This PDF editor was created with the purpose of making it as simple and intuitive as it can be. These steps can certainly make filling in the renewals quick and easy.

Step 1: The first thing would be to press the orange "Get Form Now" button.

Step 2: At this point, you can alter the renewals. Our multifunctional toolbar permits you to add, eliminate, modify, highlight, and perform other commands to the content material and areas within the form.

In order to complete the form, enter the details the platform will request you to for each of the following sections:

Within the field City, State, Zip, Phone, Fax, Email, Type of Entity eg individual, Description of Primary Business, SIC if business, SSN if individual EIN if business, ProductsServices Offered check all, Consulting, Professional, Other, and CONTRACTING REQUEST write down the details which the application requests you to do.

Outline the crucial information in the segment.

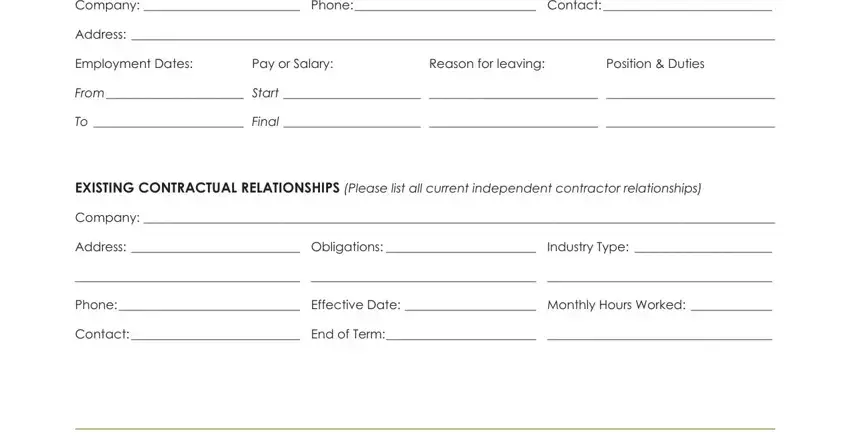

The PREVIOUS POSITIONS Please begin, Company Phone Contact, Address, Employment Dates, Pay or Salary, Reason for leaving, Position Duties, From, Start, Final, Company Phone Contact, Address, Employment Dates, Pay or Salary, and Reason for leaving area will be the place to insert the rights and obligations of either side.

Finalize by reviewing the following sections and filling them out accordingly: Company Phone Contact, Address, Employment Dates, Pay or Salary, Reason for leaving, Position Duties, From, Start, Final, EXISTING CONTRACTUAL RELATIONSHIPS, Company, Address, Obligations, Industry Type, and Phone.

Step 3: Press "Done". You can now upload the PDF document.

Step 4: In order to prevent any type of troubles down the road, you should prepare at the very least a few duplicates of the document.