Managing files using this PDF editor is simpler when compared with anything else. To update ks annual report online the file, there is nothing you should do - simply adhere to the actions listed below:

Step 1: You should click the orange "Get Form Now" button at the top of the website page.

Step 2: Once you have accessed the ks annual report online editing page you'll be able to find all of the actions you may carry out relating to your file from the top menu.

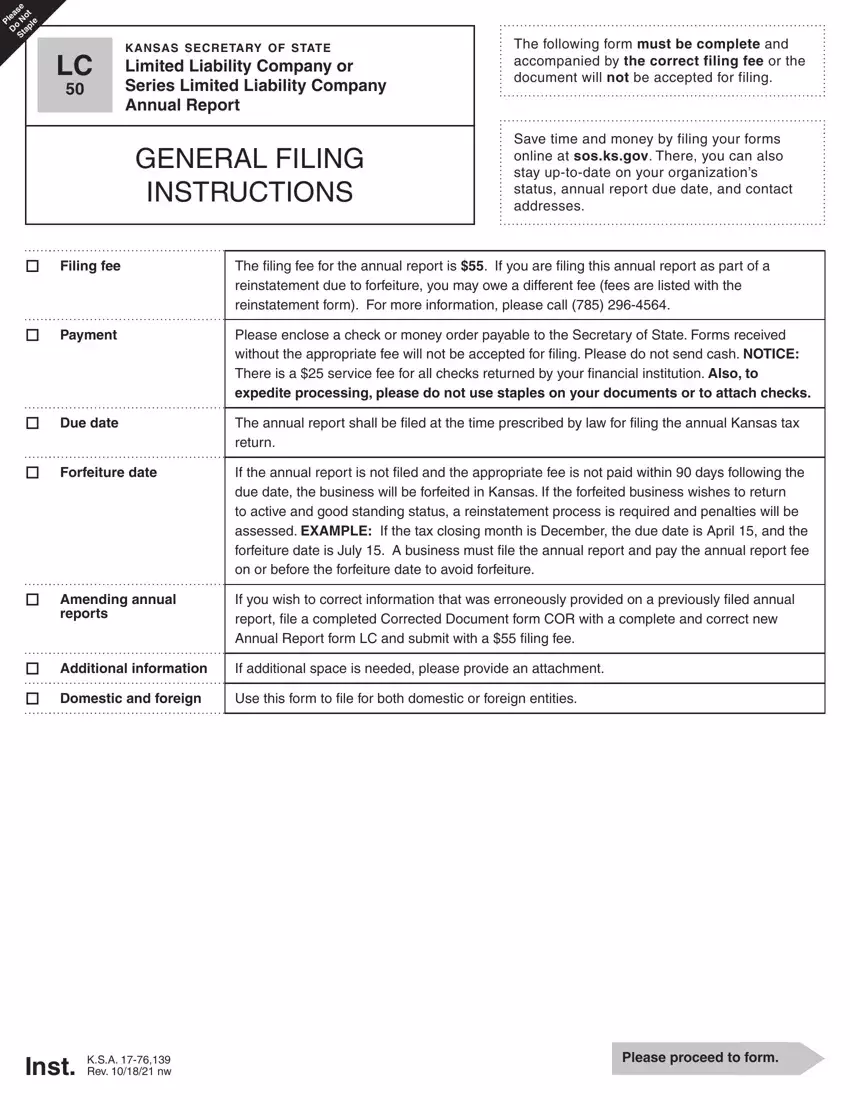

The following parts are what you are going to create to get the ready PDF file.

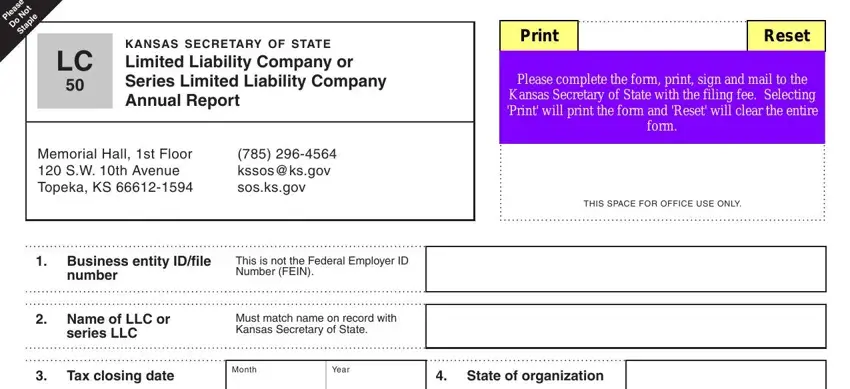

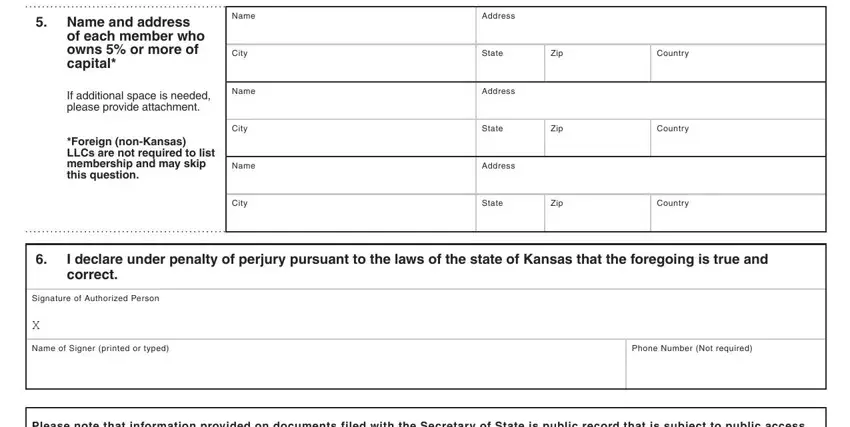

In the Name and address, of each member who owns or more, If additional space is needed, Foreign nonKansas LLCs are not, Name, City, Name, City, Name, City, Address, State, Zip, Country, and Address box, type in your information.

Step 3: Press the Done button to assure that your completed form could be transferred to any kind of electronic device you prefer or mailed to an email you indicate.

Step 4: Generate duplicates of your file - it can help you stay clear of potential future worries. And don't worry - we do not disclose or check the information you have.