Using PDF files online is definitely easy using our PDF tool. Anyone can fill out maryland form 504 here painlessly. In order to make our editor better and easier to use, we constantly develop new features, considering feedback from our users. To start your journey, consider these easy steps:

Step 1: Simply press the "Get Form Button" in the top section of this page to launch our pdf form editor. This way, you will find all that is required to work with your document.

Step 2: With the help of this advanced PDF tool, you are able to accomplish more than just fill in forms. Try each of the functions and make your documents appear perfect with custom textual content put in, or fine-tune the file's original input to perfection - all that accompanied by an ability to insert your own images and sign the file off.

With regards to the blank fields of this precise form, here is what you should do:

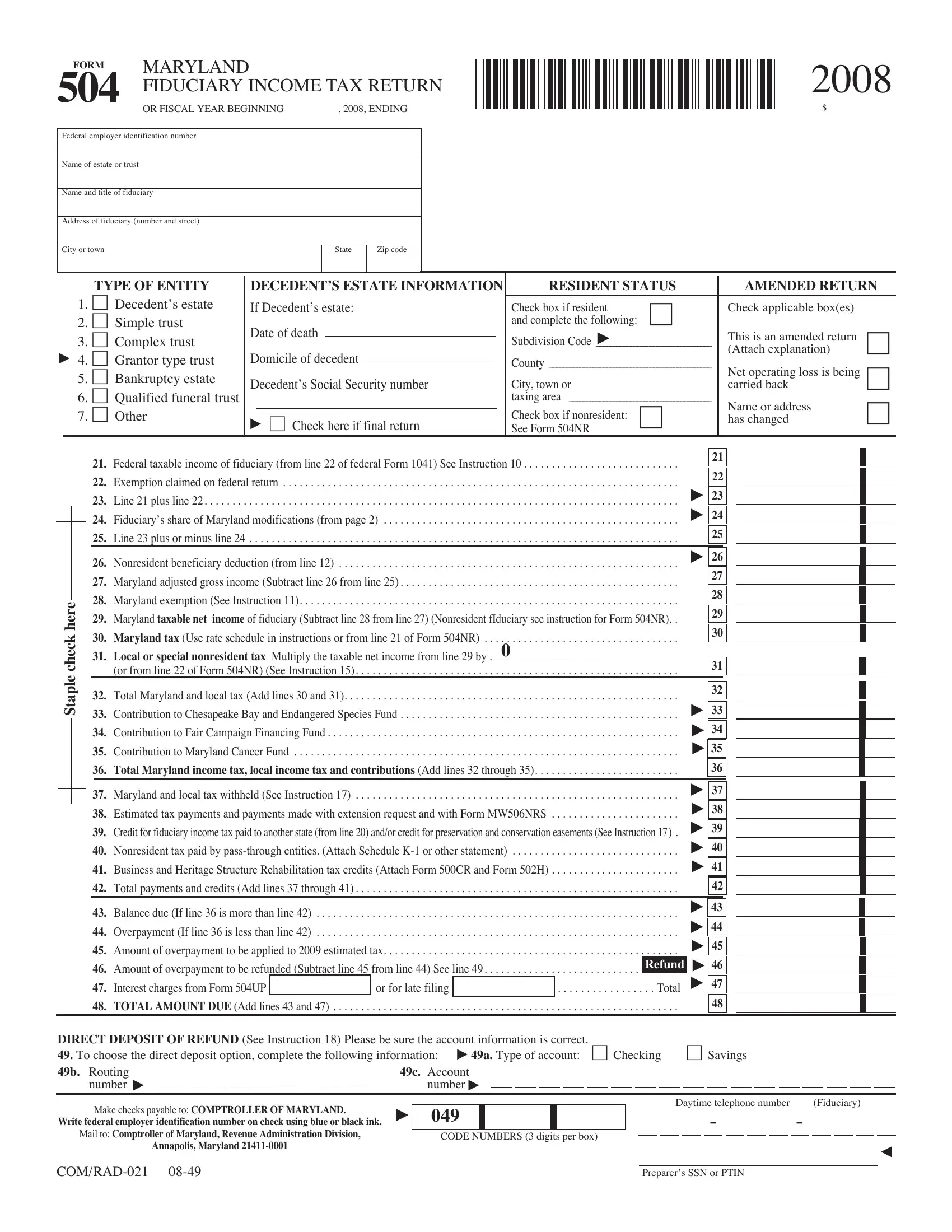

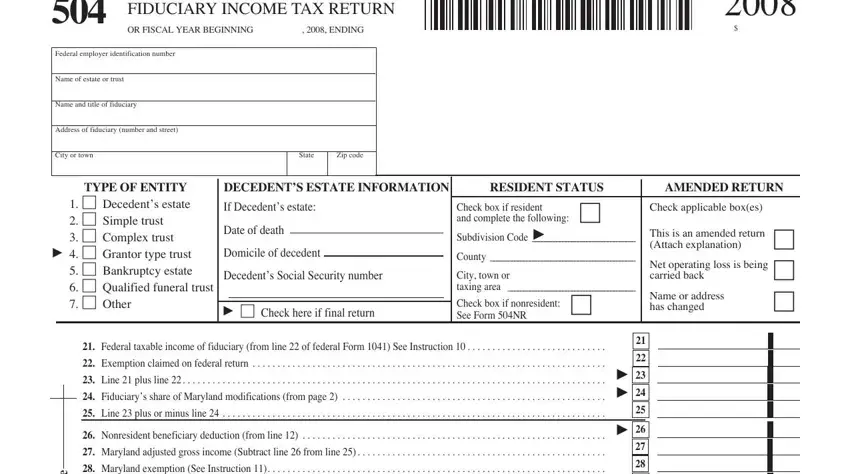

1. The maryland form 504 usually requires particular information to be typed in. Make sure the following blanks are finalized:

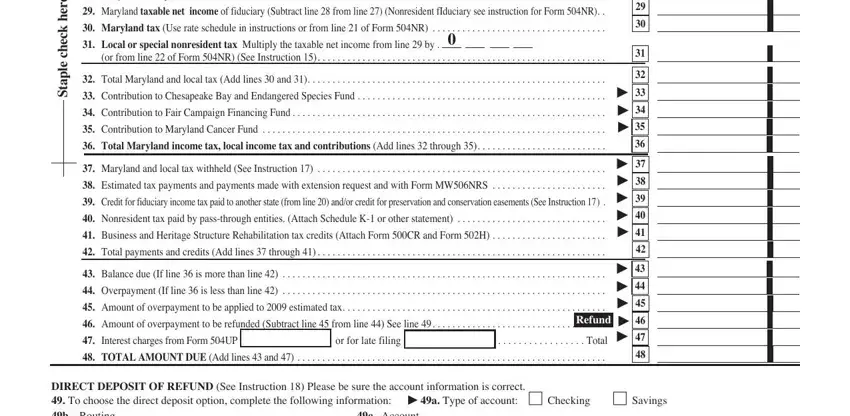

2. Your next part is to complete these blank fields: e r e h k c e h c e l p a t S, Maryland exemption See, Maryland taxable net income of, Maryland tax Use rate schedule in, Local or special nonresident tax, or from line of Form NR See, Total Maryland and local tax Add, Contribution to Chesapeake Bay, Contribution to Fair Campaign, Contribution to Maryland Cancer, Total Maryland income tax local, Maryland and local tax withheld, Estimated tax payments and, Credit for fiduciary income tax, and Nonresident tax paid by.

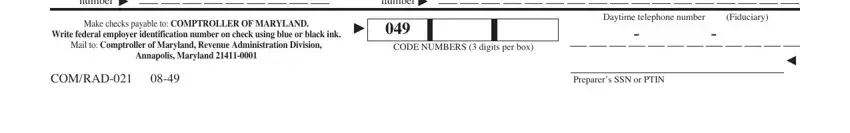

3. This third step is normally simple - complete all the form fields in number, Make checks payable to COMPTROLLER, Write federal employer, Mail to Comptroller of Maryland, Annapolis Maryland, number, CODE NUMBERS digits per box, Daytime telephone number, Fiduciary, COMRAD, and Preparers SSN or PTIN in order to complete this process.

It's very easy to make errors when completing the Mail to Comptroller of Maryland, for that reason make sure you go through it again prior to deciding to submit it.

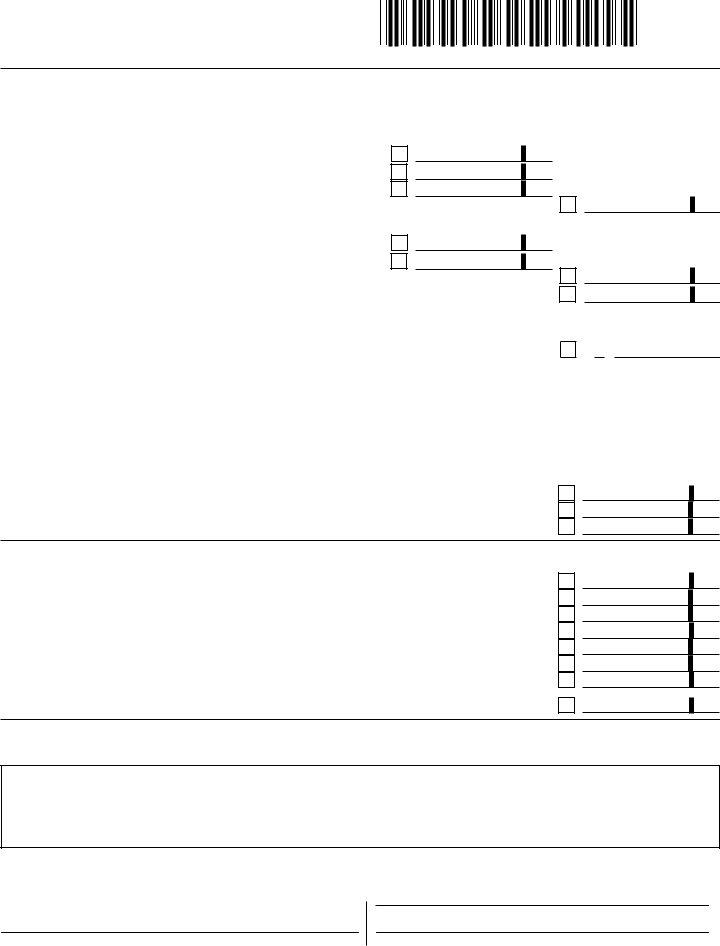

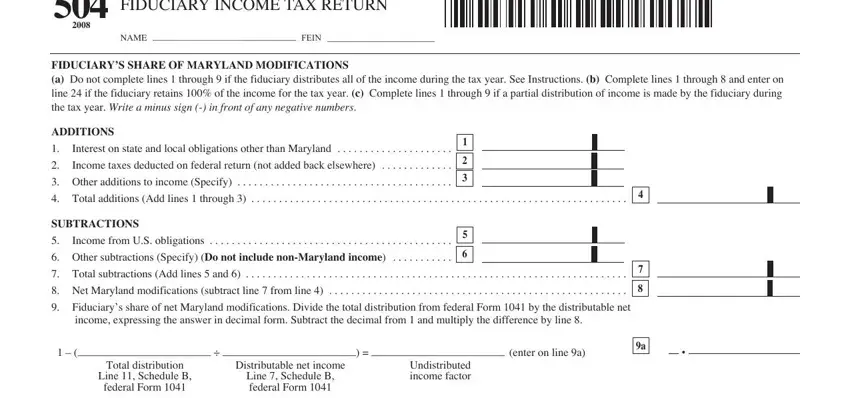

4. This next section requires some additional information. Ensure you complete all the necessary fields - MARYLAND FIDUCIARY INCOME TAX, NAME FEIN, FIDUCIARYS SHARE OF MARYLAND, ADDITIONS, Interest on state and local, Income taxes deducted on federal, Other additions to income Specify, Total additions Add lines, SUBTRACTIONS, Income from US obligations, Other subtractions Specify Do not, Total subtractions Add lines and, Net Maryland modifications, Fiduciarys share of net Maryland, and enter on line a - to proceed further in your process!

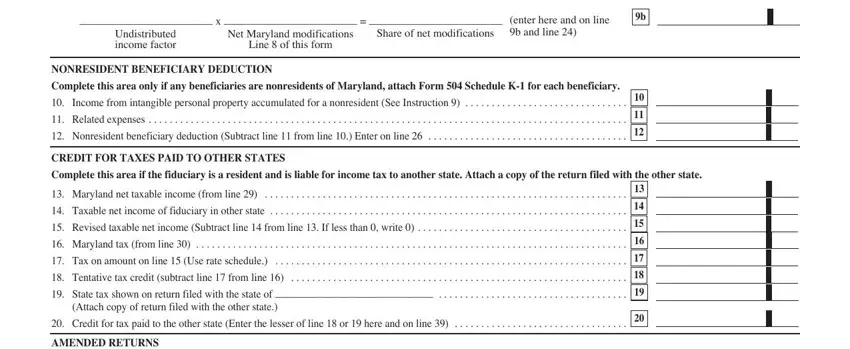

5. To conclude your document, this final subsection requires a couple of additional blank fields. Filling in Undistributed income factor, Net Maryland modifications, Share of net modifications, Line of this form, enter here and on line b and line, NONRESIDENT BENEFICIARY DEDUCTION, Complete this area only if any, Income from intangible personal, Related expenses, Nonresident beneficiary deduction, CREDIT FOR TAXES PAID TO OTHER, Complete this area if the, Maryland net taxable income from, Taxable net income of fiduciary, and Revised taxable net income should finalize the process and you can be done in a blink!

Step 3: Proofread the information you have inserted in the blank fields and click on the "Done" button. Right after creating a7-day free trial account here, you'll be able to download maryland form 504 or send it via email promptly. The PDF will also be easily accessible via your personal cabinet with your every single edit. FormsPal provides secure document tools devoid of personal data recording or sharing. Be assured that your data is safe with us!