KANSAS

CHILD SUPPORT GUIDELINES

Pursuant to Kansas Supreme Court Administrative Order No. 260 261 Amended March 26, 2012

Effective April 1, 2012

KANSAS CHILD SUPPORT GUIDELINES

Pursuant to Kansas Supreme Court Administrative Order 260 261

Effective April 1, 2012

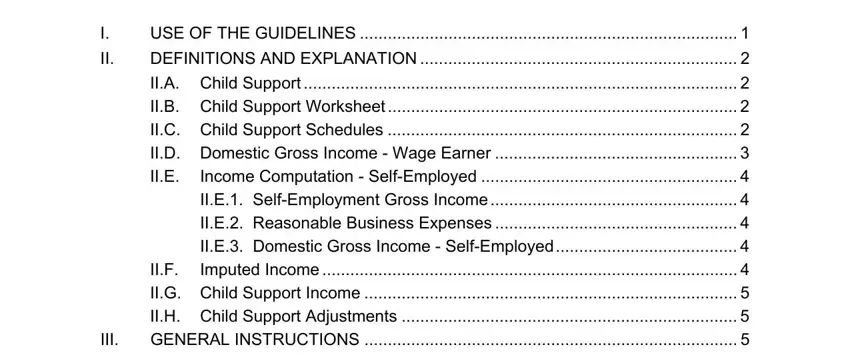

I.USE OF THE GUIDELINES

The Kansas Child Support Guidelines are the basis for establishing and reviewing child support orders in Kansas, including cases settled by agreement of the parties. Judges and hearing officers must follow the guidelines and the court shall consider all relevant evidence presented in setting an amount of child support.

The Net Parental Child Support Obligation is calculated by completing a Child Support Worksheet (Appendix I).

The calculation of the respective parental child support obligations on Line D.9 of the worksheet is a rebuttable presumption of a reasonable child support order. If a party alleges that the Line D.9 support amount is unjust or inappropriate in a particular case, the party seeking the adjustment has the burden of proof to show that an adjustment should apply. If the court finds from relevant evidence that it is in the best interest of the child to make an adjustment, the court shall complete Section E of the Child Support Worksheet. The completion of Section E of the worksheet shall constitute the written findings for deviating from the rebuttable presumption.

II.DEFINITIONS AND EXPLANATION II.A. Child Support

The purpose of child support is to provide for the needs of the child. The needs of the child are not limited to direct expenses for food, clothing, school, and entertainment. Child support is also to be used to provide for housing, utilities, transportation, and other indirect expenses related to the day-to-day care and well-being of the child.

II.B. Child Support Worksheet

The worksheet should contain the actual calculation of the child support based on Child Support Income, Work-Related Child Care Costs, Health, Dental, Orthodontic, and Optometric Insurance Premiums, and any Child Support Adjustments. (See Section IV, Specific Instructions for the Worksheet and Appendix VII for a completed sample worksheet.)

II.C. Child Support Schedules

The Child Support Schedules (Appendix II) are adopted by the Kansas Supreme Court based on the recommendation of the Kansas Child Support Guidelines Advisory Committee.1 The schedules are based upon national data regarding average family expenditures for children, which vary depending upon three major factors: the parents’ combined income, the number of children in the family, and the ages of the children.2 The schedules are derived from an economic model initially developed in 1987 by Dr. William Terrell.3 In the fall of 1989, Dr. Ann Coulson updated the schedules,4 which were then modified downward at lower income levels in 1990 at the Court’s request, and adjusted for current economic data in 1993.5 Dr. William Terrell reviewed various studies and foundation data in 1998 and 2002. These reviews led to updated schedule proposals; however, no changes were made in 1998. His more recent statistical analyses and attendant schedule changes provide the basis for the committee’s recommendations that were adopted by the Court in 2003.6 Dr. Jodi Messer-Pelkowski worked with Dr. Terrell during the review period which led to the adoption of Kansas Supreme Court Administrative Order No. 180 effective January 1, 2004, and took over Dr. Terrell’s work during 2005.7 Her analysis of economic data in spending on children served as the basis for the committee recommendations in 2007 and in 2011.

2

The schedules take into consideration that income deductions for social security, federal retirement, and federal and state income taxes, as well as property taxes on owner-occupied housing, are not available to the family for spending.8 Thus, although the schedules use combined gross monthly income as an index that identifies values in the child support schedules, the entries in the schedules used to calculate the actual child support obligation are based upon either consumption spending9 or after-tax income, whichever is lower. The schedules also include a built-in reduction from average expenditures per child (the dissolution burden), because of the financial impact on the family of maintaining two households instead of one.10

II.D. Domestic Gross Income - Wage Earner

The Domestic Gross Income for the wage earner is income from all sources, including that which is regularly or periodically received, excluding public assistance and child support received for other children in the residency of either parent. For purposes of these guidelines, the term “public assistance” means all income, whether in cash or in-kind, which is received from public sources and for which the recipient is eligible on the basis of financial need. It includes, but is not limited to, Supplemental Security Income (SSI), Earned Income Credit (EIC), food stamps, Temporary Assistance for Needy Families (TANF), General Assistance (GA), Medicaid, Low Income Energy Assistance Program (LIEAP), Section 8, and other forms of public housing assistance.

It may be necessary for the court to consider historical information and the seasonal nature of employment. For example, if overtime is regularly earned by one of the parties, then a historical average of one year should be considered.

In instances where one or both of the parties is employed by a branch of the armed forces or is called to active duty by a branch of the armed forces, then the court shall include the basic pay of the party plus Basic Allowance for Housing (BAH) and Basic Allowance for Subsistence (BAS). The court may consider cost of living differences in determining the Domestic Gross Income. Depending upon the facts of the case, the court may consider the BAH II Incentive or Special Pays and other forms of pay as found in Appendix IX.

Frequently, a wage earner’s income is adjusted for a salary reduction arrangement for qualified benefits offered under a cafeteria plan (see Appendix VI). In such cases, the use of gross wages (total income before

any salary reduction amounts) results in the simplest and fairest application of the guidelines. Therefore, the gross income of the wage earner, regardless of whether it is taxable or nontaxable, is to be used to compute child support payments.

II.E. Income Computation - Self-Employed

II.E.1. Self-Employment Gross Income

Self-Employment Gross Income is income from self-employment and all other income including that which is regularly and periodically received from any source excluding public assistance and child support received for other children in the residency of either parent.

II.E.2. Reasonable Business Expenses

In cases of self-employed persons, Reasonable Business Expenses are those actual expenditures reasonably necessary for the production of income. Depreciation shall be included only if it is shown that it is reasonably necessary for the production of income. Reasonable Business Expenses shall include the additional self-employment tax paid over and above the FICA rate.

II.E.3. Domestic Gross Income - Self-Employed

Domestic Gross Income for self-employed persons is self-employment gross income less Reasonable Business Expenses.

II.F. Imputed Income

II.F.1. Income may be imputed to the parent not having primary residency11 in appropriate circumstances, including the following:

II.F.1.a. Absent substantial justification, it should be assumed that a parent is able to earn at least the federal minimum wage and to work 40 hours per week. Incarceration does not constitute substantial justification.

II.F.1.b. When a parent is deliberately unemployed, although capable of working full-time, employment potential and probable earnings may be based on the parent’s recent work history, occupational skills, and the prevailing job opportunities in the community.

II.F.1.c. If a parent is terminated from employment for misconduct, rather than laid off, their previous wage may be imputed, but shall not be less than federal minimum wage.

II.F.1.d. When a parent receives significant in-kind payment that reduces personal living expenses as a result of employment, such as a company car, free housing, or reimbursed meals, the value of such reimbursement should be added to gross income.

II.F.1.e. When there is evidence that a parent is deliberately underemployed for the purpose of avoiding child support, the court may evaluate the circumstances to determine whether actual or potential earnings should be used.

II.F.2. Income may be imputed to the parent having primary residency in appropriate circumstances, but should not result in a higher support obligation for the other parent.

II.G. Child Support Income

Child Support Income is the Domestic Gross Income after adjustments for child support paid in other cases and for maintenance paid or received in the present case or other cases. (See Section IV, Specific Instructions for the Worksheet, Subsection D.1 and Appendix VII for a sample worksheet.)

II.H. Child Support Adjustments

Child Support Adjustments are considerations of additions or subtractions from the Net Parental Child Support Obligation to be made if in the best interests of the child. (See Section IV, Specific Instructions for the Worksheet, Subsection E.)

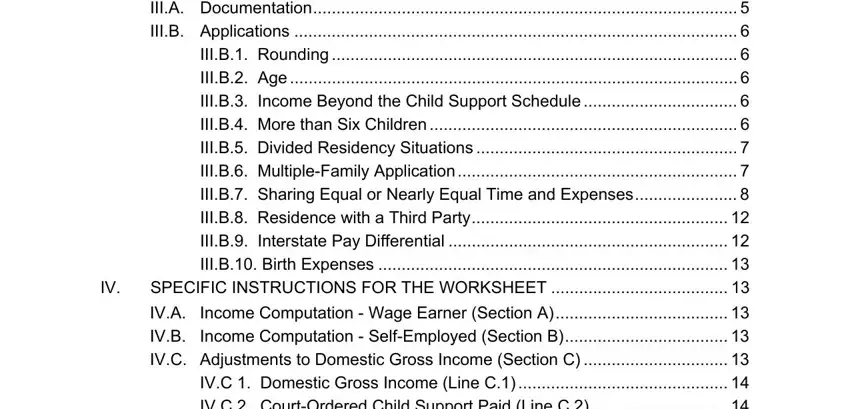

III.GENERAL INSTRUCTIONS

III.A. Documentation

The party requesting a child support order or modification shall present to the court a completed worksheet, together with a completed Domestic Relations Affidavit (Appendix III). This information shall assist the court in confirming or adjusting the various amounts entered on the worksheet.

5

The information required shall be attached to the application for support or motion to modify support.

A worksheet approved by the court shall be filed in every case where an order of child support is entered.

III.B. Applications

III.B.1. Rounding

Calculations should be rounded to the nearest tenth for percentages.

Calculations should be rounded to the nearest dollar in all instances.

In using the Child Support Schedules for income amounts not shown, it may be necessary to round to the nearest basic child support obligation amounts.

III.B.2. Age

In determining the age of a child, use the age on the child’s nearest birthday.

III.B.3. Income Beyond the Child Support Schedule

If the Combined Child Support Income exceeds the highest amount shown on the schedules, the court should exercise its discretion by considering what amount of child support should be set in addition to the highest amount on the Child Support Schedule. For the convenience of the parties, a formula is contained at the end of each child support schedule to compute the amount that is not set forth on the schedules (see Appendix VIII, Example 2).

III.B.4. More than Six Children

If the parties share legal responsibility for more than six children, support should be based upon the established needs of the children and be greater than the amount of child support on the Six Child Families’ Schedule.