Dealing with PDF documents online is very simple with our PDF editor. You can fill in Regulatory here and try out many other functions we offer. Our tool is continually developing to give the best user experience achievable, and that is because of our dedication to continual development and listening closely to comments from users. Getting underway is simple! What you need to do is adhere to these basic steps below:

Step 1: Simply press the "Get Form Button" above on this site to launch our form editing tool. There you'll find all that is necessary to work with your document.

Step 2: This tool enables you to change your PDF file in many different ways. Improve it by writing customized text, adjust what is already in the PDF, and place in a signature - all at your disposal!

It will be simple to complete the document adhering to this helpful guide! Here's what you should do:

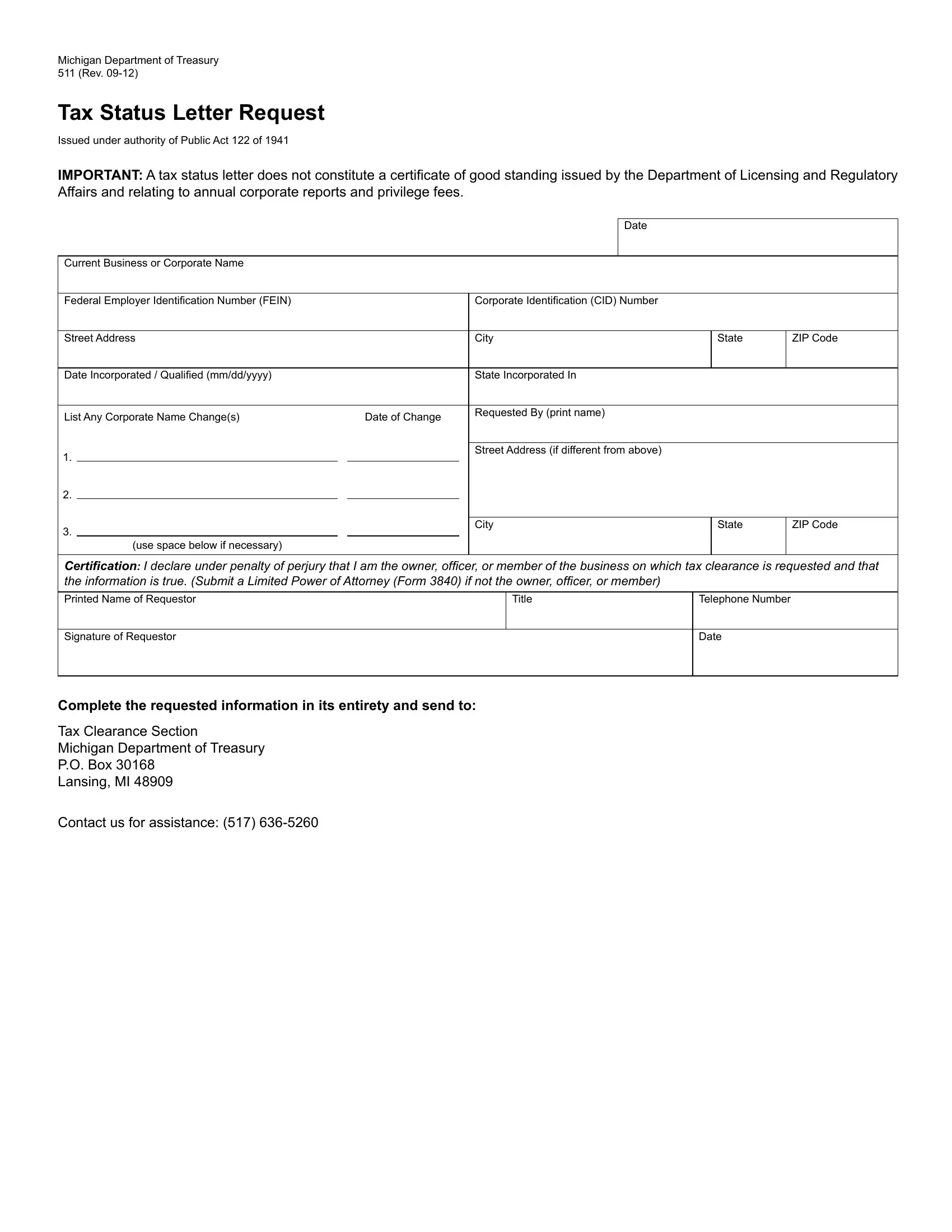

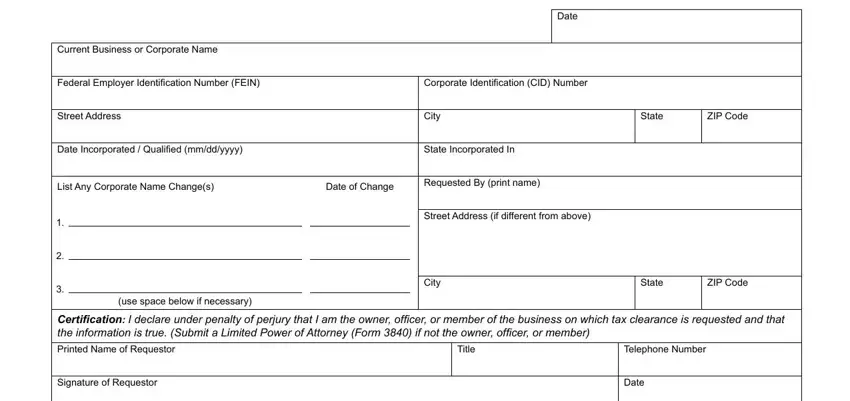

1. It is critical to complete the Regulatory properly, so be attentive when filling in the parts that contain these particular blank fields:

Step 3: Before moving on, double-check that blanks have been filled in the right way. Once you establish that it's fine, click on “Done." Acquire your Regulatory when you sign up for a 7-day free trial. Conveniently access the pdf from your FormsPal cabinet, along with any edits and adjustments being conveniently synced! FormsPal is invested in the confidentiality of all our users; we make sure all information coming through our tool continues to be protected.