In the labyrinth of regulatory compliance for commercial transportation within the United States, the Alabama International Registration Plan (IRP) Alabama form emerges as a pivotal document for motor carriers operating across state lines. Crafted by the Alabama Department of Revenue, this form primarily facilitates the reporting of quarterly fuel use, acting in tandem with the broader framework of the International Fuel Tax Agreement (IFTA). It meticulously categorizes fuel into several types, including Diesel, Motor Fuel Gasoline, Ethanol, and Propane, aiming to streamline the tax reporting process for each. Registrants are required to attach this schedule to Form IFTA-100-MN, ensuring a comprehensive summary of their fuel usage is accurately reported. Beyond the mere logging of fuel types, the form delves into calculating the average fleet miles per gallon (MPG), thereby offering insights into the fuel efficiency of the fleet across both IFTA and Non-IFTA jurisdictions. This nuanced approach not only aids in tax calculation but also embeds a layer of accountability and efficiency monitoring within the commercial transport sector. Additionally, it obligates carriers to prepare separate schedules for each fuel type and encourages the maintenance of records through the prompt to make copies. Furthermore, the form integrates instructions for accurately determining tax obligations, including adjustments for tax-paid gallons and computing net taxable gallons. Each entry meticulously calculates the tax or credit due, taking into account the specific tax rates applicable to the miles traveled within different jurisdictions. Hence, the design and function of the IRP Alabama form underscore its role not merely as a tax document but as a comprehensive tool for operational and financial assessment within the commercial transportation industry.

| Question | Answer |

|---|---|

| Form Name | Irp Alabama Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | alabama ifta application, ifta form 2021, alabama international registration, exposure incident report form |

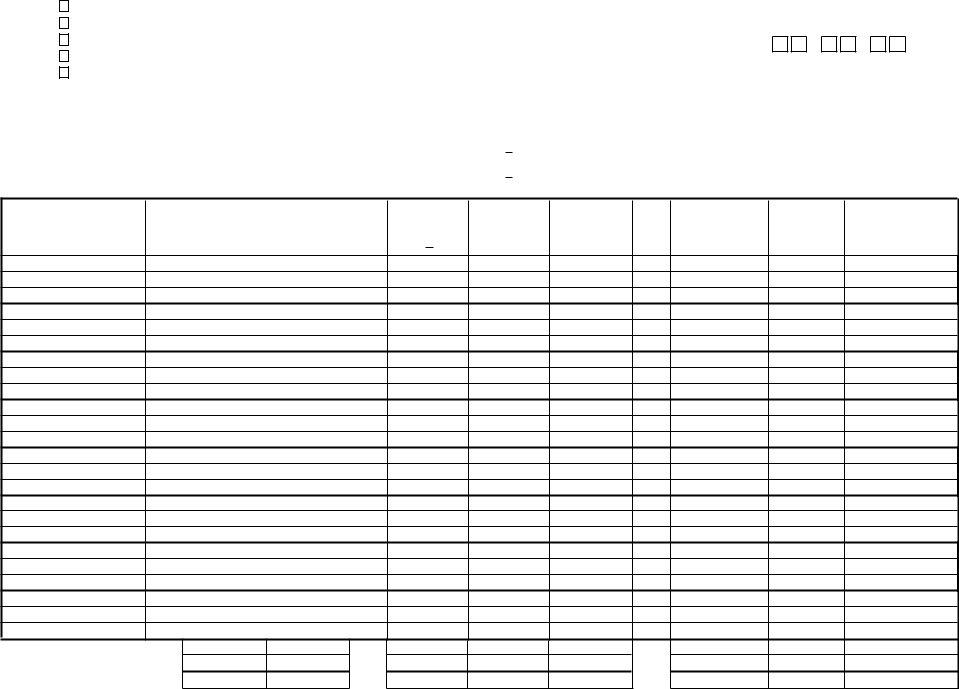

Check only one fuel type: |

|

|

|

|

Alabama Department of Revenue |

|

|

|

|

|

|

|

|

||||||||||||

|

|

Code |

Fuel Type |

|

|

IFTA Quarterly Fuel Use Tax Schedule |

|

|

|

||||||||||||||||

|

|

|

|

Attach this schedule to Form |

|

|

|

|

|

||||||||||||||||

Tax on: |

D |

(Diesel) |

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

IFT A Quarterly Fuel U se T ax Return. |

|

|

|

|

|

|

|

|

|||||||||||||

|

|

G |

(Motor fuel gasoline) |

|

|

|

|

|

Use this form to report operations for the |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Prepare a separate schedule for each fuel type. Use |

|

||||||||||||||||||||||

|

|

E |

(Ethanol) |

|

|

|

|

|

quarter ending |

|

|

|

|||||||||||||

|

|

|

|

|

additional sheets if necessary. Make a copy for your records. |

|

|

|

|

. |

|||||||||||||||

|

|

P |

(Propane) |

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

|

Day |

Year |

||||

|

|

__ |

___________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Licensee IFTA identification number |

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

AL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter credits in brackets ( ). Round to the nearest whole gallon or mile. |

Read instructions (IFTA- 101- I- MN) carefully. |

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MPG Calculation |

|

|

|

|

|

(E) |

Average Fleet MPG |

|||||

(A) Total IFTA Miles |

+ (B) Total Non- IFTA Miles |

= (C) Total Miles |

|

: |

|

(D) Total Gallons |

= |

||||||||||||||||||

(A) |

|

|

|

|

(B) |

|

|

|

(C) |

|

|

|

|

|

(all IFTA and |

|

(2 decimal places) |

||||||||

|

|

|

+ |

|

|

= |

|

|

: |

|

(D) |

|

|

|

= |

(E) |

___ ___ |

. ___ ___ |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

F

Jurisdiction

G

Rate Code

H |

I |

J |

Total IFTA |

Taxable |

MPG |

Miles |

Miles |

from E |

(See Instructions) |

(See Instructions) |

above |

|

|

|

K

Taxable Gallons

(col. I : J)

L

Tax Paid

Gallons

(See Instructions)

M

Net Taxable

Gallons

(col. K - L)

N

Tax Rate

O

Tax (Credit) Due

(col. M x N (Tax) ) (col. K x N (Surch) )

P

Interest

Due

Q

Total Due

(col. O + P)

Subtotals

Subtotals from back

Totals

Important Note: When listing additional jurisdictions and more space is needed, use the back of this form.

For Diesel, Motor fuel gasoline, Ethanol andPropane reported, transfer the total |

|

|

amount in Column Q from each schedule to the corresponding line on |

|

|

Form |

|

|

the total amount of Column Q from each schedule to Column S of the worksheet on the |

IFTA- 101- MN (4/08) |

|

back of Form |

||

|

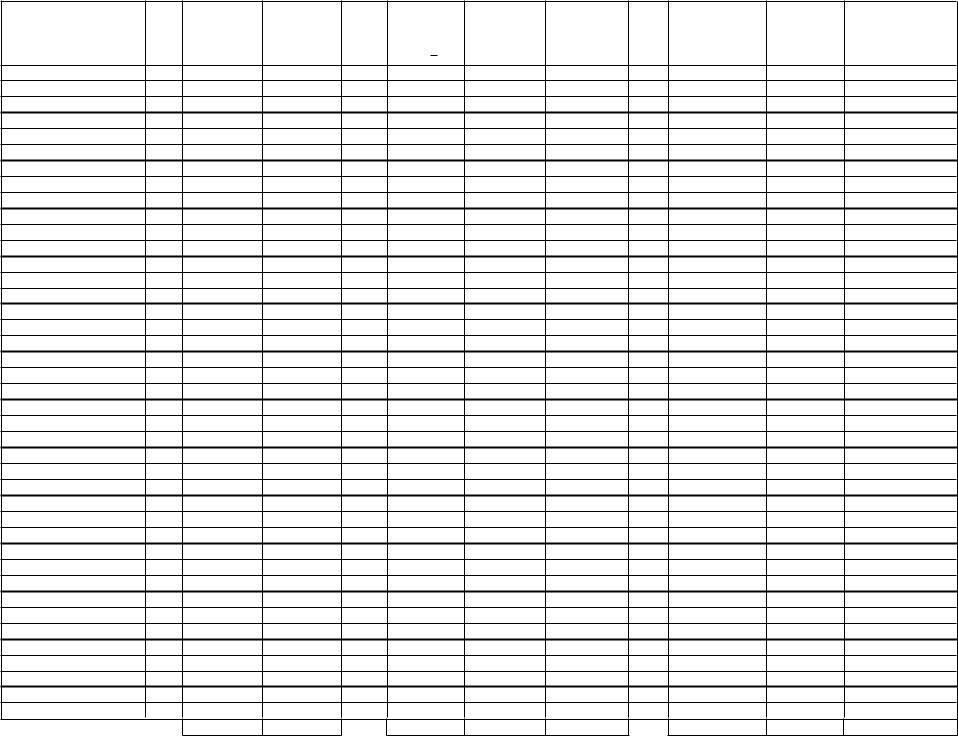

F

Jurisdiction

G

Rate Code

H |

I |

Total IFTA |

Taxable |

Miles |

Miles |

(See Instructions) (See Instructions)

J

MPG

from E on front

K

Taxable

Gallons

(col. I : J)

L

Tax Paid

Gallons

(See Instructions)

M

Net Taxable

Gallons

(col. K - L)

N

Tax Rate

O

Tax (Credit) Due

(col. M x N (Tax)) (col. K x N (Surch))

P

Interest

Due

Q

Total Due

(col. O + P)

Transfer the subtotal am ounts Subtotals

to the front of this schedule.