We were designing this PDF editor having the prospect of allowing it to be as quick to use as it can be. That's the reason the actual procedure of completing the child support papers will likely to be effortless carry out all of these steps:

Step 1: To start out, choose the orange button "Get Form Now".

Step 2: You're now on the file editing page. You may edit, add text, highlight certain words or phrases, put crosses or checks, and insert images.

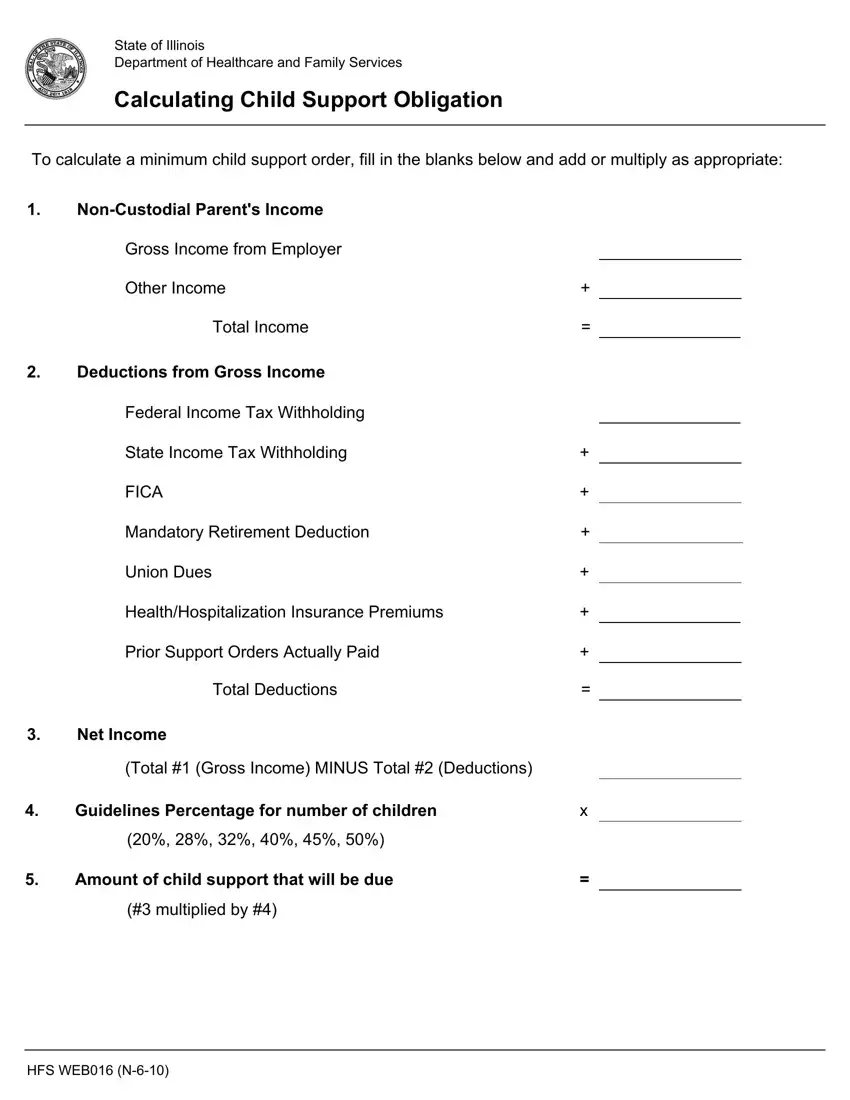

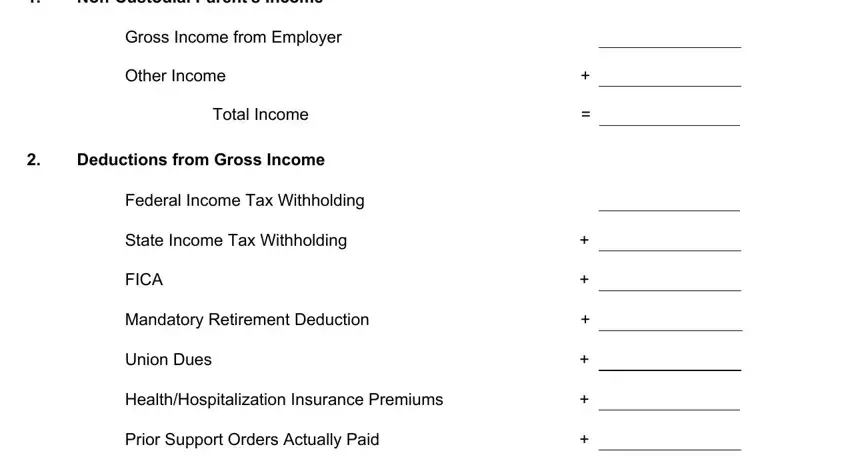

To fill out the child support papers PDF, enter the content for each of the segments:

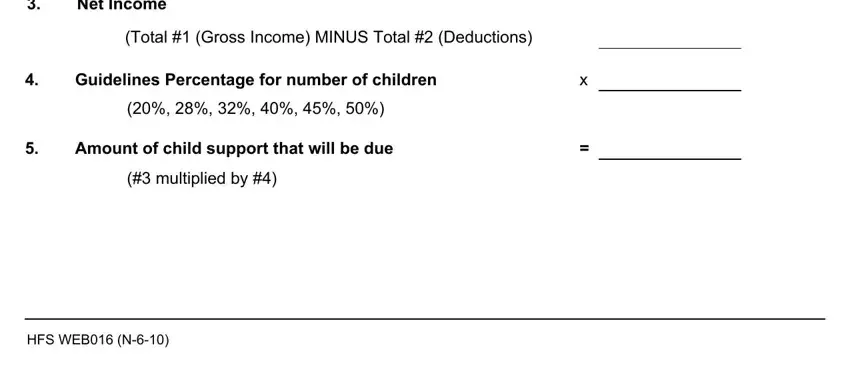

Remember to submit the data within the section Net Income, Total Gross Income MINUS Total, Guidelines Percentage for number, Amount of child support that will, multiplied by, and HFS WEB N.

Step 3: Click the Done button to save the file. At this point it is offered for export to your electronic device.

Step 4: It's possible to make copies of the file torefrain from any kind of future challenges. Don't get worried, we don't reveal or track your data.