You may work with imrf form instantly using our PDF editor online. Our tool is consistently evolving to provide the best user experience attainable, and that is because of our commitment to continual development and listening closely to comments from users. Here's what you would have to do to begin:

Step 1: Firstly, open the pdf tool by clicking the "Get Form Button" above on this page.

Step 2: Using this advanced PDF tool, it is possible to do more than merely complete blank form fields. Try all the functions and make your docs appear perfect with customized textual content put in, or adjust the original content to perfection - all comes with the capability to incorporate just about any photos and sign it off.

This PDF doc will require you to type in some specific details; to guarantee accuracy, make sure you take heed of the guidelines directly below:

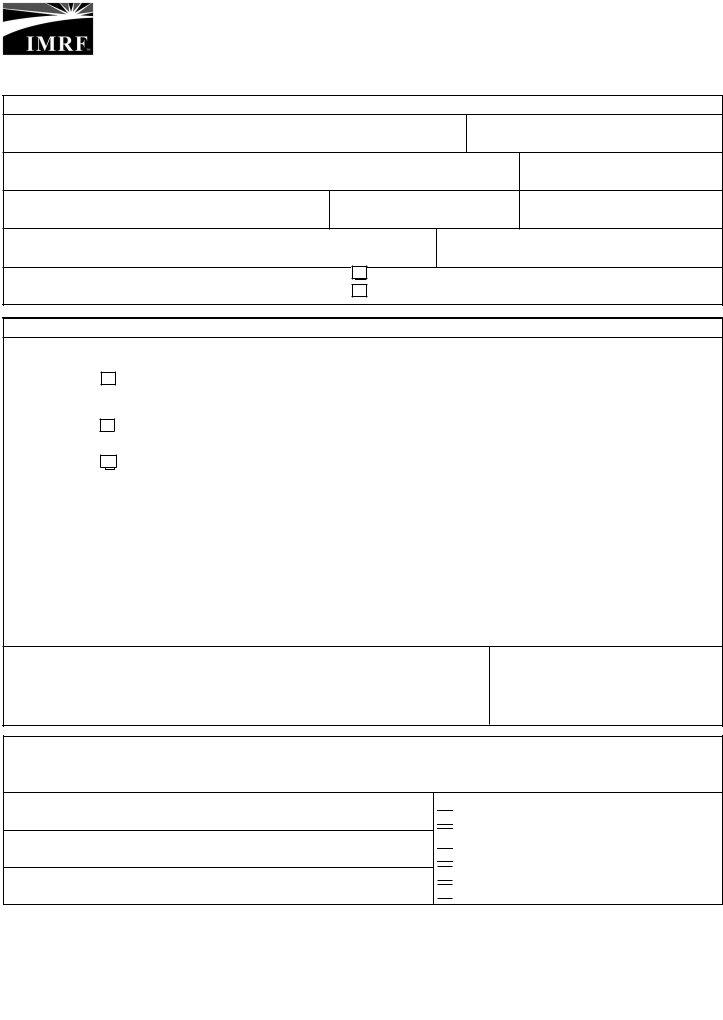

1. You need to fill out the imrf form correctly, so take care while filling out the sections that contain all of these blank fields:

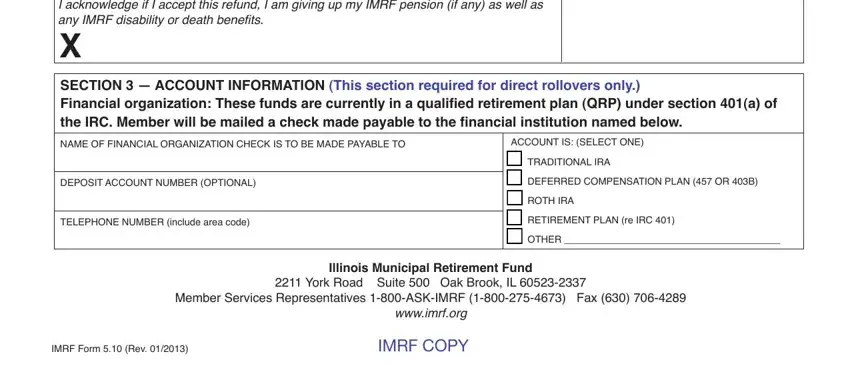

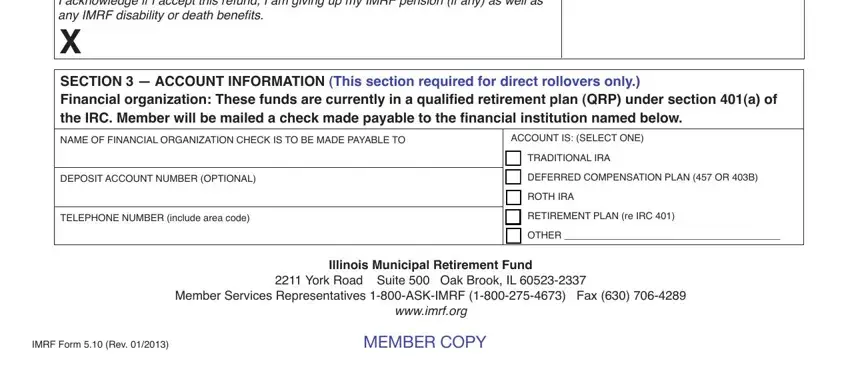

2. Just after performing this step, go to the subsequent stage and enter all required particulars in all these fields - Member Signature write do not, SECTION ACCOUNT INFORMATION This, NAME OF FINANCIAL ORGANIZATION, DEPOSIT ACCOUNT NUMBER OPTIONAL, TELEPHONE NUMBER include area code, ACCOUNT IS SELECT ONE, TRADITIONAL IRA, DEFERRED COMPENSATION PLAN OR B, ROTH IRA, RETIREMENT PLAN re IRC, OTHER, Illinois Municipal Retirement Fund, York Road Suite Oak Brook IL, Member Services Representatives, and IMRF Form Rev.

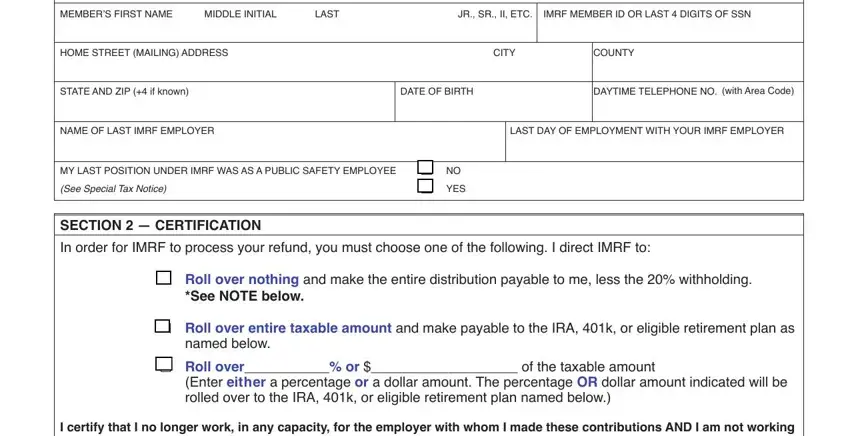

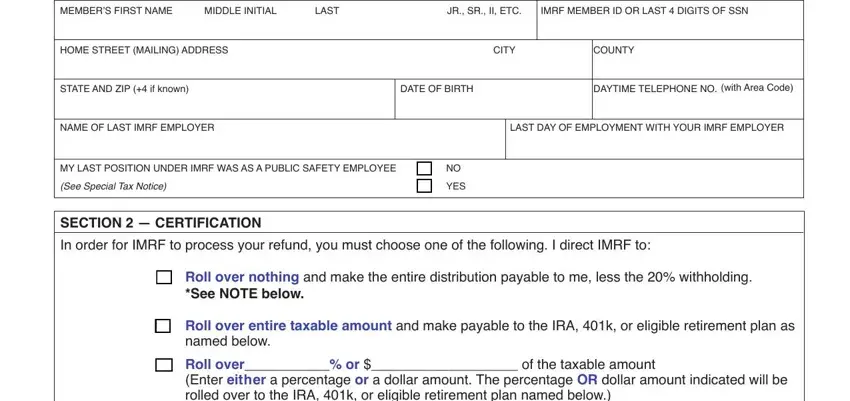

3. This subsequent part is usually rather easy, MEMBERS FIRST NAME, MIDDLE INITIAL, LAST, JR SR II ETC IMRF MEMBER ID OR, HOME STREET MAILING ADDRESS, CITY, COUNTY, STATE AND ZIP if known, DATE OF BIRTH, DAYTIME TELEPHONE NO, with Area Code, NAME OF LAST IMRF EMPLOYER, LAST DAY OF EMPLOYMENT WITH YOUR, MY LAST POSITION UNDER IMRF WAS AS, and See Special Tax Notice - these empty fields will need to be filled in here.

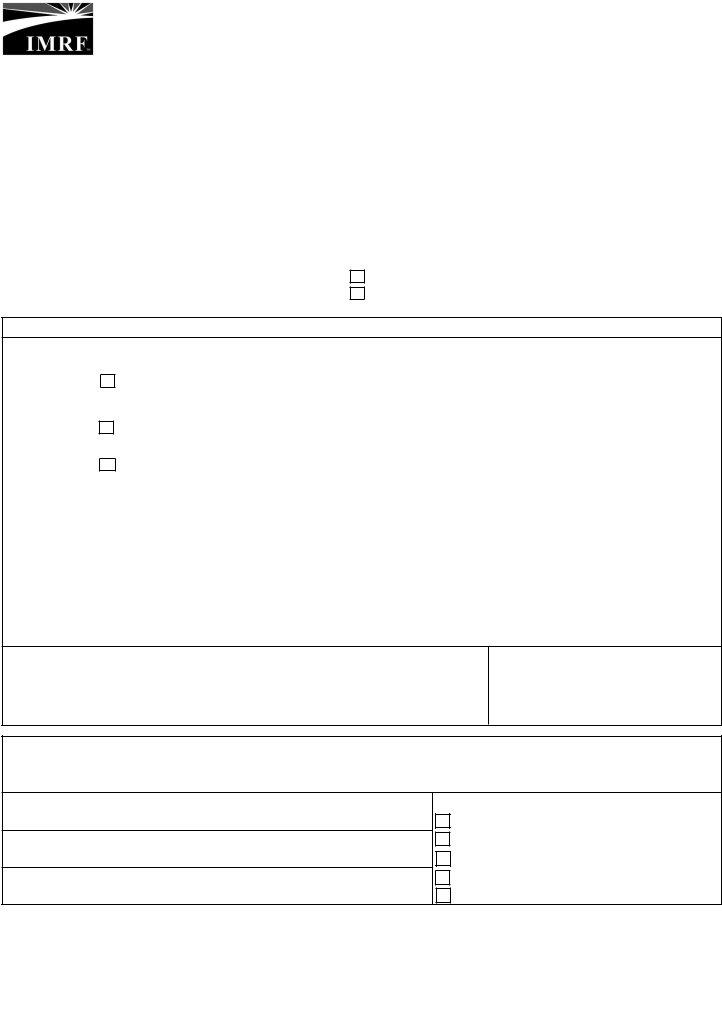

4. To move ahead, your next step involves completing several blank fields. Included in these are Member Signature write do not, SECTION ACCOUNT INFORMATION This, NAME OF FINANCIAL ORGANIZATION, DEPOSIT ACCOUNT NUMBER OPTIONAL, TELEPHONE NUMBER include area code, ACCOUNT IS SELECT ONE, TRADITIONAL IRA, DEFERRED COMPENSATION PLAN OR B, ROTH IRA, RETIREMENT PLAN re IRC, OTHER, Illinois Municipal Retirement Fund, York Road Suite Oak Brook IL, Member Services Representatives, and IMRF Form Rev, which you'll find fundamental to moving forward with this particular form.

People frequently get some points wrong while filling in TRADITIONAL IRA in this part. Be sure to revise what you enter here.

Step 3: As soon as you've looked over the details entered, click on "Done" to conclude your form. Make a free trial account at FormsPal and gain instant access to imrf form - available from your FormsPal cabinet. Whenever you work with FormsPal, it is simple to complete forms without worrying about personal data breaches or records getting shared. Our secure platform helps to ensure that your private data is stored safe.