The michigan lottery form completing procedure is effortless. Our software lets you work with any PDF form.

Step 1: Press the button "Get form here" to access it.

Step 2: Now, you can begin editing the michigan lottery form. Our multifunctional toolbar is available to you - insert, eliminate, transform, highlight, and carry out many other commands with the text in the file.

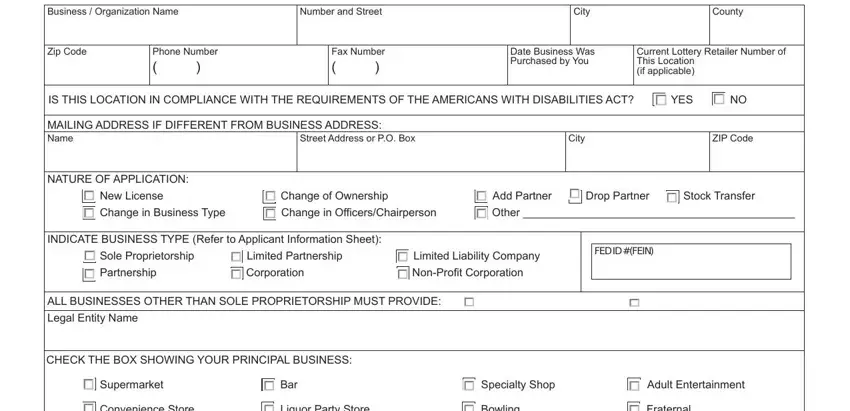

In order to create the form, type in the data the program will require you to for each of the following parts:

Complete the Convenience Store Liquor Party, GasConvenience Store Mass, Restaurant Drug Store Social Club, BarRestaurant Recreation Other, WRITE THE APPLICABLE MICHIGAN, Class C, Brewpub, SDM, SDD, ENTER THE HOURS OF OPERATION, Sunday, Monday, Tuesday, Wednesday, and Thursday fields with any information that can be required by the application.

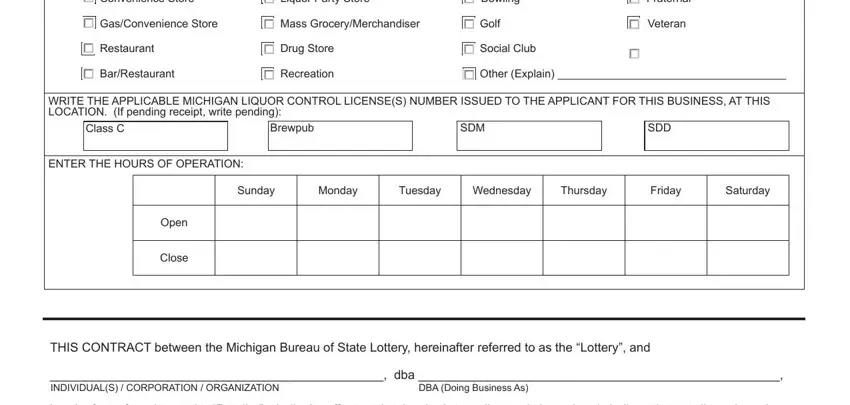

Indicate the essential information in Each ownershareholderprincipal offi, SIGNATURE, TYPE OR PRINT TITLE, PERCENT OF STOCK, TYPE OR PRINT NAME OF INDIVIDUAL, SIGNATURE, TYPE OR PRINT TITLE, PERCENT OF STOCK, TYPE OR PRINT NAME OF INDIVIDUAL, SIGNATURE, TYPE OR PRINT TITLE, PERCENT OF STOCK, TYPE OR PRINT NAME OF INDIVIDUAL, SIGNATURE, and TYPE OR PRINT TITLE part.

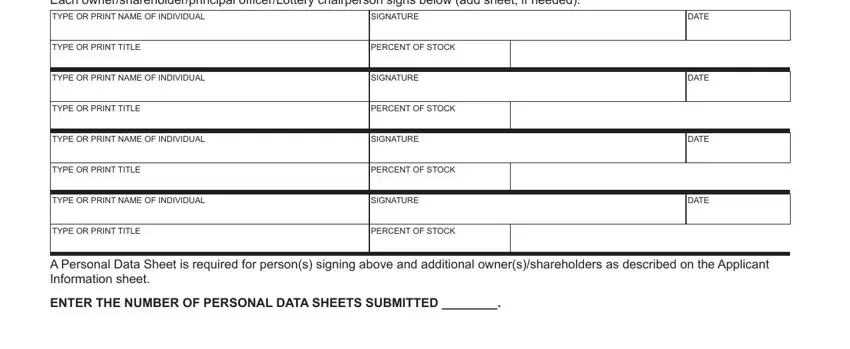

The MICHIGAN LOTTERY RETAILER SERVICES, PERSONAL DATA SHEET, Business Name dba, EACH OWNER PARTNER PRINCIPAL, NAME LAST FIRST MI, MAIDEN NAME, SOCIAL SECURITY NO, DATE OF BIRTH, SEX, DRIVERS LICENSE NO, HOME ADDRESS NO STREET, CITY, STATE, ZIP, and COUNTY box will be the place to put the rights and responsibilities of either side.

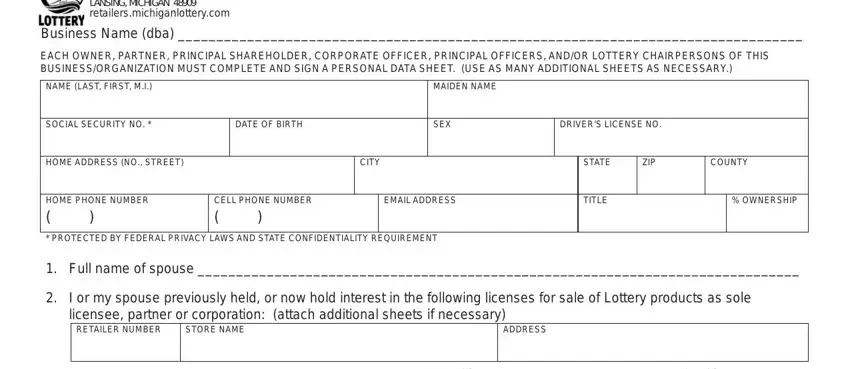

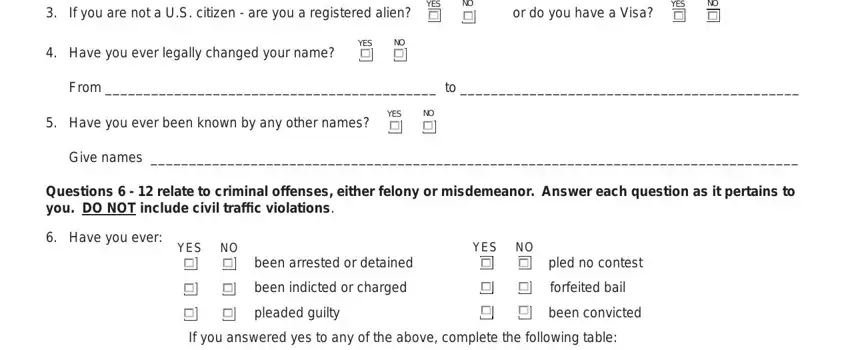

End by reading the following fields and completing them accordingly: If you are not a US citizen are, YES, or do you have a Visa, YES, Have you ever legally changed, YES, From to, Have you ever been known by any, YES, Give names, Questions relate to criminal, Have you ever, YES NO, YES NO, and been arrested or detained.

Step 3: Select "Done". Now you may upload your PDF form.

Step 4: In order to prevent different issues in the long run, you will need to prepare as a minimum a couple of copies of your form.