Should you intend to fill out 1Value, you don't have to download any kind of software - simply try our online PDF editor. Our professional team is ceaselessly endeavoring to expand the tool and make it much easier for clients with its many features. Make the most of present-day progressive prospects, and find a myriad of new experiences! All it requires is a couple of basic steps:

Step 1: Hit the orange "Get Form" button above. It will open our editor so you could begin completing your form.

Step 2: Once you access the PDF editor, you will see the form ready to be completed. Apart from filling out various blanks, you can also do many other actions with the Document, particularly writing any text, changing the original text, inserting images, signing the PDF, and a lot more.

This PDF doc requires some specific information; in order to guarantee consistency, please make sure to adhere to the next tips:

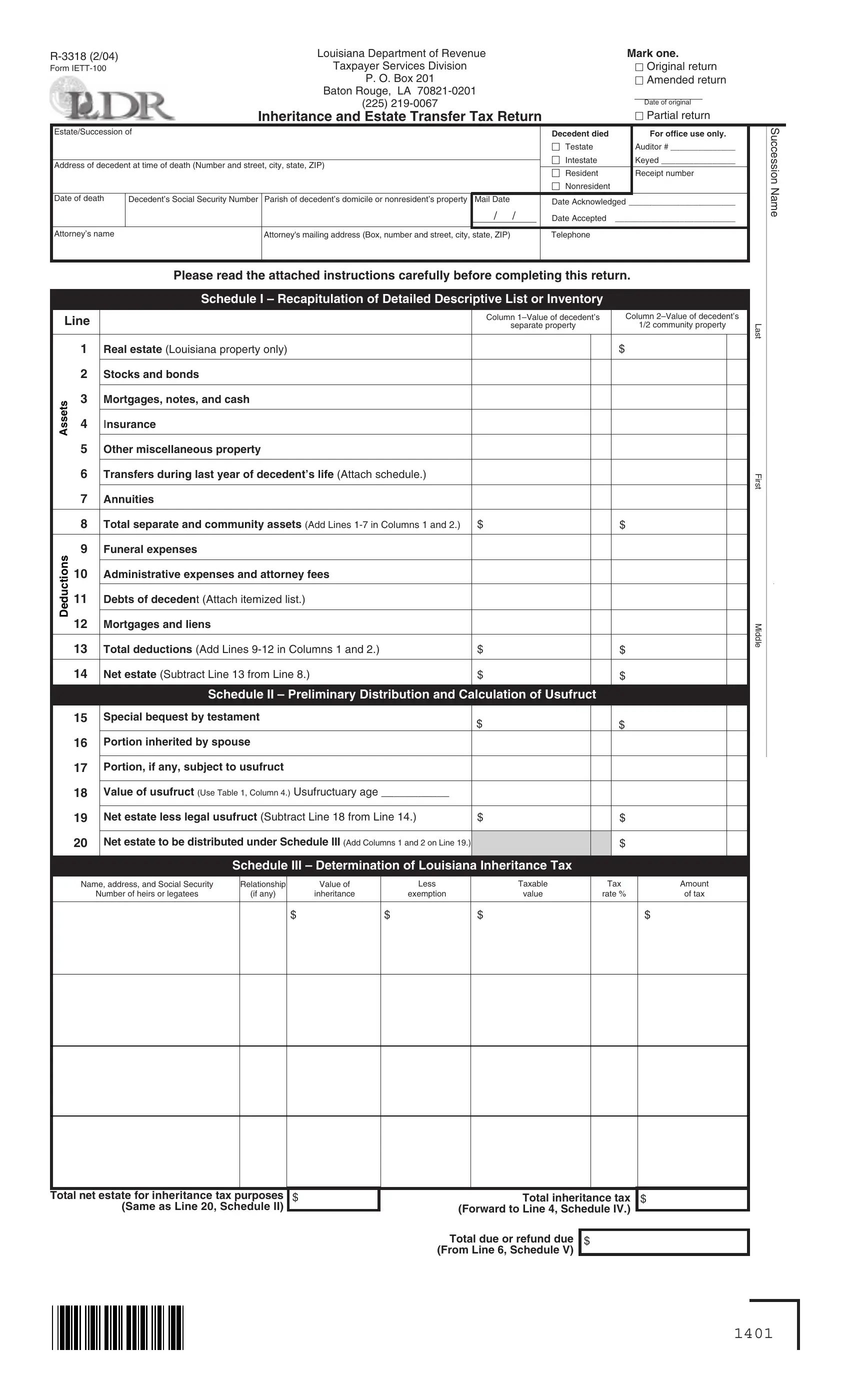

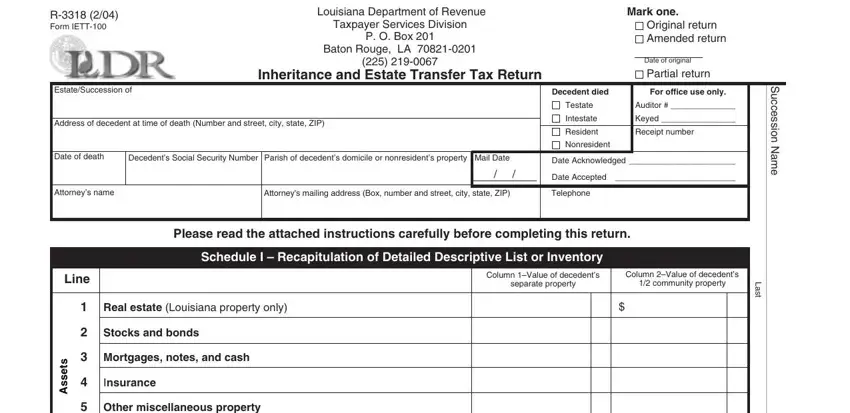

1. Firstly, when filling in the 1Value, start in the part that includes the following fields:

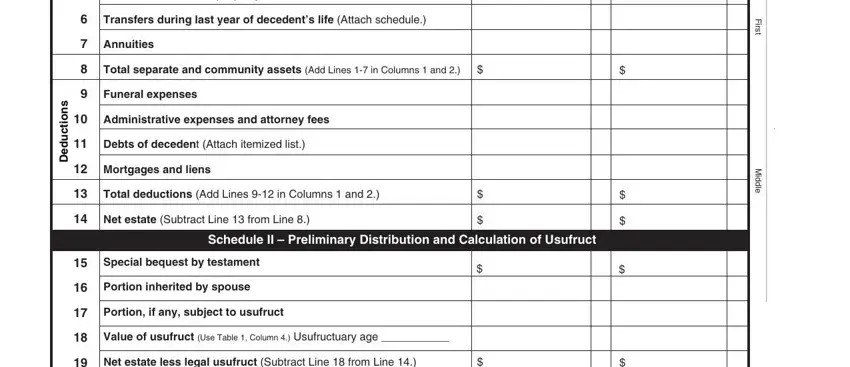

2. Just after completing the last part, go on to the next stage and enter the essential details in these blanks - Other miscellaneous property, Transfers during last year of, Annuities, Total separate and community, Funeral expenses, Administrative expenses and, Debts of decedent Attach itemized, Mortgages and liens, Total deductions Add Lines in, Net estate Subtract Line from, Schedule II Preliminary, Special bequest by testament, Portion inherited by spouse, Portion if any subject to usufruct, and Value of usufruct Use Table.

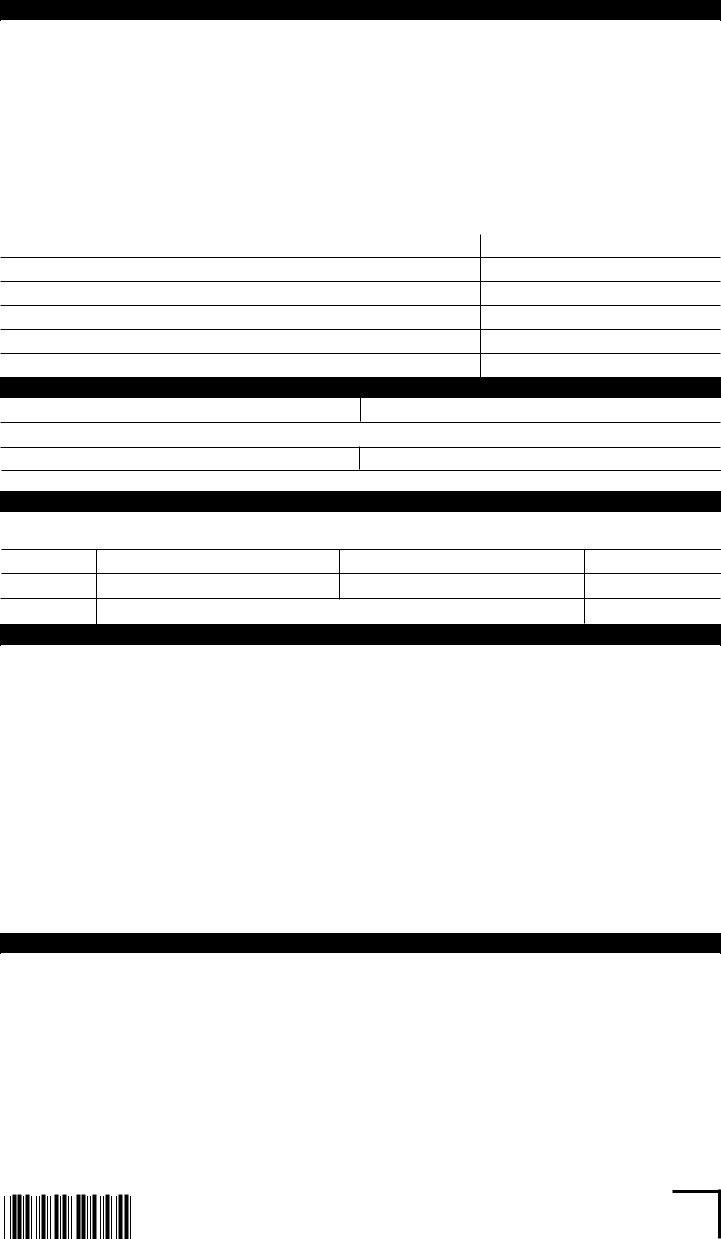

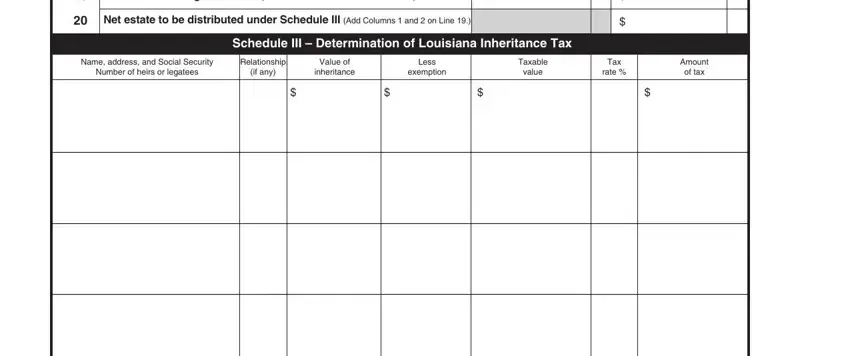

3. The next section is considered rather straightforward, Net estate less legal usufruct, Net estate to be distributed under, Name address and Social Security, Relationship, Number of heirs or legatees, if any, Value of, inheritance, Less, exemption, Taxable, value, Tax, rate, and Amount of tax - all of these fields will need to be completed here.

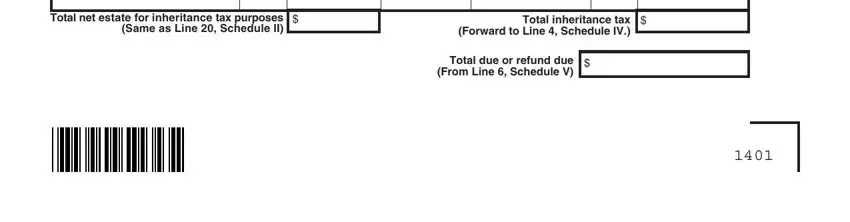

4. Now start working on this next form section! In this case you have all these Total net estate for inheritance, Total inheritance tax Forward to, and Total due or refund due From Line form blanks to fill out.

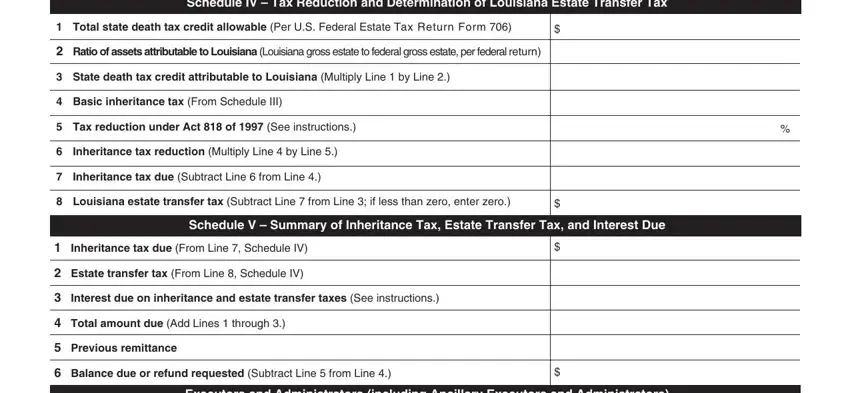

5. And finally, the following final section is what you need to complete before finalizing the document. The fields under consideration are the next: Schedule IV Tax Reduction and, Total state death tax credit, Ratio of assets attributable to, State death tax credit, Basic inheritance tax From, Tax reduction under Act of See, Inheritance tax reduction, Inheritance tax due Subtract Line, Louisiana estate transfer tax, Schedule V Summary of Inheritance, Inheritance tax due From Line, Estate transfer tax From Line, Interest due on inheritance and, Total amount due Add Lines, and Previous remittance.

As for Estate transfer tax From Line and Tax reduction under Act of See, ensure you take another look here. The two of these are certainly the most significant ones in this file.

Step 3: Soon after proofreading the completed blanks, press "Done" and you are done and dusted! Try a free trial subscription at FormsPal and obtain immediate access to 1Value - downloadable, emailable, and editable inside your FormsPal account page. FormsPal is committed to the confidentiality of all our users; we always make sure that all personal information used in our system remains protected.