Couple of things can be simpler than filling out documentation applying the PDF editor. There isn't much you need to do to modify the employment forms w 4 file - just abide by these steps in the following order:

Step 1: The initial step is to click the orange "Get Form Now" button.

Step 2: You're now capable of enhance employment forms w 4. You possess lots of options thanks to our multifunctional toolbar - you can include, erase, or change the text, highlight its particular components, as well as conduct many other commands.

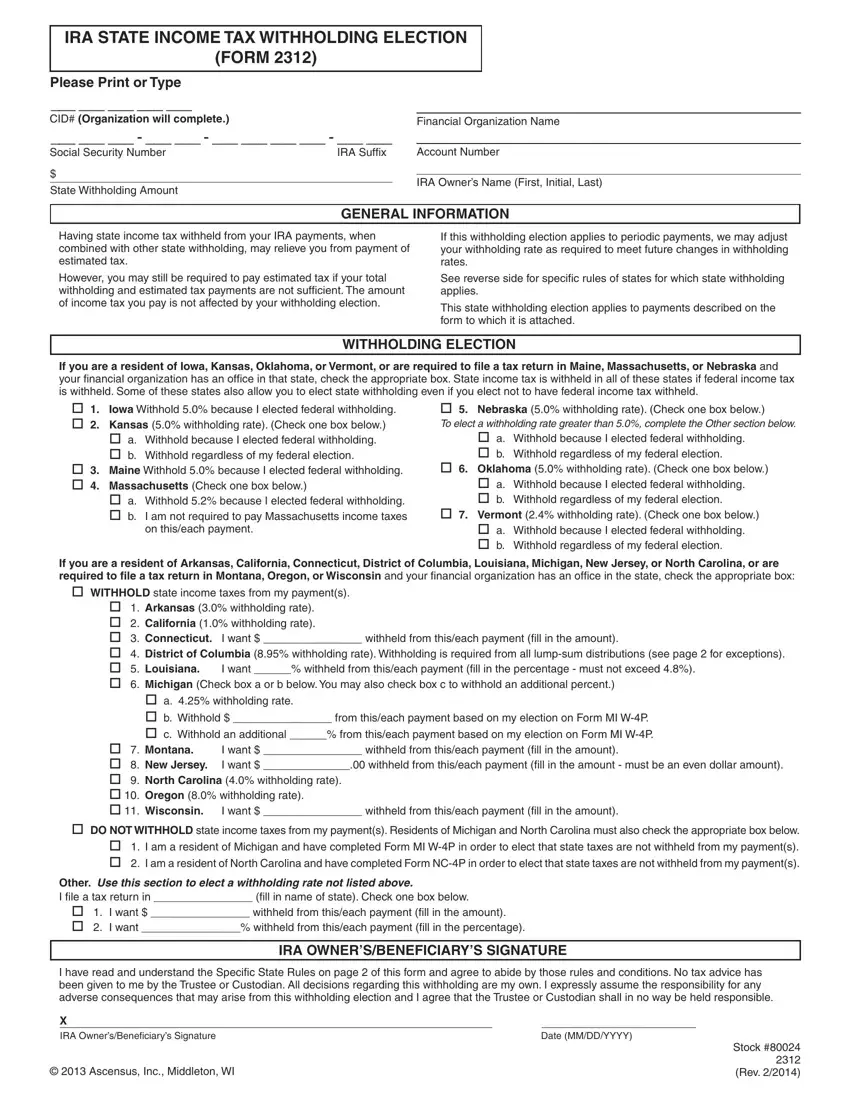

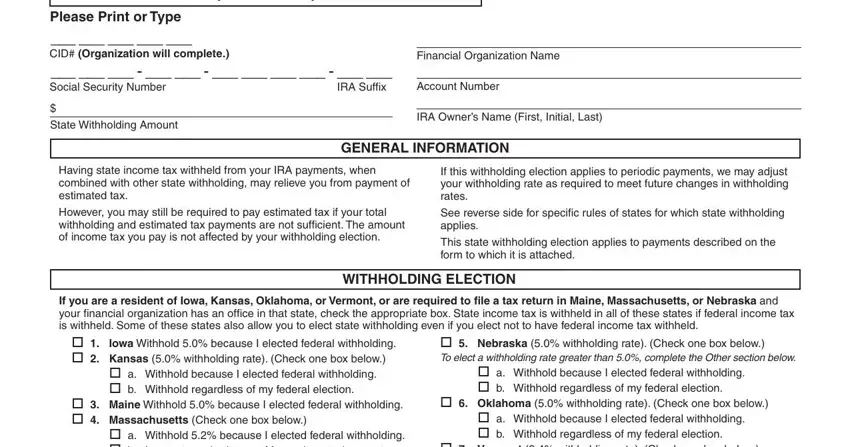

To be able to complete the employment forms w 4 PDF, enter the content for all of the sections:

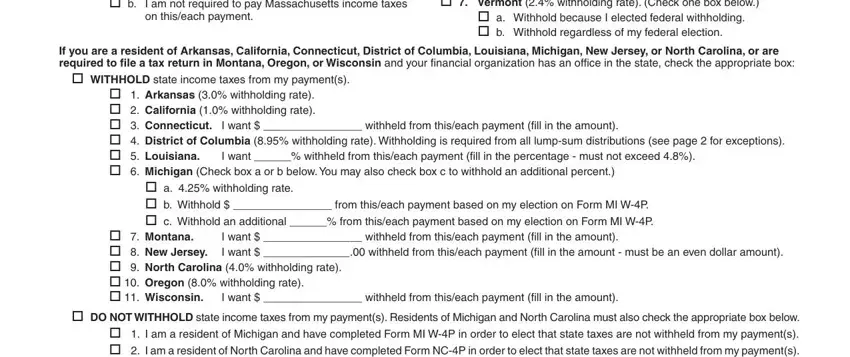

Make sure you write down the demanded information in the o o Kansas withholding rate, on thiseach payment, o Nebraska withholding rate, If you are a resident of Arkansas, o WITHHOLD state income taxes from, o Connecticut I want withheld, o District of Columbia, o Louisiana, I want withheld from thiseach, o Michigan Check box a or b below, o a withholding rate o b Withhold, I want withheld from thiseach, o Montana o New Jersey o North, and I want withheld from thiseach area.

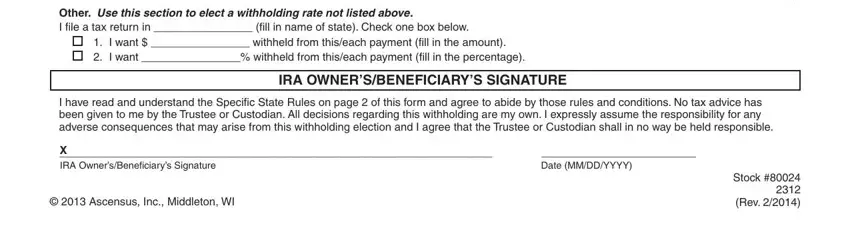

The system will require details to effortlessly submit the segment o Montana o New Jersey o North, Other Use this section to elect a, o I want withheld from thiseach, IRA OWNERSBENEFICIARYS SIGNATURE, I have read and understand the, X IRA OwnersBeneficiarys Signature, Date MMDDYYYY, Ascensus Inc Middleton WI, and Stock Rev.

Step 3: Press the "Done" button. Now you can upload the PDF document to your gadget. Besides, you can send it via email.

Step 4: Produce a duplicate of every different form. It may save you time and allow you to keep clear of misunderstandings in the long run. Also, the information you have is not used or viewed by us.