You could fill in Maryland Form 505 effortlessly by using our online tool for PDF editing. To maintain our editor on the cutting edge of practicality, we work to put into operation user-oriented capabilities and improvements regularly. We're routinely grateful for any feedback - join us in remolding the way you work with PDF files. Here is what you would need to do to get started:

Step 1: Press the orange "Get Form" button above. It is going to open our pdf tool so that you can start filling in your form.

Step 2: When you open the PDF editor, you will see the form ready to be filled in. In addition to filling in various blanks, it's also possible to perform many other things with the file, such as adding custom text, editing the original text, inserting graphics, signing the PDF, and a lot more.

This PDF form will need you to type in specific information; in order to ensure accuracy and reliability, please pay attention to the recommendations directly below:

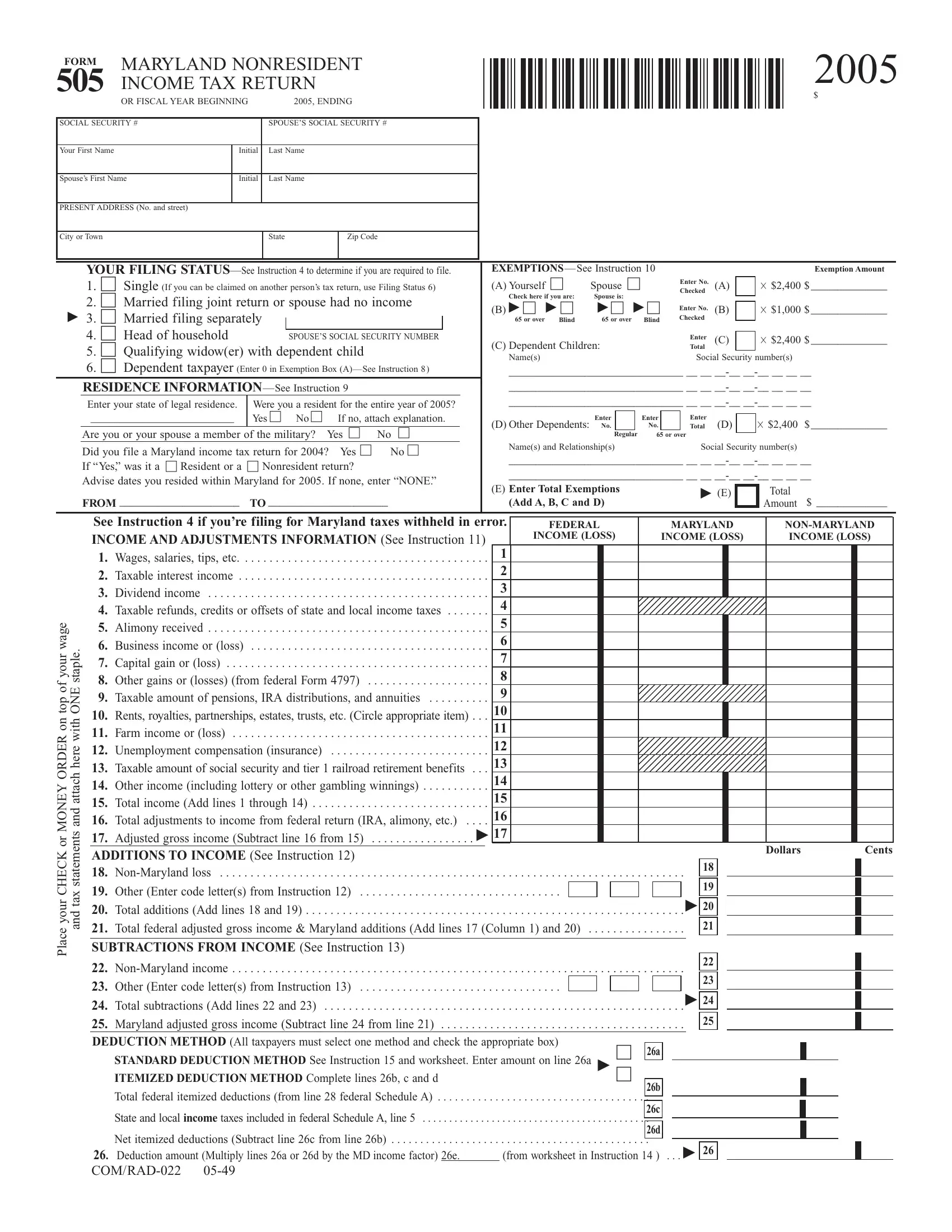

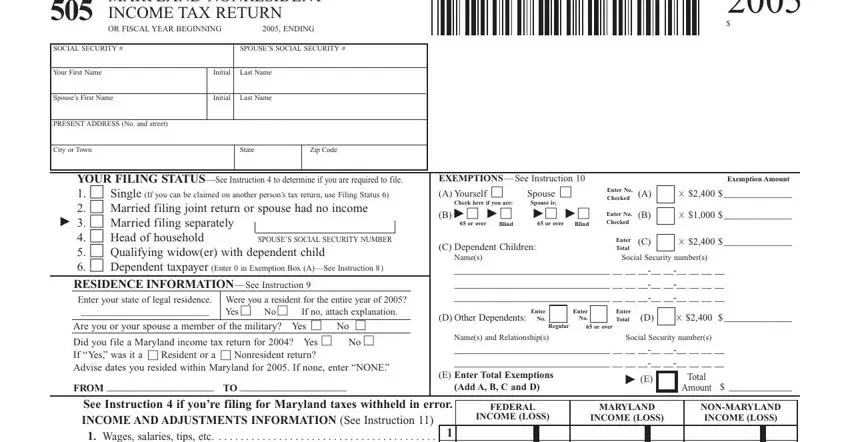

1. The Maryland Form 505 necessitates particular details to be entered. Make certain the next blanks are filled out:

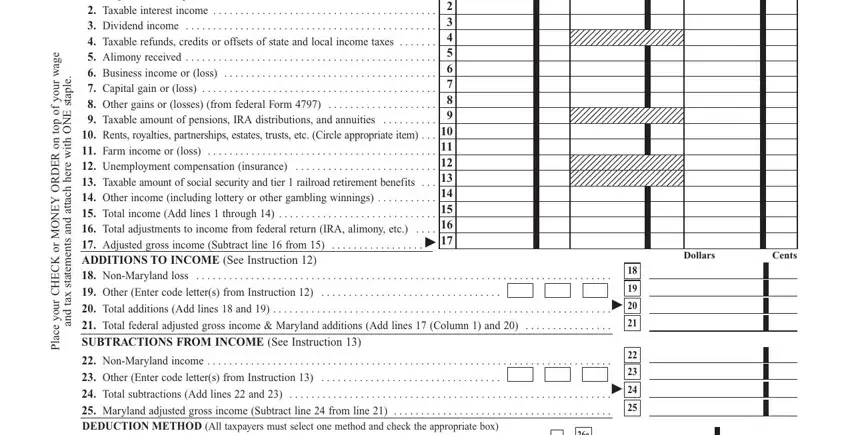

2. Once your current task is complete, take the next step – fill out all of these fields - Maryland adjusted gross income, See Instruction if youre filing, Other Enter code letters from, Total additions Add lines and, Total federal adjusted gross, NonMaryland income, Other Enter code letters from, Total subtractions Add lines and, e g a w, r u o y, f o, p o t, n o R E D R O Y E N O M, r o K C E H C, and r u o y with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

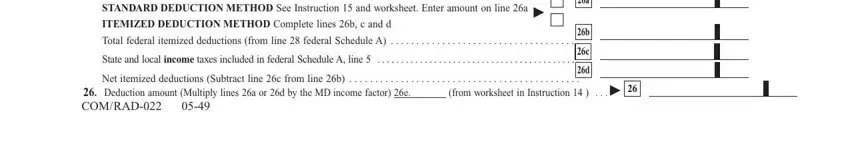

3. Completing STANDARD DEDUCTION METHOD See, ITEMIZED DEDUCTION METHOD Complete, Total federal itemized deductions, State and local income taxes, Net itemized deductions Subtract, and Deduction amount Multiply lines a is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

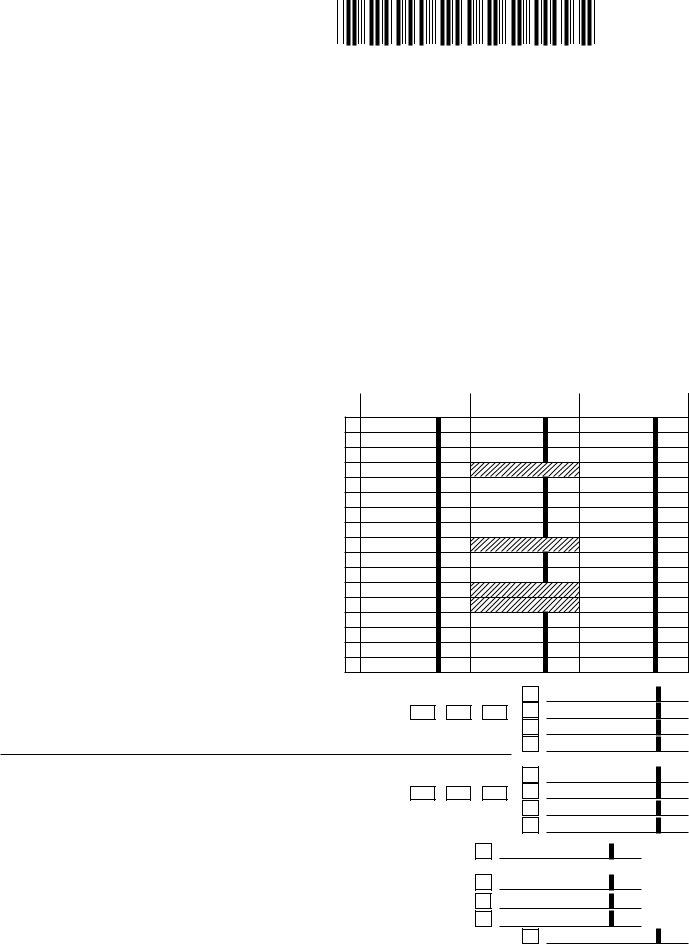

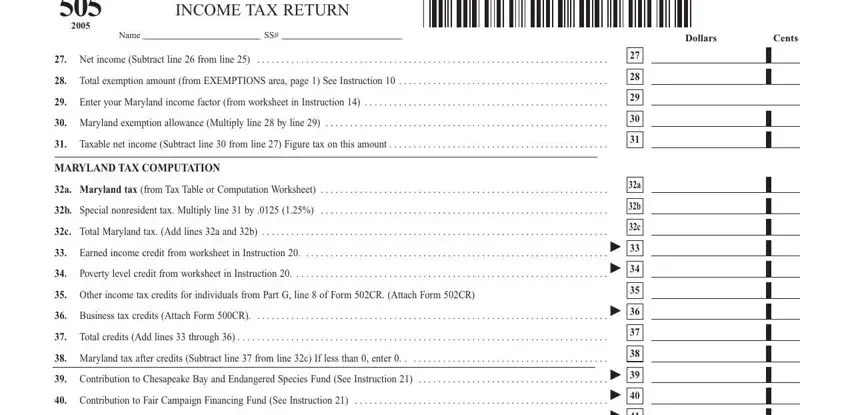

4. You're ready to fill in the next segment! In this case you will have these MARYLAND NONRESIDENT, INCOME TAX RETURN, Name SS, Dollars, Cents, Net income Subtract line from, Total exemption amount from, Enter your Maryland income factor, Maryland exemption allowance, Taxable net income Subtract line, MARYLAND TAX COMPUTATION, a Maryland tax from Tax Table or, b Special nonresident tax Multiply, c Total Maryland tax Add lines a, and Earned income credit from fields to fill out.

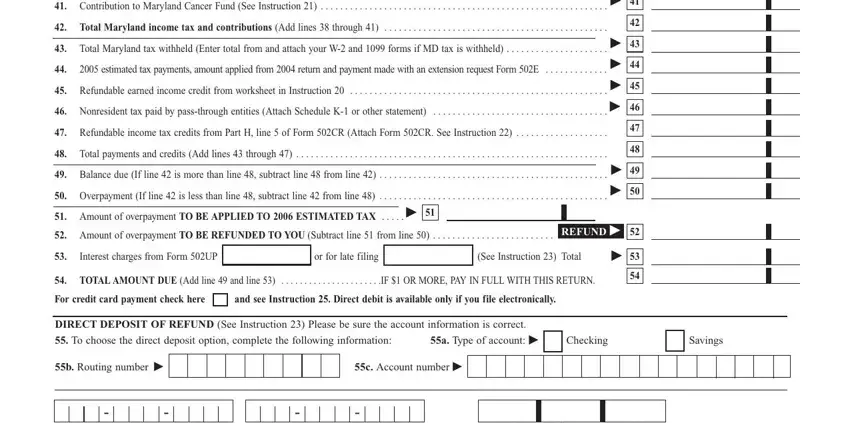

5. Last of all, the following last part is precisely what you should finish prior to finalizing the PDF. The blanks in question are the following: Contribution to Maryland Cancer, Total Maryland income tax and, Total Maryland tax withheld Enter, estimated tax payments amount, Refundable earned income credit, Nonresident tax paid by, Refundable income tax credits, Total payments and credits Add, Balance due If line is more than, Overpayment If line is less than, Amount of overpayment TO BE, Amount of overpayment TO BE, REFUND, Interest charges from Form UP or, and See Instruction Total.

A lot of people generally make some errors when filling out Refundable income tax credits in this section. Don't forget to revise everything you enter right here.

Step 3: Go through the details you've inserted in the blanks and then hit the "Done" button. Join us now and instantly get access to Maryland Form 505, set for downloading. All alterations made by you are preserved , letting you modify the pdf at a later stage if necessary. FormsPal is invested in the confidentiality of our users; we always make sure that all personal information coming through our tool is kept confidential.