You can prepare It 215 Form easily by using our online PDF editor. Our team is always endeavoring to expand the editor and ensure it is much better for users with its cutting-edge functions. Bring your experience to a higher level with continuously growing and exceptional opportunities we offer! All it takes is several easy steps:

Step 1: Hit the "Get Form" button above. It is going to open our pdf tool so you can start filling in your form.

Step 2: As you launch the PDF editor, you will find the document all set to be filled out. Apart from filling out different fields, you can also perform many other actions with the file, namely adding your own text, changing the original text, inserting graphics, placing your signature to the document, and much more.

This form will require specific details; in order to ensure correctness, remember to bear in mind the following recommendations:

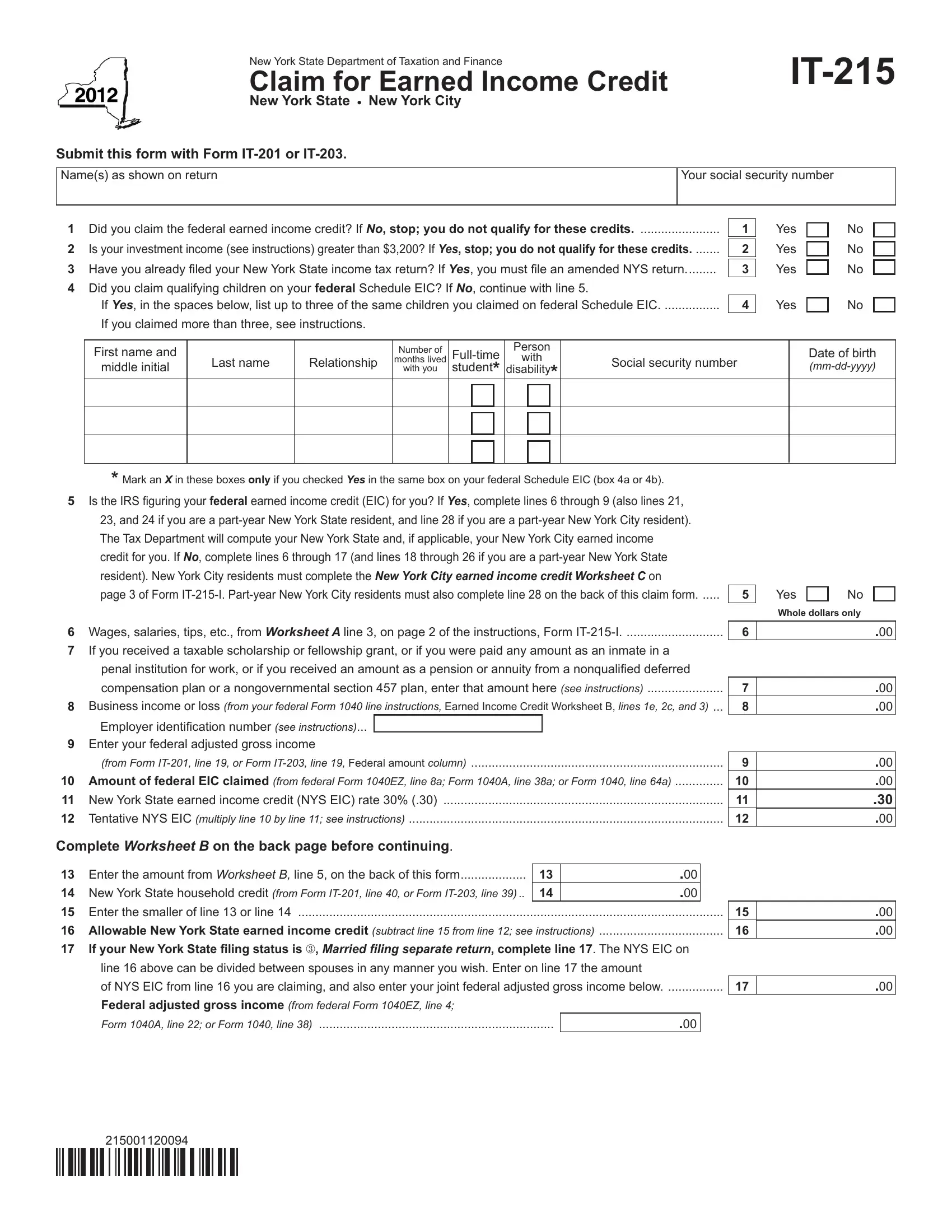

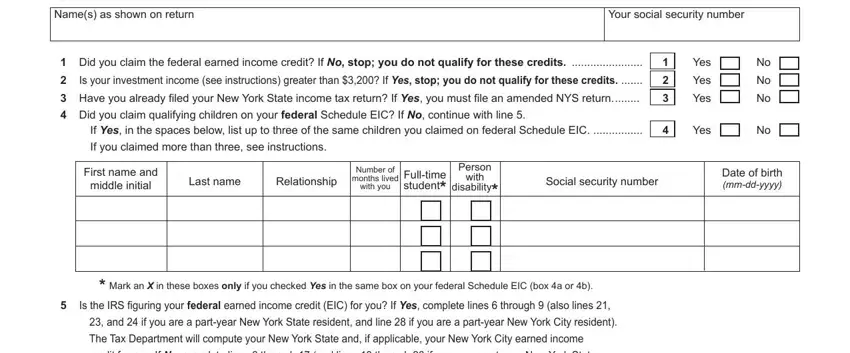

1. When filling in the It 215 Form, make sure to complete all of the important fields within the corresponding part. This will help speed up the work, allowing your details to be processed swiftly and correctly.

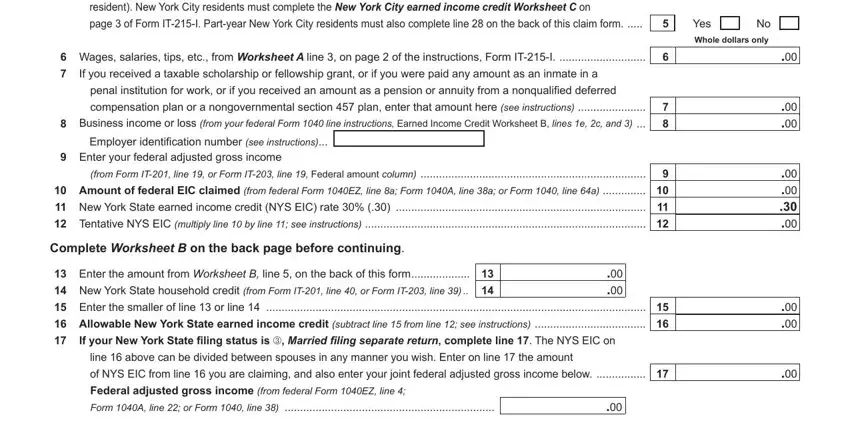

2. Just after filling out the previous section, head on to the subsequent part and enter the essential details in all these blank fields - resident New York City residents, page of Form ITI Partyear New, Wages salaries tips etc from, If you received a taxable, Employer identiication number see, Enter your federal adjusted gross, from Form IT line or Form IT line, Amount of federal EIC claimed, New York State earned income, Tentative NYS EIC multiply line, Complete Worksheet B on the back, Enter the amount from Worksheet B, New York State household credit, Enter the smaller of line or, and Allowable New York State earned.

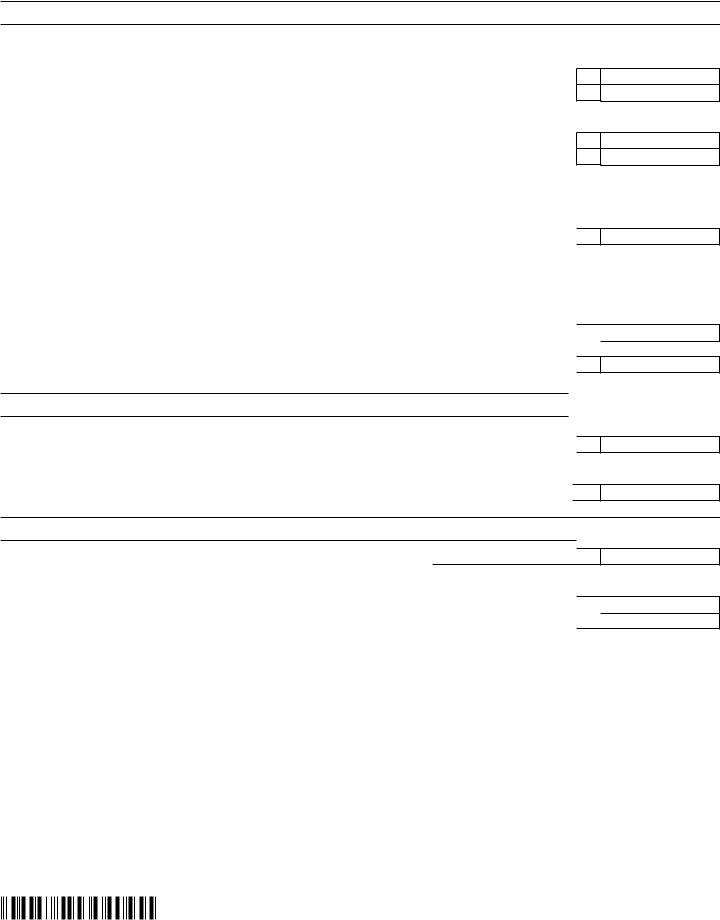

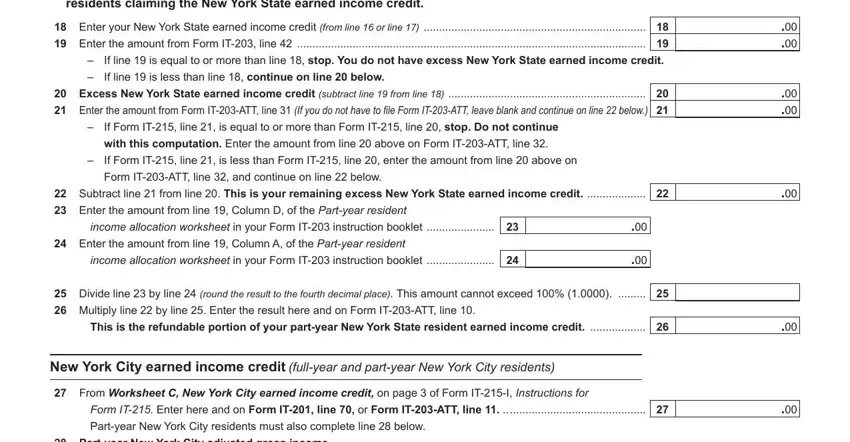

3. This 3rd step should also be fairly easy, Lines through apply only to, residents claiming the New York, Enter your New York State earned, Enter the amount from Form IT, If line is equal to or more than, Excess New York State earned, If Form IT line is equal to or, with this computation Enter the, If Form IT line is less than Form, Form ITATT line and continue on, Subtract line from line This is, income allocation worksheet in, income allocation worksheet in, Divide line by line round the, and Multiply line by line Enter the - these empty fields will need to be filled in here.

Many people generally make some mistakes while filling in Divide line by line round the in this area. You should revise whatever you enter here.

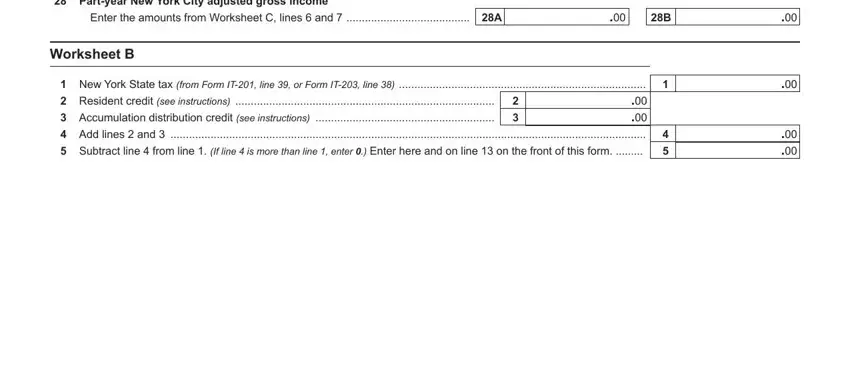

4. The following part requires your details in the following parts: Partyear New York City adjusted, Enter the amounts from Worksheet C, Worksheet B, Resident credit see instructions, New York State tax from Form IT, Accumulation distribution credit, and Subtract line from line If line. Ensure that you fill out all requested info to move forward.

Step 3: After you have looked once again at the information in the blanks, simply click "Done" to conclude your form. Find the It 215 Form once you join for a free trial. Readily view the form within your personal cabinet, with any modifications and adjustments conveniently synced! FormsPal is devoted to the confidentiality of our users; we make sure that all personal information put into our editor stays secure.