irs form 3210 can be completed online in no time. Simply use FormsPal PDF editor to do the job without delay. To keep our tool on the cutting edge of practicality, we strive to put into operation user-driven features and improvements on a regular basis. We are always glad to get suggestions - join us in revampimg the way you work with PDF forms. By taking some easy steps, it is possible to start your PDF journey:

Step 1: Open the PDF doc in our editor by clicking the "Get Form Button" at the top of this page.

Step 2: This editor will allow you to work with PDF files in many different ways. Enhance it by writing any text, adjust what's already in the file, and place in a signature - all close at hand!

This PDF form requires particular information to be entered, therefore you must take whatever time to enter what is required:

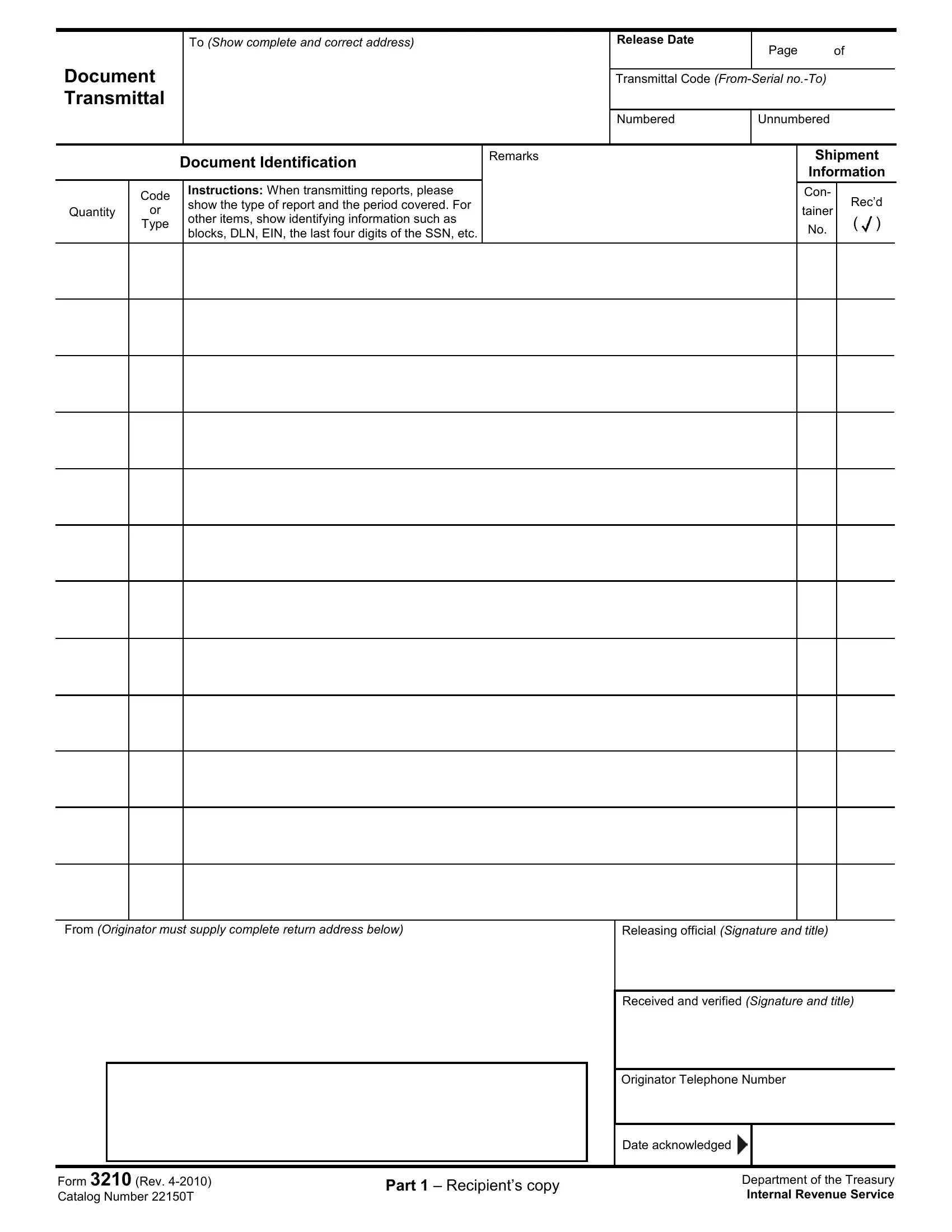

1. The irs form 3210 requires specific information to be inserted. Be sure the following blanks are completed:

2. Just after performing this part, go on to the subsequent part and complete all required details in all these fields - .

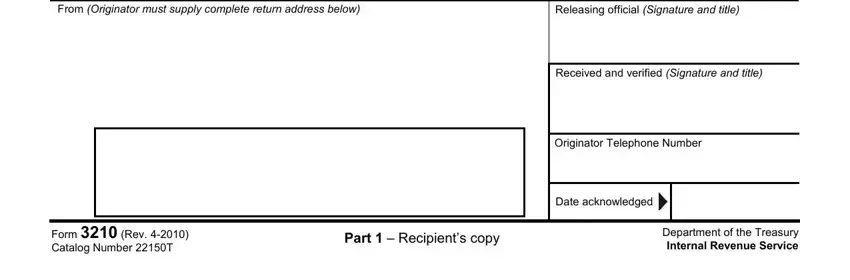

3. This next part is considered pretty straightforward, From Originator must supply, Releasing official Signature and, Received and verified Signature, Originator Telephone Number, Date acknowledged, Part Recipients copy, Department of the Treasury, Form Catalog Number, and Rev - these form fields must be filled in here.

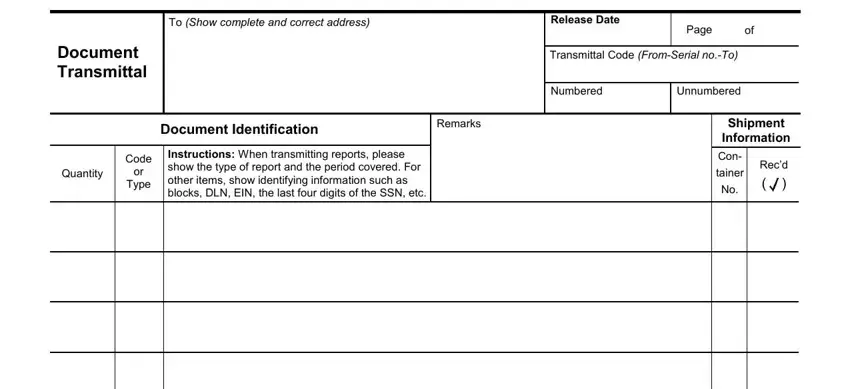

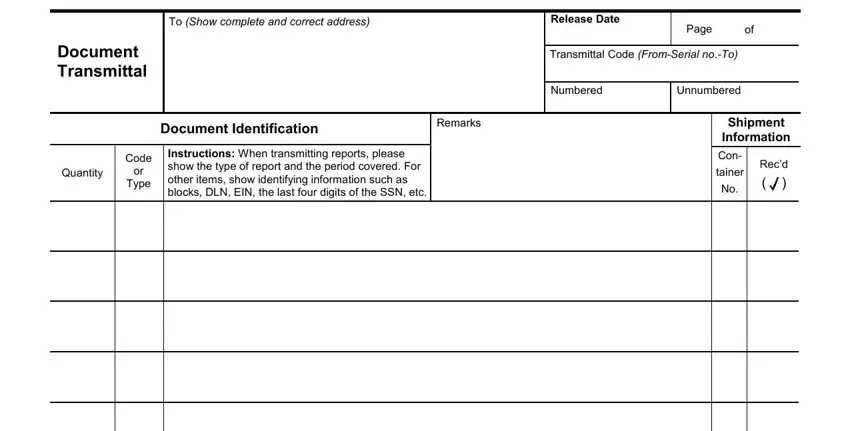

4. To move ahead, the next part will require filling out several blank fields. Included in these are To Show complete and correct, Document Transmittal, Release Date, Page, Transmittal Code FromSerial noTo, Numbered, Unnumbered, Document Identification, Remarks, Quantity, Code, Type, Instructions When transmitting, Shipment, and Information, which are essential to going forward with this particular process.

It's easy to make a mistake while filling out your Information, consequently make sure you go through it again before you send it in.

5. While you near the completion of your document, there are actually a few more requirements that have to be fulfilled. Specifically, should be done.

Step 3: Revise everything you have entered into the blank fields and then press the "Done" button. Make a free trial option with us and gain immediate access to irs form 3210 - download or modify inside your FormsPal cabinet. Here at FormsPal.com, we endeavor to make sure all your details are maintained protected.