The Maryland Form 500D, revised in 1996, serves a crucial function for corporations operating within the state's jurisdiction. It is essentially a Declaration of Estimated Corporation Income Tax, utilized when a corporation hasn't received or does not have access to the estimated tax packet, which includes four preprinted vouchers. This form enables companies to calculate and remit their estimated income tax, ensuring compliance with state tax laws. The form requires corporations to project their taxable income and calculate the due tax, distributing the payment across four quarterly installments. Additionally, Form 500D provides a section for recording installment payments, reinforcing organizational accountability and tax record accuracy. It is noteworthy that this form is not applicable to pass-through entities or for employer withholding tax purposes. Furthermore, corporations that have overpaid in the previous year can apply such overpayments towards their current estimated tax obligations. Maryland's taxation laws mandate thorough adherence to the estimated tax requirements, with specific provisions for penalties and interest accrual in instances of non-compliance. This highlights the necessity for corporations to accurately forecast their taxable income and make timely tax payments, reinforcing the form's significance in the broader context of Maryland's corporate taxation framework.

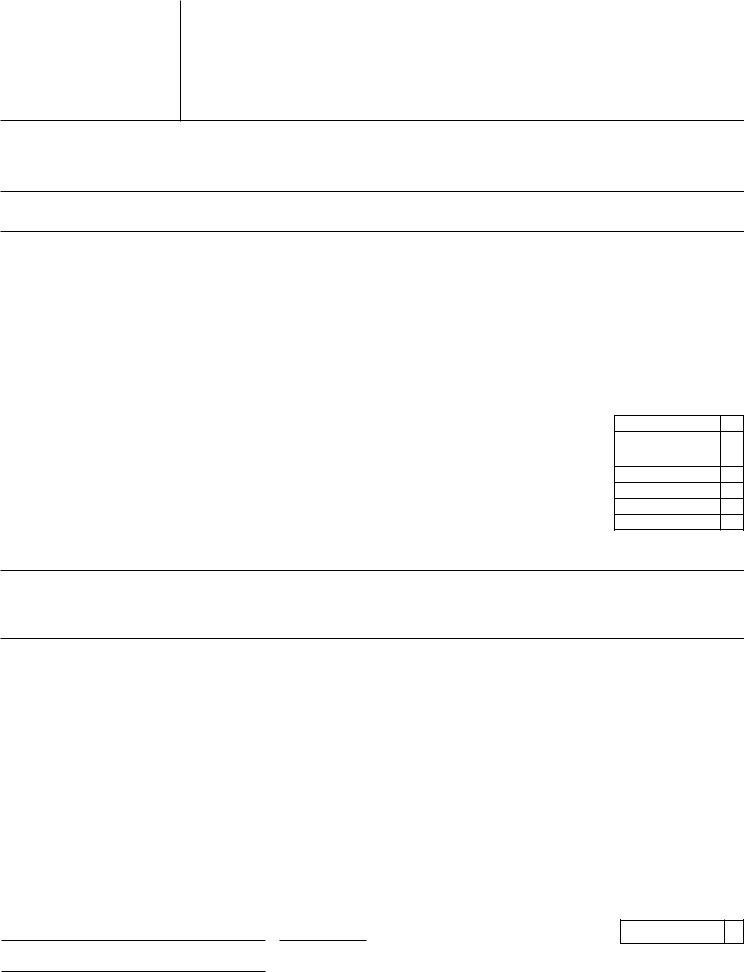

| Question | Answer |

|---|---|

| Form Name | Maryland Form 500D |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 15th, md form 500d instructions, maryland form 500d, preparers |

MARYLAND

FORM

500D

(Revised 1996)

DECLARATION OF ESTIMATED CORPORATION INCOME TAX

IF THE CORPORATION RECEIVED THE DECLARATION OF ESTIMATED CORPORATION INCOME TAX PACKET WHICH INCLUDES THE FOUR PREPRINTED VOUCHERS FOR SUBMITTING ESTIMATED PAYMENTS, PLEASE USE THE PREPRINTED VOUCHERS INSTEAD OF THIS FORM.

IF THE CORPORATION DOES NOT HAVE THE PACKET, USE THIS FORM TO REMIT ANY PAYMENT DUE AT THIS TIME. CHECK THE APPLICABLE BOX ON FORM 500D IF REPLACEMENT VOUCHERS (FORM 500DP) ARE NEEDED FOR REMAINING INSTALLMENTS OF THE CURRENT TAX YEAR.

SEE INSTRUCTIONS ON REVERSE SIDE

Estimated Tax Worksheet (Complete this worksheet to compute the estimated tax due)

1. |

Taxable income expected for the taxable year or period BEGINNING in 1997 |

1 |

|

|

|

|

|||

2. |

Estimated income tax due for the year (7% of line 1) |

2 |

|

|

|

|

|||

3. |

Estimated tax due per quarter (line 2 divided by four) |

3 |

|

|

|

|

|||

|

|

|

|

|

Record of Installment Payments (Complete this record for your files)

1. |

PRIOR YEAR (1996) OVERPAYMENT applied as a credit to estimated tax for 1997 |

1 |

||

|

||||

|

Date Due |

Date Paid |

Check No. |

|

2. |

15th day of the 4th month |

___________________ |

______________ |

2 |

3. |

15th day of the 6th month |

___________________ |

______________ |

3 |

4. |

15th day of the 9th month |

___________________ |

______________ |

4 |

5. |

15th day of the 12th month |

___________________ |

______________ |

5 |

6. |

Total estimated tax payments for 1997 (Claim this amount on Form 500 - line 10a |

6 |

||

|

||||

for the taxable year BEGINNING in 1997.)

CUT ALONG THIS LINE AND RETAIN TOP PORTION OF FORM FOR CORPORATE RECORDS.

SUBMIT BOTTOM PORTION WITH REMITTANCE TO THE COMPTROLLER OF THE TREASURY, REVENUE ADMINISTRATION DIVISION,

ANNAPOLIS, MARYLAND

M ARYLAND |

DECLARATION OF ESTIMATED |

|

|

|

|

|

OR FISCAL YEAR |

|

|

||||

FORM 500D |

CORPORATION INCOME TAX |

|

19 |

|

(ENDINGBEGINNING_____________________,, |

1919____) |

|||||||

|

|

||||||||||||

|

M AIL TO: COM PTROLLER OF THE TREASURY |

|

|

|

|

|

|

|

|

|

|

||

|

REVENUE ADM INISTRATION DIVISION |

|

|

|

|

|

|

|

|

|

|

||

|

ANNAPOLIS, M ARYLAND |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Em ployer Identification No. (9 digits) |

|

|

|

|

DO NOT WRITE IN THIS SPACE |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||||

|

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nam e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Num ber and street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City or tow n, state |

|

Zip code |

M E |

YE |

|

EC |

|

|

|

|

|

|

|

|

|

|

▶ |

▶ |

|

▶ |

|

▶ |

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE AND VERIFICATION: I declare that I have exam ined this declaration and to the best of m y knowledge and belief, it is true, correct and com plete.

Officer’s (or preparer’s) signature |

Date |

CHECK HERE □ to request replacement vouchers for the remainder of the current taxable year.

Amount of tax enclosed (if am ount of estim ated tax is zero, do not file this form )

Title (or preparer’s firm nam e and address)

DO NOT USE THIS FORM IF THE CORPORATION HAS FORM 500DP

INSTRUCTIONS FOR MARYLAND FORM 500D (Revised 1996)

DECLARATION OF ESTIMATED CORPORATION INCOME TAX

GENERAL INSTRUCTIONS

Purpose of Form Form 500D is used by a corporation to declare and remit estimated income tax when the preprinted Form 500DP is unavailable.

Corporations expected to be subject to estimated tax require- ments should have received a Declaration of Estimated Corporation Income Tax Packet. The estimated tax packet includes a work- sheet, record of payments, four preprinted vouchers (Form 500DP) and instructions. Please use the Form 500DP which contains pre- printed taxpayer information and provides for prompt and accurate processing of the declaration payment.

If the corporation does not have the estimated tax packet, use Form 500D to remit any payment due.

NOTE: Do not use this form for

General Requirements Every corporation having Maryland taxable income which will develop a tax in excess of $1,000 for the taxable year or period must make estimated income tax pay- ments. The total estimated tax payments for the year must be at least 90% of the tax developed for the current taxable year or 100% of the tax developed for the prior tax year. At least 25% of the total estimated tax must be remitted by each of the four installment due dates.

In the case of a short tax period the total estimated tax required is the same as for a regular taxable year, 90% of the tax developed for the current (short) taxable year or 100% of the tax developed for the prior tax year. The minimum estimated tax for each of the installment due dates is the total estimated tax required divided by the number of installment due dates occurring during the short tax year.

Maryland law provides for the accrual of interest and imposition of penalty for failure to pay any tax when due.

If it is necessary to amend the estimated, recalculate the amount of estimated tax required using the estimated tax worksheet provided on this form. Adjust the amount of the next installment to reflect any previous underpayment or overpayment. The remaining installments must be at least 25% of the amended estimated tax due for the year.

Consolidated returns are not allowed under Maryland law. Affiliated corporations which file a consolidated federal return must file separate Maryland declarations for each member corporation.

When and Where to File File Form 500D on or before the 15th day of the 4th, 6th, 9th and 12th months following the beginning

of the taxable year or period. In addition to payment with Form 500DP or 500D, the corporation may partially or fully apply any overpayment from the prior year Form 500 – Corporation Income Tax Return to the estimated tax obligation for this year.

The estimated tax must be filed with the Comptroller of the Treasury, Revenue Administration Division, Annapolis, Maryland

SPECIFIC INSTRUCTIONS

Name, Address and Other Information Type or print the required information in the designated area. DO NOT USE THE LABEL FROM THE TAX BOOKLET COVER.

Enter the name exactly as specified in the Articles of Incorpo- ration, or as amended, and continue with any “Trading As” (T/A) name if applicable.

Enter the Federal Employer Identification Number (FEIN). If the FEIN has not been secured, enter “APPLIED FOR” followed by the date of application. If a FEIN has not been applied for, do so immediately.

Check the box to request replacement vouchers for the remainder of the current taxable year. Do not check the box to request vouchers for the next taxable year; a packet including vouchers will be issued automatically.

Taxable Year or Period ENTER THE BEGINNING AND END-

ING DATES OF THE TAXABLE YEAR IN THE SPACE PROVIDED ON FORM 500D.

The same taxable year or period used for the federal return must be used for Form 500D.

Amount of Tax Enclosed Enter the amount of tax due in the space provided and remit full payment with this form.

Signature and Verification An authorized officer or the paid preparer must sign and date Form 500D indicating the corporate title or preparer firm name and address.

Payment Instructions Include a check or money order made payable to the Comptroller of the Treasury for the full amount due. All payments must indicate the Federal Employer Identification Number, type of tax and tax year beginning and ending dates.

DO NOT SEND CASH.

Mailing Instructions Use the envelope provided in the tax booklet and place an “X” in the appropriate box in the lower left corner to indicate the type of document enclosed. Also, be sure to read and follow the reminders listed on the back of the envelope.