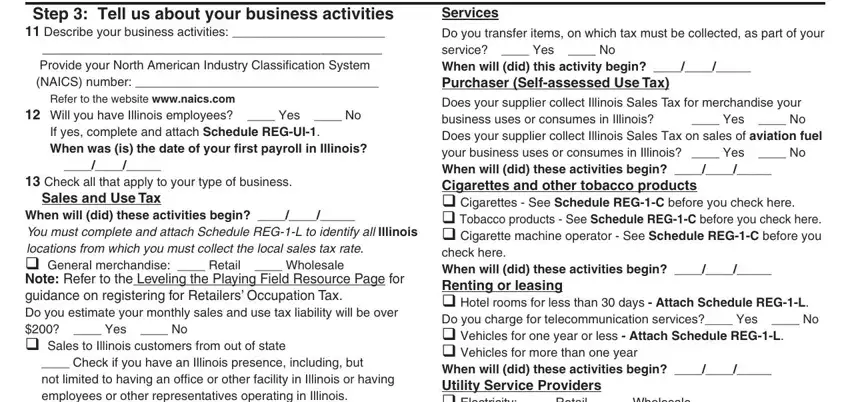

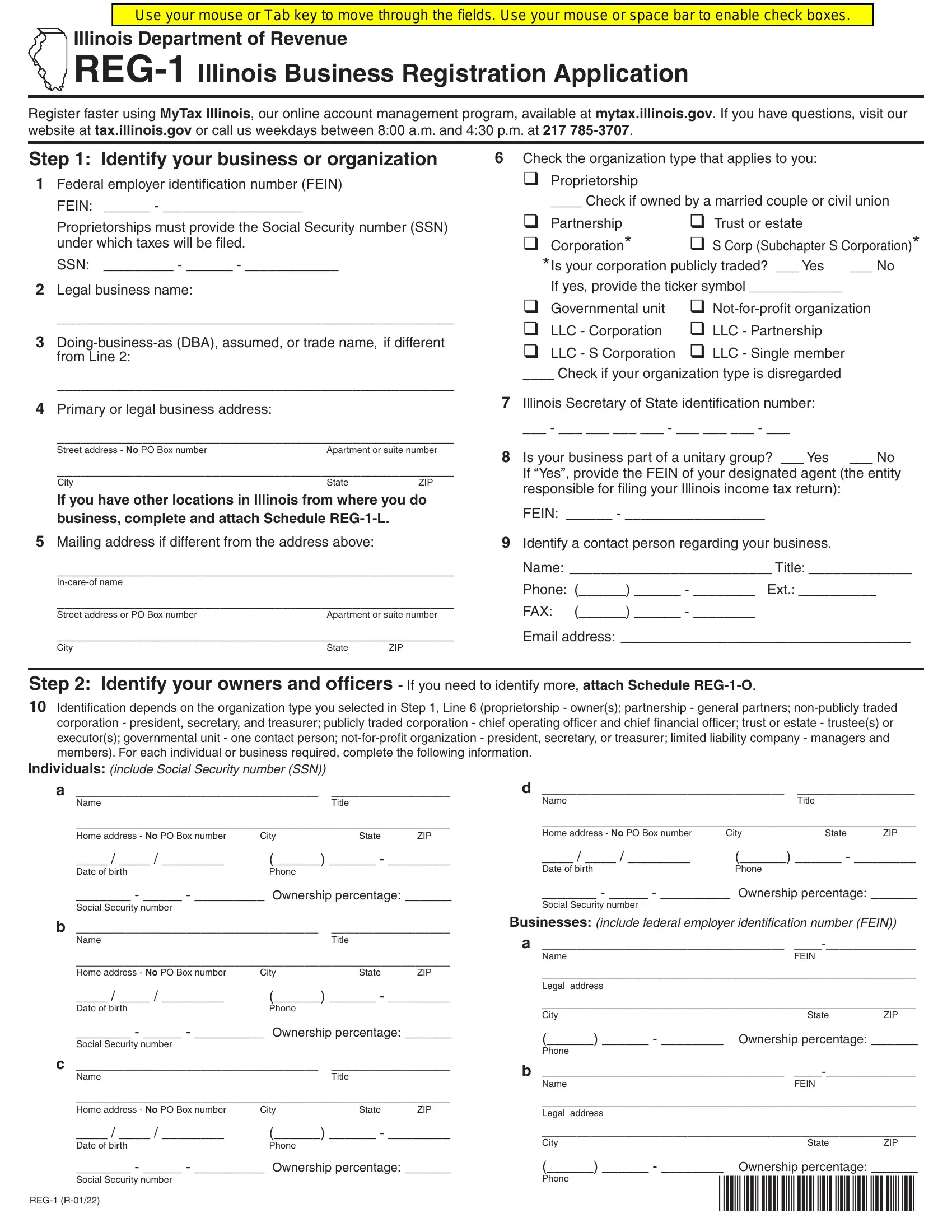

Step 3: Tell us about your business activities

11 Describe your business activities: ______________________

____________________________________________

Provide your North American Industry Classification System (NAICS) number: ___________________________________

Refer to the website www.naics.com

12 Will you have Illinois employees? ____ Yes ____ No

If yes, complete and attach Schedule REG-UI-1.

When was (is) the date of your first payroll in Illinois?

____/____/_____

13 Check all that apply to your type of business.

Sales and Use Tax

When will (did) these activities begin? ____/____/_____

You must complete and attach Schedule REG-1-L to identify all Illinois locations from which you must collect the local sales tax rate.

q General merchandise: ____ Retail ____ Wholesale

Note: Refer to the Leveling the Playing Field Resource Page for guidance on registering for Retailers’ Occupation Tax.

Do you estimate your monthly sales and use tax liability will be over $200? ____ Yes ____ No

qSales to Illinois customers from out of state

____ Check if you have an Illinois presence, including, but

not limited to having an office or other facility in Illinois or having employees or other representatives operating in Illinois.

____ Check if you have inventory in Illinois or if your Illinois

presence is due to inventory within the state. Attach Schedule REG-1-L.

____ Check if you make $100,000 or more in annual sales from

your own sales to Illinois purchasers.

____ Check if you make 200 or more separate transactions

annually from your own sales to Illinois purchasers. Are you registering as an out of state remote retailer?

____ Yes ____ No

When will (did) these activities begin? ____/____/_____

qCheck if you are a marketplace facilitator-Attach Schedule REG-1-MKP.

qSoft drinks (other than fountain soft drinks) in Chicago

qVehicle, watercraft, aircraft, or trailers

qSales or delivery of tires. Do you always pay the Tire User Fee to

your supplier? ____ Yes ____ No

qSales from vending machines. How many vending machines? ____

qLiquor at retail (bar, tavern, liquor store, etc.)

qMotor fuel/fuel: ____ Retail ____ Wholesale - Attach Form REG-8-A

____ Check here if you are required to collect prepaid sales tax.

qSales of Motor Fuel in a county that imposes County Motor Fuel Tax

qSales of Motor Fuel in a municipality that imposes Municipal Motor Fuel Tax

q Aviation fuel: ____ Retail ____ Wholesale

(if wholesale, attach Form REG-8-A)

qMedical cannabis - Attach Schedule REG-1-MC.

____ Cultivation Center ____ Dispensing Organization

When will (did) these activities begin? ____/____/_____

Services

Do you transfer items, on which tax must be collected, as part of your service? ____ Yes ____ No

When will (did) this activity begin? ____/____/_____

Purchaser (Self-assessed Use Tax)

Does your supplier collect Illinois Sales Tax for merchandise your

business uses or consumes in Illinois? ____ Yes ____ No

Does your supplier collect Illinois Sales Tax on sales of aviation fuel your business uses or consumes in Illinois? ____ Yes ____ No

When will (did) these activities begin? ____/____/_____

Cigarettes and other tobacco products

qCigarettes - See Schedule REG-1-C before you check here.

qTobacco products - See Schedule REG-1-C before you check here.

qCigarette machine operator - See Schedule REG-1-C before you check here.

When will (did) these activities begin? ____/____/_____

Renting or leasing

qHotel rooms for less than 30 days - Attach Schedule REG-1-L.

Do you charge for telecommunication services?____ Yes ____ No

qVehicles for one year or less - Attach Schedule REG-1-L.

qVehicles for more than one year

When will (did) these activities begin? ____/____/_____

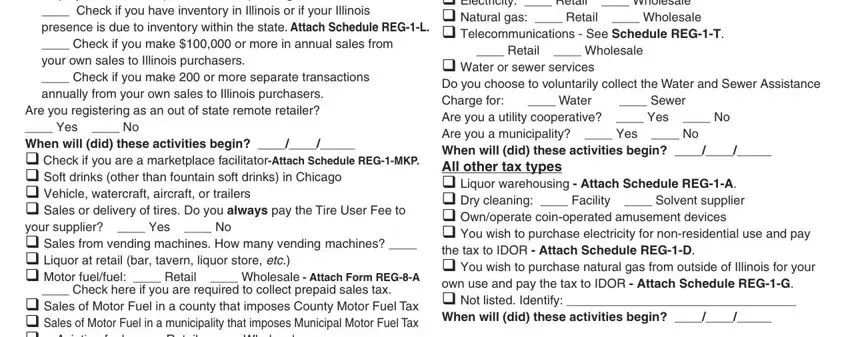

Utility Service Providers

q Electricity: ____ Retail |

____ Wholesale |

q Natural gas: ____ Retail |

____ Wholesale |

qTelecommunications - See Schedule REG-1-T.

____ Retail ____ Wholesale

qWater or sewer services

Do you choose to voluntarily collect the Water and Sewer Assistance

Charge for: |

____ Water |

____ Sewer |

Are you a utility cooperative? |

____ Yes ____ No |

Are you a municipality? ____ Yes ____ No

When will (did) these activities begin? ____/____/_____

All other tax types

qLiquor warehousing - Attach Schedule REG-1-A.

q Dry cleaning: ____ Facility ____ Solvent supplier

qOwn/operate coin-operated amusement devices

qYou wish to purchase electricity for non-residential use and pay the tax to IDOR - Attach Schedule REG-1-D.

qYou wish to purchase natural gas from outside of Illinois for your own use and pay the tax to IDOR - Attach Schedule REG-1-G.

qNot listed. Identify: _________________________________

When will (did) these activities begin? ____/____/_____