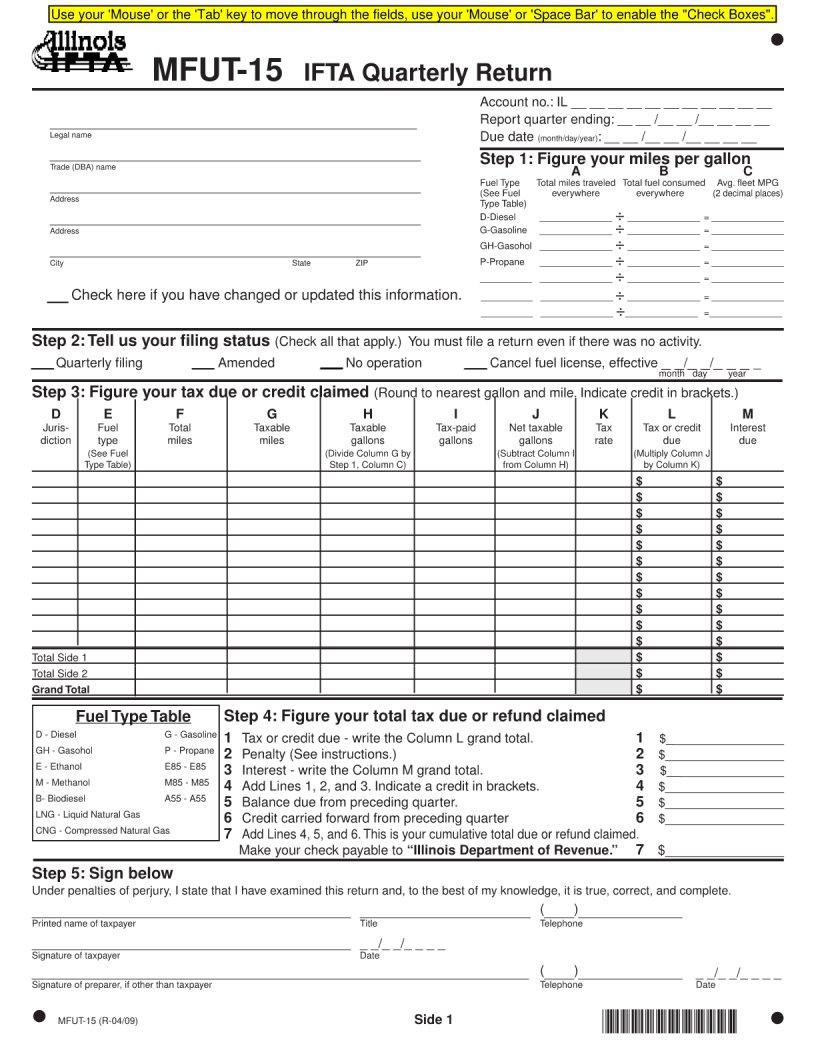

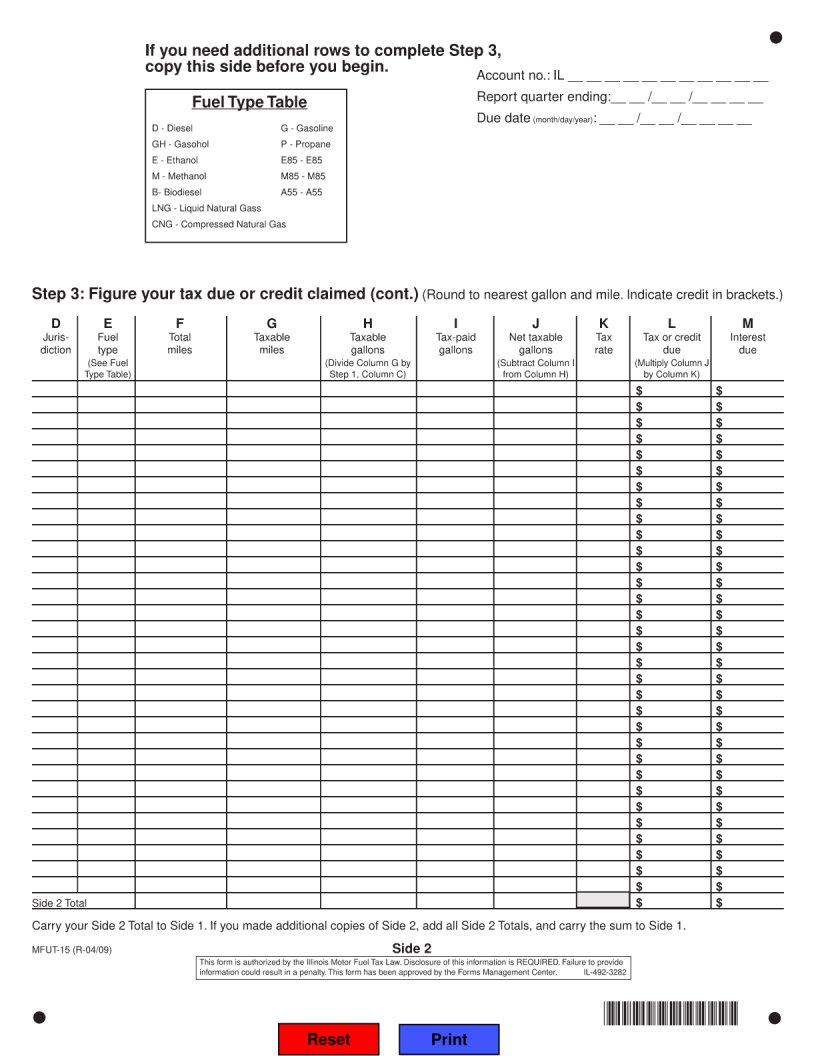

In the realm of tax documentation, few forms carry the specificity and focus consistent with the needs of motor fuel taxpayers like the MFUT 15 form. This essential document serves as a linchpin for companies in the fuel industry, tasked with the critical job of reporting motor fuel use. It outlines various requirements and stipulations for the accurate reporting of motor fuel utilization, tax liabilities, and potential refunds. Designed to ensure compliance and streamline the tax reporting process, the MFUT 15 form stands as a testament to the intricate relationship between regulatory procedures and sector-specific operational standards. Moreover, this form aids in the meticulous accounting of fuel consumption, a task paramount for environmental considerations and economic accuracy. The thorough completion and timely submission of this document are not merely administrative tasks but essential duties that reflect the ongoing commitment of businesses to adhere to jurisdictional tax laws and support the fundamental infrastructure that fuel taxes finance.

| Question | Answer |

|---|---|

| Form Name | MFUT 15 Form |

| Form Length | 2 pages |

| Fillable? | Yes |

| Fillable fields | 559 |

| Avg. time to fill out | 37 min 27 sec |

| Other names | mfut 15 ifta, mfut 15, mfut 15 fill, illinois ifta quarterly return |