Through the online PDF editor by FormsPal, it is easy to complete or change maryland form 505nr here. The editor is consistently upgraded by us, acquiring additional features and becoming even more convenient. To get started on your journey, consider these easy steps:

Step 1: Access the PDF doc inside our editor by clicking on the "Get Form Button" at the top of this page.

Step 2: After you access the file editor, you'll notice the document ready to be filled in. Aside from filling out various fields, you can also perform other sorts of things with the Document, that is writing custom words, changing the original text, inserting illustrations or photos, placing your signature to the PDF, and a lot more.

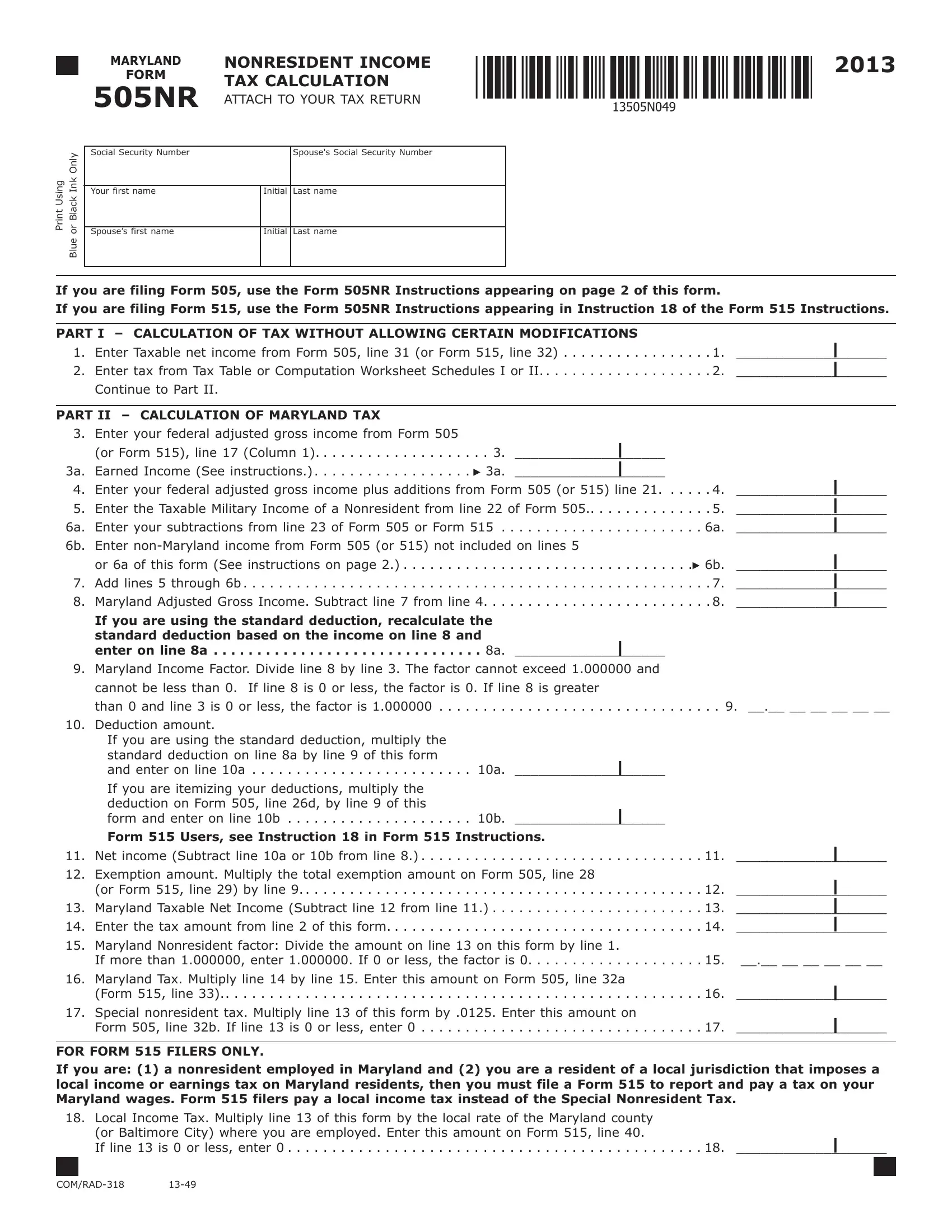

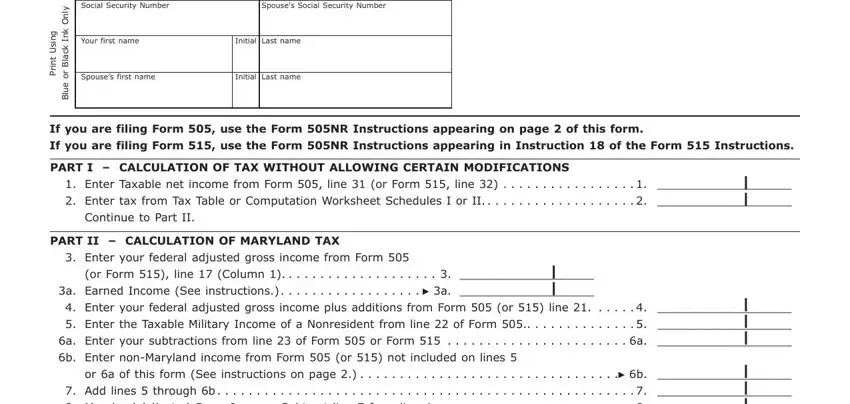

So as to finalize this PDF form, ensure that you type in the information you need in every field:

1. Whenever filling in the maryland form 505nr, be sure to include all of the necessary blank fields in its corresponding section. This will help to expedite the work, which allows your information to be processed swiftly and correctly.

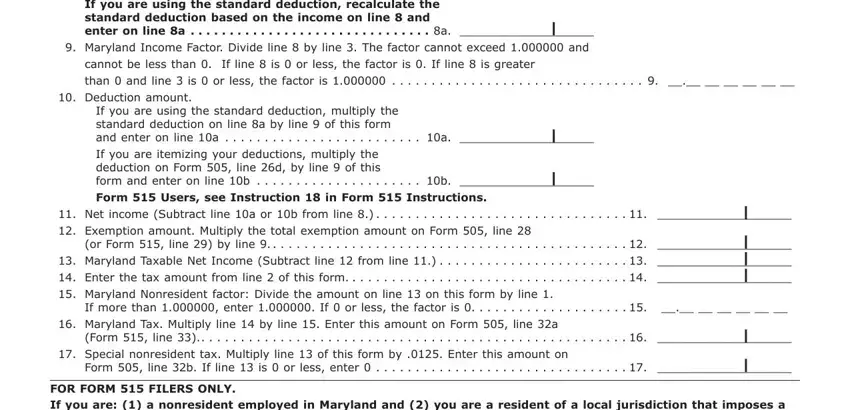

2. Once your current task is complete, take the next step – fill out all of these fields - If you are using the standard, Maryland Income Factor Divide, cannot be less than If line is, than and line is or less the, Deduction amount, If you are using the standard, If you are itemizing your, Form Users see Instruction in, Net income Subtract line a or b, Exemption amount Multiply the, or Form line by line, Maryland Taxable Net Income, Enter the tax amount from line, Maryland Nonresident factor, and If more than enter If or less with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

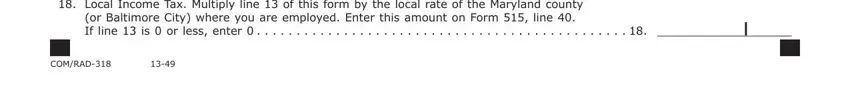

3. The following segment should be quite straightforward, Local Income Tax Multiply line, or Baltimore City where you are, and COMRAD - all these empty fields must be completed here.

In terms of or Baltimore City where you are and Local Income Tax Multiply line, be certain you take another look in this current part. Both these could be the key ones in this page.

Step 3: Confirm that your details are right and click on "Done" to continue further. After getting a7-day free trial account here, you'll be able to download maryland form 505nr or send it through email right away. The form will also be readily available via your personal account with your each and every modification. FormsPal offers safe document editing with no data recording or any kind of sharing. Be assured that your data is safe with us!