If you're a resident of Indiana, then it's likely that you've come across the State Form 43931 at some point during your life. Whether for filing tax returns or applying for public assistance programs such as SNAP or TANF, understanding what this form is and how to complete it properly can be a critical part of participating in various government-funded initiatives. In this blog post, we'll discuss what the Form 43931 is and provide instructions on filling it out correctly. By taking the time to learn about this document now, Indiana residents will have an easier time completing their paperwork in the future and utilizing all of the services they need throughout their lives!

| Question | Answer |

|---|---|

| Form Name | Indiana State 43931 Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | indiana state form self, state of indiana employee tax form, indiana state form report, form 43931 self income |

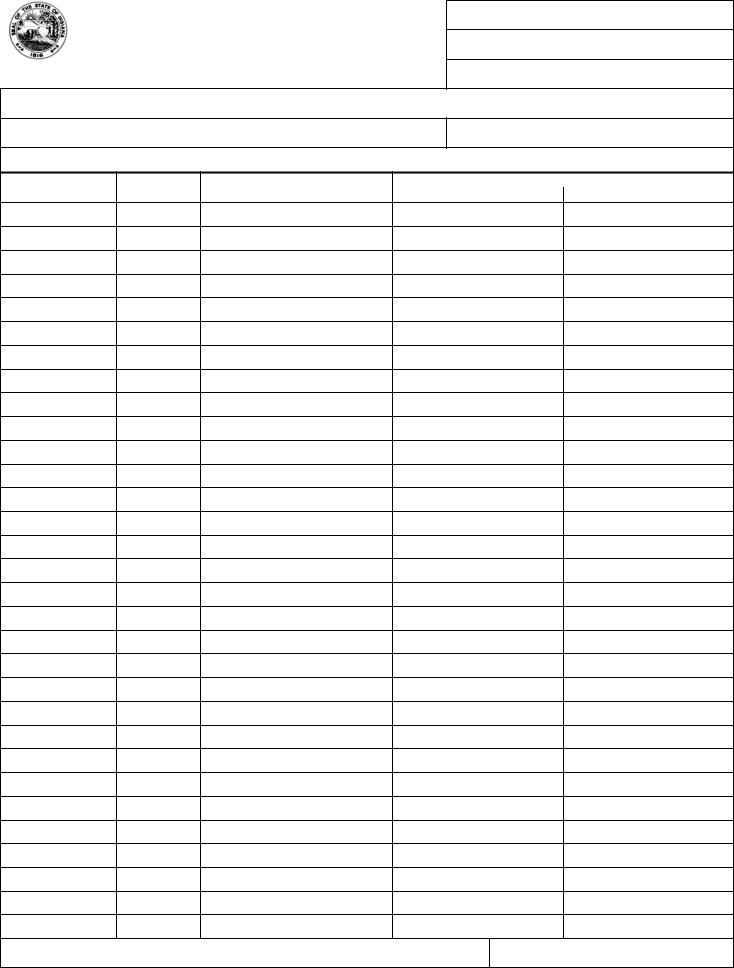

REPORT OF

State Form 43931 (R4 /

Case name

Case number

Name of caseworker / identification number

This document has been created for the convenience of

Name of

Type of business

DAY OF |

HOURS |

AMOUNT OF |

|

COSTS |

MONTH |

PER DAY |

INCOME RECEIVED |

Type |

Amount |

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

28.

29.

30.

31.

Signature of

Date signed (month, day, year)