It shouldn’t be difficult to prepare form independent review through our PDF editor. This is how you will be able rapidly develop your template.

Step 1: On this page, click the orange "Get form now" button.

Step 2: So, you are able to update your form independent review. The multifunctional toolbar helps you insert, erase, adjust, highlight, and do many other commands to the content material and areas within the file.

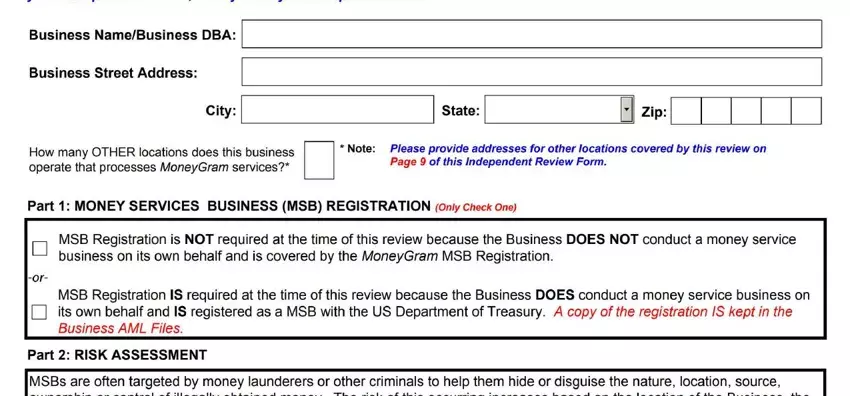

Type in the details requested by the software to complete the document.

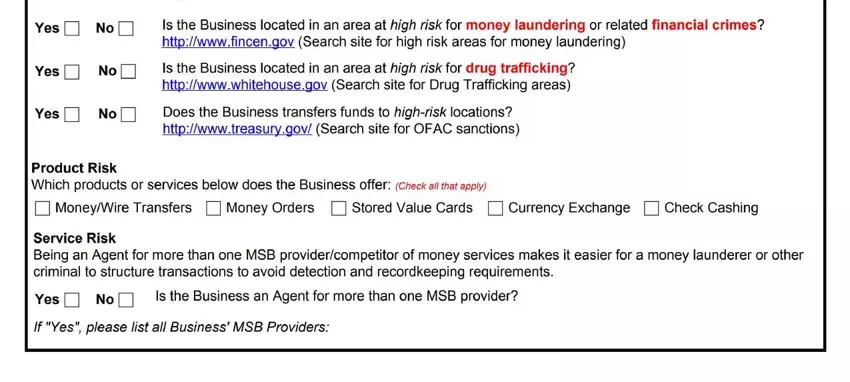

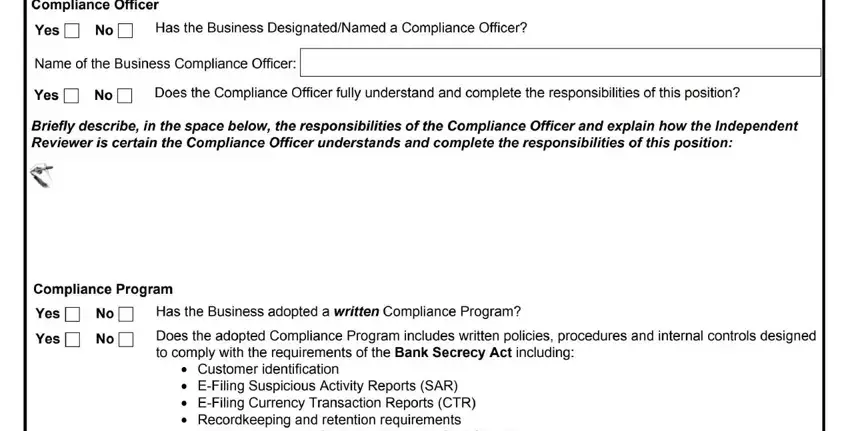

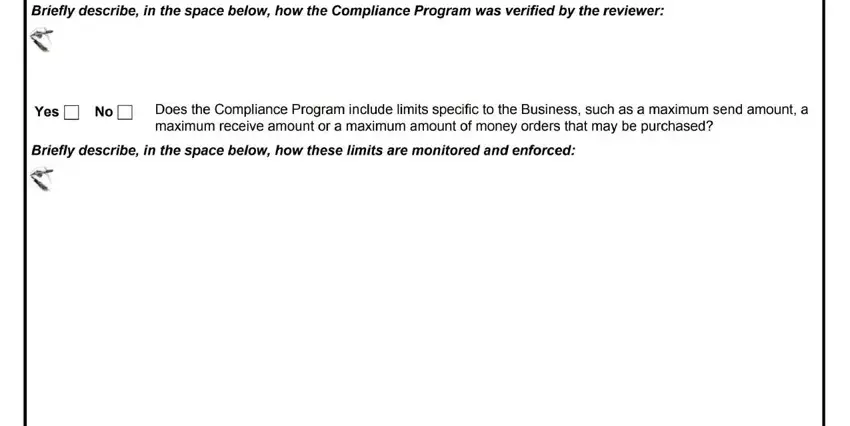

Fill in the Yes, NoD, Yes, Yes, NoD, and NoD areas with any details that is required by the software.

Identify the most significant data the segment.

The area has to be used to list the rights or responsibilities of both parties.

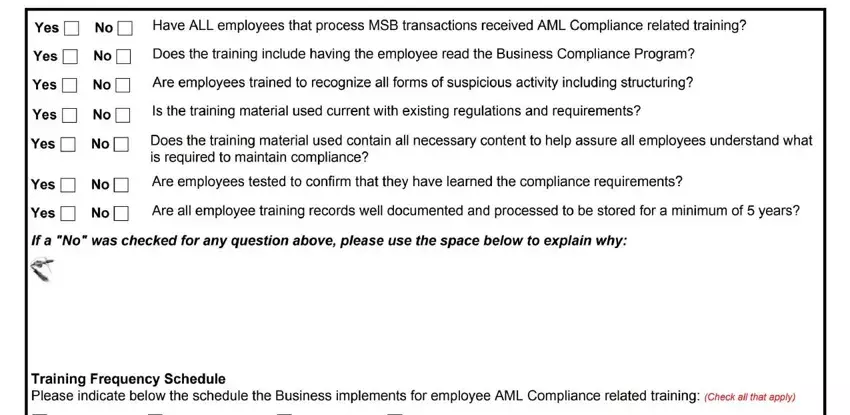

Finish the template by checking the next sections: Part, EMPLOYEE, TRAINING Yes, Yes, Yes Yes, Yes NoD, NoD, No NoNo, and NoNo.

Step 3: Once you choose the Done button, your ready file can be easily exported to all of your devices or to electronic mail indicated by you.

Step 4: Have a copy of every single form. It could save you time and permit you to stay away from difficulties as time goes on. Also, the information you have won't be shared or viewed by us.