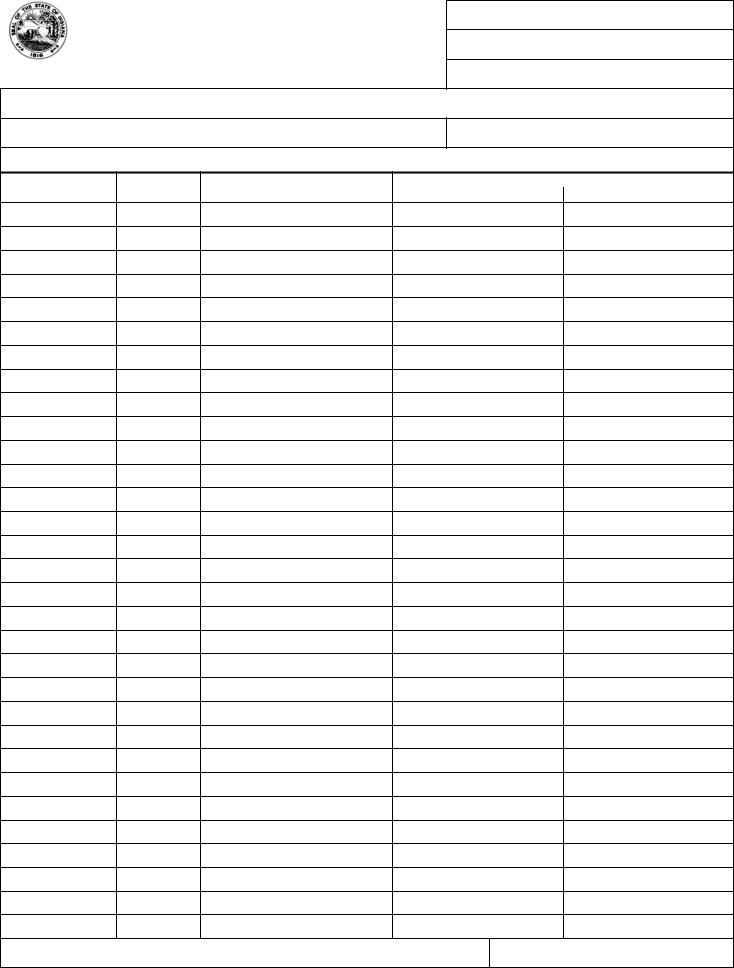

For many self-employed individuals in Indiana, accurately reporting income can be a critical yet intricate part of managing their financial responsibilities, whether it be for tax purposes, applying for loans, or securing other forms of financial assistance. The Indiana State Form 43931 emerges as a vital tool in this process, designed specifically to simplify the monthly reporting of both gross income and business-related expenses for those managing their own businesses. This document caters to the unique needs of self-employed professionals by providing a structured format where they can meticulously list their daily earnings and expenditures over the course of a month. From the name of the individual and the type of business to a detailed day-by-day breakdown of hours worked, income received, and costs incurred, the form ensures a comprehensive snapshot of the business's monthly financial activity. Additionally, it requires the signature of the self-employed person alongside the date, thereby affirming the accuracy of the information provided. This form not only serves as an official record for the individual's business transactions but also assists caseworkers with precise identification numbers in efficiently processing and verifying the financial data submitted. By offering a clear framework for reporting, the State Form 43931 significantly aids in maintaining detailed and accurate financial records, reinforcing the importance of transparency and accountability in the realm of self-employment.

| Question | Answer |

|---|---|

| Form Name | Indiana State 43931 Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | indiana state form self, state of indiana employee tax form, indiana state form report, form 43931 self income |

REPORT OF

State Form 43931 (R4 /

Case name

Case number

Name of caseworker / identification number

This document has been created for the convenience of

Name of

Type of business

DAY OF |

HOURS |

AMOUNT OF |

|

COSTS |

MONTH |

PER DAY |

INCOME RECEIVED |

Type |

Amount |

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

28.

29.

30.

31.

Signature of

Date signed (month, day, year)