michigan statutory will form can be filled in online without difficulty. Simply use FormsPal PDF tool to accomplish the job right away. Our team is aimed at making sure you have the perfect experience with our tool by constantly releasing new features and enhancements. With all of these improvements, working with our editor becomes easier than ever before! To get the process started, consider these basic steps:

Step 1: Just press the "Get Form Button" at the top of this webpage to launch our pdf file editing tool. There you'll find everything that is necessary to fill out your document.

Step 2: Using this state-of-the-art PDF tool, it is easy to do more than merely fill out blanks. Edit away and make your forms look high-quality with custom textual content put in, or tweak the original input to perfection - all that comes along with the capability to add your personal images and sign the PDF off.

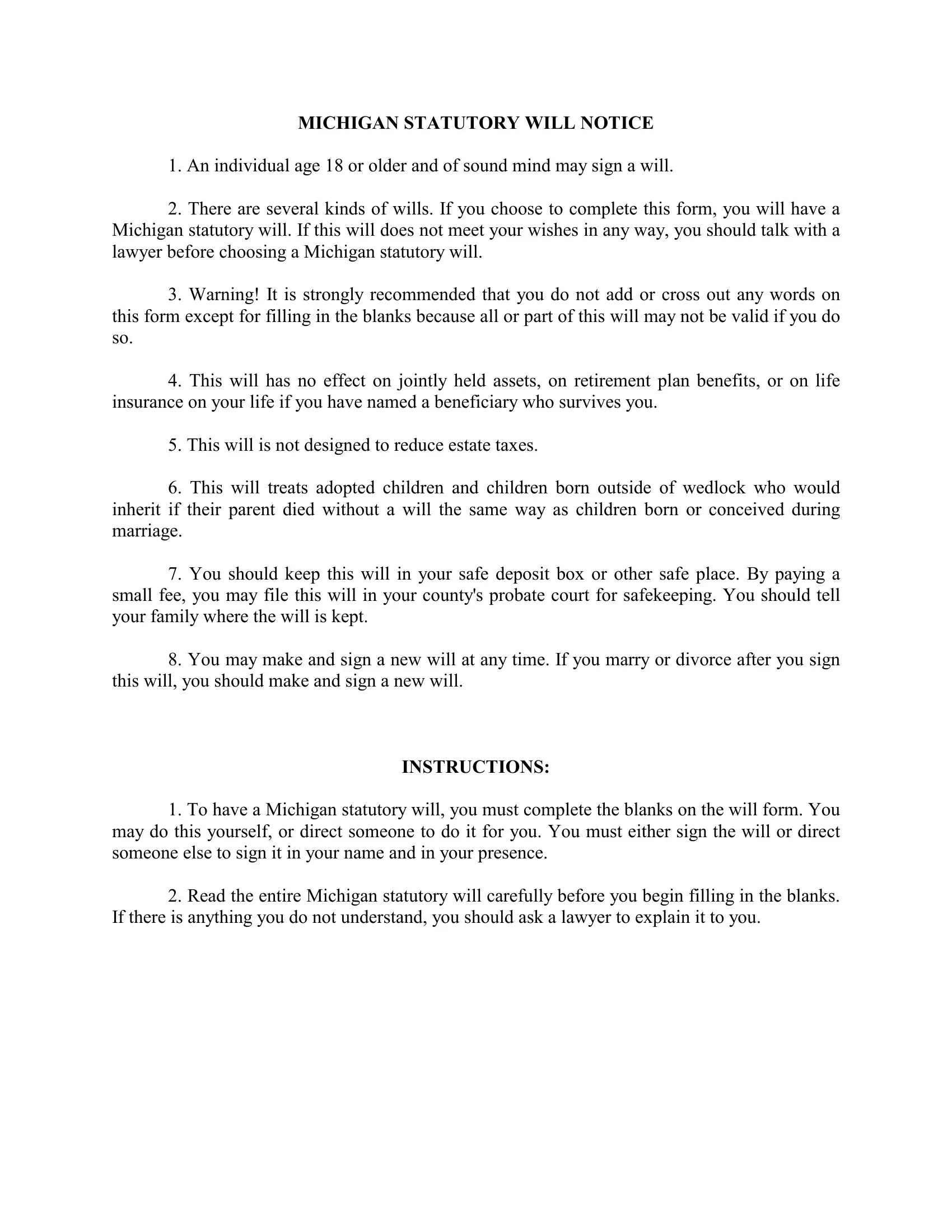

This PDF form requires particular information to be typed in, therefore you must take some time to provide what's expected:

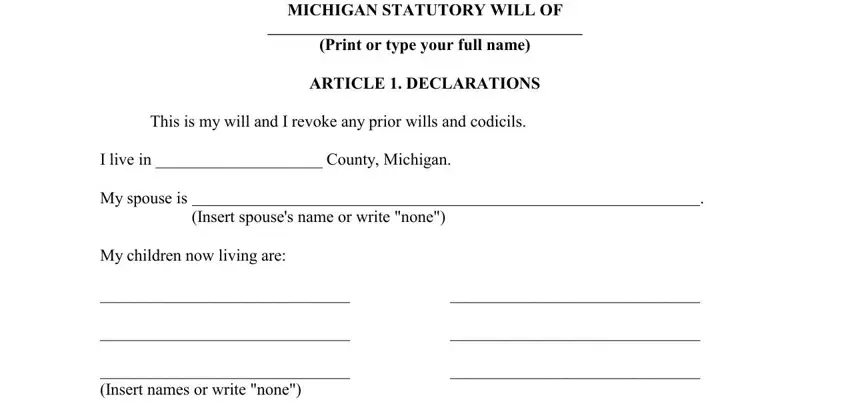

1. Start filling out the michigan statutory will form with a number of major blank fields. Gather all the necessary information and ensure there is nothing forgotten!

2. Right after finishing the last section, head on to the subsequent part and fill in all required details in all these blank fields - CASH GIFTS TO PERSONS OR.

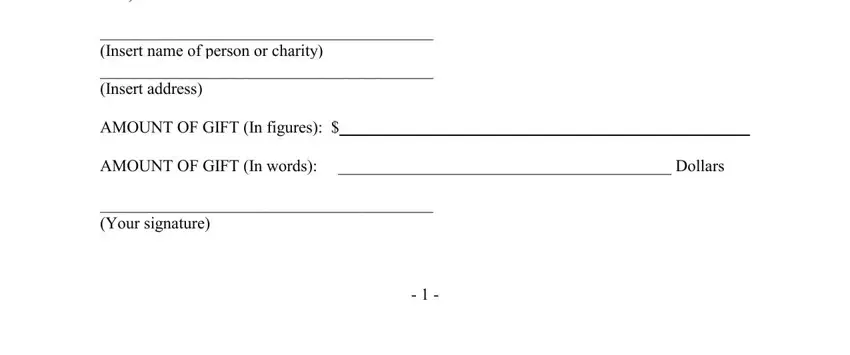

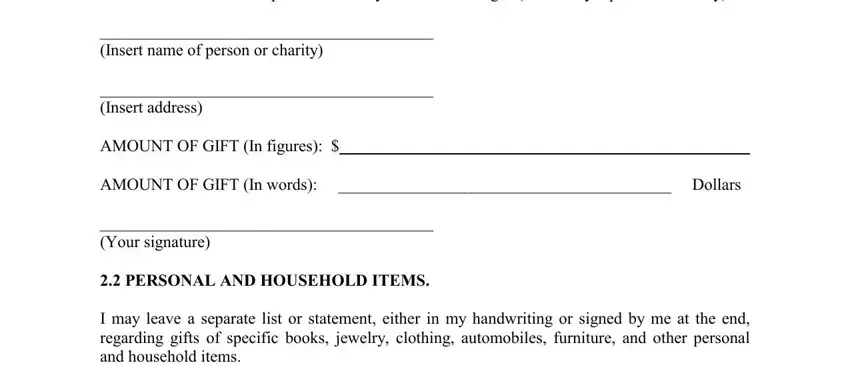

3. This third section is normally relatively easy, Full name and address of person or - all these empty fields needs to be filled in here.

4. This next section requires some additional information. Ensure you complete all the necessary fields - Full name and address of person or, and Your signature - to proceed further in your process!

Be very careful while filling in Full name and address of person or and Full name and address of person or, since this is where many people make a few mistakes.

5. Now, this last segment is what you should finish prior to using the form. The blanks in question include the following: b All to be distributed to my, Your signature, ARTICLE NOMINATIONS OF PERSONAL, GUARDIAN AND CONSERVATOR, and Personal representatives guardians.

Step 3: Revise the details you have inserted in the blanks and press the "Done" button. Create a 7-day free trial account with us and acquire immediate access to michigan statutory will form - downloadable, emailable, and editable inside your FormsPal cabinet. FormsPal ensures your data confidentiality via a protected method that in no way saves or shares any kind of private data provided. Be assured knowing your docs are kept confidential each time you work with our editor!