You can complete submitting without difficulty with our PDFinity® editor. To retain our tool on the forefront of efficiency, we strive to implement user-driven capabilities and improvements regularly. We're routinely grateful for any suggestions - assist us with revolutionizing the way you work with PDF docs. By taking some simple steps, it is possible to begin your PDF journey:

Step 1: Press the "Get Form" button in the top part of this page to open our PDF editor.

Step 2: Once you start the file editor, you will get the document made ready to be filled out. Besides filling out various fields, you could also do many other things with the Document, including putting on custom words, modifying the original text, inserting images, signing the PDF, and more.

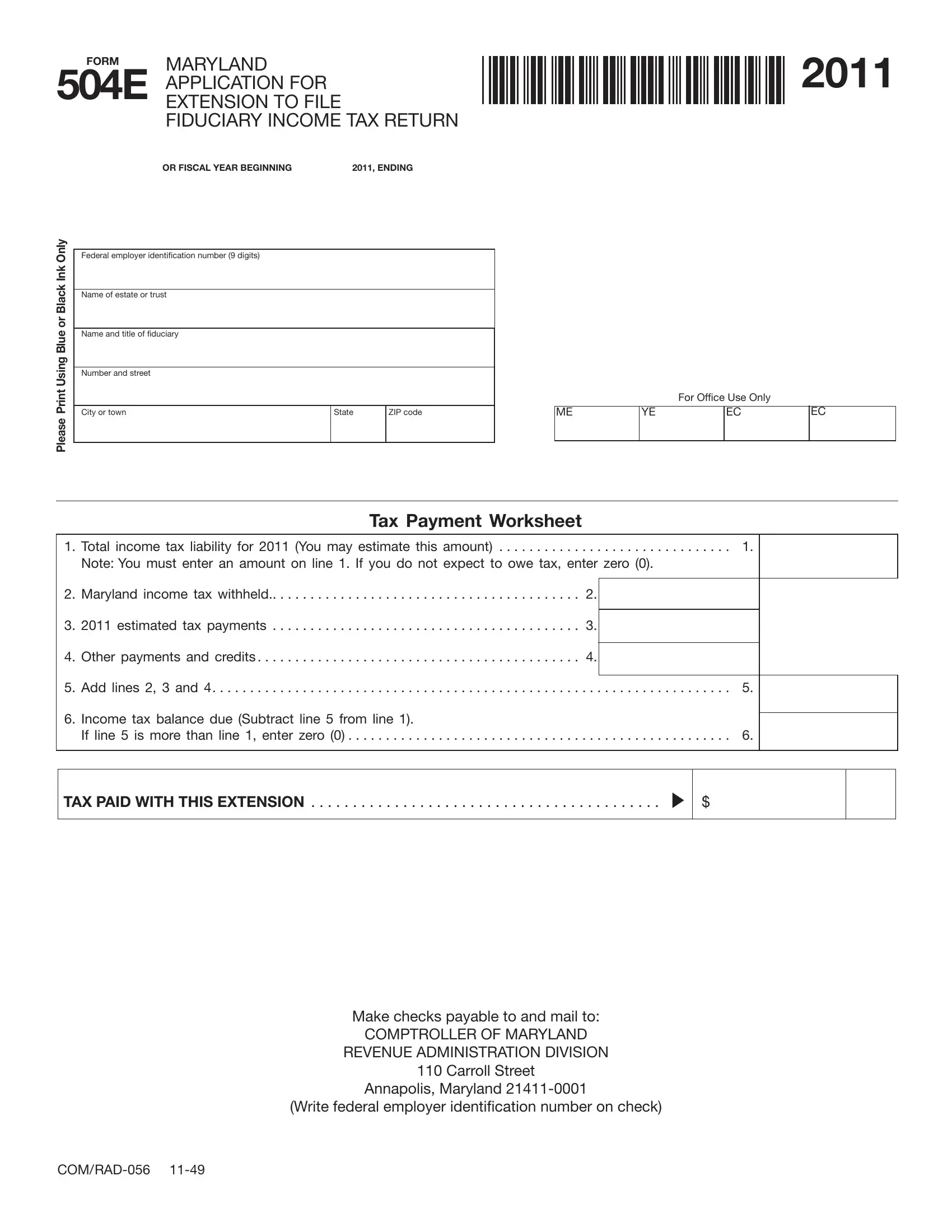

In an effort to complete this form, be sure you type in the right details in every single field:

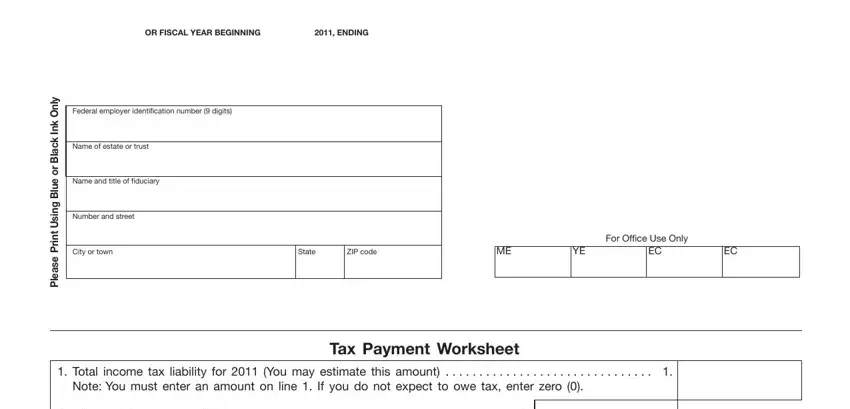

1. Firstly, while filling out the submitting, beging with the section that contains the subsequent blanks:

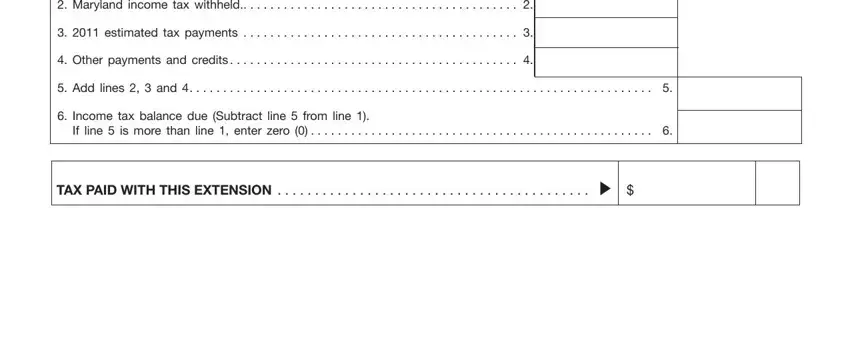

2. Once this section is finished, you should include the necessary details in Maryland income tax withheld, estimated tax payments, Other payments and credits, Add lines and, Income tax balance due Subtract, and TAX PAID WITH THIS EXTENSION so you're able to go further.

People often make mistakes while filling out Other payments and credits in this part. Make sure you go over everything you type in here.

Step 3: After you have reviewed the details entered, simply click "Done" to conclude your form at FormsPal. Right after setting up afree trial account at FormsPal, you'll be able to download submitting or email it directly. The PDF file will also be at your disposal via your personal account with your each edit. FormsPal guarantees protected form editor with no personal data recording or distributing. Feel at ease knowing that your data is in good hands here!