Should you would like to fill out business tangible personal property return form 104, you don't need to install any programs - simply try our PDF tool. To keep our tool on the forefront of efficiency, we strive to integrate user-driven capabilities and enhancements on a regular basis. We are always grateful for any suggestions - join us in revampimg PDF editing. All it takes is a couple of simple steps:

Step 1: Just hit the "Get Form Button" at the top of this webpage to get into our form editor. This way, you'll find everything that is necessary to work with your file.

Step 2: Using our handy PDF tool, it is easy to do more than simply fill out blank fields. Express yourself and make your forms appear great with customized text added in, or fine-tune the file's original input to excellence - all comes along with the capability to insert stunning images and sign it off.

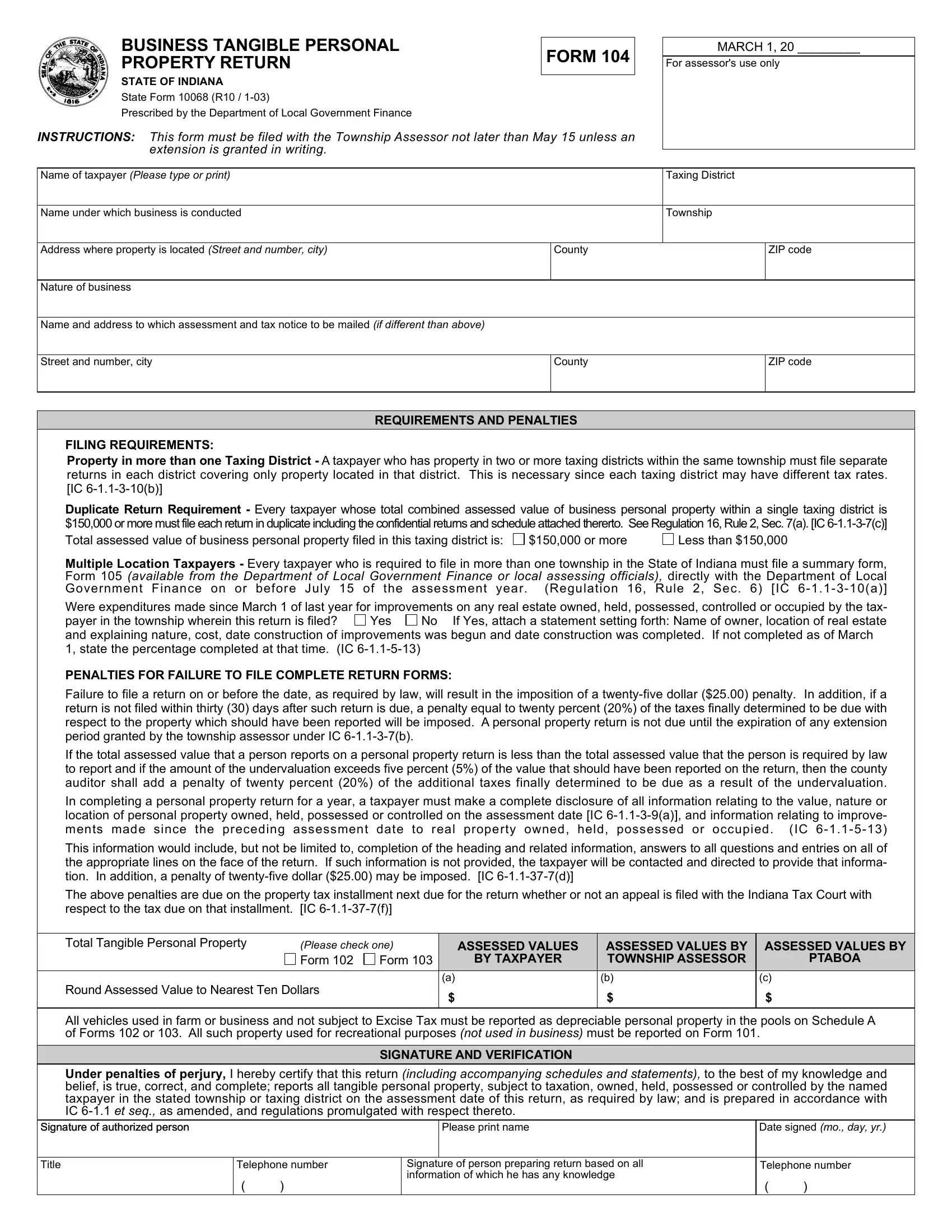

This PDF form will require particular details to be entered, thus you should definitely take some time to provide what's requested:

1. The business tangible personal property return form 104 requires certain details to be inserted. Be sure that the subsequent blank fields are completed:

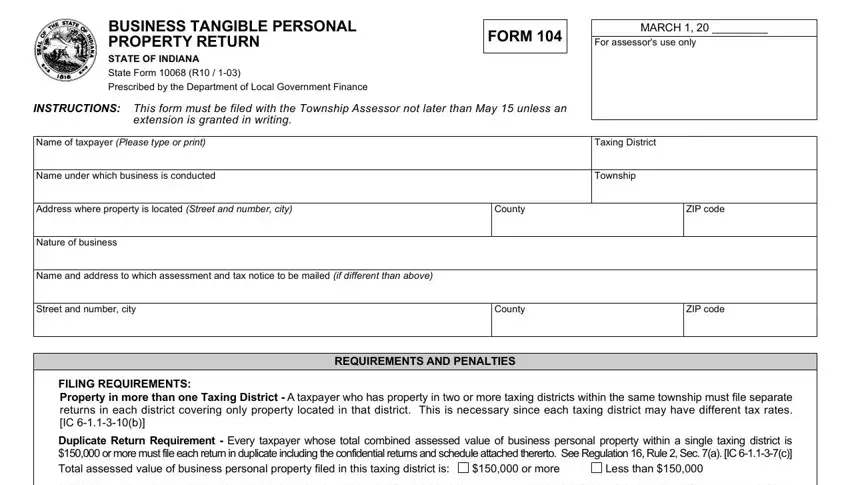

2. After completing this part, go to the subsequent stage and fill in the necessary details in these blank fields - Multiple Location Taxpayers Every, Were expenditures made since March, Yes, PENALTIES FOR FAILURE TO FILE, Failure to file a return on or, If the total assessed value that a, In completing a personal property, This information would include but, The above penalties are due on the, Total Tangible Personal Property, Please check one Form, Form, ASSESSED VALUES, BY TAXPAYER, and ASSESSED VALUES BY TOWNSHIP.

As to Total Tangible Personal Property and Were expenditures made since March, make sure that you review things in this section. These are certainly the key fields in this document.

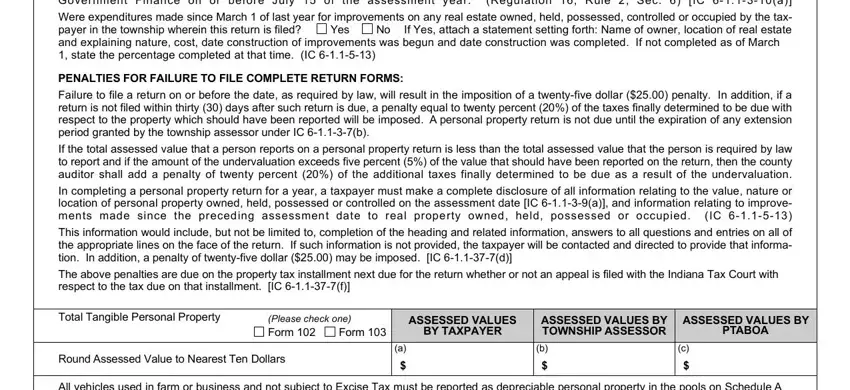

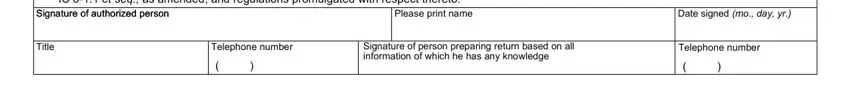

3. The following segment will be focused on Under penalties of perjury I, Signature of authorized person, Please print name, Date signed mo day yr, Title, Telephone number, Signature of person preparing, and Telephone number - fill in each one of these fields.

Step 3: Before finishing the document, make certain that blanks have been filled in the proper way. The moment you are satisfied with it, click “Done." Sign up with us today and easily get business tangible personal property return form 104, prepared for download. All changes made by you are preserved , allowing you to modify the document later if required. FormsPal is committed to the confidentiality of our users; we always make sure that all information entered into our system remains protected.