Distribution Request - |

DRD |

IRA Beneficiary Claim/Disclaim Form |

|

Instructions: Use this form if you are a beneficiary and would like to claim or disclaim your benefit from a LPL Financial LLC (“LPL”) sponsored IRA account with a deceased owner. If you choose to claim your benefit as beneficiary, you can treat assets as your own IRA (spouse only), or transfer to a beneficiary IRA. Do not use this form for a Qualified Retirement Plan (QRP) or 403(b) 7 account. Please note: If you are a non-resident alien, you must open a Beneficiary IRA in order to claim your benefit, select Option A, Scenario 1.

The Internal Revenue Code imposes requirements as to the amount and timing of distributions from this account including Required Minimum Distributions. Please consult with your tax advisor.

Please mail completed form to LPL Financial Attn: Trade Direct, P.O. Box 509049 San Diego, CA 92150-9049 or fax to (858) 202-8500. Documents to submit with this form:

·Each beneficiary must complete and sign a separate Distribution Request - Beneficiary Claim/Disclaim Form. If there are multiple beneficiaries journaling securities to Beneficiary IRA accounts and the underlying securities cannot be evenly divided, please complete/sign Addendum A.

·A certified copy of the Death Certificate is required for all claim/disclaim transactions. ·Additional requirements will be necessary for specific beneficiary types:

·Estate: Court-certified Letters of Testamentary will be required. Also, the executor must obtain a Tax ID Number/EIN for the estate. The executor will sign this form.

·Trust: A complete copy of the Trust will be required. Note: if the Tax ID Number for a grantor trust is the same as the deceased grantor's Social Security Number, a new Tax ID Number/EIN must be obtained for the trust (with the exception of co-grantors). The trustee(s) will sign this form (if the Private Trust Company, N.A. acts as the trustee, please contact them directly at 800-877-7210 extension 7990.)

·Minor or Conservatorship: Letters of Guardianship or Conservatorship will be required. The Guardian or Conservatorship will sign this form.

·MCorporation/Non-Corporate Entity: A copy of the Corporate/Non-Corporate Resolution reflecting authorized signer(s). The corporate/non-corporate officer(s) will sign this form.

·Beneficiary No Longer Living: attach a copy of the beneficiary's death certificate.

NOTE: We reserve the right to request additional information we may deem necessary to settle the claim or disclaimer.

Information and Request

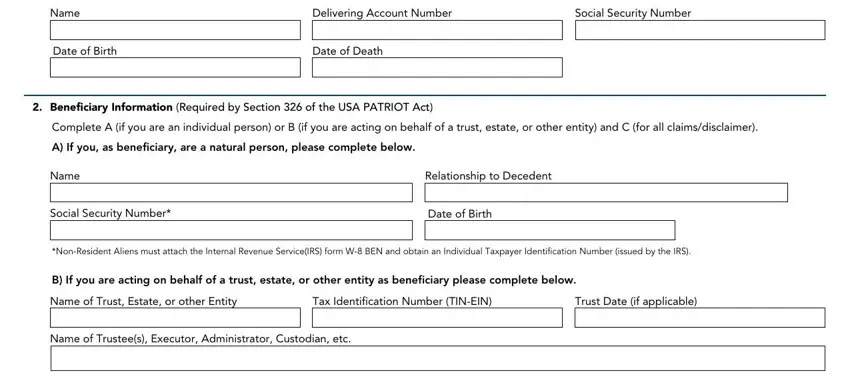

1. Deceased IRA Owner Information |

|

|

|

|

Name |

Delivering Account Number |

Social Security Number |

|

|

|

|

|

|

|

Date of Birth |

Date of Death |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.Beneficiary Information (Required by Section 326 of the USA PATRIOT Act)

Complete A (if you are an individual person) or B (if you are acting on behalf of a trust, estate, or other entity) and C (for all claims/disclaimer).

A) If you, as beneficiary, are a natural person, please complete below.

Name |

|

Relationship to Decedent |

|

|

|

|

Social Security Number* |

|

Date of Birth |

|

|

|

|

*Non-Resident Aliens must attach the Internal Revenue Service(IRS) form W-8 BEN and obtain an Individual Taxpayer Identification Number (issued by the IRS).

B) If you are acting on behalf of a trust, estate, or other entity as beneficiary please complete below.

Name of Trust, Estate, or other Entity |

|

Tax Identification Number (TIN-EIN) |

|

Trust Date (if applicable) |

|

|

|

|

|

Name of Trustee(s), Executor, Administrator, Custodian, etc.

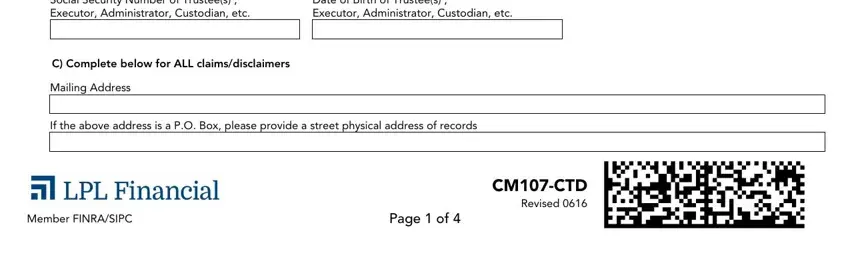

Social Security Number of Trustee(s) , |

|

Date of Birth of Trustee(s) , |

Executor, Administrator, Custodian, etc. |

|

Executor, Administrator, Custodian, etc. |

|

|

|

C) Complete below for ALL claims/disclaimers

Mailing Address

If the above address is a P.O. Box, please provide a street physical address of records

CM107-CTD

Revised 0616

Member FINRA/SIPC |

Page 1 of 4 |

DRD

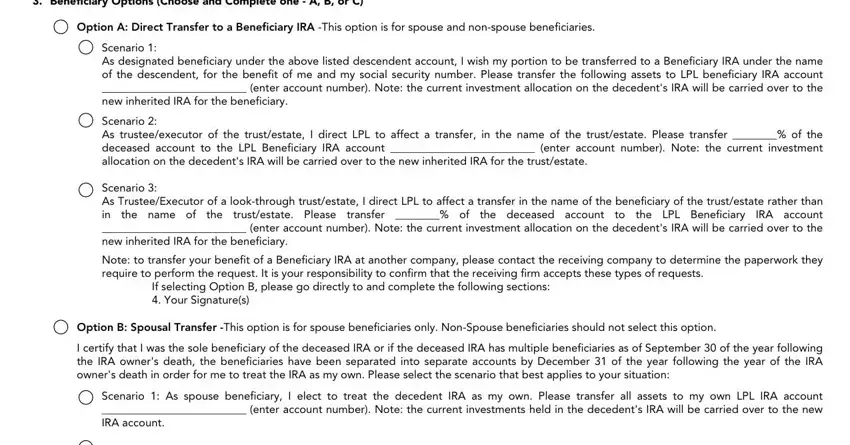

3. Beneficiary Options (Choose and Complete one - A, B, or C)

Option A: Direct Transfer to a Beneficiary IRA -This option is for spouse and non-spouse beneficiaries.

Scenario 1:

As designated beneficiary under the above listed descendent account, I wish my portion to be transferred to a Beneficiary IRA under the name of the descendent, for the benefit of me and my social security number. Please transfer the following assets to LPL beneficiary IRA account

__________________________ (enter account number). Note: the current investment allocation on the decedent's IRA will be carried over to the

new inherited IRA for the beneficiary.

Scenario 2:

As trustee/executor of the trust/estate, I direct LPL to affect a transfer, in the name of the trust/estate. Please transfer ________% of the

deceased account to the LPL Beneficiary IRA account __________________________ (enter account number). Note: the current investment

allocation on the decedent's IRA will be carried over to the new inherited IRA for the trust/estate.

Scenario 3:

As Trustee/Executor of a look-through trust/estate, I direct LPL to affect a transfer in the name of the beneficiary of the trust/estate rather than in the name of the trust/estate. Please transfer ________% of the deceased account to the LPL Beneficiary IRA account

__________________________ (enter account number). Note: the current investment allocation on the decedent's IRA will be carried over to the

new inherited IRA for the beneficiary.

Note: to transfer your benefit of a Beneficiary IRA at another company, please contact the receiving company to determine the paperwork they require to perform the request. It is your responsibility to confirm that the receiving firm accepts these types of requests.

If selecting Option B, please go directly to and complete the following sections:

4. Your Signature(s)

Option B: Spousal Transfer -This option is for spouse beneficiaries only. Non-Spouse beneficiaries should not select this option.

I certify that I was the sole beneficiary of the deceased IRA or if the deceased IRA has multiple beneficiaries as of September 30 of the year following the IRA owner's death, the beneficiaries have been separated into separate accounts by December 31 of the year following the year of the IRA owner's death in order for me to treat the IRA as my own. Please select the scenario that best applies to your situation:

Scenario 1: As spouse beneficiary, I elect to treat the decedent IRA as my own. Please transfer all assets to my own LPL IRA account

__________________________ (enter account number). Note: the current investments held in the decedent's IRA will be carried over to the new

IRA account.

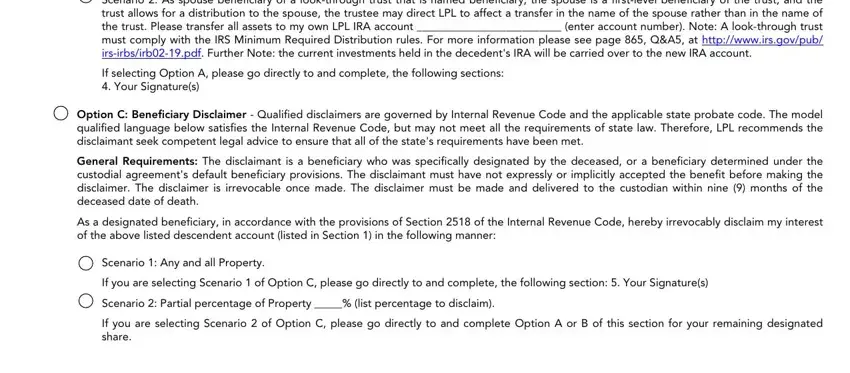

Scenario 2: As spouse beneficiary of a look-through trust that is named beneficiary, the spouse is a first-level beneficiary of the trust, and the trust allows for a distribution to the spouse, the trustee may direct LPL to affect a transfer in the name of the spouse rather than in the name of the trust. Please transfer all assets to my own LPL IRA account __________________________ (enter account number). Note: A look-through trust

must comply with the IRS Minimum Required Distribution rules. For more information please see page 865, Q&A5, at http://www.irs.gov/pub/ irs-irbs/irb02-19.pdf. Further Note: the current investments held in the decedent's IRA will be carried over to the new IRA account.

If selecting Option A, please go directly to and complete, the following sections:

4. Your Signature(s)

Option C: Beneficiary Disclaimer - Qualified disclaimers are governed by Internal Revenue Code and the applicable state probate code. The model qualified language below satisfies the Internal Revenue Code, but may not meet all the requirements of state law. Therefore, LPL recommends the disclaimant seek competent legal advice to ensure that all of the state's requirements have been met.

General Requirements: The disclaimant is a beneficiary who was specifically designated by the deceased, or a beneficiary determined under the custodial agreement's default beneficiary provisions. The disclaimant must have not expressly or implicitly accepted the benefit before making the disclaimer. The disclaimer is irrevocable once made. The disclaimer must be made and delivered to the custodian within nine (9) months of the deceased date of death.

As a designated beneficiary, in accordance with the provisions of Section 2518 of the Internal Revenue Code, hereby irrevocably disclaim my interest of the above listed descendent account (listed in Section 1) in the following manner:

Scenario 1: Any and all Property.

If you are selecting Scenario 1 of Option C, please go directly to and complete, the following section: 5. Your Signature(s)

Scenario 2: Partial percentage of Property _____% (list percentage to disclaim).

If you are selecting Scenario 2 of Option C, please go directly to and complete Option A or B of this section for your remaining designated share.

CM107-CTD

Account Number |

Revised 0616 |

|

Page 2 of 4

DRD

4. Signature

Your signature below indicates that you have received and read the Beneficiary Information Guide for beneficiaries. I understand the tax implications of disclaimers, transfers, rollovers, and distributions. I further certify that no tax advice has been given to me by LPL. All decisions regarding any authorization herein are my own. I expressly assume responsibility for tax implications and adverse consequences, which may arise, and I agree that LPL shall in no way be held responsible.

•I certify that I am a US person (including US resident Alien) unless I have attached an Internal Revenue Service (IRS) Form W-8 BEN.

•I certify that if the beneficiary is for an Estate, Charity, Corporation, LLC, or Trust, that I have the authorization to complete and sign this form.

•If the beneficiary is a “look through trust or estate” as checked in Section 3, I certify the trust or estate is a look though trust or estate as described in Treasury Regulation 1.401(a)(9) and take full responsibility for my direction. Should any negative tax or other consequences arise from this direction, I will not hold Private Trust Company N.A. ("PTC") or LPL responsible in any way.

•If a distribution is selected above, I certify that I am the proper party to receive payment(s) form this account and the information is true and accurate. I understand the tax implications of distributions and understand that it is my responsibility to determine the taxable amount of any distribution made under this authorization.

•I have reviewed and accept the below statement:

(A)All parties to this agreement are giving up the right to sue each other in court, including the right to a trial by jury, except as provided by the rules of the arbitration forum in which a claim is filed.

(B)Arbitration awards are generally final and binding; a party's ability to have a court reverse or modify an arbitration award is very limited.

(C)The ability of the parties to obtain documents, witness statements and other discovery is generally more limited in arbitration than in court proceedings.

(D)The arbitrators do not have to explain the reason(s) for their award, unless, in an eligible case, a joint request for an explained decision has been submitted by all parties to the panel at least 20 days prior to the first hearing date.

(E)The Panel of Arbitrators will typically include a minority of arbitrators who were or are affiliated with the securities industry.

(F)The rules of some arbitration forums may impose time limits for bringing a claim in arbitration. In some cases, a claim that is ineligible for arbitration may be brought in court.

(G)The rules of the arbitration forum in which the claim is filed, and any amendments thereto, shall be incorporated into this agreement.

Account Holder Signature |

Account Holder Name (print) |

Date |

CM107-CTD

Account Number |

Revised 0616 |

|

Page 3 of 4

Do Not Return This Page |

DRD |

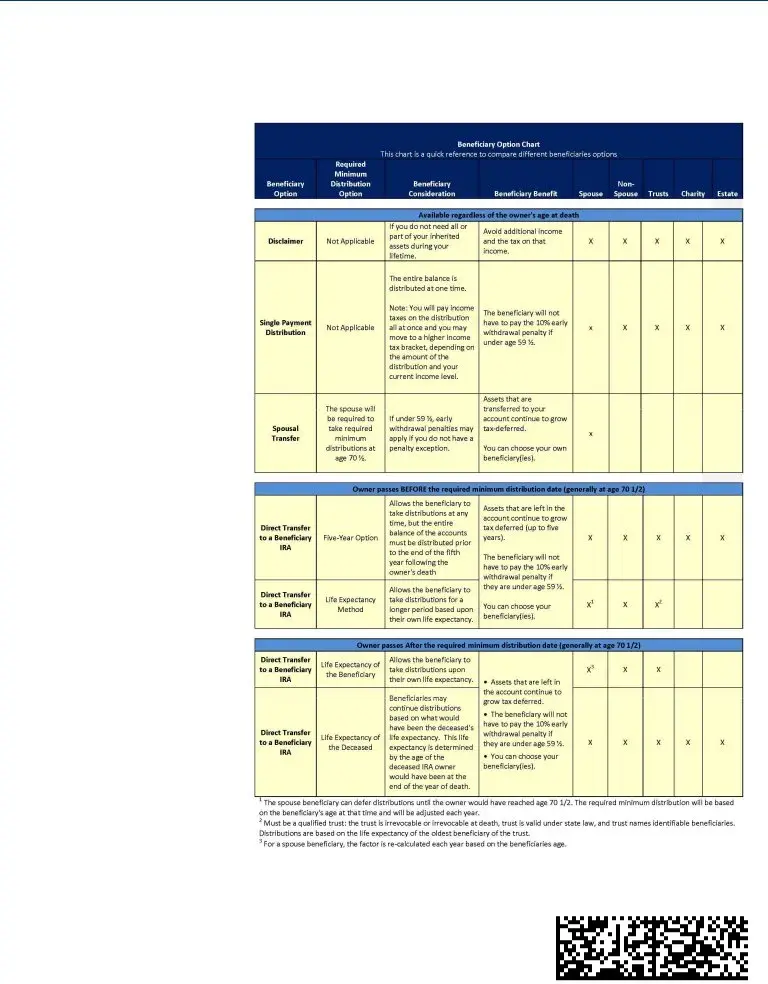

Beneficiary Information Guide Introduction

The Beneficiary Information Guide outlines the options available to beneficiaries of an Individual Retirement Account (IRA). LPL presents this information based on our understanding of the applicable tax laws as a guide to you, but we suggest that you consult with your tax advisor to discuss your individual tax circumstance. The Internal Revenue Code imposes requirements as to the amount and timing of distributions from this account including Required Minimum Distributions. Please consult with your tax advisor.

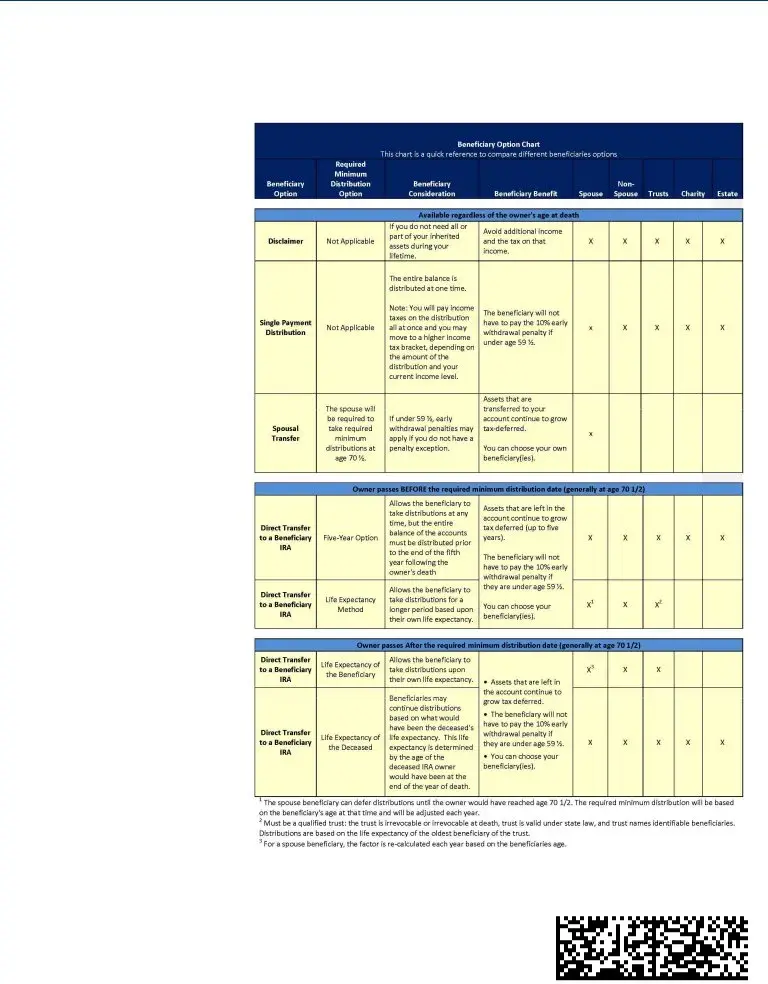

Review of Your Options As Beneficiary

Option A. Direct Transfer to a Beneficiary IRA

You can open an account called a Beneficiary IRA and transfer the inherited IRA to this new account. The assets will keep growing tax- deferred, and the required minimum distributions generally depend upon whether the original IRA holder died before or after his/ her required beginning date (generally April 1 of the year following the year when the original IRA owner reaches at 70 ½ years old) and whether you are a spouse beneficiary, non- spouse beneficiary, trust, charity or estate.

Option B. Single Payment Distribution

If the beneficiary has an immediate financial need -- such as covering final expenses or paying the bills of the owner's estate -- a lump sum payment may make the most sense. But there are some issues to consider and the beneficiary should consult with a tax professional before using this option:

·The distribution may increase the beneficiary's taxes in the year they are taken

·The beneficiary will lose the tax-deferral advantage of the IRA

·A non-spouse beneficiary cannot rollover the payment into another IRA or employer sponsored plan

Option C. Spousal Transfer

If you are a spouse beneficiary, you can transfer the inherited IRA into your own existing IRA or establish a new one in your own name. The monies in the account are available to you at any time and will be subject to the normal distribution rules for all IRA owners.

Option D. Disclaimer

If you find that you do not need or want your inherited assets, you may choose to disclaim or refuse to inherit all or part of your inherited assets. A qualified disclaimer allows you as the beneficiary to refuse all or a portion of the inherited IRA, avoiding additional income and taxes on that income.

A beneficiary who disclaims an IRA cannot dictate to whom the benefit will be paid. Once disclaimed, the payout will go to the next designated beneficiary, whether that beneficiary is primary or contingent. Once made, an effective disclaimer is irrevocable.

Note: A disclaimer must be filed within nine months of the account owner's death and before any benefits of the disclaimed assets are accepted. LPL recommends the disclaimant seek legal advice to ensure that the Internal Revenue Code and the applicable state probate codes have been met before any decision is made.

CM107-CTD

Revised 0616

-Use this attachment when there are multiple beneficiaries to a Retirement account journaling securities to a Beneficiary IRA and the underlying securities cannot be evenly divided.

-Include any cash portions / distributions to be split as well. If more pages are needed, use additional copies of this form, but all beneficiaries must sign each page.

-Note: LPL Financial cannot accept percentages. Specific share amounts must be listed for each security. Mutual Funds can only be moved in share values to the 3rd decimal point.

|

|

|

Receiving A/C# |

|

L |

|

Receiving A/C# |

|

L |

|

Receiving A/C# |

|

L |

|

Receiving A/C# |

|

L |

Receiving A/C# |

|

L |

|

|

|

Registration |

L |

|

Registration |

L |

|

Registration |

L |

|

Registration |

L |

Registration |

L |

|

|

|

|

|

|

L |

|

|

|

|

L |

|

|

|

|

L |

|

|

|

|

L |

|

|

|

|

L |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Security / Cash |

Symbol or CUSIP |

|

Share Amount to Journal |

|

|

Share Amount to Journal |

|

|

Share Amount to Journal |

|

|

Share Amount to Journal |

|

|

Share Amount to Journal |

|

|

(or ALL) |

|

|

(or ALL) |

|

|

(or ALL) |

|

|

(or ALL) |

|

|

(or ALL) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All beneficiaries receiving a portion of this account must sign below: I/we hereby finally and irrevocably release and discharge you of any claims by me or my legal representatives with reference to the foregoing, including the proceeds of the sale or other disposition thereof. I/we authorize LPL Financial to initiate credit or debit entries and adjustments.

Account Holder Signature |

Account Holder Name (print) |

Date |

|

|

|

|

|

Account Holder Signature |

Account Holder Name (print) |

Date |

|

|

|

|

|

Account Holder Signature |

Account Holder Name (print) |

Date |

CM107A-CTD

|

Revised 0616 |

Member FINRA/SIPC |

Page 0 of 4 |