There's nothing troublesome concerning filling in the it 214 online once you begin using our PDF editor. By taking these simple steps, you'll get the fully filled out PDF in the minimum time period you can.

Step 1: The first thing is to select the orange "Get Form Now" button.

Step 2: Now you are on the form editing page. You may enhance and add text to the form, highlight words and phrases, cross or check particular words, include images, insert a signature on it, erase unrequired fields, or remove them altogether.

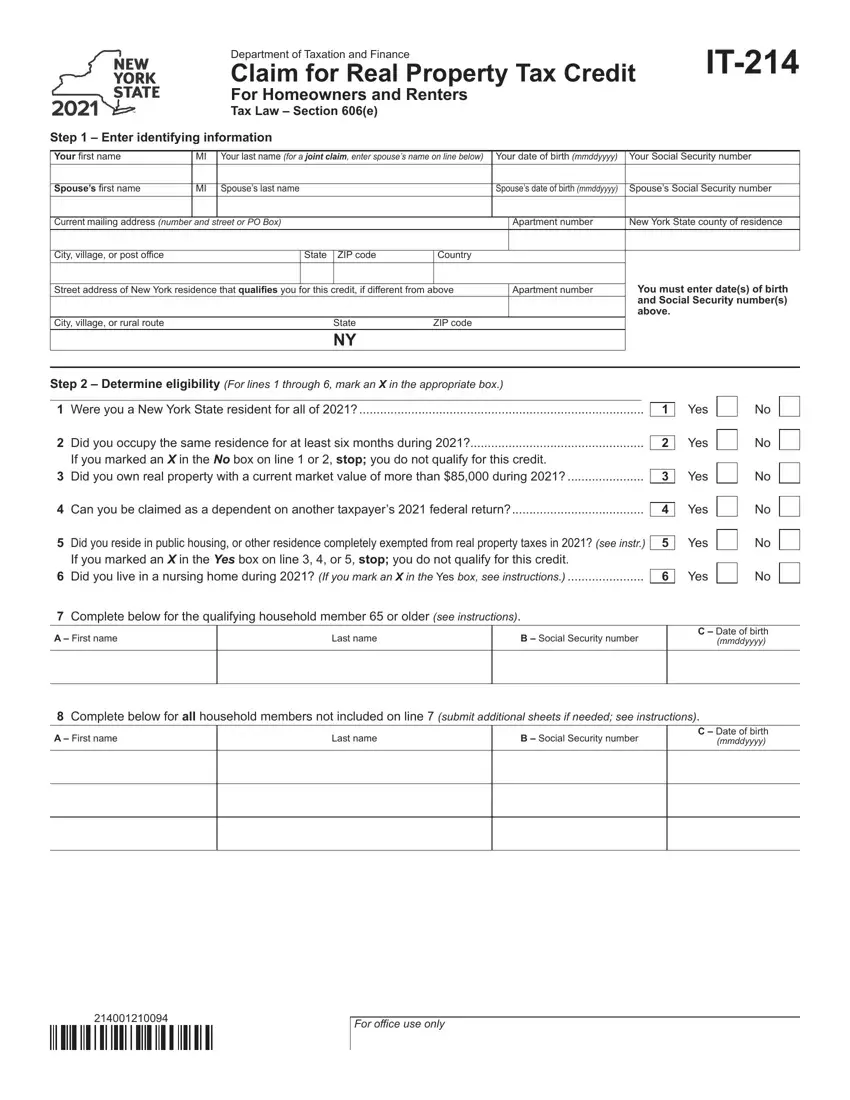

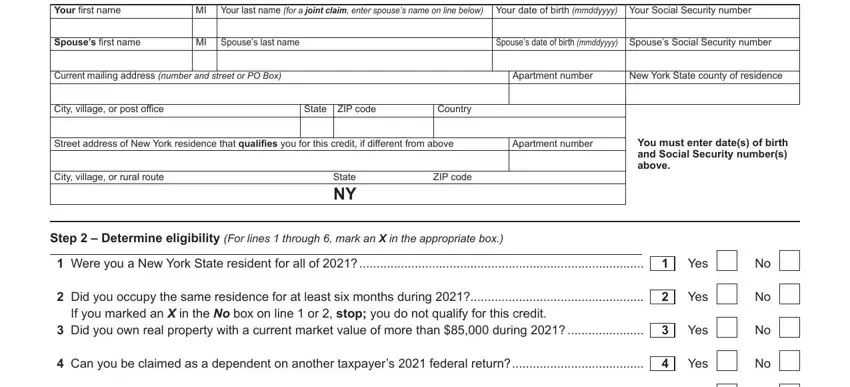

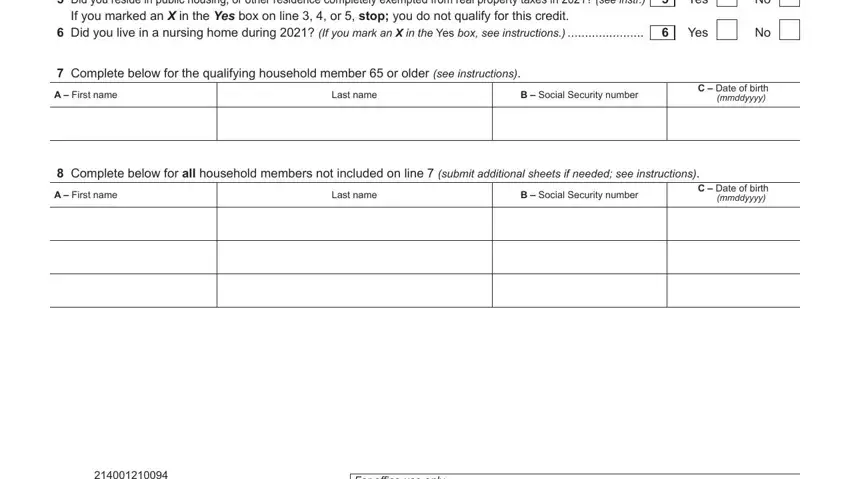

Complete the it 214 online PDF by entering the information required for each individual section.

Type in the appropriate data in the field Lastname, B, Social, Security, number C, Dateofbirth, mm, dd, yyyy B, Social, Security, number Lastname, C, Dateofbirth, mm, dd, yyyy and For, office, use, only

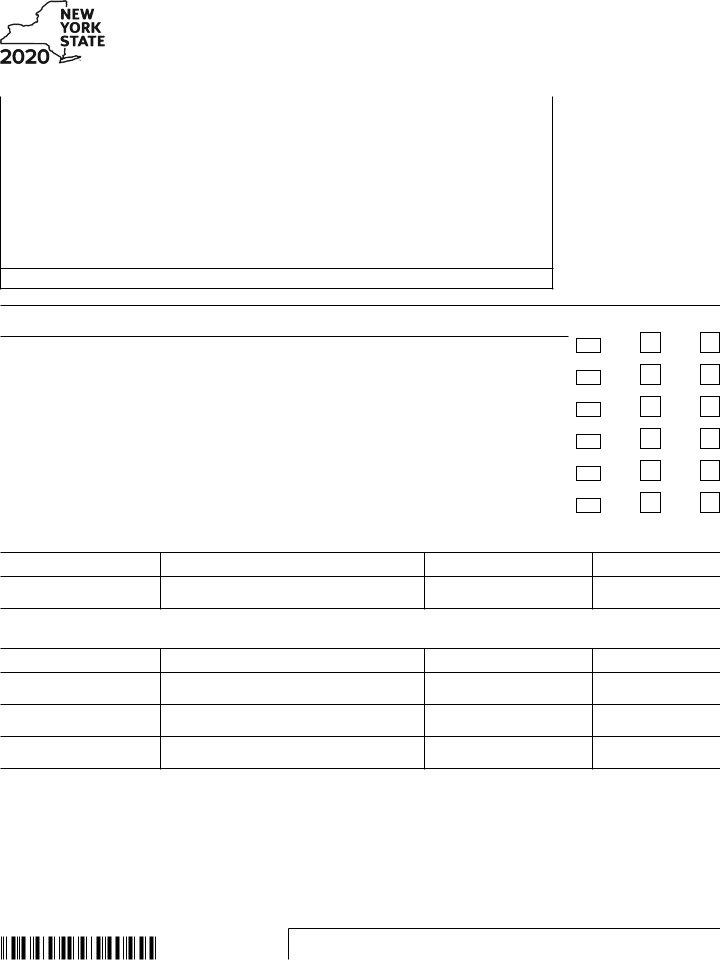

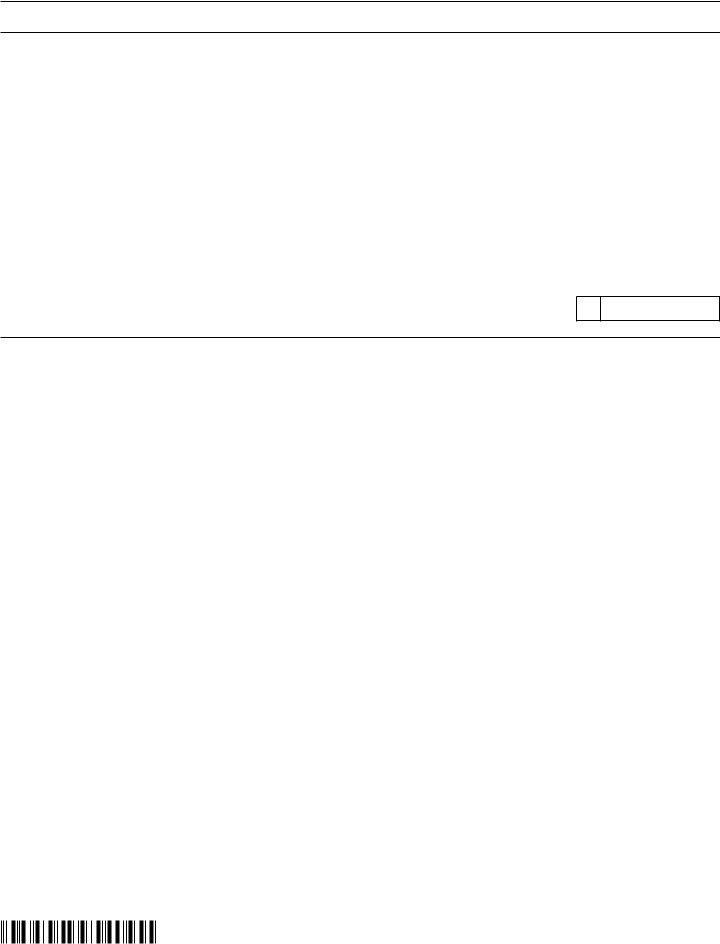

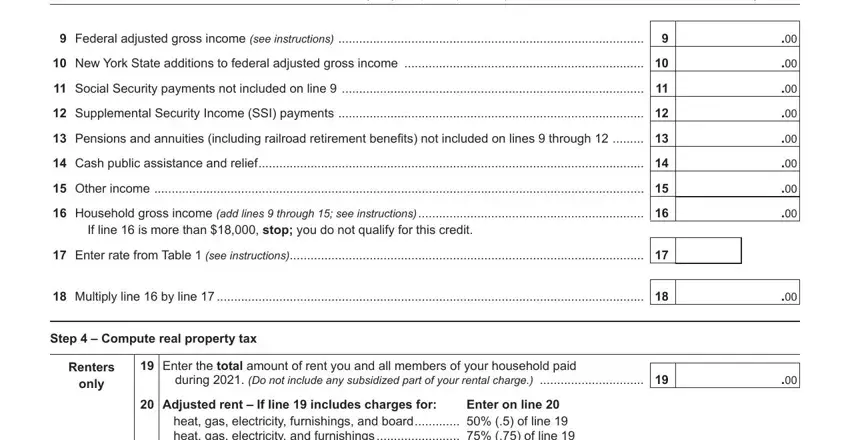

You may be required to note the details to help the system prepare the area Multiply, line, by, line Step, Compute, real, property, tax Renters, and only.

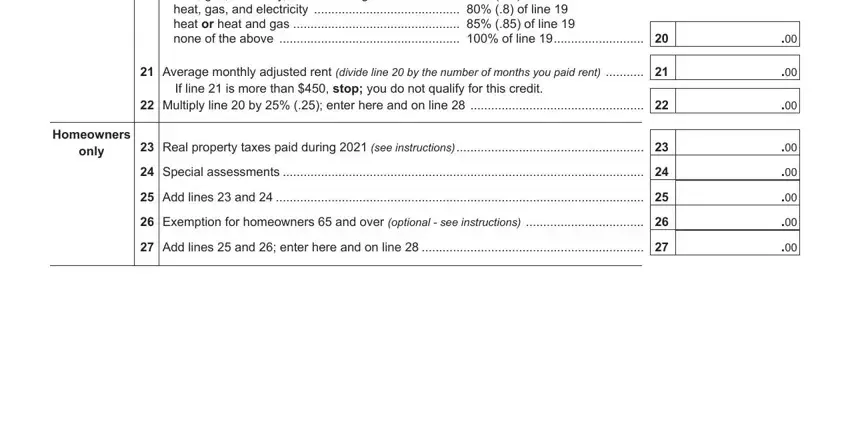

You need to list the rights and responsibilities of the sides within the Multiply, line, by, enter, here, and, online only, and Homeowners part.

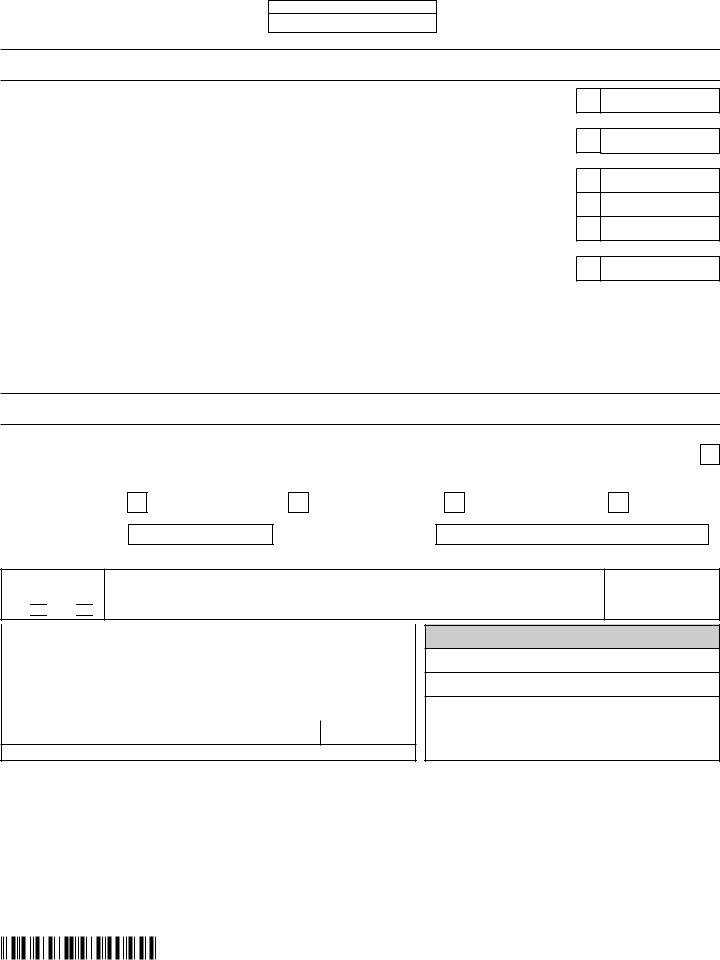

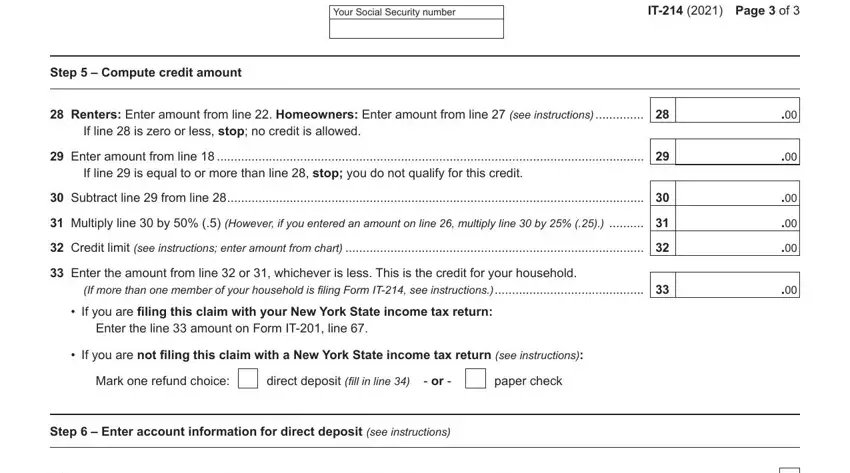

End up by analyzing the next areas and completing them as required: Your, Social, Security, number IT, Page, of Step, Compute, credit, amount Enter, the, line, amount, on, Form, IT, line Mark, one, refund, choice direct, deposit, fill, inline and paper, check

Step 3: Press the Done button to save the document. Then it is accessible for transfer to your device.

Step 4: To protect yourself from any kind of difficulties down the road, you should generate minimally several copies of the form.