It is possible to complete the legalshield will questionnaire document using our PDF editor. The next steps will assist you to immediately create your document.

Step 1: To start out, choose the orange button "Get Form Now".

Step 2: At this point, you can start modifying your legalshield will questionnaire. Our multifunctional toolbar is at your disposal - add, remove, alter, highlight, and conduct various other commands with the content material in the form.

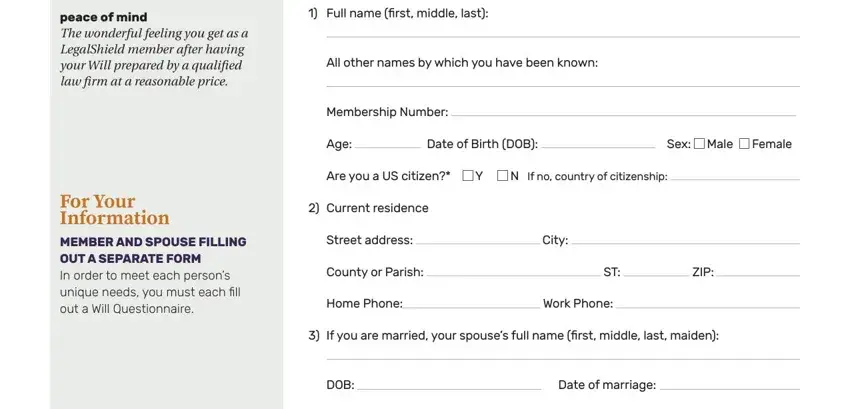

Provide the requested data in every single part to prepare the PDF legalshield will questionnaire

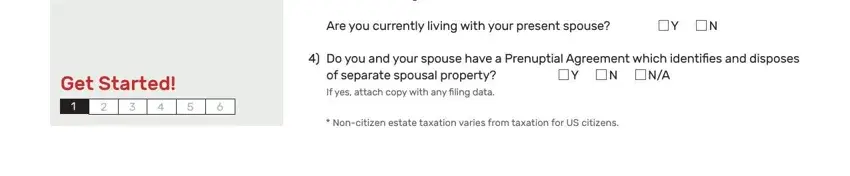

The application will need you to fill out the Place of marriage, Are you currently living with your, Get Started, Do you and your spouse have a, of separate spousal property If, and Noncitizen estate taxation varies field.

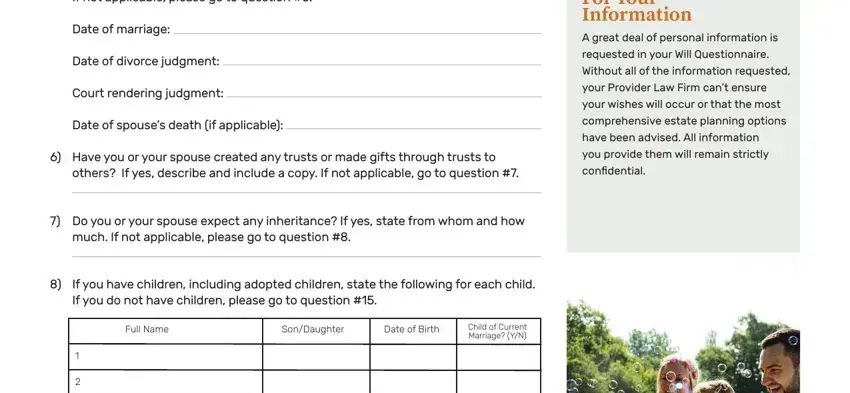

The system will ask you to provide specific important information to easily complete the segment If not applicable please go to, Date of marriage, Date of divorce judgment, Court rendering judgment, Date of spouses death if applicable, Have you or your spouse created, For Your Information A great deal, requested in your Will, Without all of the information, your Provider Law Firm cant ensure, your wishes will occur or that the, comprehensive estate planning, have been advised All information, you provide them will remain, and others If yes describe and include.

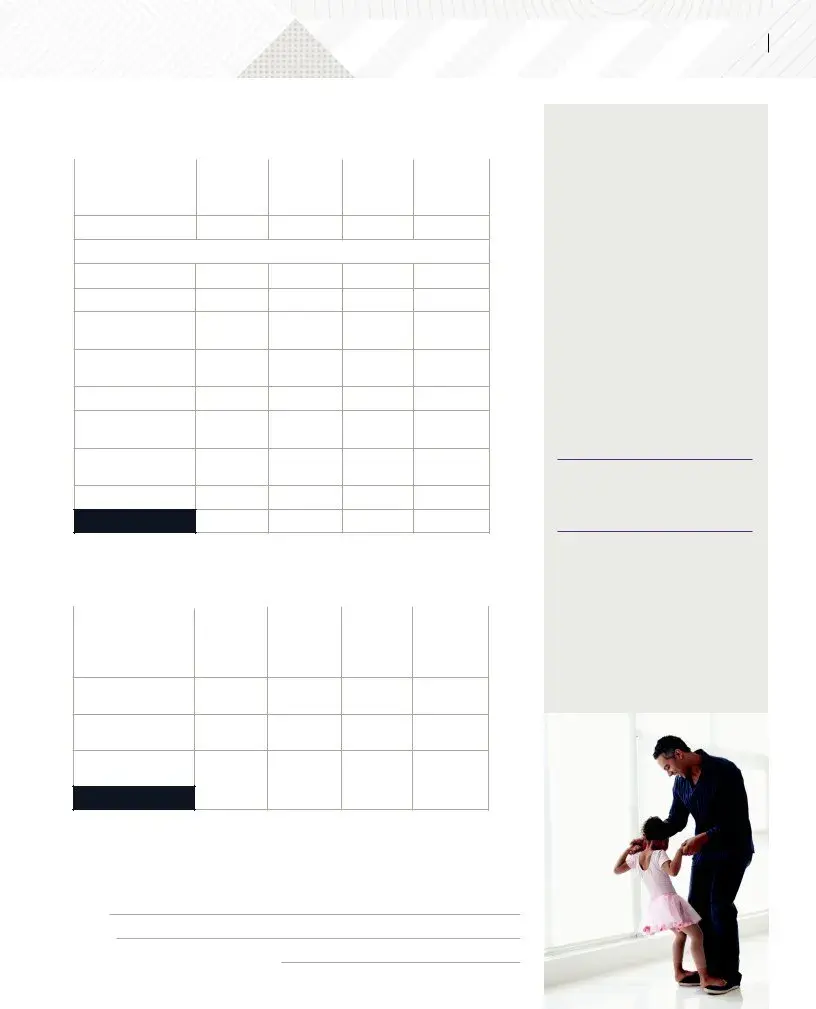

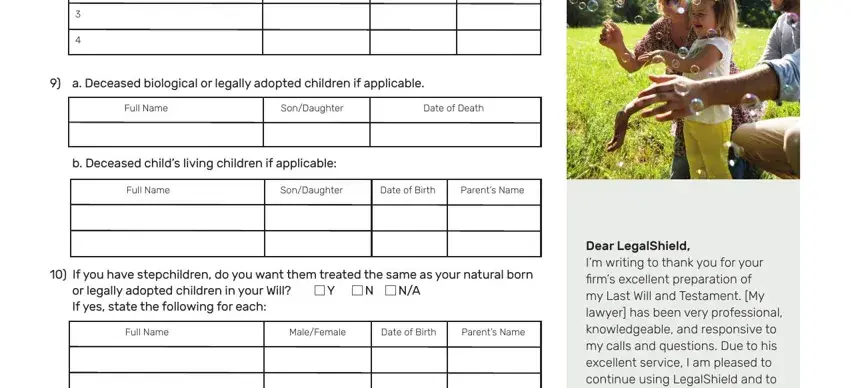

Inside of space a Deceased biological or legally, Full Name SonDaughter Date of Death, b Deceased childs living children, Full Name SonDaughter Date of, If you have stepchildren do you, or legally adopted children in, Full Name MaleFemale Date of Birth, and Dear LegalShield Im writing to, identify the rights and obligations.

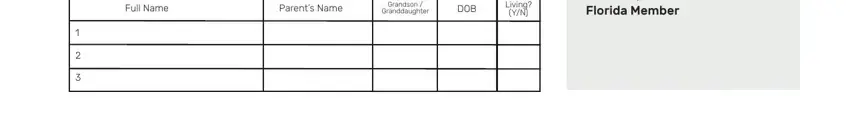

End by checking the next areas and filling them out as required: Full Name Parents Name, Grandson Granddaughter, DOB, Living YN, and Dear LegalShield Im writing to.

Step 3: When you select the Done button, your final document is simply transferable to any type of of your devices. Or, you can send it through mail.

Step 4: It can be easier to prepare copies of the file. There is no doubt that we are not going to display or read your information.

Y

Y  N

N  N/A If yes, state the following for each:

N/A If yes, state the following for each:

6

6