Our PDF editor makes it simple to fill in documents. You should not perform much to manage masshealth renewal application senior forms. Merely consider these steps.

Step 1: To start with, click on the orange "Get form now" button.

Step 2: You're now on the file editing page. You may edit, add content, highlight specific words or phrases, put crosses or checks, and insert images.

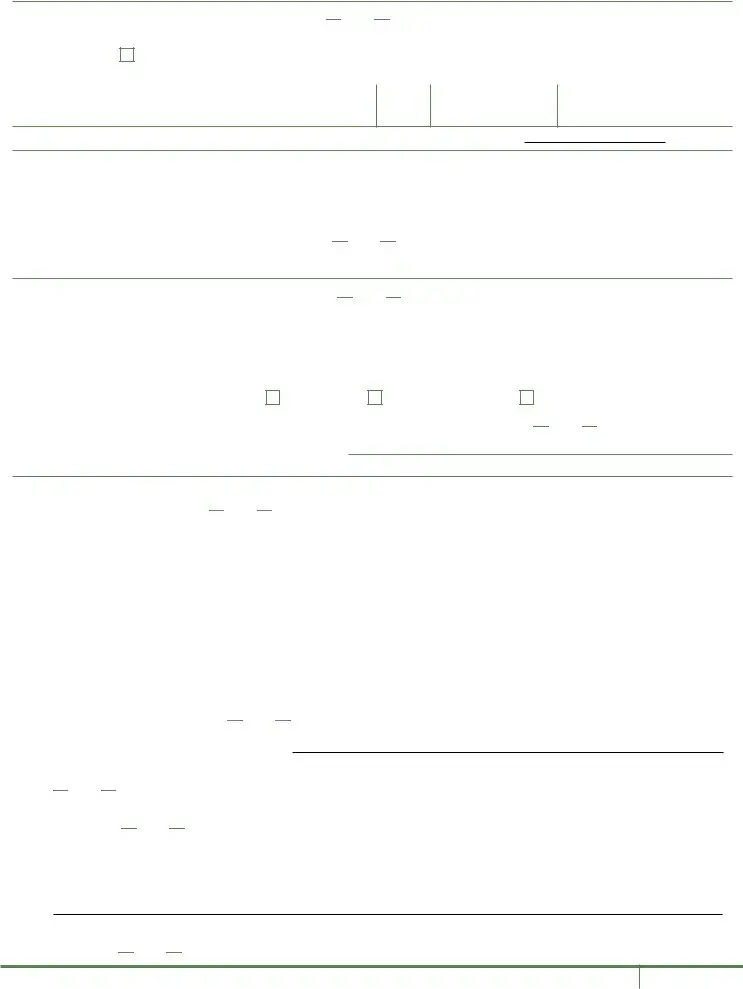

For every single area, complete the content demanded by the system.

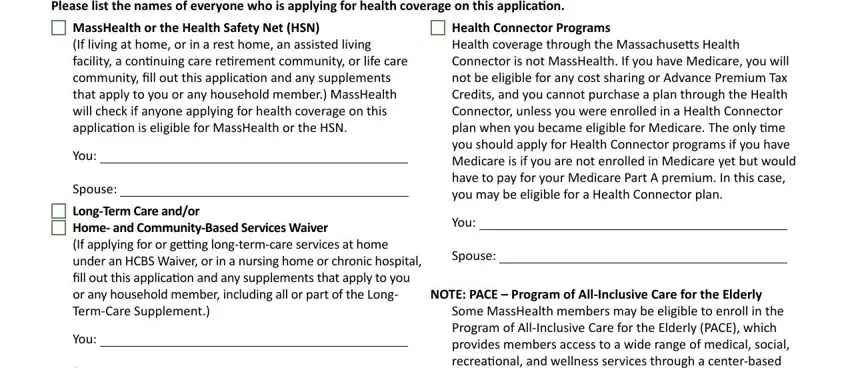

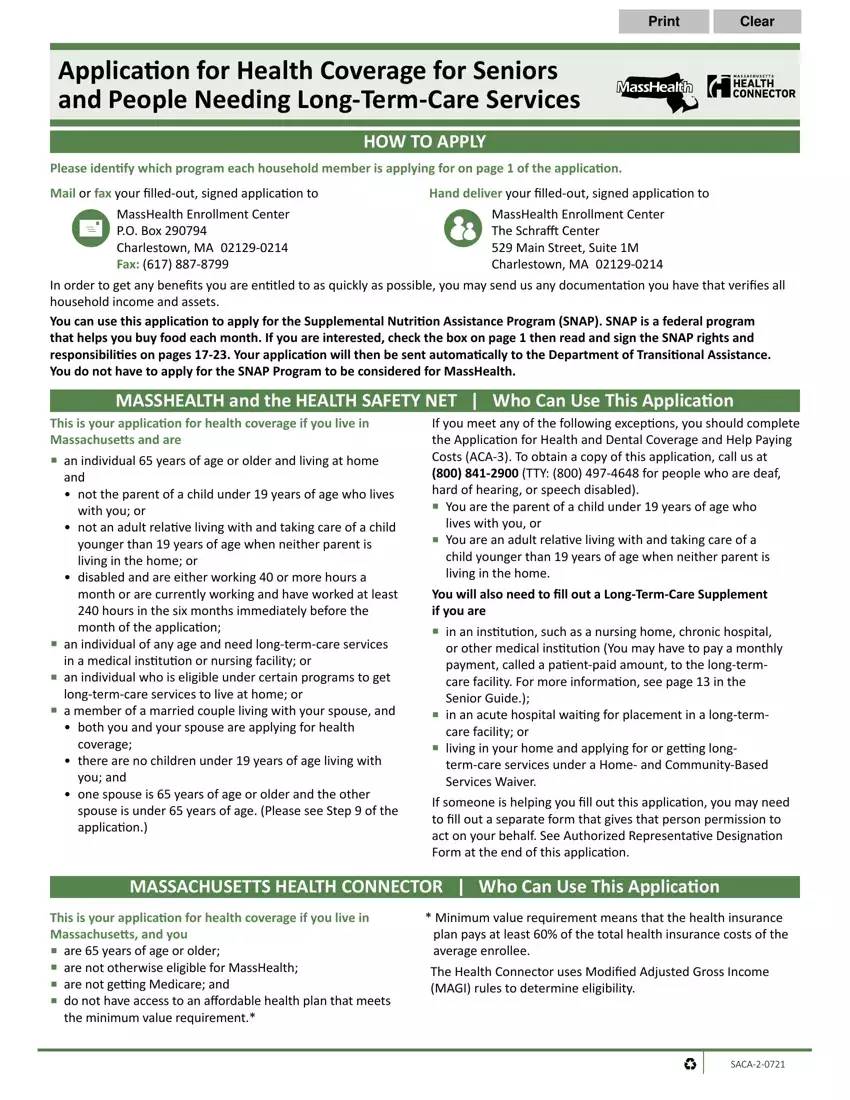

The program will expect you to fill in the Please list the names of everyone, MassHealth or the Health Safety, You, Spouse LongTerm Care andor Home, You, Spouse, Health Connector Programs Health, You, Spouse, NOTE PACE Program of AllInclusive, and Some MassHealth members may be area.

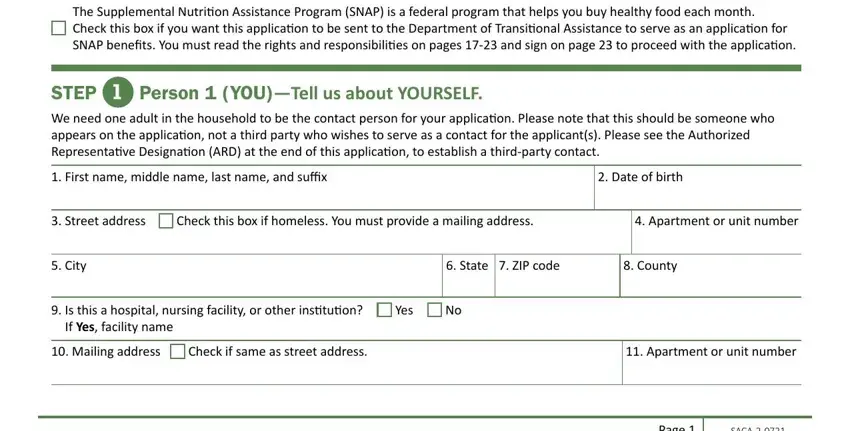

Write the key particulars in The Supplemental Nutrition, STEP Person YOUTell us about, First name middle name last name, Date of birth, Street address, Check this box if homeless You, Apartment or unit number, City, State ZIP code, County, Is this a hospital nursing, Yes No, If Yes facility name, Mailing address, and Check if same as street address part.

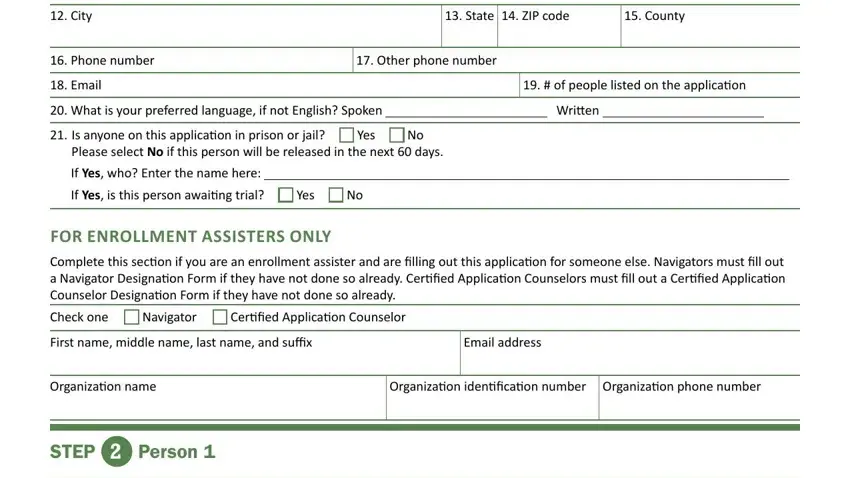

The City, State ZIP code County, Phone number Other phone number, Email of people listed on the, What is your preferred language, Written, Is anyone on this application in, Please select No if this person, If Yes is this person awaiting, FOR ENROLLMENT ASSISTERS ONLY, Check one, Navigator, Certified Application Counselor, First name middle name last name, and Organization name Organization segment enables you to point out the rights and responsibilities of both parties.

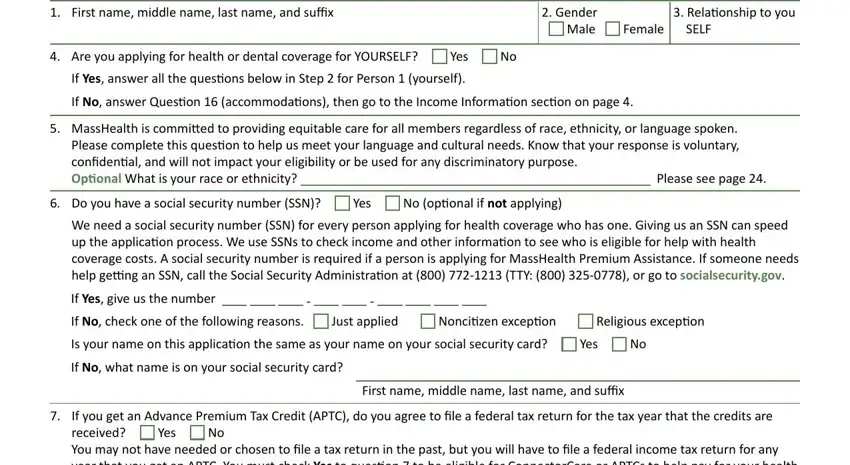

Finalize by reviewing the next sections and filling them in as required: First name middle name last name, Male, Female SELF, Are you applying for health or, If Yes answer all the questions, If No answer Question, MassHealth is committed to, Please see page, Do you have a social security, We need a social security number, If Yes give us the number, If No check one of the following, Just applied, Noncitizen exception, and Religious exception.

Step 3: When you have selected the Done button, your form should be available for export to each device or email address you identify.

Step 4: Create duplicates of your template. This is going to protect you from possible future worries. We cannot check or share your data, for that reason be certain it will be safe.

MassHealth or the Health Safety Net (HSN)

MassHealth or the Health Safety Net (HSN)

Home- and

Home- and

Health Connector Programs

Health Connector Programs

Check this box if you want this application to be sent to the Department of Transitional Assistance to serve as an application for SNAP benefits. You must read the rights and responsibilities on pages

Check this box if you want this application to be sent to the Department of Transitional Assistance to serve as an application for SNAP benefits. You must read the rights and responsibilities on pages  Check if same as street address.

Check if same as street address.

Yes

Yes  No Please select

No Please select  Yes

Yes  No

No Yes

Yes  No If

No If  Yes

Yes  No (optional if

No (optional if

Yes

Yes  No If

No If  Yes

Yes  No

No

Yes

Yes

No If

No If  Yes

Yes  No

No Yes

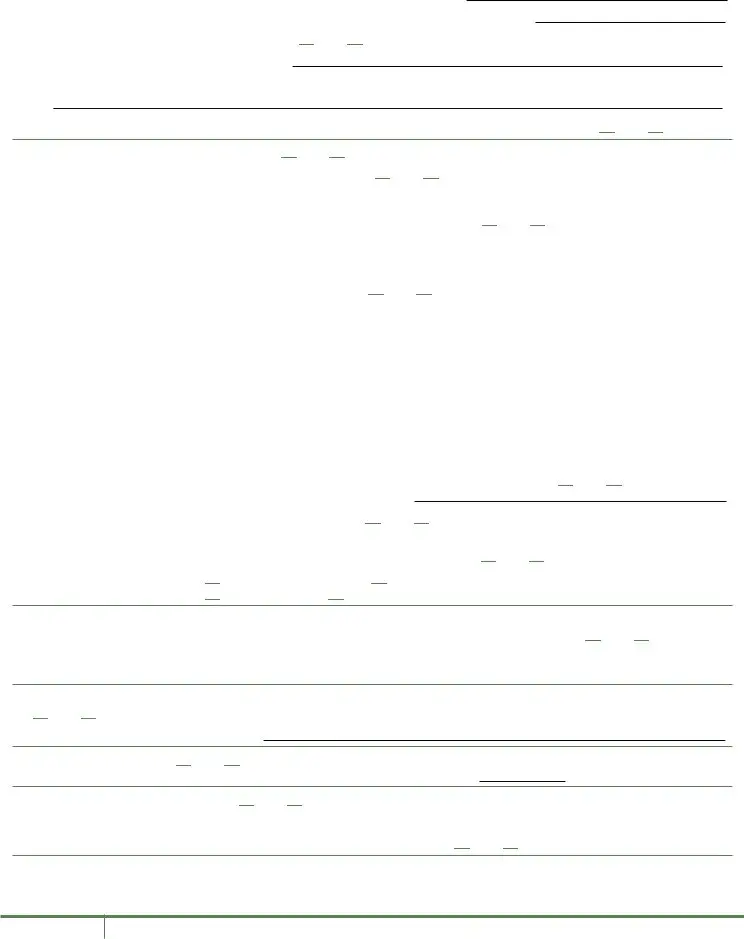

Yes  No You will claim a personal exemption deduction on your federal income tax return for any individual listed on this application as a dependent who is enrolled in coverage through the Massachusetts Health Connector and whose premium for coverage is paid in whole or in part by advance payments. List name(s) and date(s) of birth of dependents.

No You will claim a personal exemption deduction on your federal income tax return for any individual listed on this application as a dependent who is enrolled in coverage through the Massachusetts Health Connector and whose premium for coverage is paid in whole or in part by advance payments. List name(s) and date(s) of birth of dependents. Yes

Yes  No

No

Yes

Yes

No

No

Yes

Yes

No

No

Yes

Yes

No

No Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No

No

Yes

Yes  No If

No If  Yes

Yes  No

No Yes

Yes  No

No victim of severe trafficking,

victim of severe trafficking,  a spouse, child, sibling, or parent of a trafficking victim

a spouse, child, sibling, or parent of a trafficking victim

a battered spouse,

a battered spouse,  a child or the parent of battered spouse?

a child or the parent of battered spouse? Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No

No Rent

Rent  Own

Own Yes

Yes  No Name:

No Name: Yes

Yes  No If

No If  Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No If

No If

Yes

Yes

No

No

Trusts $ How often received?

Trusts $ How often received?

Net farming or fishing income: On average, how much net income (profits after business expenses are paid) or loss will you

Net farming or fishing income: On average, how much net income (profits after business expenses are paid) or loss will you Yes

Yes  No

No

other (describe):

other (describe):

Yes

Yes  No Examples of

No Examples of  Yes

Yes  No

No Educator expense: Yearly amount $______

Educator expense: Yearly amount $______ Certain business expenses of reservists, performing artists, or

Certain business expenses of reservists, performing artists, or  Health Savings Account deduction: Yearly amount $______

Health Savings Account deduction: Yearly amount $______ Moving expenses for members of the Armed Forces: Yearly amount $______

Moving expenses for members of the Armed Forces: Yearly amount $______ Deductible part of

Deductible part of  Contribution to

Contribution to

Penalty on early withdrawal of savings: Yearly amount $______

Penalty on early withdrawal of savings: Yearly amount $______ Alimony paid: alimony payments for a divorce, separation agreement, or court order that was finalized before January 1, 2019, enter the amount of those payments here. Yearly amount $______

Alimony paid: alimony payments for a divorce, separation agreement, or court order that was finalized before January 1, 2019, enter the amount of those payments here. Yearly amount $______ Individual Retirement Account (IRA) deduction: Yearly amount $______

Individual Retirement Account (IRA) deduction: Yearly amount $______ Student loan deduction (interest only, not total payment): Yearly amount $______

Student loan deduction (interest only, not total payment): Yearly amount $______ None

None Yes

Yes  No

No Male

Male  Female

Female Yes

Yes  No. If

No. If

No street address. Note: if you check this box, you must provide a mailing address.

No street address. Note: if you check this box, you must provide a mailing address.

Yes

Yes  No If

No If

Yes

Yes

No If

No If  Yes

Yes  No (optional if

No (optional if

Yes

Yes  No If

No If  Yes

Yes  No

No

Yes

Yes

If

If  Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No.

No.

Yes

Yes

No

No Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No If

No If  Yes

Yes  No

No Yes

Yes  No

No victim of severe trafficking,

victim of severe trafficking,  a spouse, child, sibling, or parent of a trafficking victim

a spouse, child, sibling, or parent of a trafficking victim a battered spouse,

a battered spouse,  a child or the parent of battered spouse?

a child or the parent of battered spouse? Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No

No