This PDF editor makes it simple to create the computershare metlife deceased transfer request file. You should be able to get the document as soon as possible by following these basic steps.

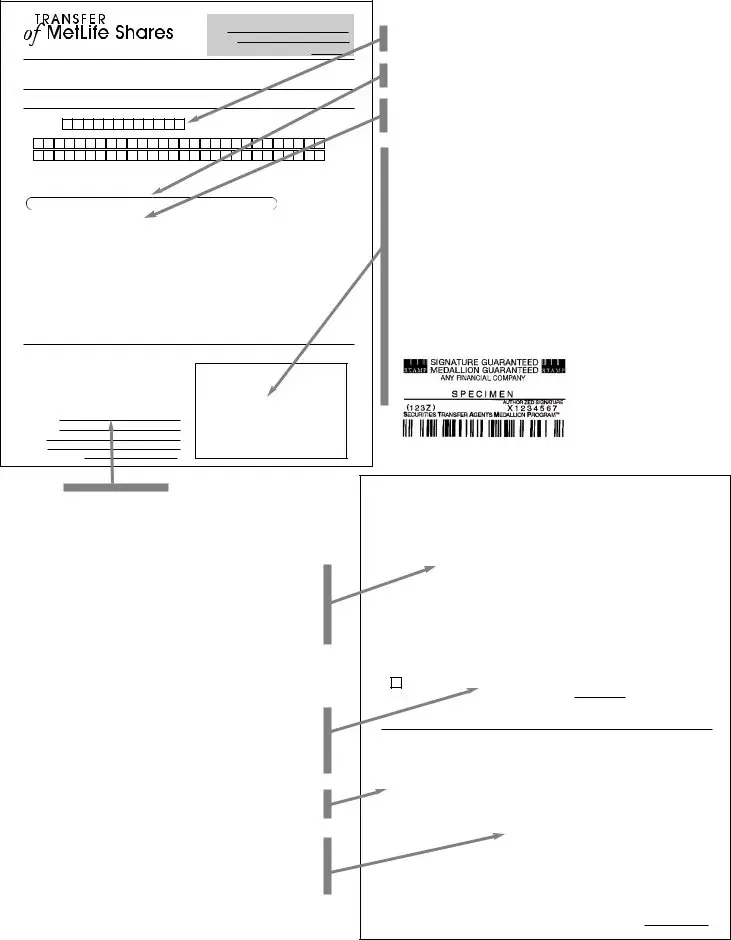

Step 1: You should choose the orange "Get Form Now" button at the top of the following page.

Step 2: At this point, it is possible to alter your computershare metlife deceased transfer request. This multifunctional toolbar helps you insert, erase, modify, highlight, and also do many other commands to the words and phrases and fields within the document.

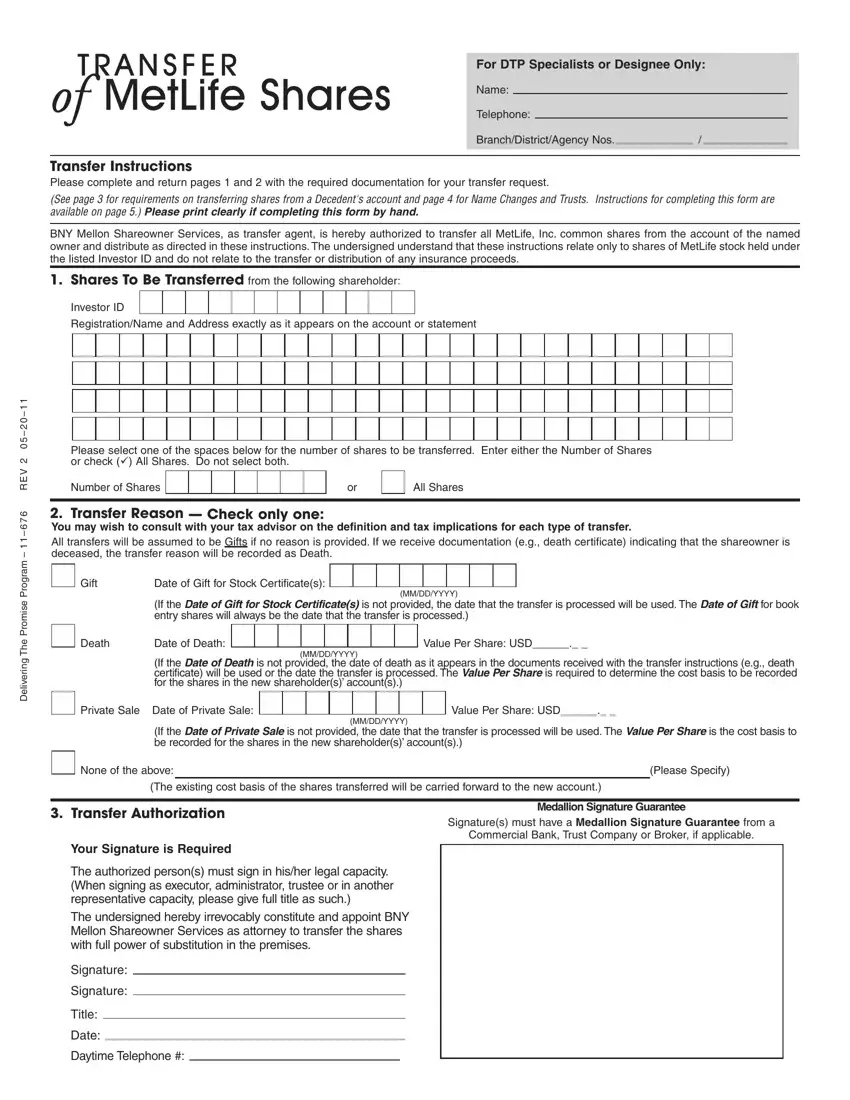

Prepare the computershare metlife deceased transfer request PDF by providing the text necessary for every single section.

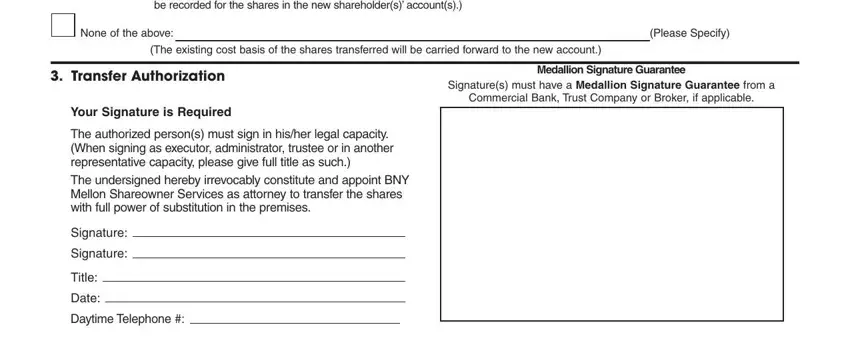

The application will need you to fill in the If the Date of Private Sale is not, None of the above, Please Specify, The existing cost basis of the, Medallion Signature Guarantee, Transfer Authorization, Your Signature is Required, The authorized persons must sign, Signature, Signature, Title, Date, and Daytime Telephone segment.

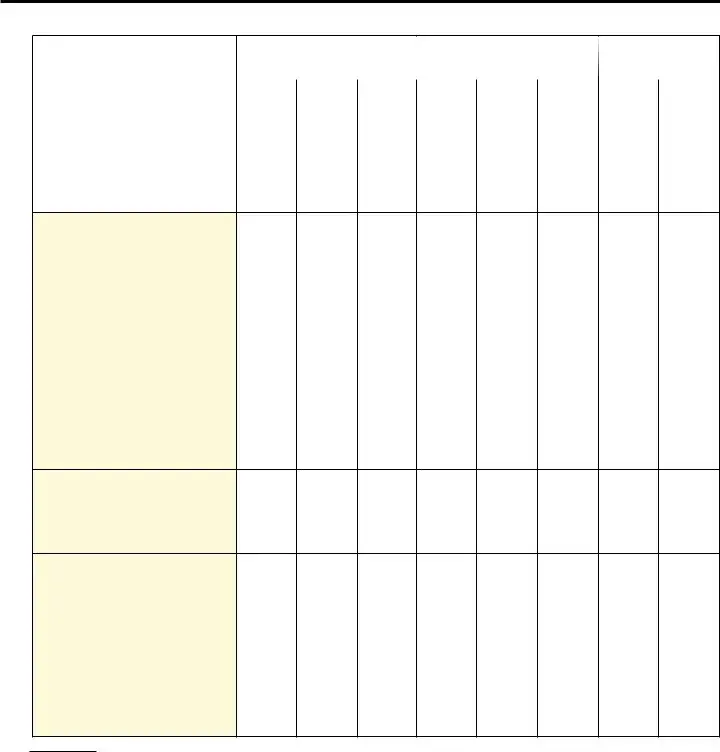

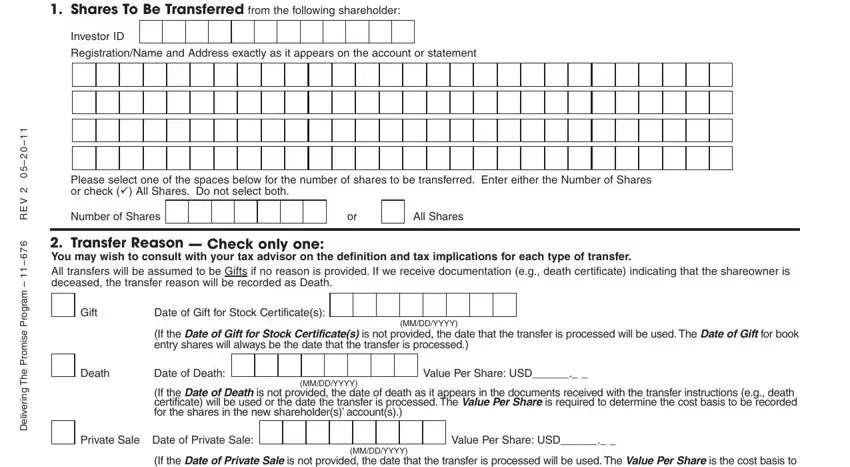

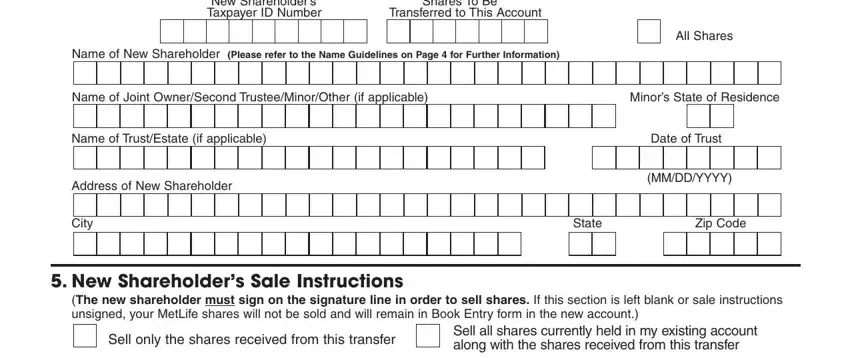

Remember to provide the required data in the New Shareholders Taxpayer ID Number, Shares To Be Transferred to This, Name of New Shareholder Please, All Shares, Name of Joint OwnerSecond, Minors State of Residence, Name of TrustEstate if applicable, Address of New Shareholder, City, Date of Trust, MMDDYYYY, State, Zip Code, New Shareholders Sale Instructions, and The new shareholder must sign on field.

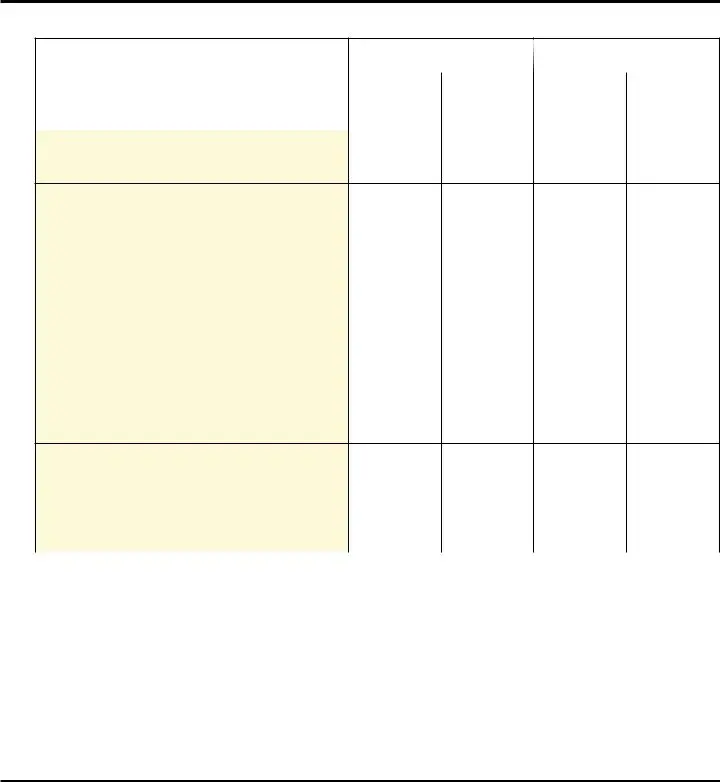

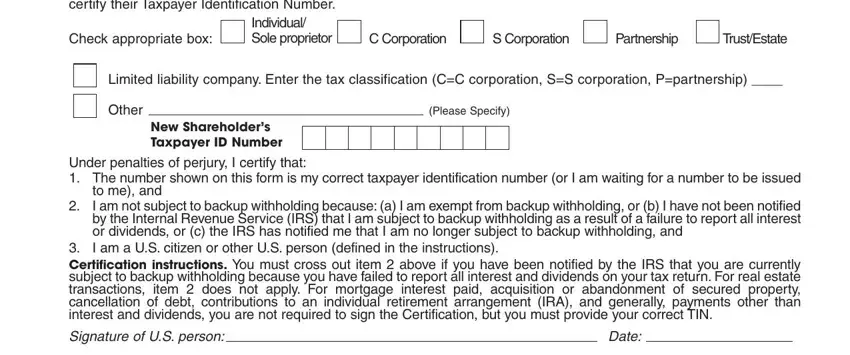

The YOUR ACCOUNT MAY BE SUBJECT TO, Check appropriate box, Individual Sole proprietor, C Corporation, S Corporation, Partnership, TrustEstate, Limited liability company Enter, Other, New Shareholders Taxpayer ID Number, Please Specify, Under penalties of perjury I, to me and I am not subject to, Certification instructions You, and Signature of US person section will be your place to indicate the rights and obligations of all sides.

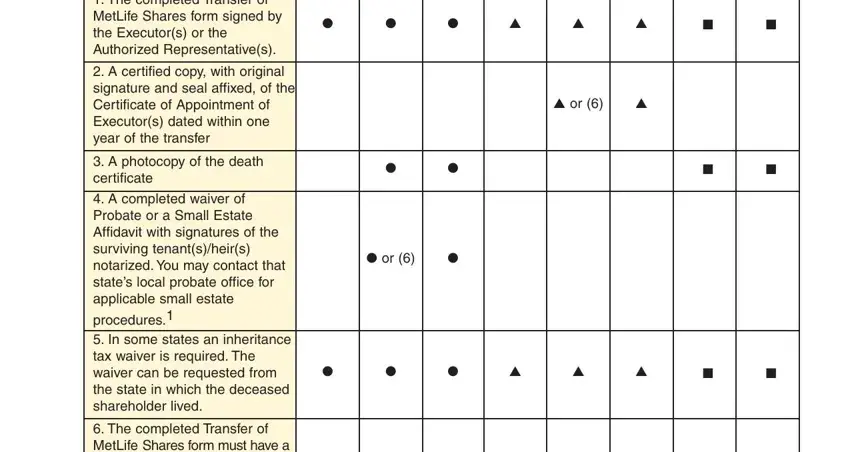

Finalize by analyzing the following sections and filling them out as required: The completed Transfer of MetLife, A certified copy with original, A photocopy of the death, A completed waiver of Probate or, and The completed Transfer of MetLife.

Step 3: Click "Done". You can now transfer your PDF form.

Step 4: Ensure that you stay away from potential misunderstandings by making no less than a couple of duplicates of your document.