We were making the PDF editor with the prospect of allowing it to be as effortless to work with as possible. For this reason the process of filling in the lynch designation merrill form is going to be effortless use these particular actions:

Step 1: You should select the orange "Get Form Now" button at the top of the following webpage.

Step 2: As soon as you've entered the editing page lynch designation merrill form, you should be able to notice all the actions available for your document in the top menu.

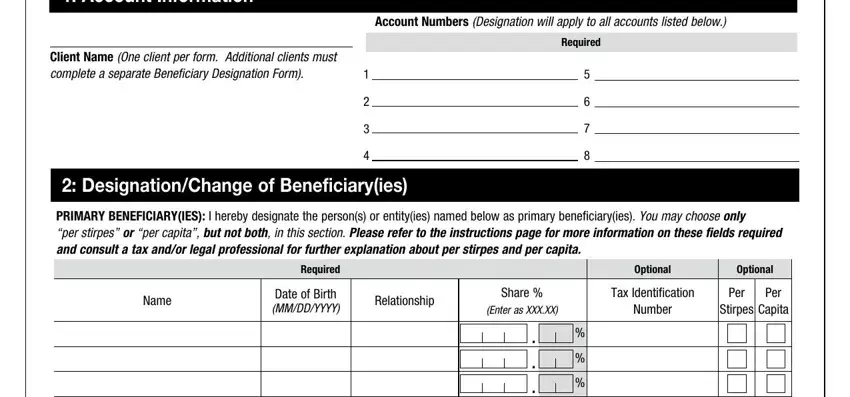

The following parts are going to make up your PDF file:

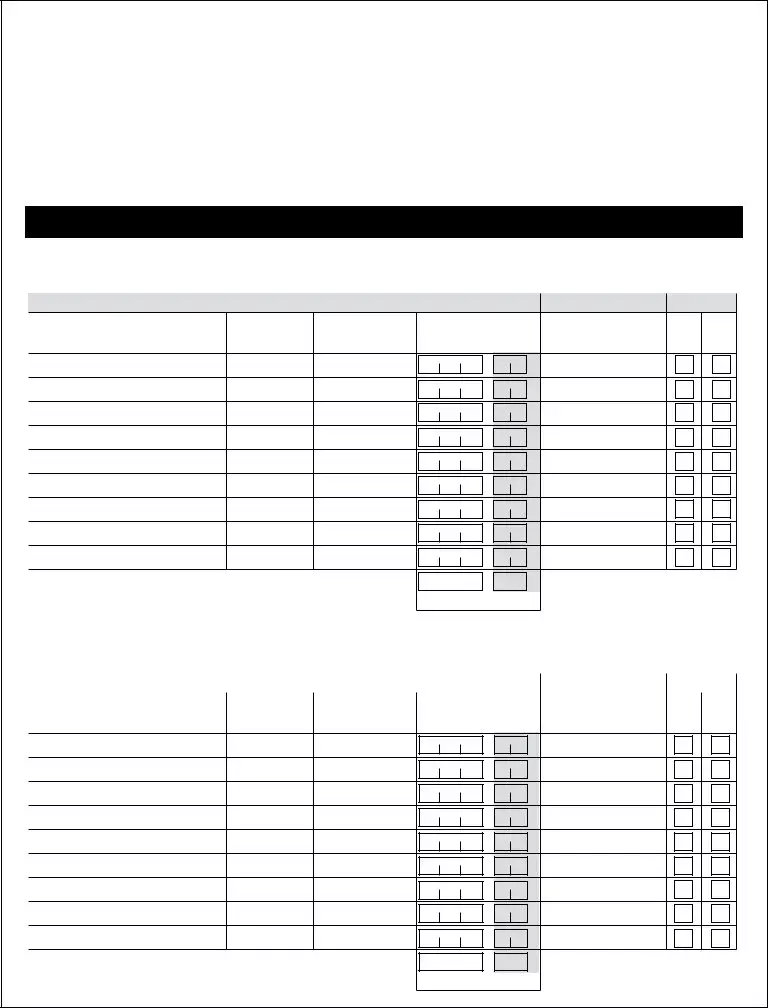

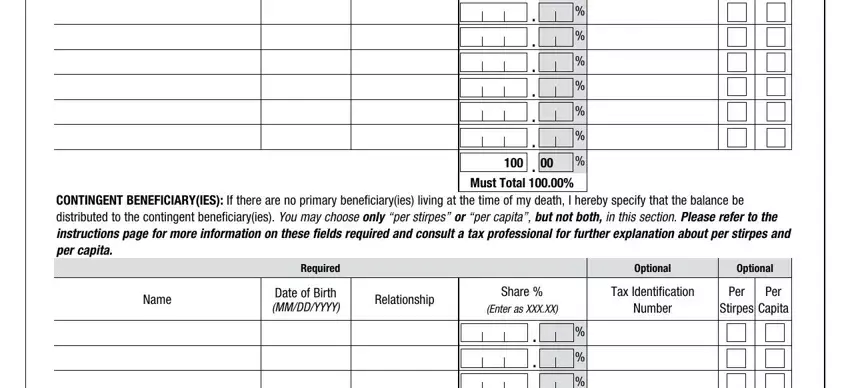

Type in the appropriate information in the area Enter, as, XXXX, Xu, u, u, u, u, u, u, u, uC, J, Must, Total Required, Optional, Optional, Name, DateofBirth, MM, DD, YYYY Relationship, Share, Enter, as, XXXX, Xu, u, u, u, u, u, u, u, uC, J, Must, Total Tax, Identification Number, Per, Stir, pes and Per, Capita

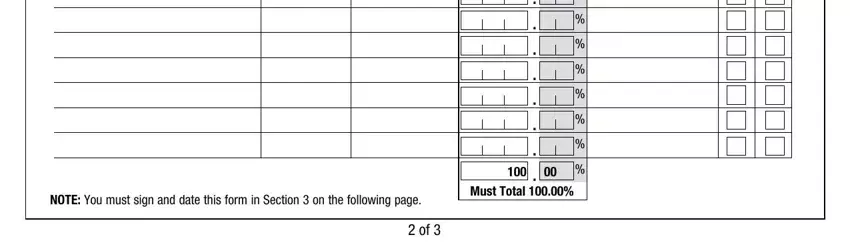

Write down the important data in Enter, as, XXXX, Xu, u, u, u, u, u, u, u, uC, J, Must, Total segment.

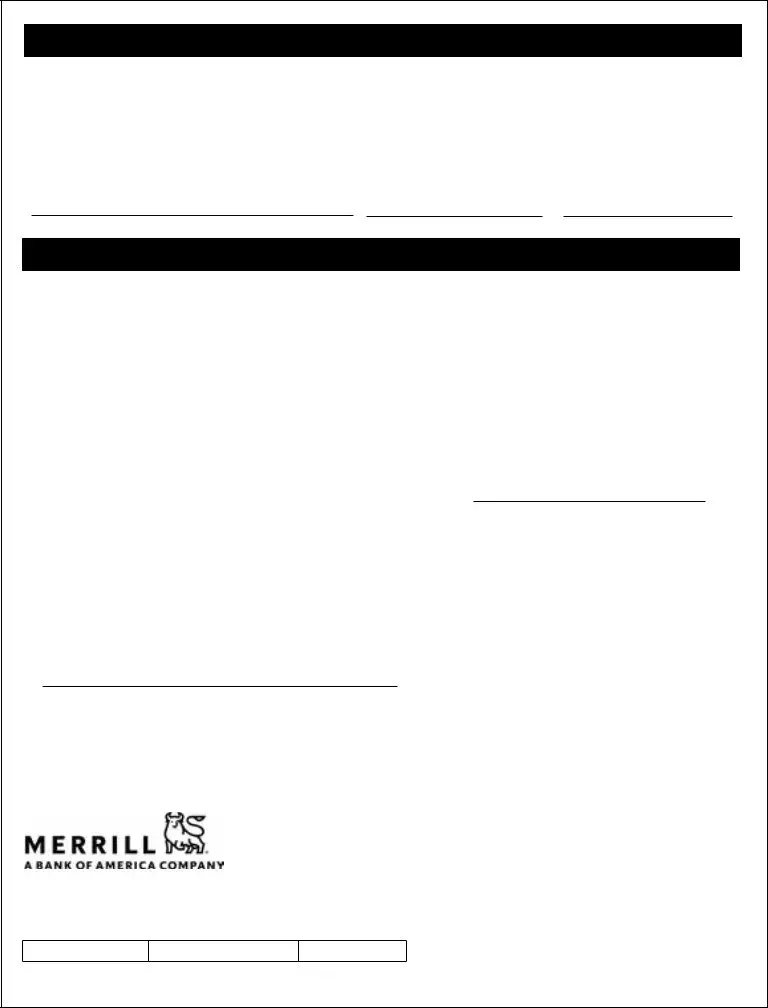

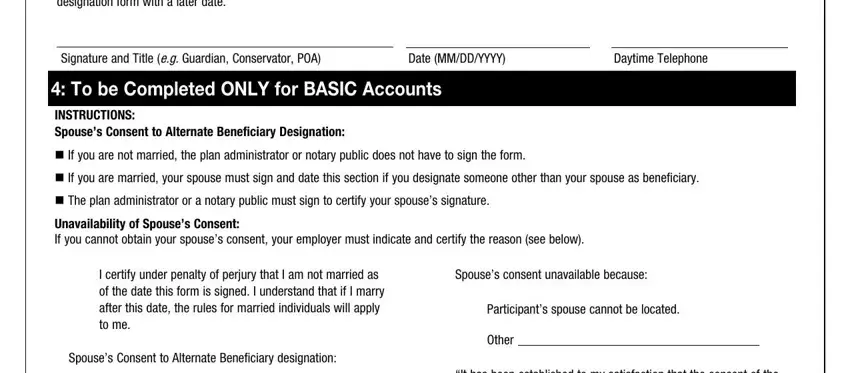

The Date, MM, DD, YYYY Daytime, Telephone Spouses, consent, unavailable, because Participants, spouse, cannot, be, located and Other segment has to be applied to write down the rights or responsibilities of both parties.

Step 3: Once you press the Done button, your ready form may be transferred to each of your gadgets or to email indicated by you.

Step 4: Have a duplicate of any file. It should save you time and make it easier to stay clear of complications in the long run. Keep in mind, the information you have isn't revealed or checked by us.