Undyed can be completed online easily. Just use FormsPal PDF editing tool to get it done fast. FormsPal is aimed at providing you with the perfect experience with our editor by constantly introducing new capabilities and upgrades. With these updates, working with our tool gets easier than ever before! If you are looking to begin, here's what it will require:

Step 1: Press the "Get Form" button above. It'll open up our tool so you could begin filling out your form.

Step 2: Once you access the online editor, you'll see the document made ready to be completed. Aside from filling in various blank fields, it's also possible to perform some other things with the file, such as adding any textual content, modifying the original textual content, adding illustrations or photos, placing your signature to the form, and more.

Filling out this PDF will require focus on details. Make sure all required fields are completed properly.

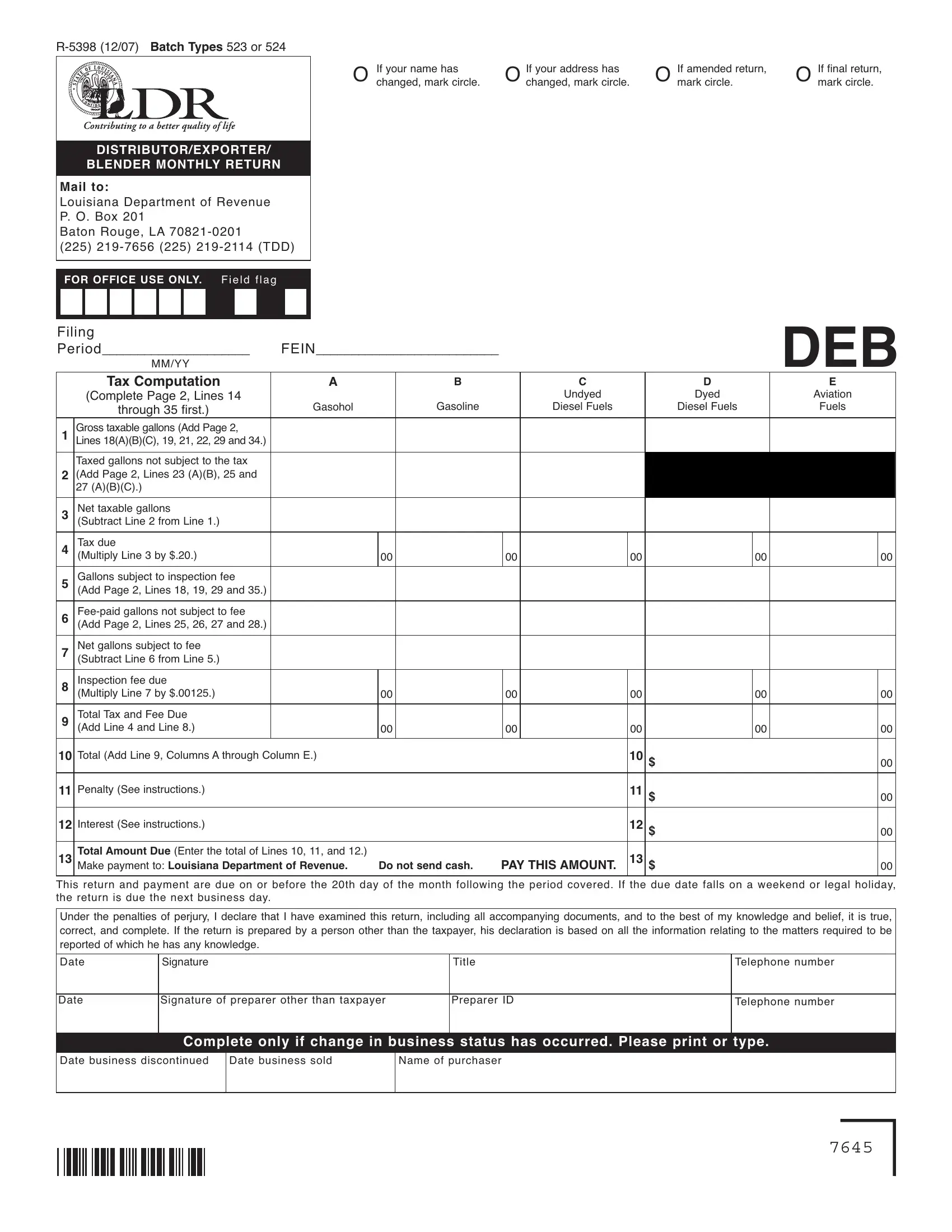

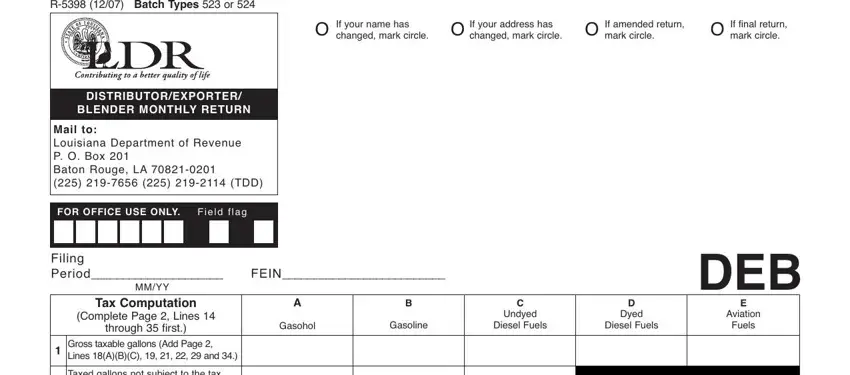

1. It is very important complete the Undyed properly, thus be careful when filling out the parts that contain these specific blank fields:

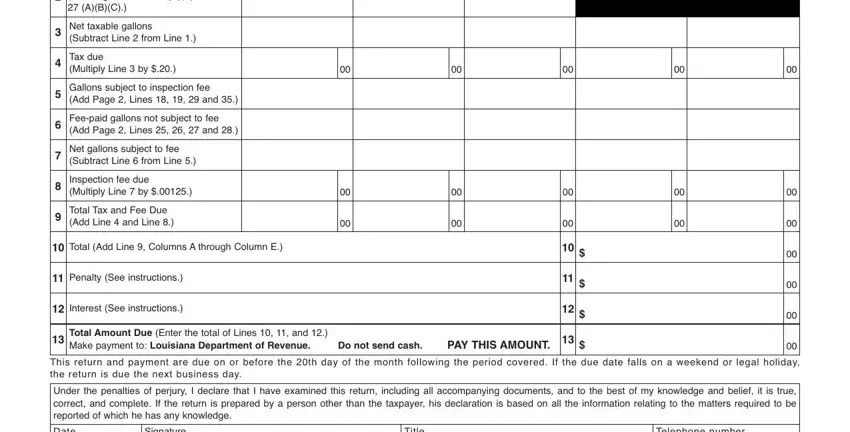

2. Soon after performing this part, head on to the subsequent stage and fill out all required details in these fields - Taxed gallons not subject to the, Net taxable gallons Subtract Line, Tax due Multiply Line by, Gallons subject to inspection fee, Feepaid gallons not subject to fee, Net gallons subject to fee, Inspection fee due Multiply Line, Total Tax and Fee Due Add Line, Total Add Line Columns A through, Penalty See instructions, Interest See instructions, Total Amount Due Enter the total, Do not send cash, PAY THIS AMOUNT, and This return and payment are due on.

People frequently get some points wrong while filling out Total Tax and Fee Due Add Line in this part. Ensure you revise whatever you type in right here.

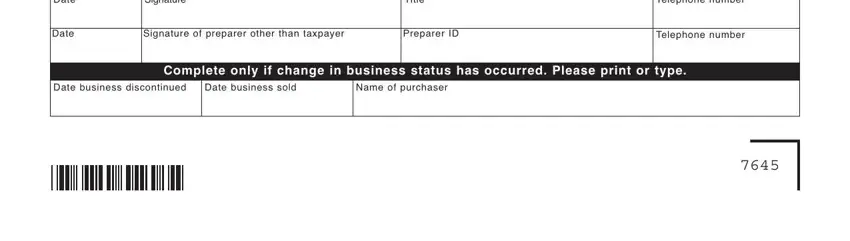

3. This next step is all about Date, Date, Signature, Title, Signature of preparer other than, Preparer ID, Telephone number, Telephone number, Date business discontinued, Date business sold, Name of purchaser, and Complete only if change in - type in each of these fields.

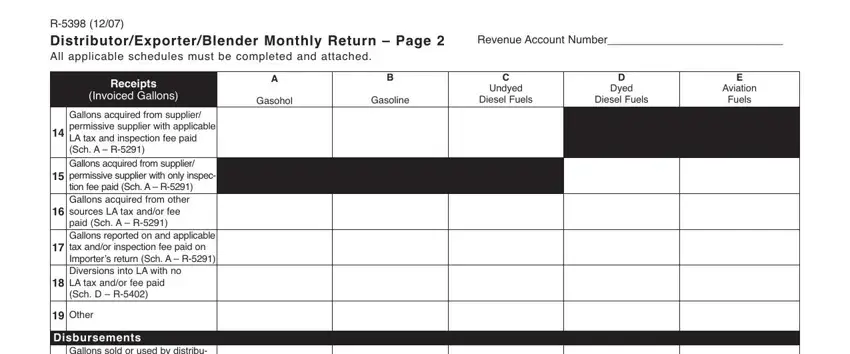

4. To move ahead, the next form section requires filling in a couple of fields. These include R DistributorExporterBlender, Revenue Account Number, Receipts, Invoiced Gallons, Gallons acquired from supplier, Other, Disbursements, Gallons sold or used by distribu, Gasohol, Gasoline, Undyed, Diesel Fuels, Dyed, Diesel Fuels, and Aviation, which you'll find crucial to going forward with this PDF.

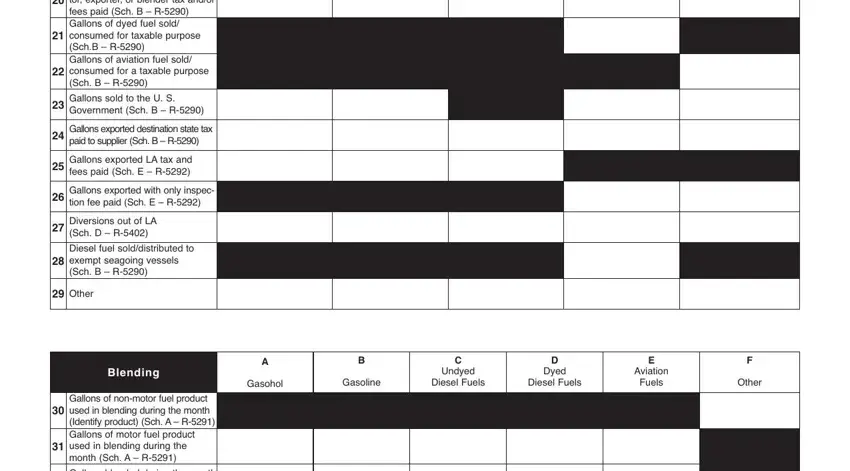

5. Last of all, the following last portion is precisely what you have to finish before using the form. The fields here are the following: Gallons sold or used by distribu, Gallons sold to the U S Government, Gallons exported destination state, Gallons exported LA tax and fees, Gallons exported with only inspec, Diversions out of LA Sch D R, Diesel fuel solddistributed to, Other, Blending, Gallons of nonmotor fuel product, Gallons blended during the month, Gasohol, Gasoline, Undyed, and Diesel Fuels.

Step 3: When you've glanced through the details provided, click on "Done" to finalize your form at FormsPal. Join FormsPal right now and immediately access Undyed, set for downloading. Each change made is conveniently kept , enabling you to change the document further when necessary. FormsPal is dedicated to the confidentiality of all our users; we make sure all personal information entered into our editor is kept secure.