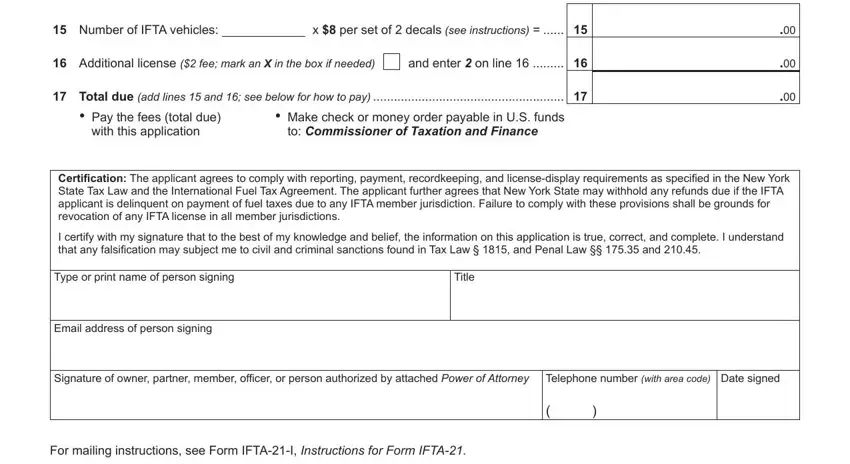

Make sure you write down the essential information in the Decal order, Number of IFTA vehicles, x per set of decals see, Additional license fee mark an X, and enter on line, Total due add lines and see, Pay the fees total due with this, Make check or money order payable, Certification The applicant agrees, I certify with my signature that, Type or print name of person, Title, Email address of person signing, Signature of owner partner member, and Telephone number with area code field.

Step 3: Choose the Done button to make sure that your finished form is available to be exported to any type of electronic device you want or forwarded to an email you indicate.

Step 4: Prepare as much as two or three copies of the form to refrain from any possible challenges.