Working with PDF documents online is actually a breeze with our PDF tool. You can fill out mi 3683 fillable here without trouble. To maintain our tool on the forefront of practicality, we strive to put into action user-oriented features and improvements regularly. We are routinely grateful for any feedback - join us in revampimg PDF editing. If you are looking to begin, here is what it will take:

Step 1: Hit the "Get Form" button at the top of this webpage to open our PDF tool.

Step 2: After you start the editor, you will find the form prepared to be filled in. In addition to filling out various fields, you may also do other actions with the file, such as putting on your own text, changing the original text, adding illustrations or photos, affixing your signature to the PDF, and much more.

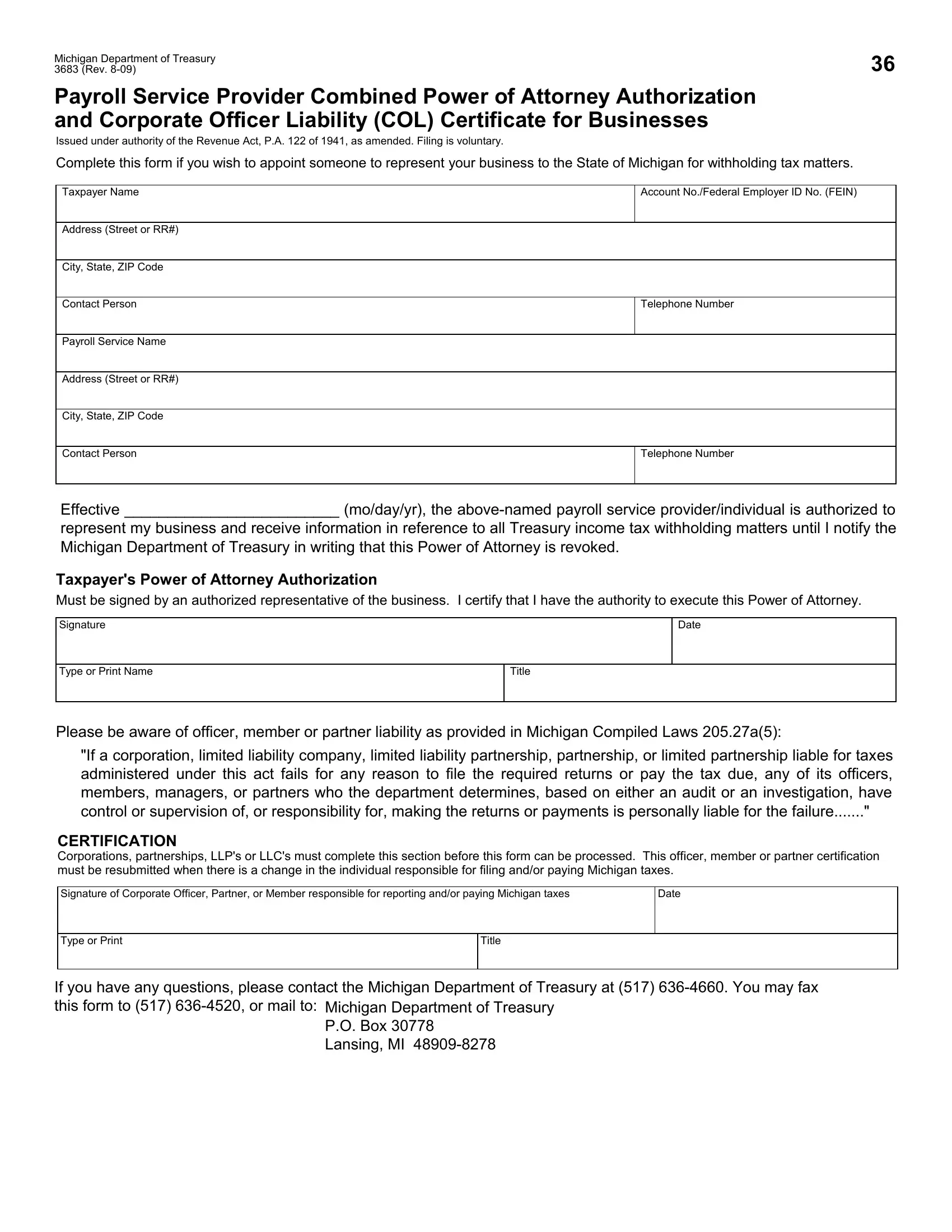

This PDF will need particular information to be filled out, so you need to take whatever time to fill in precisely what is required:

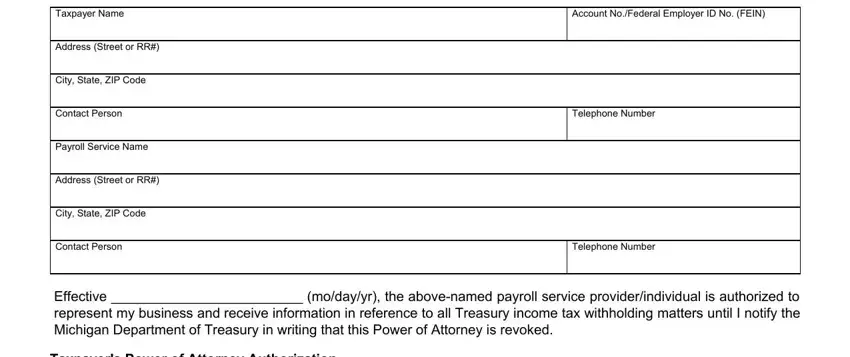

1. The mi 3683 fillable requires specific details to be typed in. Ensure the subsequent fields are completed:

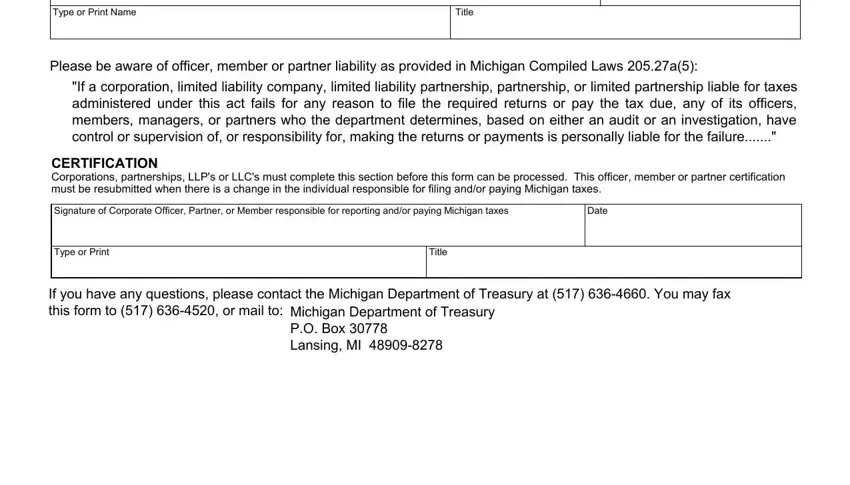

2. Once your current task is complete, take the next step – fill out all of these fields - Type or Print Name, Title, Please be aware of officer member, If a corporation limited liability, CERTIFICATION Corporations, Signature of Corporate Officer, Date, Type or Print, Title, If you have any questions please, and Michigan Department of Treasury PO with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It's very easy to make errors when filling in your Title, for that reason you'll want to go through it again prior to when you send it in.

Step 3: Make sure the information is accurate and click on "Done" to conclude the task. Make a free trial plan with us and gain direct access to mi 3683 fillable - with all transformations preserved and available from your FormsPal account. We don't share or sell the details you use whenever dealing with documents at FormsPal.