Whenever you want to fill out nj motor fuels, you won't have to install any kind of software - just use our PDF editor. To make our editor better and simpler to use, we constantly implement new features, with our users' feedback in mind. Here's what you will want to do to get going:

Step 1: Simply hit the "Get Form Button" at the top of this site to start up our pdf form editing tool. Here you will find all that is necessary to work with your document.

Step 2: Once you start the PDF editor, you'll notice the form ready to be filled in. Aside from filling out different fields, it's also possible to perform various other actions with the file, such as adding custom text, editing the original textual content, adding graphics, signing the form, and more.

Pay close attention when completing this document. Make sure that each field is filled out accurately.

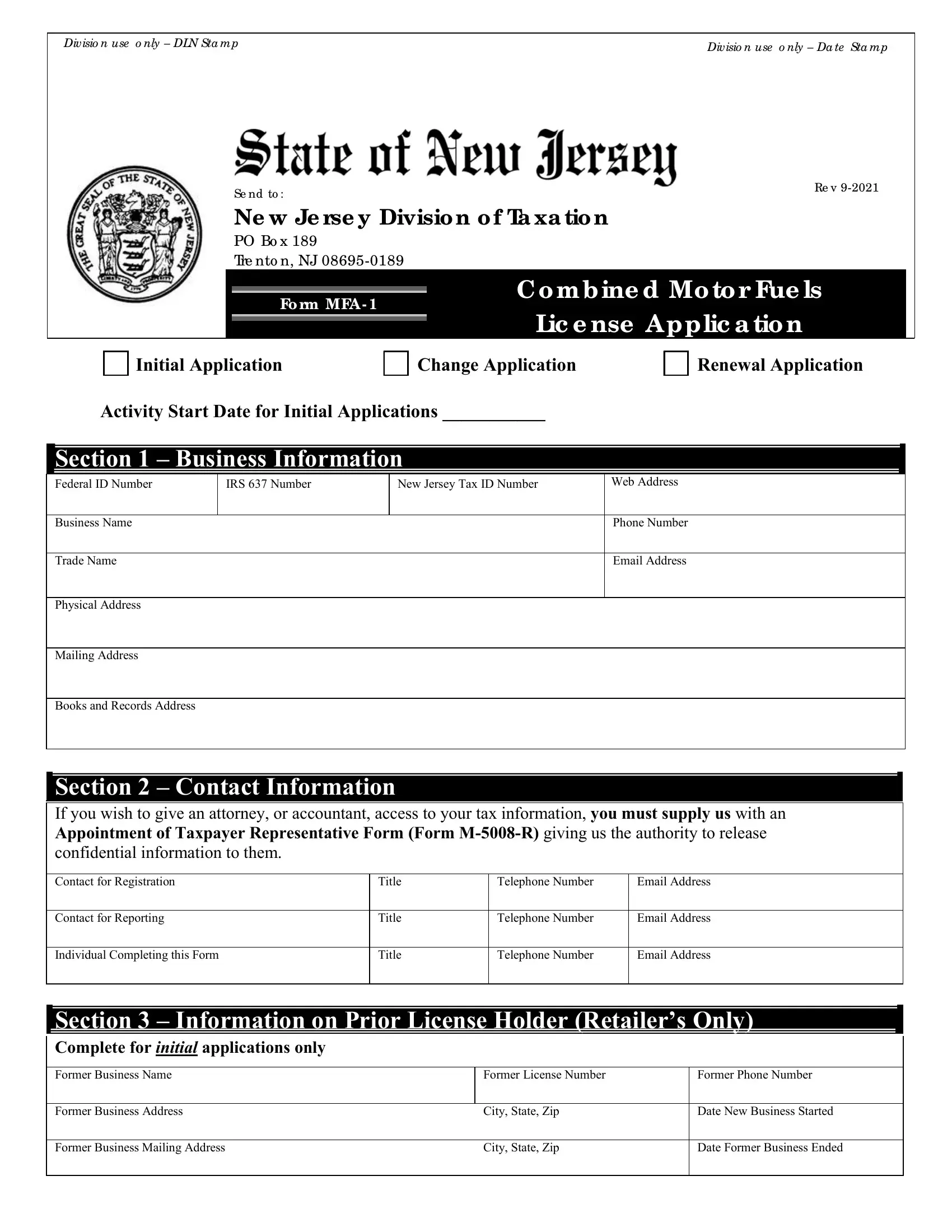

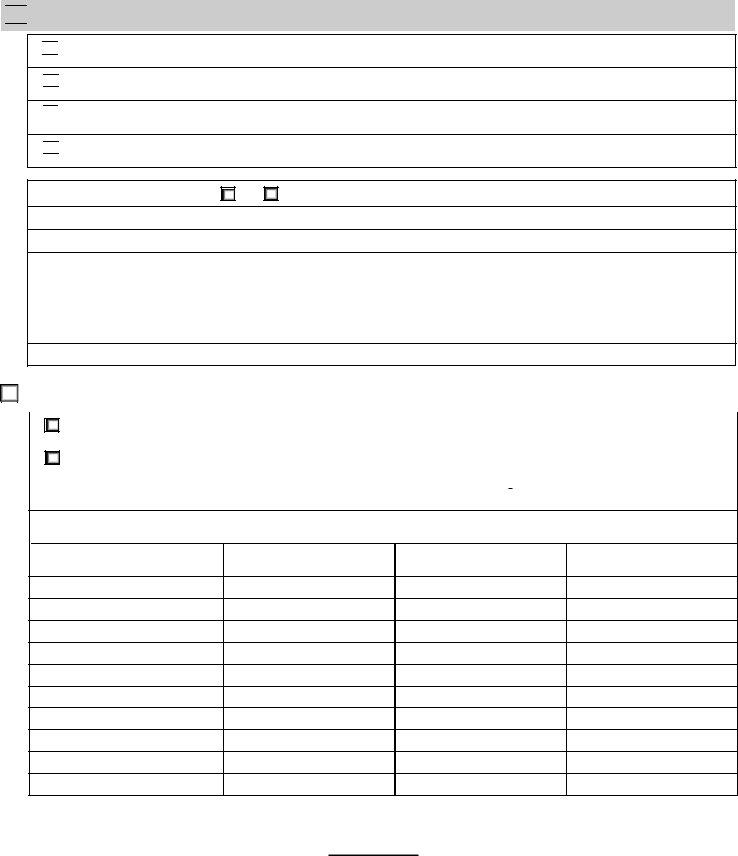

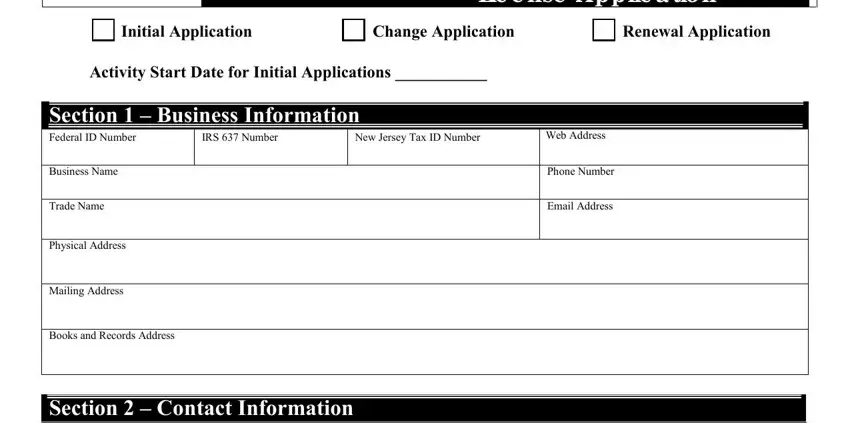

1. First, when filling in the nj motor fuels, start with the area that includes the subsequent blank fields:

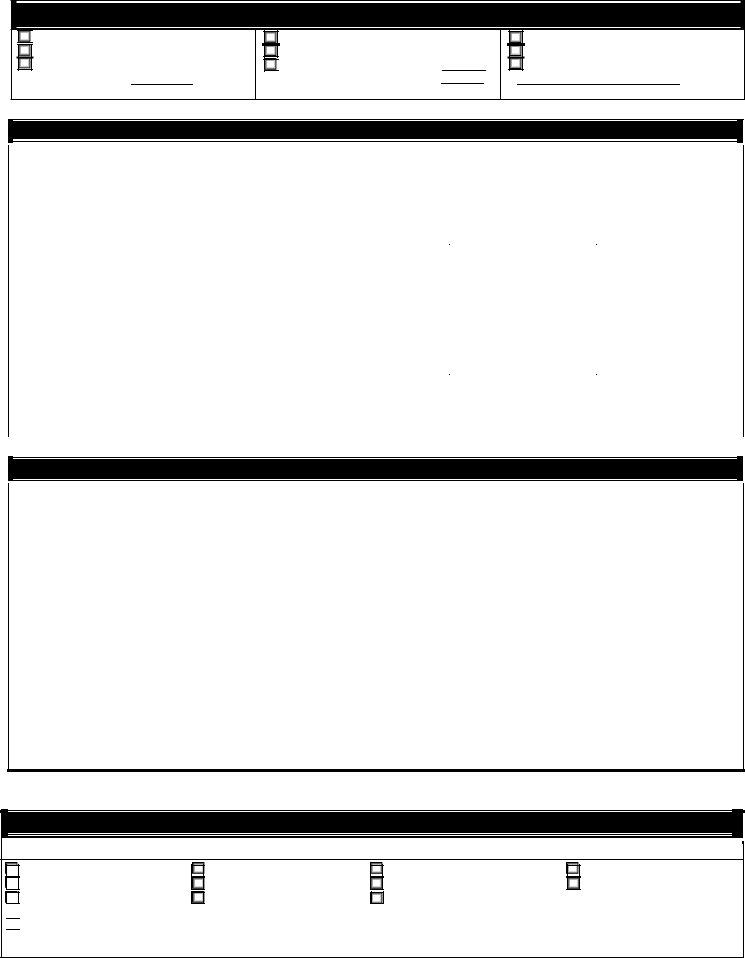

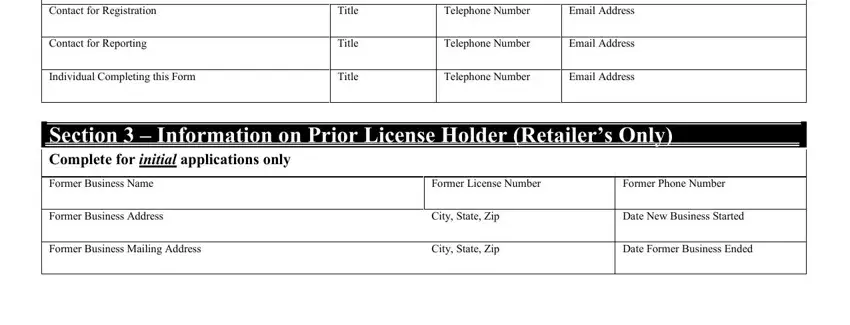

2. Right after performing the previous step, go to the subsequent step and fill out the essential particulars in these blank fields - Contact for Registration, Contact for Reporting, Individual Completing this Form, Title, Title, Title, Telephone Number, Email Address, Telephone Number, Email Address, Telephone Number, Email Address, Section Information on Prior, Former Business Name, and Former Business Address.

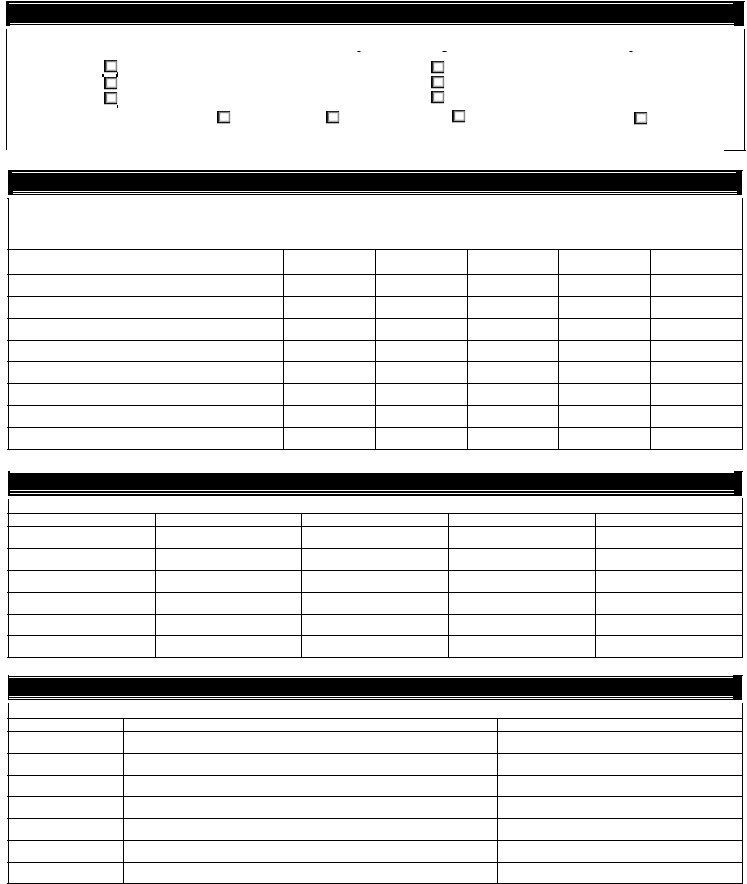

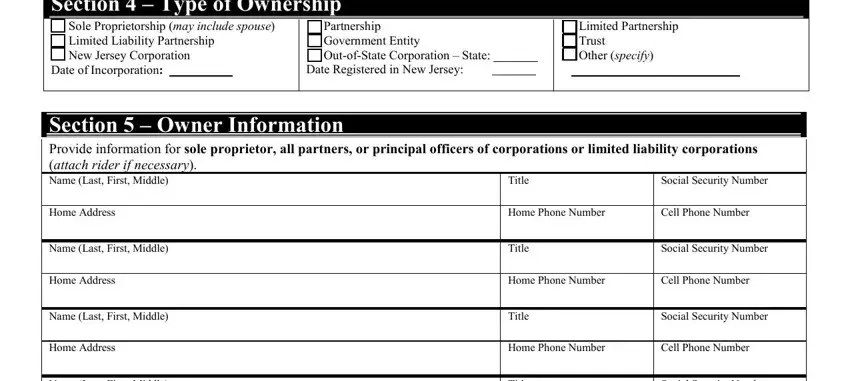

3. In this part, check out Section Type of Ownership, Sole Proprietorship may include, Date of Incorporation, Partnership Government Entity, Date Registered in New Jersey, Limited Partnership Trust Other, Section Owner Information, Social Security Number, Title, Home Address, Name Last First Middle, Home Address, Name Last First Middle, Home Address, and Name Last First Middle. Every one of these should be completed with greatest focus on detail.

When it comes to Home Address and Home Address, ensure you get them right in this current part. The two of these could be the most significant fields in this file.

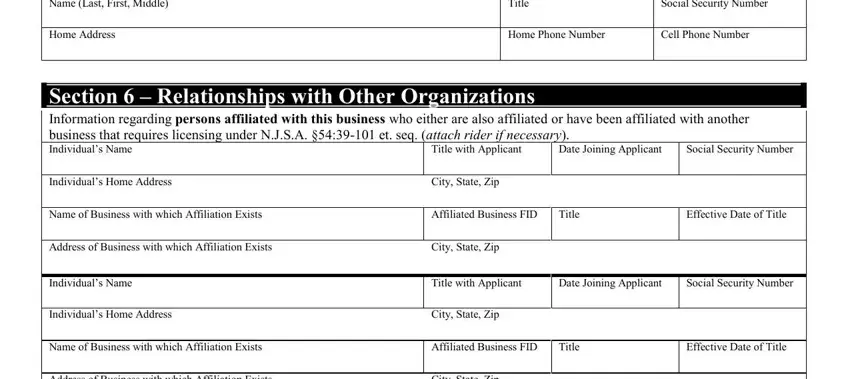

4. This next section requires some additional information. Ensure you complete all the necessary fields - Name Last First Middle, Home Address, Title, Social Security Number, Home Phone Number, Cell Phone Number, Section Relationships with Other, Date Joining Applicant, Title with Applicant, Social Security Number, Individuals Home Address, City State Zip, Name of Business with which, Affiliated Business FID, and Title - to proceed further in your process!

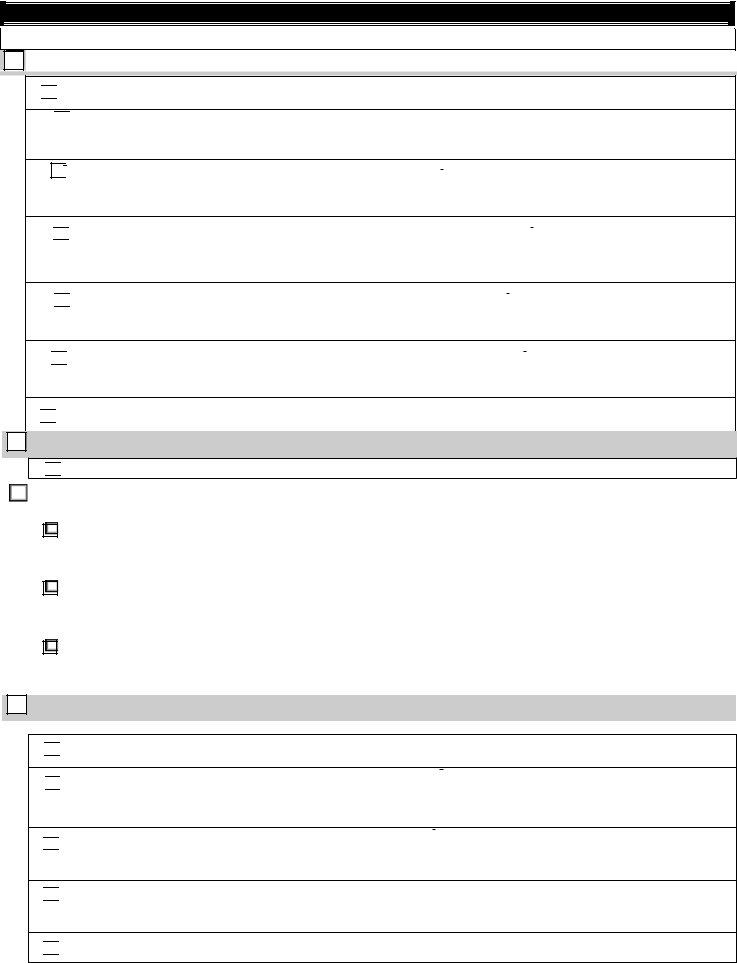

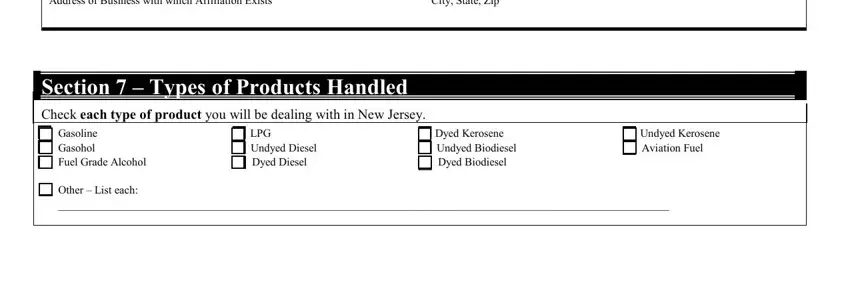

5. To finish your form, this final area features a couple of additional fields. Typing in Address of Business with which, City State Zip, Section Types of Products Handled, Check each type of product you, and Gasoline LPG Dyed Kerosene Undyed is going to conclude the process and you will be done in no time at all!

Step 3: Proofread what you have entered into the blank fields and then click on the "Done" button. Download your nj motor fuels the instant you sign up for a 7-day free trial. Quickly get access to the document from your personal cabinet, together with any modifications and changes conveniently synced! We do not share the details you provide when dealing with forms at FormsPal.