Our finest developers worked hard to develop the PDF editor we are extremely pleased to deliver to you. This software can help you simply fill out lancaster county pa taxes and can save your time. You need to simply adhere to this particular procedure.

Step 1: To get started, select the orange button "Get Form Now".

Step 2: Now it's easy to edit the lancaster county pa taxes. This multifunctional toolbar lets you include, remove, alter, and highlight content material as well as undertake many other commands.

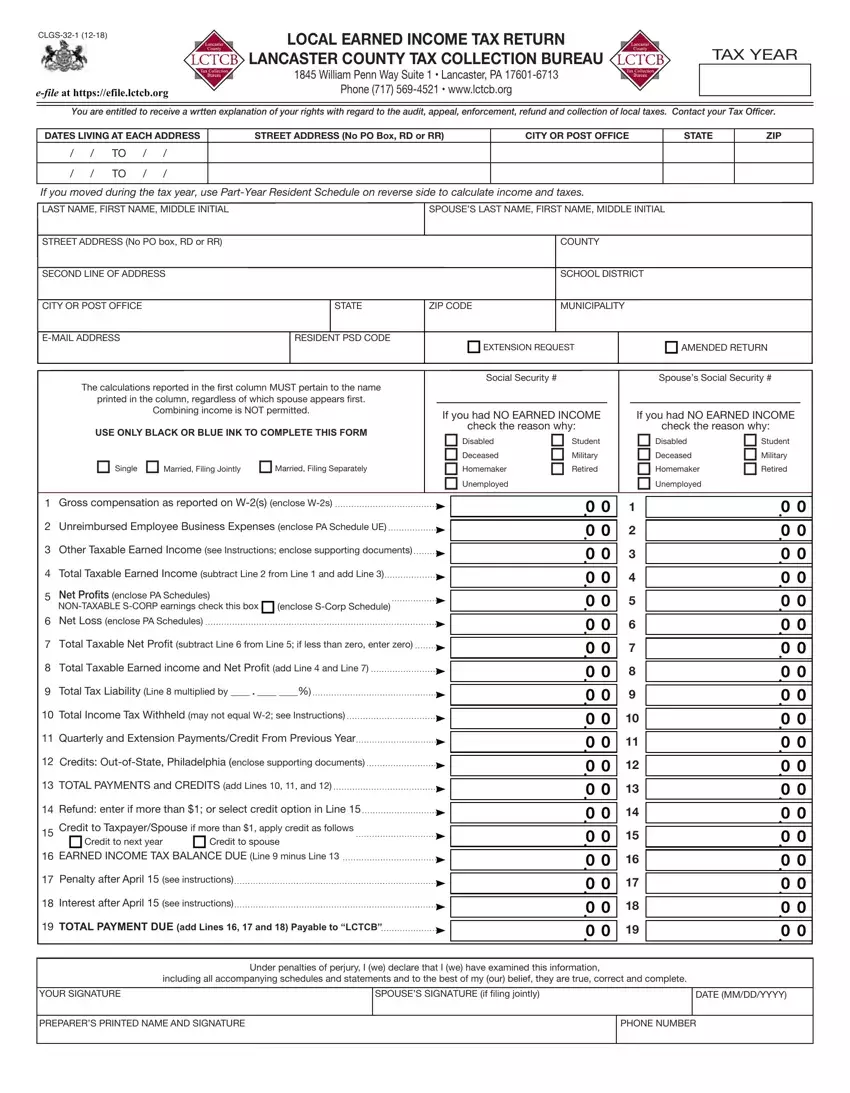

Enter the essential data in every single section to fill out the PDF lancaster county pa taxes

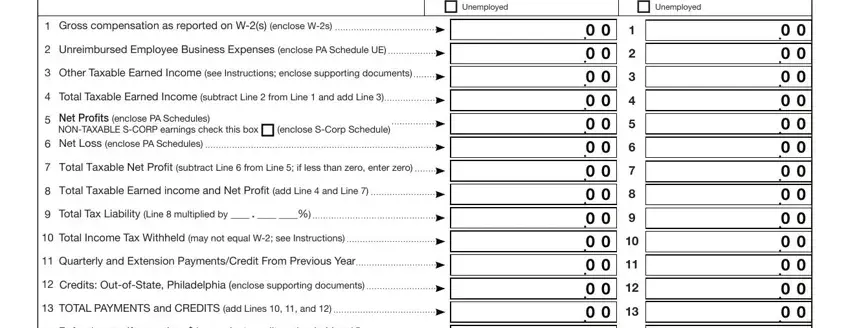

Fill out the Gross compensation as reported on, Unreimbursed Employee Business, Other Taxable Earned Income see, Total Taxable Earned Income, Net Profits enclose PA Schedules, enclose SCorp Schedule, Total Taxable Net Profit subtract, Total Taxable Earned income and, Total Tax Liability Line, Total Income Tax Withheld may not, Quarterly and Extension, Credits OutofState Philadelphia, TOTAL PAYMENTS and CREDITS add, If you had NO EARNED INCOME check, and Unemployed areas with any particulars that will be requested by the platform.

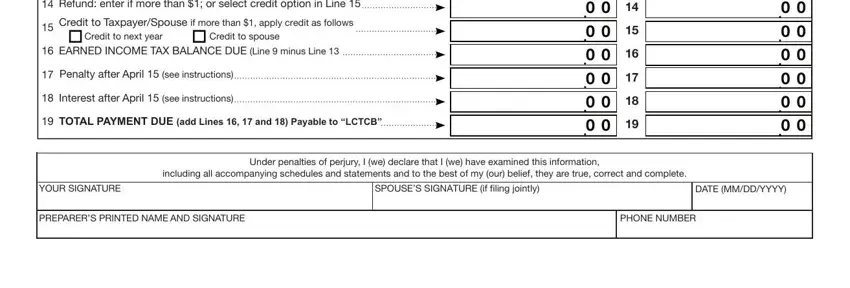

You will need to note specific information inside the segment Refund enter if more than or, Credit to next year, Credit to TaxpayerSpouse if more, Credit to spouse, Penalty after April see, Interest after April see, TOTAL PAYMENT DUE add Lines and, Under penalties of perjury I we, YOUR SIGNATURE, SPOUSES SIGNATURE if filing jointly, DATE MMDDYYYY, PREPARERS PRINTED NAME AND, and PHONE NUMBER.

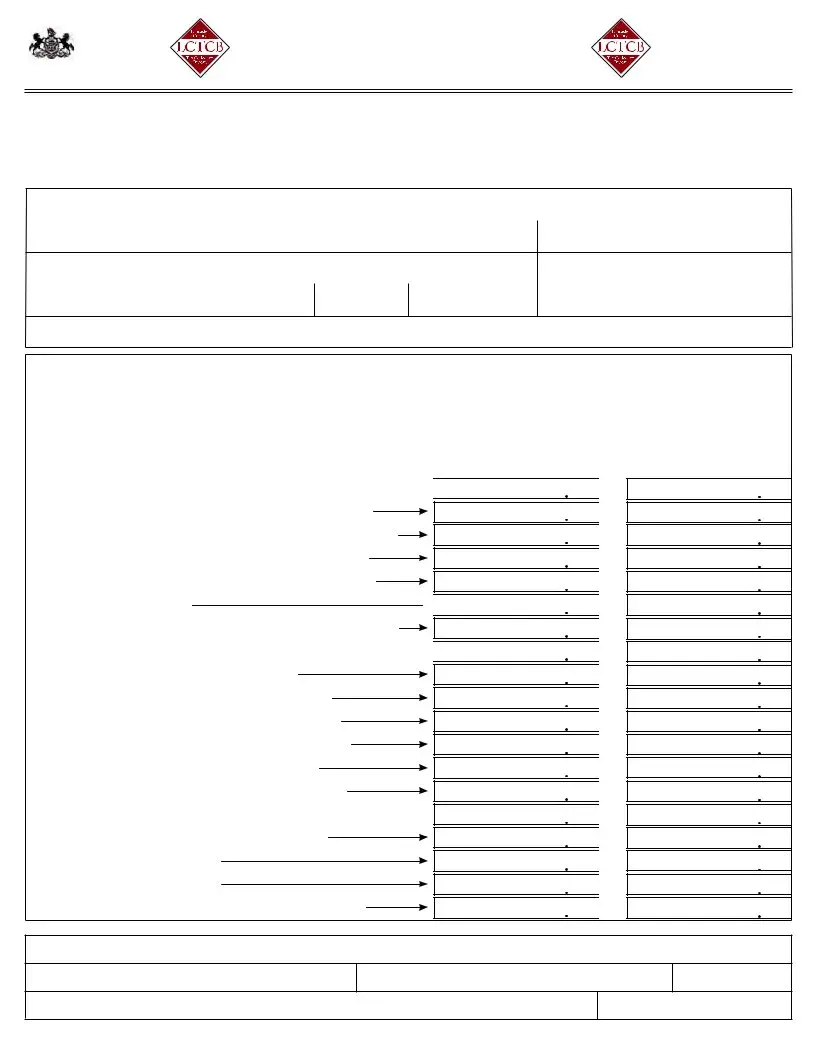

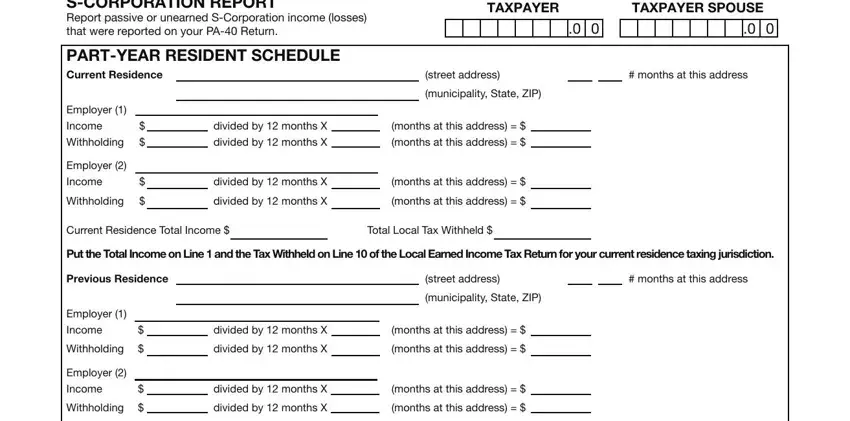

You need to write down the rights and obligations of the sides inside the SCORPORATION REPORT Report passive, PARTYEAR RESIDENT SCHEDULE Current, TAXPAYER, TAXPAYER SPOUSE, street address, municipality State ZIP, months at this address, Employer, Income, Withholding, Employer, Income, Withholding, divided by months X, and divided by months X paragraph.

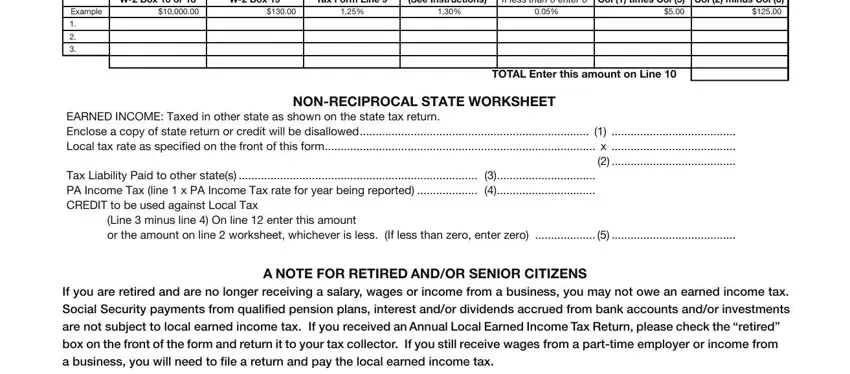

Finalize by checking all of these fields and filling out the required information: Workplace Location NonResident, Column minus Column If less, Disallowed Withholding Credit Col, Credit Allowed for Tax Withheld, Local Wages W Box or, Tax Withheld W Box, Resident EIT Rate Tax Form Line, Example, TOTAL Enter this amount on Line, EARNED INCOME Taxed in other state, NONRECIPROCAL STATE WORKSHEET, Tax Liability Paid to other states, Line minus line On line enter, and A NOTE FOR RETIRED ANDOR SENIOR.

Step 3: Choose the button "Done". Your PDF form is available to be exported. You can upload it to your pc or send it by email.

Step 4: Generate copies of the file - it can help you avoid forthcoming complications. And don't be concerned - we don't distribute or look at your data.