Working with PDF files online can be quite easy using our PDF editor. Anyone can fill out in state form 2837 here painlessly. The editor is consistently upgraded by our staff, getting new awesome functions and growing to be better. If you're seeking to get started, this is what it takes:

Step 1: Open the PDF form in our tool by clicking the "Get Form Button" above on this webpage.

Step 2: This editor provides you with the capability to work with nearly all PDF files in a range of ways. Enhance it with any text, correct existing content, and add a signature - all when you need it!

It really is easy to fill out the form with this practical tutorial! Here's what you must do:

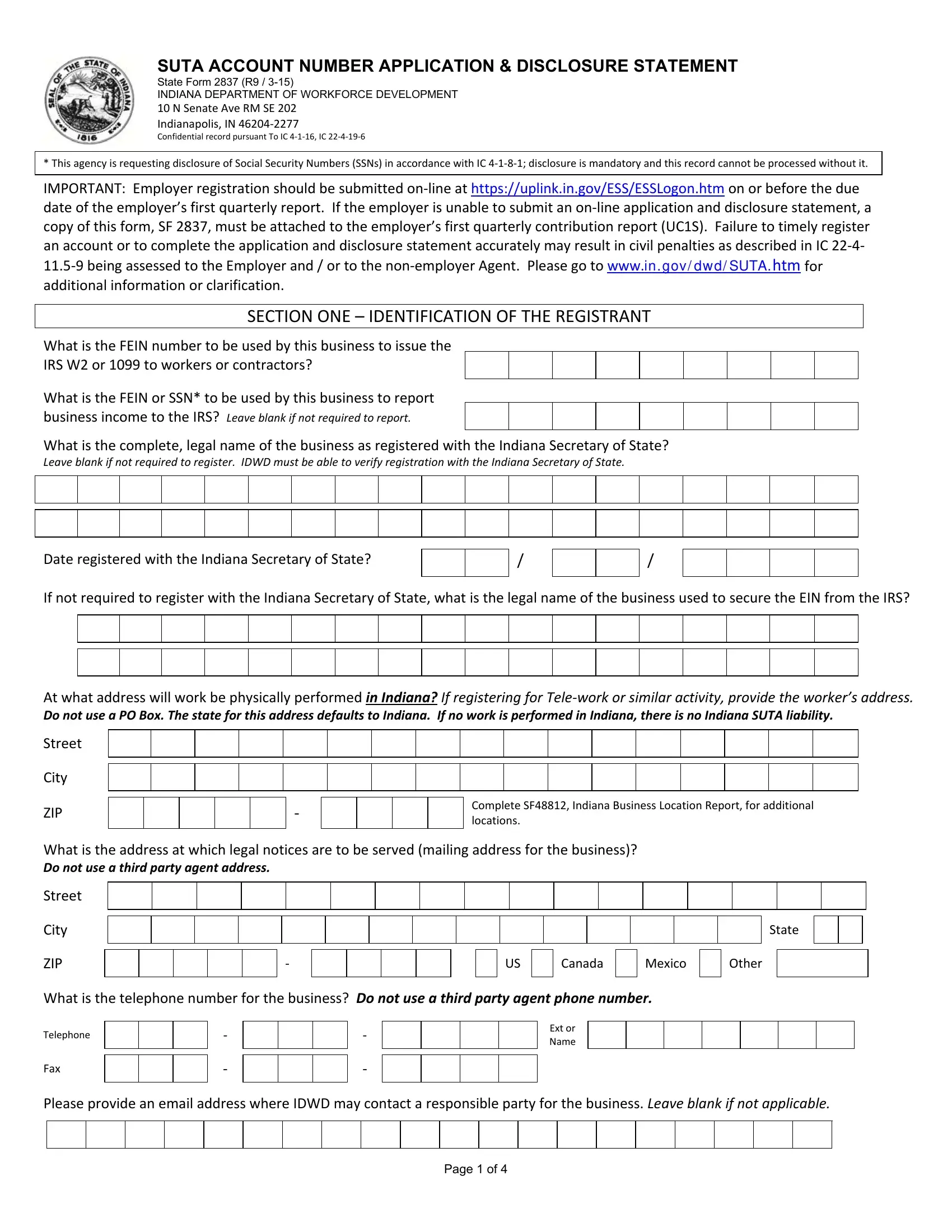

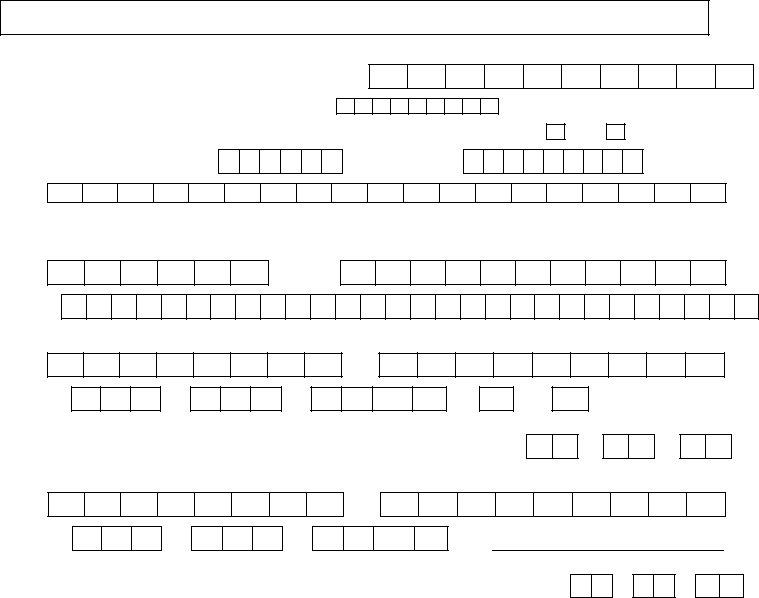

1. Start completing your in state form 2837 with a selection of major blanks. Consider all of the information you need and ensure nothing is overlooked!

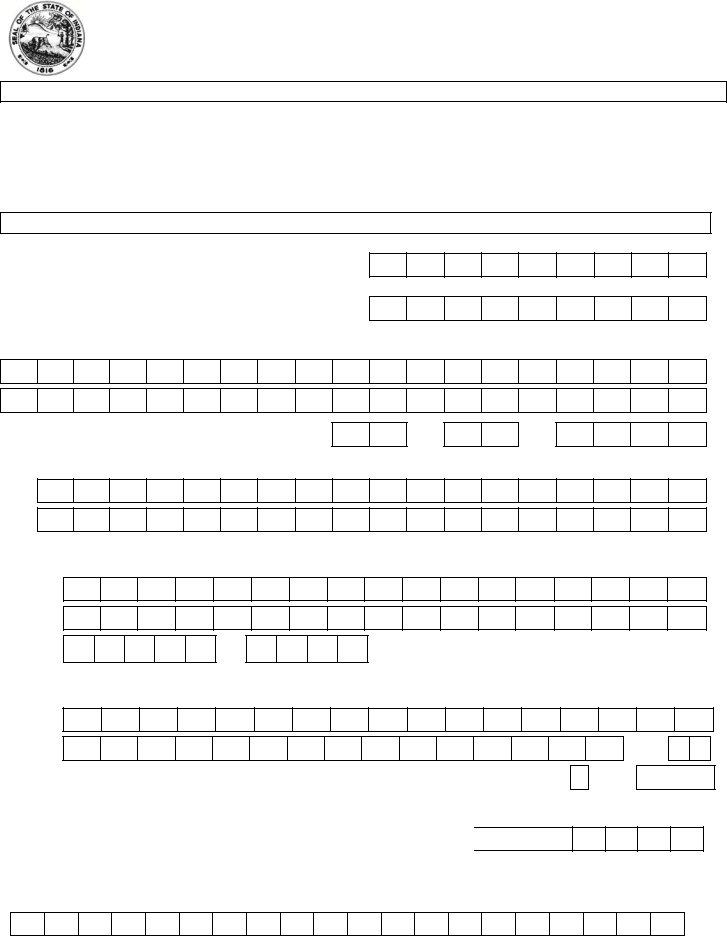

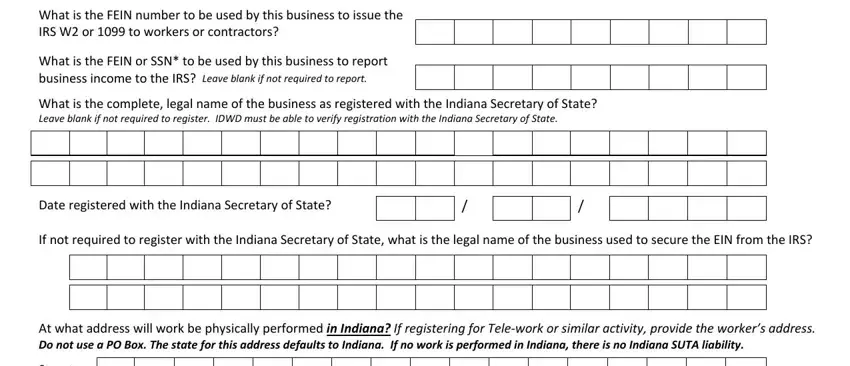

2. Right after the prior part is filled out, go to enter the applicable details in these: At what address will work be, City, ZIP, Complete SF Indiana Business, What is the address at which legal, City, ZIP, State, Canada, Mexico, Other, What is the telephone number for, Telephone, Fax, and Ext or Name.

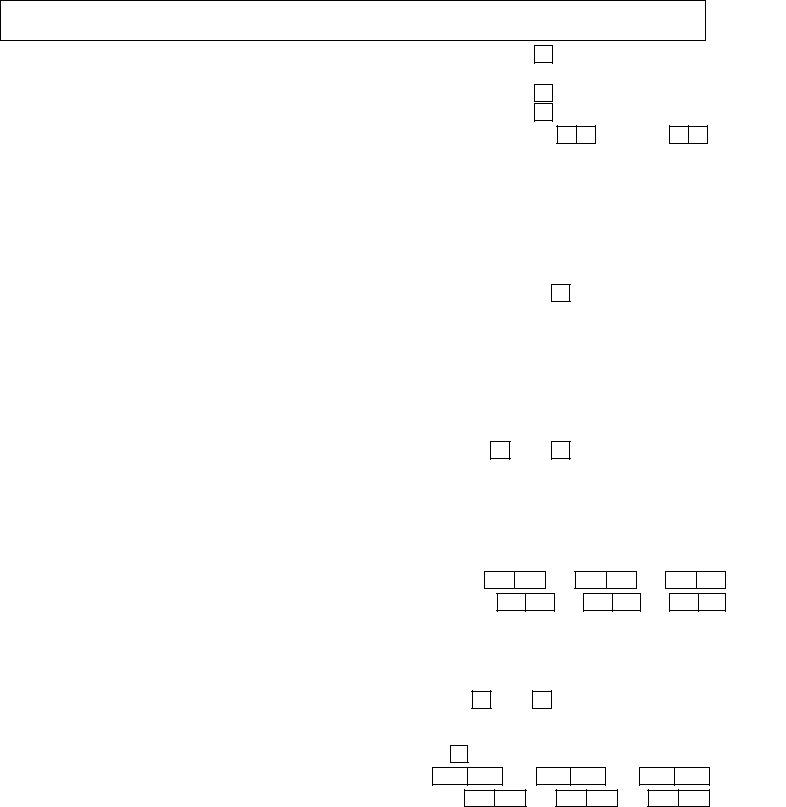

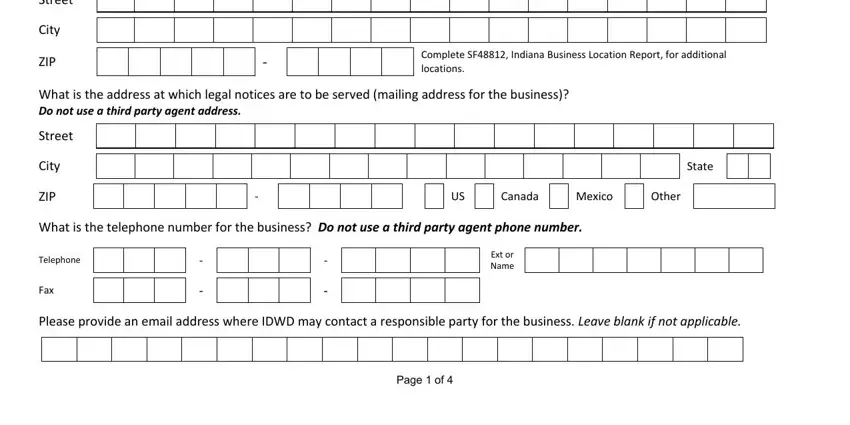

3. The next step is typically quite easy, You can only qualify answer yes, Are you registering as a FUTA, Yes, No If No go to questions Local, Indiana State Agency Foreign, If Yes select the Federal, Yes, Yes, Indiana Not for Profit, If No go to question, Other State Not for Profit, and Are you registering as a FUTA - every one of these blanks will have to be filled in here.

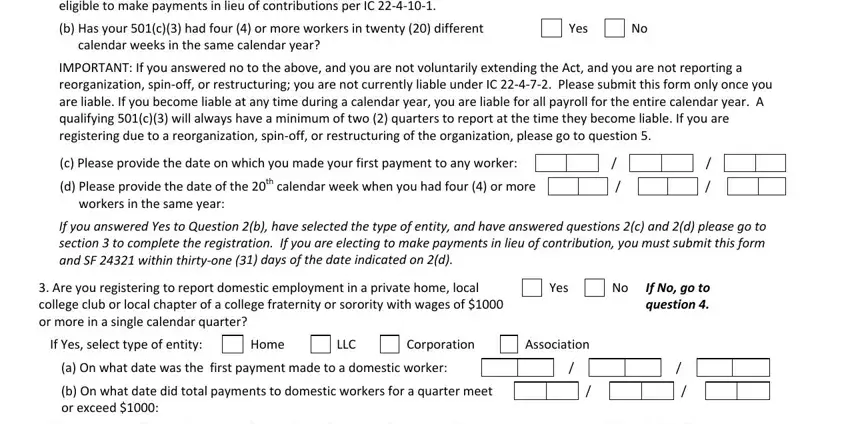

4. The following subsection needs your details in the following areas: Are you registering as a FUTA, Yes, c Please provide the date on which, Are you registering to report, Yes, If No go to question, If Yes select type of entity, Home, LLC, Corporation, Association, a On what date was the first, and If you answered Yes to Question. Remember to fill in all needed info to go onward.

Be very mindful when completing Are you registering as a FUTA and LLC, because this is the part where many people make a few mistakes.

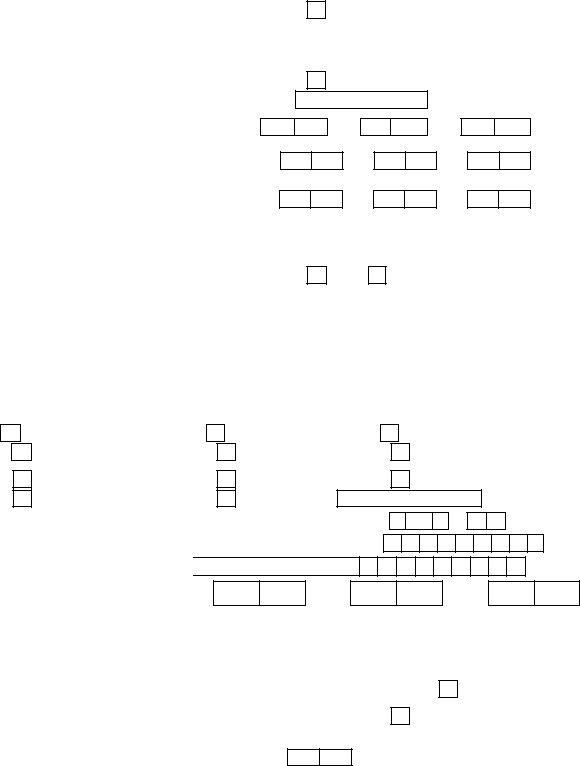

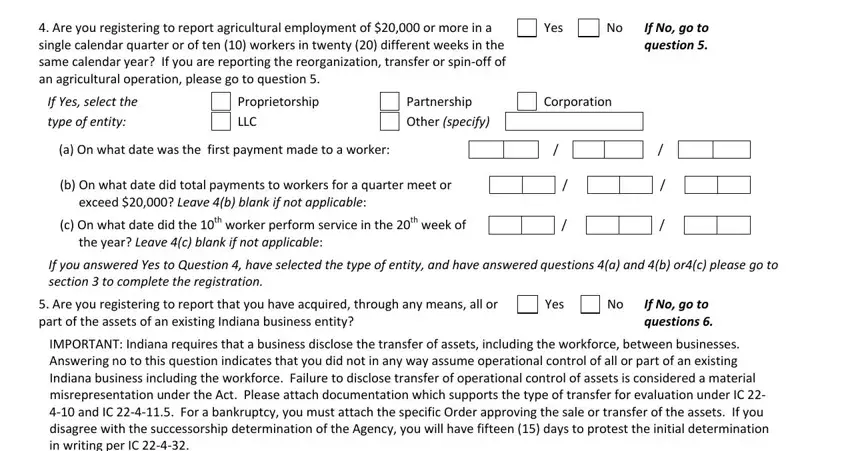

5. The document has to be finished by filling out this area. Further you can see a comprehensive list of blank fields that require specific information in order for your document submission to be faultless: Are you registering to report, Partnership Other specify, a On what date was the first, b On what date did total payments, Yes, If No go to question, Corporation, If you answered Yes to Question, Are you registering to report, Yes, If No go to questions, and IMPORTANT Indiana requires that a.

Step 3: Make certain your information is right and click on "Done" to progress further. Join FormsPal now and immediately gain access to in state form 2837, ready for download. Every change you make is handily kept , making it possible to customize the form at a later stage when required. We don't sell or share any details you provide while filling out forms at FormsPal.