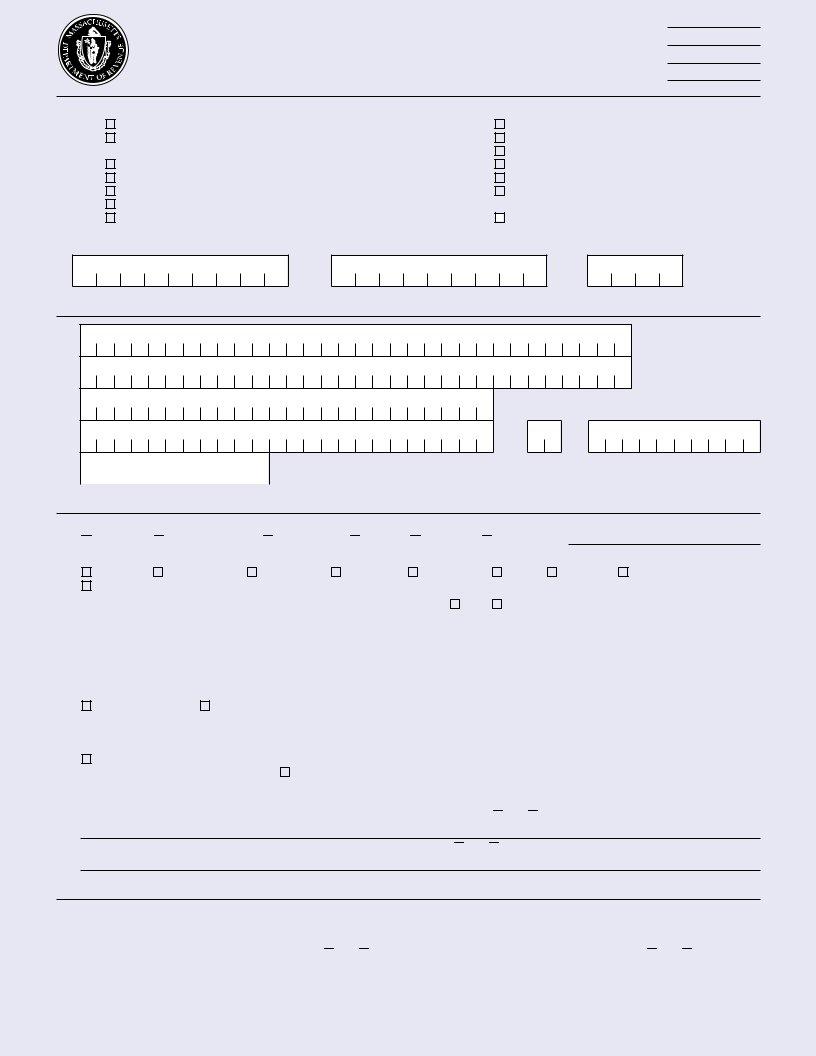

Engaging with the intricate framework of regulatory compliance in Massachusetts entails a comprehensive understanding of the Massachusetts Department of Revenue's TA-1 Form, a crucial document for businesses operating within the state. This application for original registration navigates through a wide array of tax responsibilities, ranging from income tax withholding for employers to nuanced obligations such as sales/use tax on goods and services, meals tax, and even specific surcharges relevant to businesses operating in Boston. Moreover, entities like charitable organizations or those dealing in specific sectors such as alcoholic beverages and telecommunication services, find themselves within the spectrum of this form's applicability. The form demands detailed disclosure of business particulars, from federal identification numbers to the nature of the business, alongside a declaration of the tax types the entity is applying for. Not only does it call for identifying the principal place of business and ownership details but also stipulates the need for proving exemption status if applicable. The document also delves into operational specifics such as seasonality of the business and estimated tax obligations. Furthermore, it covers the procedures for entities undergoing organizational changes or those commencing operations in particular districts like the Convention Center Financing District, mapping out the tax landscape in Massachusetts for new and existing businesses alike.

| Question | Answer |

|---|---|

| Form Name | Massachusetts Form Ta 1 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | massachusetts form ta, print fprm 1 es ma, ta 1 form printable, ma ta 1 |

Form

Application for Original Registration

Rev. 12/02

Massachusetts

Department of

Revenue

Check As Many As Apply

1. A |

1. |

|

Employer under the Income Tax Withholding Law (payroll tax) |

D |

|

Governmental or Charitable Exempt Purchaser |

|

|

|||||

|

2. |

|

Withholding for Pension Plans, Annuities and Retirement |

E |

|

Chapter 180 Organization Selling Alcoholic Beverages |

|

|

|

||||

|

|

|

Distributions |

F |

|

Use Tax Purchaser |

|

|

|

|

|||

|

|

|

|

|||

B |

1. |

|

Sales/Use Tax on Goods Vendor |

G |

|

Boston Sightseeing Tour Surcharge |

|

|

|||||

|

|

|||||

|

2. |

|

Sales/Use Tax on Telecommunications Services Vendor |

H |

|

Boston Vehicular Rental Transaction Surcharge |

|

|

|

||||

|

|

|

||||

|

3. |

|

Meals Tax on Food and All Beverages |

I |

|

Parking Facilities Surcharge in Boston, Springfield |

|

|

|

||||

|

|

|

||||

|

4. |

|

Purchasing in MA for |

|

|

and/or Worcester |

|

|

|

|

|||

|

|

|

||||

C |

|

|

Room Occupancy Excise |

J |

|

Cigar and Smoking Tobacco Excise |

|

|

|

||||

|

|

Note: If you are selling cigarettes at retail, see instructions.

2.

Federal Identification number

3.

Social Security number

4.

No. of locations

Principal Place of Business

5.

6.

7.

10.

Owner, partnership or legal corporate name

Name (cont’d.)

Number and street

City or town

(Area code) Telephone number

( |

|

) |

|

|

|

— |

|

|

|

|

8.

State

9.

Zip

—

General Information. If a corporation, trust, association, fiduciary, or partnership — you must complete Schedule

11.Indicate type of organization:

Corporation Trust or association Sole proprietor Fiduciary Partnership Other (specify):

12.Indicate type of business:

|

|

|

Retail trade |

|

|

Wholesale trade |

|

|

Manufacturing |

|

Construction |

|

|

Governmental |

|

|

Finance |

|

Real estate |

|

|

Service |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

Other (specify): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. Describe nature of business: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

14. |

Business activity code |

|

|

|

|

|

|

|

|

|

15. Check applicable box: |

|

Profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

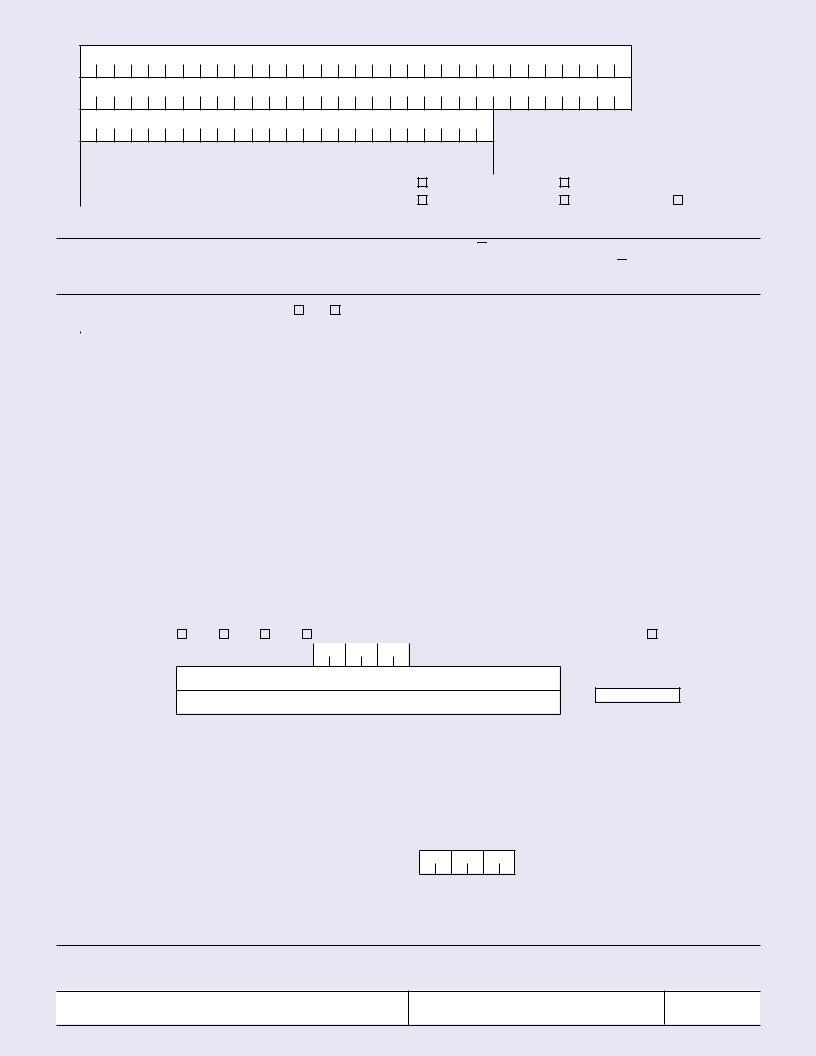

16. |

If subsidiary corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

Name of parent corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Identification number |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

❿ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

17. |

If sole proprietor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

Name of owner |

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security number |

||||||||||||||||||||||||

|

(sole owner) |

|

|

|

|

❿ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. Reason for applying: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Started new business |

|

Purchased existing business — enter name, address, and Federal |

|

Federal Identification number |

|

|

|||||||||

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

Identification number of previous owner |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Identification number |

|

|

|||||||

|

|

|

Organizational change — Federal Identification number and close date of previous organization must be |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

entered, or application will be returned. |

|

Other (attach explanation) |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Mo |

Day |

|

Yr |

|||||||

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Background Information |

Close date: |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19.Are any Massachusetts tax returns due or any Massachusetts taxes owed by your firm? Yes No. If yes, please explain:

20.Have you ever been issued a Certificate of Registration that was later revoked? Yes No. If yes, please explain:

Exempt Organizations

21.If you are applying for exempt purchaser status, be sure to include a copy of your IRS letter of exemption under Section 501(c)(3) of the Internal Revenue Code. Subordinate organizations covered under an IRS group exemption letter should include a copy of the group exemption ruling and a copy of the organization’s directory page listing the organization as an approved subordinate. Both of the questions below must be answered.

A. Are you exempt from paying U.S. income taxes? Yes No. B. Are you exempt from paying local property taxes? Yes No.

Location of business |

Federal Identification number |

|

|

|

|

22.Trade name

Trade name (cont’d.)

23.Number and street (PO box is not acceptable)

24. |

City or town |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25. |

State |

26. |

Zip |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

27. |

(Area code) Telephone number |

|

|

|

28. |

Send certificate to: |

|

Principal place of business |

|

Location of business. |

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

( |

|

) |

|

|

|

— |

|

|

|

|

29. |

Send tax forms to: |

|

Principal place of business |

|

Location of business |

|

Other. |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If “Other,” complete Schedule

Convention Center Financing District

30.Check here if your business location is within a Convention Center Financing District: (see pages

31.Check here if your business location is within a hotel, motel or other lodging establishment in Boston or Cambridge:

Filing Frequencies

32. |

Is this location seasonal? (See instructions) |

|

|

Yes |

|

|

No. |

|

|

|

|

33. Indicate |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

If “yes,” check month(s) or partial month(s) business operates. |

|

|

|

|

|

|

paid for each applicable tax. Check the appropriate box(es). |

|||||||||||||||||||||||||||||||||||||||||||

|

Check month(s) |

Jan |

Feb |

Mar |

Apr |

May |

|

Jun |

|

Jul |

|

Aug |

Sep |

Oct |

Nov |

Dec |

Check appropriate box |

|

$0 – $100 |

$101– $1,200 |

over $25,000 |

||||||||||||||||||||||||||||||

|

Withholding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Withholding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Sales/Use on Goods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check appropriate box(es) |

|

|

|

$0 – $100 |

|

|

$101– $1,200 |

over $1,200 |

|||||||||||||

|

Sales/Use on |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales/Use on Goods |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telecom. Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales/Use on Telecom. Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Meals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Meals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Room Occupancy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Room Occupancy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use Tax Purchaser |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Tax Type Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Withholding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34. |

Date you were first required to withhold |

|

Mo |

|

|

Day |

|

Yr |

|

|

|

|

|

35. Number of employees |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

taxes at this location. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

in Massachusetts: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Sales/Use Tax on Goods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

36. |

Date you were first required to collect sales/use tax at this location. |

|

Mo |

|

Day |

|

Yr |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

Sales/Use Tax on Telecommunications Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

37. |

Date you were first required to collect sales/use tax on telecommunications services at this location. |

Mo |

Day |

|

Yr |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

Meals Tax on Food and All Beverages |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

38. |

Check if you serve: |

|

Food |

|

Beer |

|

|

Wine |

|

|

|

Alc. bev. |

|

|

|

|

39. Check if food/beverage vending machine: |

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

40. |

Date you were first required to collect meals tax. |

|

|

Mo |

|

|

Day |

Yr |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

41. Name and address

on liquor license42. Seating capacity: at this location.

Room Occupancy

43. |

Date you were first required to collect room occupancy tax. |

|

Mo |

Day |

Yr |

|

|

44. |

|

Locality code |

45. |

Number of rooms: |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use Tax Purchaser |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

46. |

Date you were first required to pay use tax. |

Mo |

|

Day |

|

|

Yr |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Convention Center Financing Surcharges |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

47. |

Date you were first required to collect: a. Boston Sightseeing Tour Surcharge. |

Mo |

Day |

|

Yr |

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

b. Boston Vehicular Rental Transaction Surcharge. |

Mo |

|

Day |

|

Yr |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

c. Parking Facilities Surcharge in Boston, Springfield and/or Worcester.

Mo

Day

Yr

Cigar and Smoking Tobacco Excise

48. Date you were first required to collect cigar and smoking tobacco excise. |

Mo |

Day |

Yr |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mail to: Massachusetts Department of Revenue, Data Integration Bureau, PO Box 7022, Boston, MA 02204.

I hereby certify that the statements made herein have been examined by me and are, to the best of my knowledge and belief, true and correct. Signed under the pains and penalties of perjury. The signing of this application is evidence that you may be individually and personally responsible for any sums required to be paid to the Commonwealth, under MGL, Chapters 62B, Sec. 5; 64G, Sec. 7B; 64H, Sec. 16 and 64I, Sec. 17.

Your signature

Title

Date