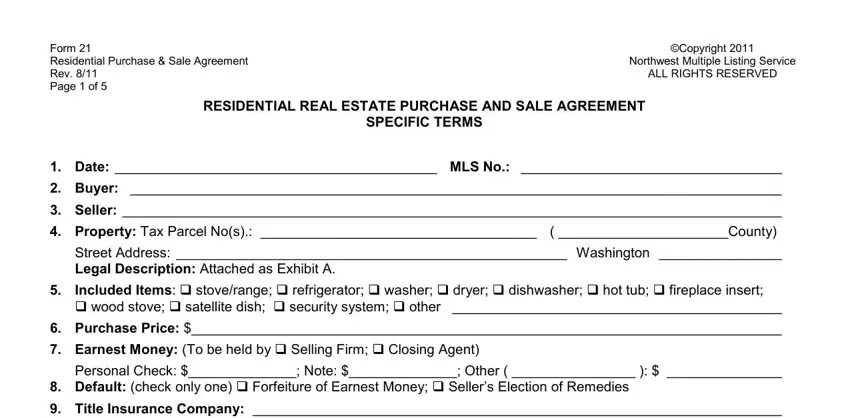

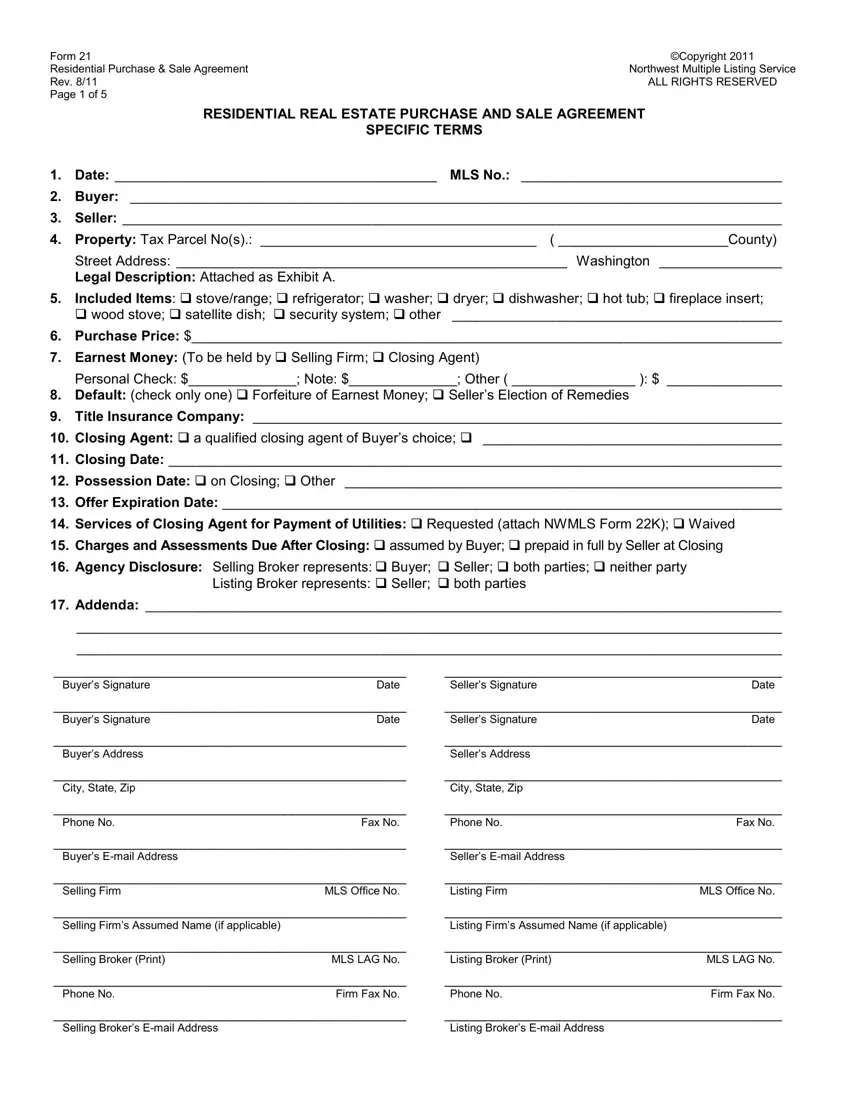

Form 21 |

©Copyright 2011 |

Residential Purchase & Sale Agreement |

Northwest Multiple Listing Service |

Rev. 8/11 |

ALL RIGHTS RESERVED |

Page 1 of 5 |

|

RESIDENTIAL REAL ESTATE PURCHASE AND SALE AGREEMENT |

SPECIFIC TERMS |

|

1. Date: __________________________________________ MLS No.: |

__________________________________ |

2.Buyer: _____________________________________________________________________________________

3.Seller: ______________________________________________________________________________________

4. Property: Tax Parcel No(s).: ____________________________________ ( ______________________County)

Street Address: ___________________________________________________ Washington ________________

Legal Description: Attached as Exhibit A.

5.Included Items: stove/range; refrigerator; washer; dryer; dishwasher; hot tub; fireplace insert;

wood stove; satellite dish; security system; other ___________________________________________

6.Purchase Price: $_____________________________________________________________________________

7.Earnest Money: (To be held by Selling Firm; Closing Agent)

Personal Check: $______________; Note: $______________; Other ( ________________ ): $ _______________

8.Default: (check only one) Forfeiture of Earnest Money; Seller’s Election of Remedies

9.Title Insurance Company: _____________________________________________________________________

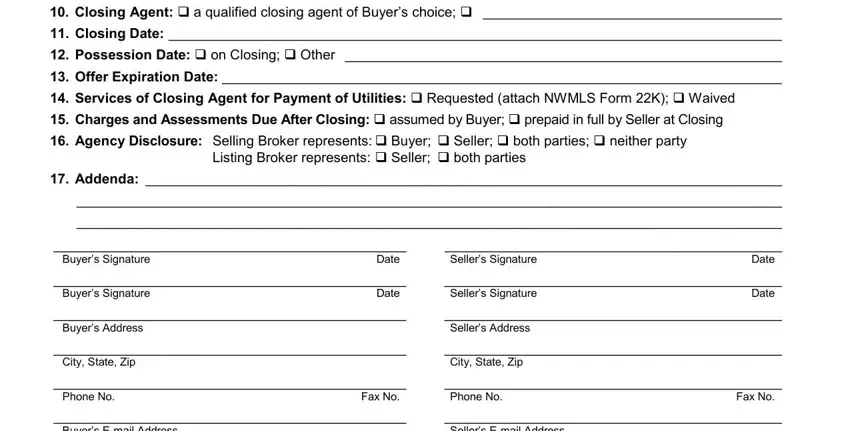

10.Closing Agent: a qualified closing agent of Buyer’s choice; _______________________________________

11.Closing Date: ________________________________________________________________________________

12.Possession Date: on Closing; Other _________________________________________________________

13.Offer Expiration Date: _________________________________________________________________________

14.Services of Closing Agent for Payment of Utilities: Requested (attach NWMLS Form 22K); Waived

15.Charges and Assessments Due After Closing: assumed by Buyer; prepaid in full by Seller at Closing

16.Agency Disclosure: Selling Broker represents: Buyer; Seller; both parties; neither party

Listing Broker represents: Seller; both parties

17.Addenda: ___________________________________________________________________________________

____________________________________________________________________________________________

____________________________________________________________________________________________

______________________________________________ |

____________________________________________ |

Buyer’s Signature |

Date |

Seller’s Signature |

Date |

______________________________________________ |

____________________________________________ |

Buyer’s Signature |

Date |

Seller’s Signature |

Date |

______________________________________________ |

____________________________________________ |

Buyer’s Address |

|

Seller’s Address |

|

______________________________________________ |

____________________________________________ |

City, State, Zip |

|

City, State, Zip |

|

______________________________________________ |

____________________________________________ |

Phone No. |

Fax No. |

Phone No. |

Fax No. |

______________________________________________ |

____________________________________________ |

Buyer’s E-mail Address |

|

Seller’s E-mail Address |

|

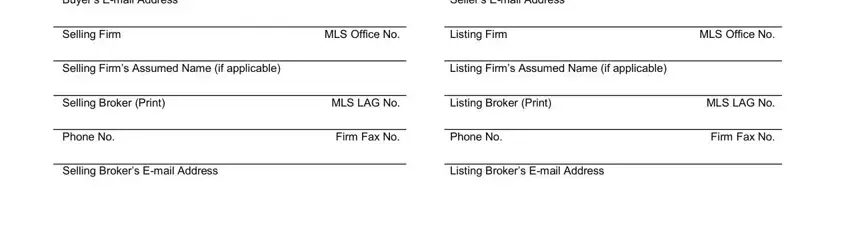

______________________________________________ |

____________________________________________ |

Selling Firm |

MLS Office No. |

Listing Firm |

MLS Office No. |

______________________________________________ |

____________________________________________ |

Selling Firm’s Assumed Name (if applicable) |

|

Listing Firm’s Assumed Name (if applicable) |

|

______________________________________________ |

____________________________________________ |

Selling Broker (Print) |

MLS LAG No. |

Listing Broker (Print) |

MLS LAG No. |

______________________________________________ |

____________________________________________ |

Phone No. |

Firm Fax No. |

Phone No. |

Firm Fax No. |

______________________________________________ |

____________________________________________ |

Selling Broker’s E-mail Address |

|

Listing Broker’s E-mail Address |

|

Form 21 |

|

|

©Copyright 2011 |

|

Residential Purchase & Sale Agreement |

Northwest Multiple Listing Service |

Rev. 8/11 |

RESIDENTIAL REAL ESTATE PURCHASE AND SALE AGREEMENT |

ALL RIGHTS RESERVED |

|

Page 2 of 5 |

|

|

|

|

GENERAL TERMS |

|

|

|

|

Continued |

|

|

a. Purchase Price. Buyer shall pay to Seller the Purchase Price, including the Earnest Money, in cash at Closing, unless |

1 |

otherwise specified in this Agreement. Buyer represents that Buyer has sufficient funds to close this sale in accordance |

2 |

with this Agreement and is not relying on any contingent source of funds, including funds from loans, the sale of other |

3 |

property, gifts, retirement, or future earnings, except to the extent otherwise specified in this Agreement. |

4 |

b. Earnest Money. Buyer shall deliver the Earnest Money within 2 days after mutual acceptance of this Agreement to |

5 |

Selling Broker who will deposit any check to be held by Selling Firm, or deliver any Earnest Money to be held by Closing |

6 |

Agent, within 3 days of receipt or mutual acceptance, whichever occurs later. If the Earnest Money is held by Selling |

7 |

Firm and is over $10,000.00 it shall be deposited into an interest bearing trust account in Selling Firm’s name provided |

8 |

that Buyer completes an IRS Form W-9. Interest, if any, after deduction of bank charges and fees, will be paid to Buyer. 9

Buyer shall reimburse Selling Firm for bank charges and fees in excess of the interest earned, if any. If the Earnest |

10 |

Money held by Selling Firm is over $10,000.00 Buyer has the option to require Selling Firm to deposit the Earnest |

11 |

Money into the Housing Trust Fund Account, with the interest paid to the State Treasurer, if both Seller and Buyer so |

12 |

agree in writing. If the Buyer does not complete an IRS Form W-9 before Selling Firm must deposit the Earnest Money |

13 |

or the Earnest Money is $10,000.00 or less, the Earnest Money shall be deposited into the Housing Trust Fund 14

Account. Selling Firm may transfer the Earnest Money to Closing Agent at Closing. If all or part of the Earnest Money is |

15 |

to be refunded to Buyer and any such costs remain unpaid, the Selling Firm or Closing Agent may deduct and pay them |

16 |

therefrom. The parties instruct Closing Agent to provide written verification of receipt of the Earnest Money and notice of |

17 |

dishonor of any check to the parties and Brokers at the addresses and/or fax numbers provided herein. |

18 |

Upon termination of this Agreement, a party or the Closing Agent may deliver a form authorizing the release of Earnest |

19 |

Money to the other party or the parties. The party(s) shall execute such form and deliver the same to the Closing Agent. 20

If either party fails to execute the release form, the other party may make a written demand to the Closing Agent for the |

21 |

Earnest Money. If only one party makes such a demand, Closing Agent shall promptly deliver notice of the demand to |

22 |

the other party. If the other party does not object to the demand within 10 days of Closing Agent’s notice, Closing Agent |

23 |

shall disburse the Earnest Money to the party making the demand. If Closing Agent complies with the preceding 24

process, each party shall be deemed to have released Closing Agent from any and all claims or liability related to the |

25 |

disbursal of the Earnest Money. The parties are advised that, notwithstanding the foregoing, Closing Agent may require |

26 |

the parties to execute a separate agreement before disbursing the Earnest Money. If either party fails to authorize the |

27 |

release of the Earnest Money to the other party when required to do so under this Agreement, that party shall be in |

28 |

breach of this Agreement. Upon either party’s request, the party holding the Earnest Money shall commence an 29

interpleader action in the county in which the Property is located. For the purposes of this paragraph, the term Closing |

30 |

Agent includes a Selling Firm holding the Earnest Money. The parties authorize the party commencing an interpleader |

31 |

action to deduct up to $500.00 for the costs thereof. |

32 |

c.Included Items. Any of the following items, including items identified in Specific Term No. 5 if the corresponding box is 33 checked, located in or on the Property are included in the sale: built-in appliances; wall-to-wall carpeting; curtains, 34 drapes and all other window treatments; window and door screens; awnings; storm doors and windows; installed 35 television antennas; ventilating, air conditioning and heating fixtures; trash compactor; fireplace doors, gas logs and gas 36 log lighters; irrigation fixtures; electric garage door openers and remotes; water heaters; installed electrical fixtures; 37

lighting fixtures; shrubs, plants and trees planted in the ground; all bathroom and other fixtures; and all associated |

38 |

operating equipment. If any of the above Included Items are leased or encumbered, Seller shall acquire and clear title at |

39 |

or before Closing. |

40 |

d.Condition of Title. Unless otherwise specified in this Agreement, title to the Property shall be marketable at Closing. 41 The following shall not cause the title to be unmarketable: rights, reservations, covenants, conditions and restrictions, 42 presently of record and general to the area; easements and encroachments, not materially affecting the value of or 43 unduly interfering with Buyer’s reasonable use of the Property; and reserved oil and/or mining rights. Monetary 44 encumbrances or liens not assumed by Buyer, shall be paid or discharged by Seller on or before Closing. Title shall be 45

conveyed by a Statutory Warranty Deed. If this Agreement is for conveyance of a buyer’s interest in a Real Estate |

46 |

Contract, the Statutory Warranty Deed shall include a buyer’s assignment of the contract sufficient to convey after |

47 |

acquired title. |

48 |

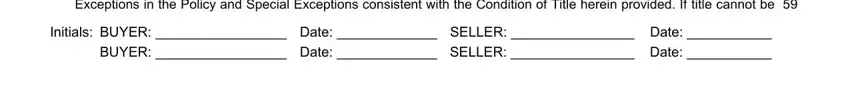

e.Title Insurance. Seller authorizes Buyer’s lender or Closing Agent, at Seller’s expense, to apply for the then-current 49 ALTA form of Homeowner’s Policy of Title Insurance for One-to-Four Family Residence, from the Title Insurance 50 Company. If Seller previously received a preliminary commitment from a Title Insurance Company that Buyer declines 51 to use, Buyer shall pay any cancellation fees owing to the original Title Insurance Company. Otherwise, the party 52 applying for title insurance shall pay any title cancellation fee, in the event such a fee is assessed. If the Title Insurance 53 Company selected by the parties will not issue a Homeowner’s Policy for the Property, the parties agree that the Title 54 Insurance Company shall instead issue the then-current ALTA standard form Owner’s Policy, together with 55 homeowner’s additional protection and inflation protection endorsements, if available. The Title Insurance Company 56 shall send a copy of the preliminary commitment to Seller, Listing Broker, Buyer and Selling Broker. The preliminary 57 commitment, and the title policy to be issued, shall contain no exceptions other than the General Exclusions and 58 Exceptions in the Policy and Special Exceptions consistent with the Condition of Title herein provided. If title cannot be 59

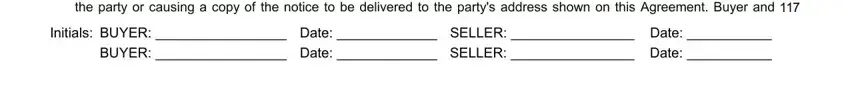

Initials: BUYER: _________________ |

Date: _____________ |

SELLER: ________________ |

Date: ___________ |

BUYER: _________________ |

Date: _____________ |

SELLER: ________________ |

Date: ___________ |

Form 21 |

|

|

©Copyright 2011 |

|

Residential Purchase & Sale Agreement |

Northwest Multiple Listing Service |

Rev. 8/11 |

RESIDENTIAL REAL ESTATE PURCHASE AND SALE AGREEMENT |

ALL RIGHTS RESERVED |

|

Page 3 of 5 |

|

|

|

GENERAL TERMS |

|

|

|

|

Continued |

|

|

|

made so insurable prior to the Closing Date, then as Buyer’s sole and exclusive remedy, the Earnest Money shall, |

60 |

unless Buyer elects to waive such defects or encumbrances, be refunded to the Buyer, less any unpaid costs described |

61 |

in this Agreement, and this Agreement shall thereupon be terminated. Buyer shall have no right to specific performance |

62 |

or damages as a consequence of Seller’s inability to provide insurable title. |

|

|

63 |

f.Closing and Possession. This sale shall be closed by the Closing Agent on the Closing Date. If the Closing Date falls 64 on a Saturday, Sunday, legal holiday as defined in RCW 1.16.050, or day when the county recording office is closed, 65 the Closing Agent shall close the transaction on the next day that is not a Saturday, Sunday, legal holiday, or day when 66 the county recording office is closed. “Closing” means the date on which all documents are recorded and the sale 67 proceeds are available to Seller. Seller shall deliver keys and garage door remotes to Buyer on the Closing Date or on 68 the Possession Date, whichever occurs first. Buyer shall be entitled to possession at 9:00 p.m. on the Possession Date. 69 Seller shall maintain the Property in its present condition, normal wear and tear excepted, until the Buyer is entitled to 70 possession. If possession transfers at a time other than Closing, the parties agree to execute NWMLS Form 65A 71

(Rental Agreement/Occupancy Prior to Closing) or NWMLS Form 65B (Rental Agreement/Seller Occupancy After |

72 |

Closing) (or alternative rental agreements) and are advised of the need to contact their respective insurance companies |

73 |

to assure appropriate hazard and liability insurance policies are in place, as applicable. |

74 |

g.Section 1031 Like-Kind Exchange. If either Buyer or Seller intends for this transaction to be a part of a Section 1031 75 like-kind exchange, then the other party shall cooperate in the completion of the like-kind exchange so long as the 76 cooperating party incurs no additional liability in doing so, and so long as any expenses (including attorneys’ fees and 77 costs) incurred by the cooperating party that are related only to the exchange are paid or reimbursed to the cooperating 78

party at or prior to Closing. Notwithstanding the Assignment paragraph of this Agreement, any party completing a |

79 |

Section 1031 like-kind exchange may assign this Agreement to its qualified intermediary or any entity set up for the |

80 |

purposes of completing a reverse exchange. |

81 |

h.Closing Costs and Prorations and Charges and Assessments. Seller and Buyer shall each pay one-half of the 82 escrow fee unless otherwise required by applicable FHA or VA regulations. Taxes for the current year, rent, interest, 83 and lienable homeowner’s association dues shall be prorated as of Closing. Buyer shall pay Buyer’s loan costs, 84 including credit report, appraisal charge and lender’s title insurance, unless provided otherwise in this Agreement. If any 85 payments are delinquent on encumbrances which will remain after Closing, Closing Agent is instructed to pay such 86 delinquencies at Closing from money due, or to be paid by, Seller. Buyer shall pay for remaining fuel in the fuel tank if, 87 prior to Closing, Seller obtains a written statement as to the quantity and current price from the supplier. Seller shall pay 88 all utility charges, including unbilled charges. Unless waived in Specific Term No. 14, Seller and Buyer request the 89

services of Closing Agent in disbursing funds necessary to satisfy unpaid utility charges in accordance with RCW 60.80 |

90 |

and Seller shall provide the names and addresses of all utilities providing service to the Property and having lien rights |

91 |

(attach NWMLS Form 22K Identification of Utilities or equivalent). |

92 |

Buyer is advised to verify the existence and amount of any local improvement district, capacity or impact charges or |

93 |

other assessments that may be charged against the Property before or after Closing. Seller will pay such charges that |

94 |

are encumbrances at the time of Closing, or that are or become due on or before Closing. Charges levied before |

95 |

Closing, but becoming due after Closing shall be paid as agreed in Specific Term No. 15. |

96 |

i.Sale Information. Listing Broker and Selling Broker are authorized to report this Agreement (including price and all 97

terms) to the Multiple Listing Service that published it and to its members, financing institutions, appraisers, and anyone |

98 |

else related to this sale. Buyer and Seller expressly authorize all Closing Agents, appraisers, title insurance companies, |

99 |

and others related to this Sale, to furnish the Listing Broker and/or Selling Broker, on request, any and all information 100

and copies of documents concerning this sale. |

101 |

j.FIRPTA - Tax Withholding at Closing. The Closing Agent is instructed to prepare a certification (NWMLS Form 22E or 102

equivalent) that Seller is not a “foreign person” within the meaning of the Foreign Investment In Real Property Tax Act. 103 Seller shall sign this certification. If Seller is a foreign person, and this transaction is not otherwise exempt from FIRPTA, 104

Closing Agent is instructed to withhold and pay the required amount to the Internal Revenue Service. |

105 |

k.Notices. In consideration of the license to use this and NWMLS's companion forms and for the benefit of the Listing 106 Broker and the Selling Broker as well as the orderly administration of the offer, counteroffer or this Agreement, the 107 parties irrevocably agree that unless otherwise specified in this Agreement, any notice required or permitted in, or 108 related to, this Agreement (including revocations of offers or counteroffers) must be in writing. Notices to Seller must be 109 signed by at least one Buyer and shall be deemed given only when the notice is received by Seller, by Listing Broker or 110 at the licensed office of Listing Broker. Notices to Buyer must be signed by at least one Seller and shall be deemed 111 given only when the notice is received by Buyer, by Selling Broker or at the licensed office of Selling Broker. Receipt by 112 Selling Broker of a Form 17, Disclosure of Information on Lead-Based Paint and Lead-Based Paint Hazards, Public 113 Offering Statement or Resale Certificate, homeowners’ association documents provided pursuant to NWMLS Form 114 22D, or a preliminary commitment for title insurance provided pursuant to NWMLS Form 22T shall be deemed receipt 115 by Buyer. Selling Broker and Listing Broker have no responsibility to advise of receipt of a notice beyond either phoning 116 the party or causing a copy of the notice to be delivered to the party's address shown on this Agreement. Buyer and 117

Initials: BUYER: _________________ |

Date: _____________ |

SELLER: ________________ |

Date: ___________ |

BUYER: _________________ |

Date: _____________ |

SELLER: ________________ |

Date: ___________ |

Form 21 |

|

|

©Copyright 2011 |

Residential Purchase & Sale Agreement |

Northwest Multiple Listing Service |

Rev. 8/11 |

RESIDENTIAL REAL ESTATE PURCHASE AND SALE AGREEMENT |

ALL RIGHTS RESERVED |

Page 4 of 5 |

|

|

|

GENERAL TERMS |

|

Continued

Seller must keep Selling Broker and Listing Broker advised of their whereabouts in order to receive prompt notification 118

of receipt of a notice. |

119 |

l.Computation of Time. Unless otherwise specified in this Agreement, any period of time measured in days and stated 120 in this Agreement shall start on the day following the event commencing the period and shall expire at 9:00 p.m. of the 121 last calendar day of the specified period of time. Except for the Possession Date, if the last day is a Saturday, Sunday 122 or legal holiday as defined in RCW 1.16.050, the specified period of time shall expire on the next day that is not a 123 Saturday, Sunday or legal holiday. Any specified period of 5 days or less shall not include Saturdays, Sundays or legal 124 holidays. If the parties agree that an event will occur on a specific calendar date, the event shall occur on that date, 125 except for the Closing Date, which, if it falls on a Saturday, Sunday, legal holiday as defined in RCW 1.16.050, or day 126 when the county recording office is closed, shall occur on the next day that is not a Saturday, Sunday, legal holiday, or 127 day when the county recording office is closed. If the parties agree upon and attach a legal description after this 128 Agreement is signed by the offeree and delivered to the offeror, then for the purposes of computing time, mutual 129

acceptance shall be deemed to be on the date of delivery of an accepted offer or counteroffer to the offeror, rather than 130

on the date the legal description is attached. Time is of the essence of this Agreement. |

131 |

m.Facsimile and E-mail Transmission. Facsimile transmission of any signed original document, and retransmission of 132 any signed facsimile transmission, shall be the same as delivery of an original. At the request of either party, or the 133

Closing Agent, the parties will confirm facsimile transmitted signatures by signing an original document. E-mail 134 transmission of any document or notice shall not be effective unless the parties to this Agreement otherwise agree in 135

n.Integration and Electronic Signatures. This Agreement constitutes the entire understanding between the parties and 137 supersedes all prior or contemporaneous understandings and representations. No modification of this Agreement shall 138

be effective unless agreed in writing and signed by Buyer and Seller. The parties acknowledge that a signature in 139

electronic form has the same legal effect and validity as a handwritten signature. |

140 |

o.Assignment. Buyer may not assign this Agreement, or Buyer’s rights hereunder, without Seller’s prior written consent, 141 unless the parties indicate that assignment is permitted by the addition of “and/or assigns” on the line identifying the 142

Buyer on the first page of this Agreement. |

143 |

p.Default. In the event Buyer fails, without legal excuse, to complete the purchase of the Property, then the following 144

provision, as identified in Specific Term No. 8, shall apply: |

145 |

i.Forfeiture of Earnest Money. That portion of the Earnest Money that does not exceed five percent (5%) of the 146 Purchase Price shall be forfeited to the Seller as the sole and exclusive remedy available to Seller for such failure. 147

ii.Seller’s Election of Remedies. Seller may, at Seller’s option, (a) keep the Earnest Money as liquidated damages 148 as the sole and exclusive remedy available to Seller for such failure, (b) bring suit against Buyer for Seller’s actual 149

damages, (c) bring suit to specifically enforce this Agreement and recover any incidental damages, or (d) pursue 150

any other rights or remedies available at law or equity. |

151 |

q.Professional Advice and Attorneys’ Fees. Buyer and Seller are advised to seek the counsel of an attorney and a 152 certified public accountant to review the terms of this Agreement. Buyer and Seller agree to pay their own fees incurred 153

for such review. However, if Buyer or Seller institutes suit against the other concerning this Agreement the prevailing 154

party is entitled to reasonable attorneys’ fees and expenses. |

155 |

r.Offer. Buyer shall purchase the Property under the terms and conditions of this Agreement. Seller shall have until 9:00 156 p.m. on the Offer Expiration Date to accept this offer, unless sooner withdrawn. Acceptance shall not be effective until a 157

signed copy is received by Buyer, by Selling Broker or at the licensed office of Selling Broker. If this offer is not so 158

accepted, it shall lapse and any Earnest Money shall be refunded to Buyer. |

159 |

s.Counteroffer. Any change in the terms presented in an offer or counteroffer, other than the insertion of the Seller’s 160 name, shall be considered a counteroffer. If a party makes a counteroffer, then the other party shall have until 9:00 p.m. 161 on the counteroffer expiration date to accept that counteroffer, unless sooner withdrawn. Acceptance shall not be 162

effective until a signed copy is received by Seller, by Listing Broker or at the licensed office of Listing Broker. If the 163

counteroffer is not so accepted, it shall lapse and any Earnest Money shall be refunded to Buyer. |

164 |

t.Offer and Counteroffer Expiration Date. If no expiration date is specified for an offer/counteroffer, the 165

offer/counteroffer shall expire 2 days after the offer/counteroffer is delivered by the party making the offer/counteroffer, 166

unless sooner withdrawn. |

167 |

u.Agency Disclosure. Selling Firm, Selling Firm’s Designated Broker, Selling Broker’s Branch Manager (if any) and 168 Selling Broker’s Managing Broker (if any) represent the same party that Selling Broker represents. Listing Firm, Listing 169 Firm’s Designated Broker, Listing Broker’s Branch Manager (if any), and Listing Broker’s Managing Broker (if any) 170 represent the same party that the Listing Broker represents. If Selling Broker and Listing Broker are different persons 171 affiliated with the same Firm, then both Buyer and Seller confirm their consent to Designated Broker, Branch Manager 172

Initials: BUYER: _________________ |

Date: _____________ |

SELLER: ________________ |

Date: ___________ |

BUYER: _________________ |

Date: _____________ |

SELLER: ________________ |

Date: ___________ |

Form 21 |

|

|

©Copyright 2011 |

Residential Purchase & Sale Agreement |

Northwest Multiple Listing Service |

Rev. 8/11 |

RESIDENTIAL REAL ESTATE PURCHASE AND SALE AGREEMENT |

ALL RIGHTS RESERVED |

Page 5 of 5 |

|

|

|

GENERAL TERMS |

|

Continued

(if any), and Managing Broker (if any) representing both parties as dual agents. If Selling Broker and Listing Broker are 173 the same person representing both parties then both Buyer and Seller confirm their consent to that person and his/her 174 Designated Broker, Branch Manager (if any), and Managing Broker (if any) representing both parties as dual agents. All 175

parties acknowledge receipt of the pamphlet entitled “The Law of Real Estate Agency.” |

176 |

v.Commission. Seller and Buyer agree to pay a commission in accordance with any listing or commission agreement to 177 which they are a party. The Listing Firm’s commission shall be apportioned between Listing Firm and Selling Firm as 178 specified in the listing. Seller and Buyer hereby consent to Listing Firm or Selling Firm receiving compensation from 179 more than one party. Seller and Buyer hereby assign to Listing Firm and Selling Firm, as applicable, a portion of their 180 funds in escrow equal to such commission(s) and irrevocably instruct the Closing Agent to disburse the commission(s) 181 directly to the Firm(s). In any action by Listing or Selling Firm to enforce this paragraph, the prevailing party is entitled to 182

court costs and reasonable attorneys’ fees. Seller and Buyer agree that the Firms are intended third party beneficiaries 183

under this Agreement. |

184 |

w.Cancellation Rights/Lead-Based Paint. If a residential dwelling was built on the Property prior to 1978, and Buyer 185

receives a Disclosure of Information on Lead-Based Paint and Lead-Based Paint Hazards (NWMLS Form 22J) after 186

mutual acceptance, Buyer may rescind this Agreement at any time up to 3 days thereafter. |

187 |

x.Information Verification Period and Property Condition Disclaimer. Buyer shall have 10 days after mutual 188 acceptance to verify all information provided from Seller or Listing Firm related to the Property. This contingency shall 189 be deemed satisfied unless Buyer gives notice identifying the materially inaccurate information within 10 days of mutual 190 acceptance. If Buyer gives timely notice under this section, then this Agreement shall terminate and the Earnest Money 191 shall be refunded to Buyer. Buyer and Seller agree, that except as provided in this Agreement, all representations and 192 information regarding the Property and the transaction are solely from the Seller or Buyer, and not from any Broker. The 193 parties acknowledge that the Brokers are not responsible for assuring that the parties perform their obligations under 194 this Agreement and that none of the Brokers has agreed to independently investigate or confirm any matter related to 195 this transaction except as stated in this Agreement, or in a separate writing signed by such Broker. In addition, Brokers 196 do not guarantee the value, quality or condition of the Property and some properties may contain building materials, 197 including siding, roofing, ceiling, insulation, electrical, and plumbing, that have been the subject of lawsuits and/or 198 governmental inquiry because of possible defects or health hazards. Some properties may have other defects arising 199 after construction, such as drainage, leakage, pest, rot and mold problems. Brokers do not have the expertise to identify 200 or assess defective products, materials, or conditions. Buyer is urged to use due diligence to inspect the Property to 201 Buyer’s satisfaction and to retain inspectors qualified to identify the presence of defective materials and evaluate the 202 condition of the Property as there may be defects that may only be revealed by careful inspection. Buyer and Seller 203 acknowledge that home protection plans may be available which may provide additional protection and benefit to Buyer 204 and Seller. Brokers may assist the parties with locating and selecting third party service providers, such as inspectors or 205

contractors, but Brokers cannot guarantee or be responsible for the services provided by those third parties. The parties 206

agree to exercise their own judgment and due diligence regarding third-party service providers. |

207 |

Initials: BUYER: _________________ |

Date: _____________ |

SELLER: ________________ |

Date: ___________ |

BUYER: _________________ |

Date: _____________ |

SELLER: ________________ |

Date: ___________ |