maryland personal property tax form 4a can be completed easily. Just make use of FormsPal PDF editor to complete the job without delay. Our professional team is constantly working to improve the tool and make it much better for clients with its cutting-edge features. Enjoy an ever-improving experience today! Here is what you'd have to do to start:

Step 1: Simply click on the "Get Form Button" above on this site to open our pdf file editing tool. There you'll find all that is needed to fill out your file.

Step 2: This tool will allow you to work with PDF forms in various ways. Change it with customized text, correct what's already in the document, and add a signature - all when it's needed!

Filling out this document requires thoroughness. Ensure that every blank field is completed correctly.

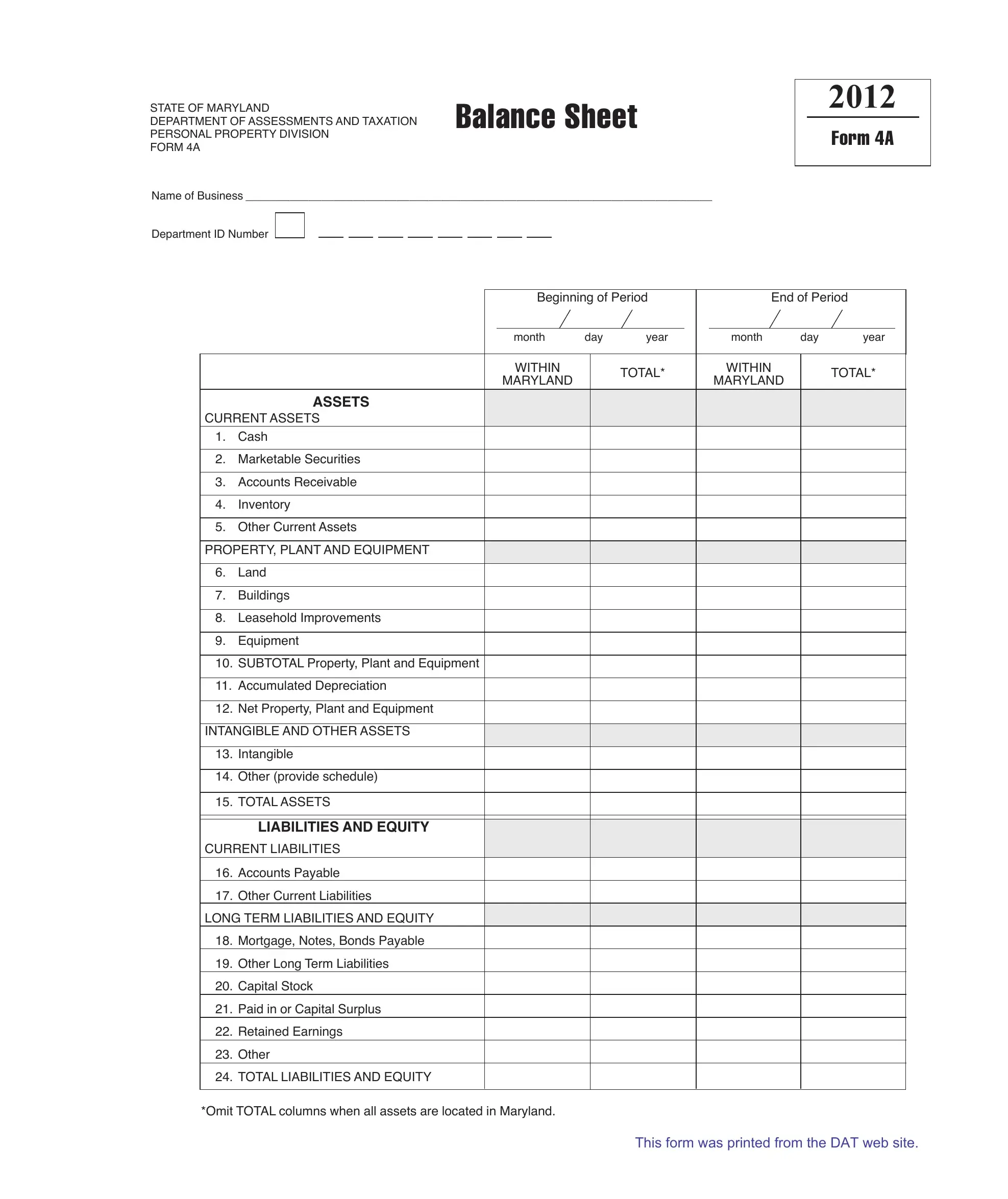

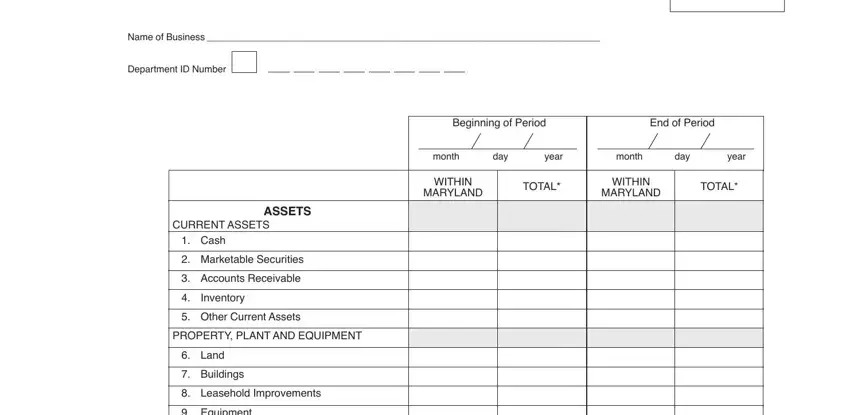

1. To start with, while completing the maryland personal property tax form 4a, start out with the page with the following blank fields:

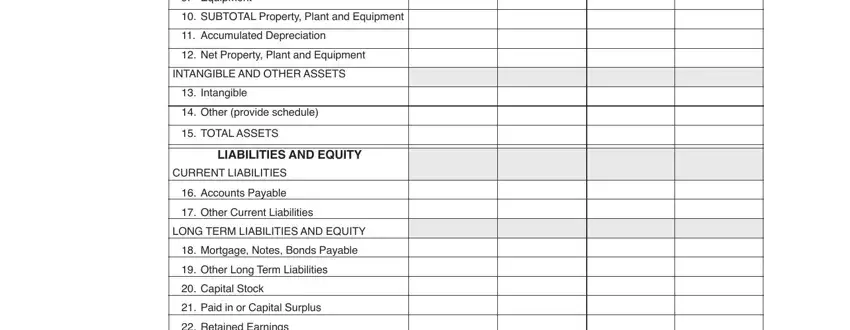

2. The third step would be to fill out these fields: Equipment, SUBTOTAL Property Plant and, Accumulated Depreciation, Net Property Plant and Equipment, INTANGIBLE AND OTHER ASSETS, Intangible, Other provide schedule, TOTAL ASSETS, lIABIlITIES AND EQUITY, CURRENT LIABILITIES, Accounts Payable, Other Current Liabilities, LONG TERM LIABILITIES AND EQUITY, Mortgage Notes Bonds Payable, and Other Long Term Liabilities.

Concerning INTANGIBLE AND OTHER ASSETS and Accumulated Depreciation, ensure you review things in this current part. Those two are the most important fields in the PDF.

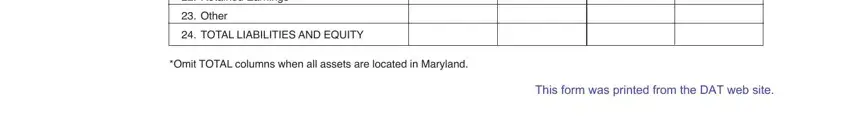

3. The next part is generally pretty uncomplicated, Retained Earnings, Other, TOTAL LIABILITIES AND EQUITY, Omit TOTAL columns when all assets, and This form was printed from the DAT - each one of these form fields has to be completed here.

Step 3: Once you have reviewed the information you filled in, press "Done" to finalize your document generation. Try a 7-day free trial plan with us and obtain instant access to maryland personal property tax form 4a - download, email, or edit in your FormsPal account page. FormsPal ensures your data confidentiality by having a protected system that in no way records or distributes any kind of sensitive information used. Rest assured knowing your files are kept safe every time you use our service!