You could complete form specified transport effortlessly in our online PDF tool. The tool is consistently maintained by us, getting new functions and growing to be greater. With some easy steps, you may begin your PDF editing:

Step 1: Hit the "Get Form" button above. It's going to open our tool so you can start filling out your form.

Step 2: This tool helps you customize the majority of PDF documents in various ways. Transform it with customized text, correct original content, and place in a signature - all within the reach of a couple of mouse clicks!

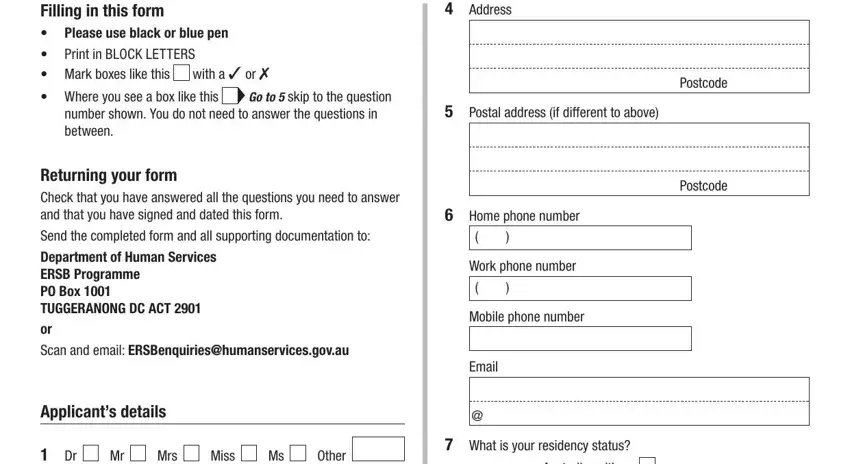

As for the blanks of this precise form, this is what you should consider:

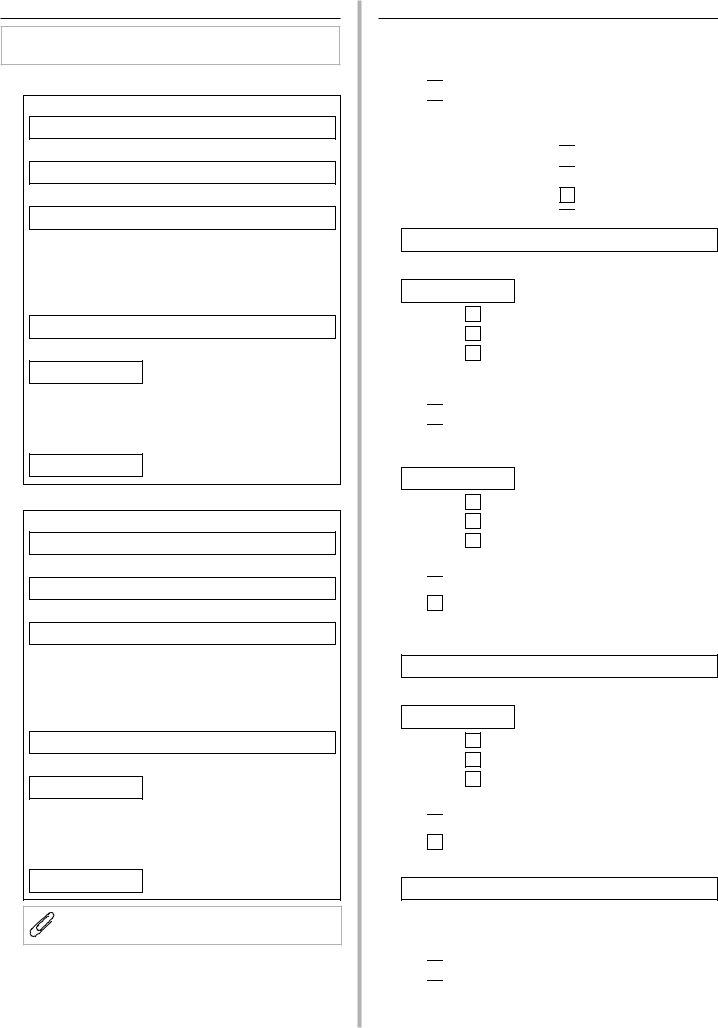

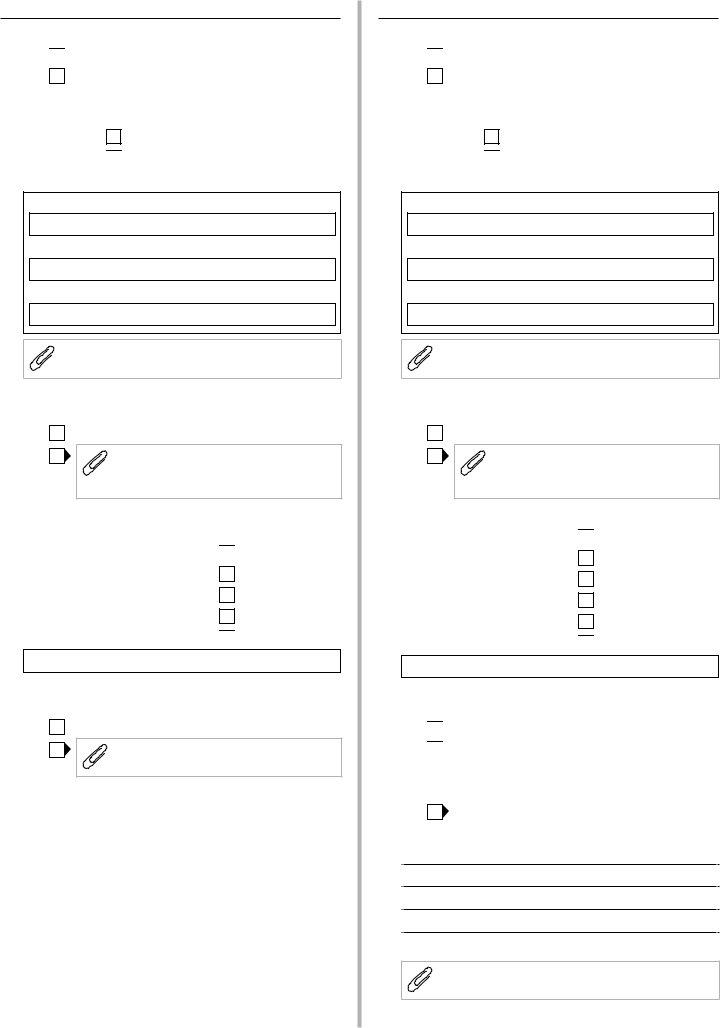

1. It is critical to complete the form specified transport correctly, thus pay close attention while working with the areas comprising all these fields:

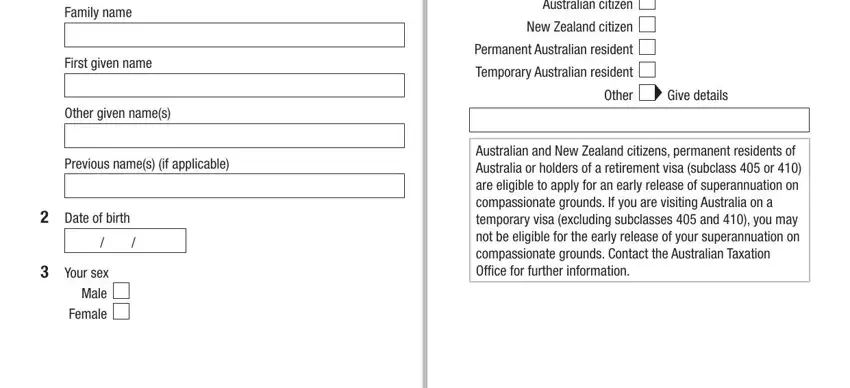

2. Once the previous segment is finished, you have to add the required specifics in Family name, First given name, Other given names, Previous names if applicable, Date of birth, Your sex Male, Female, Australian citizen, New Zealand citizen, Permanent Australian resident, Temporary Australian resident, Other, Give details, and Australian and New Zealand in order to move forward further.

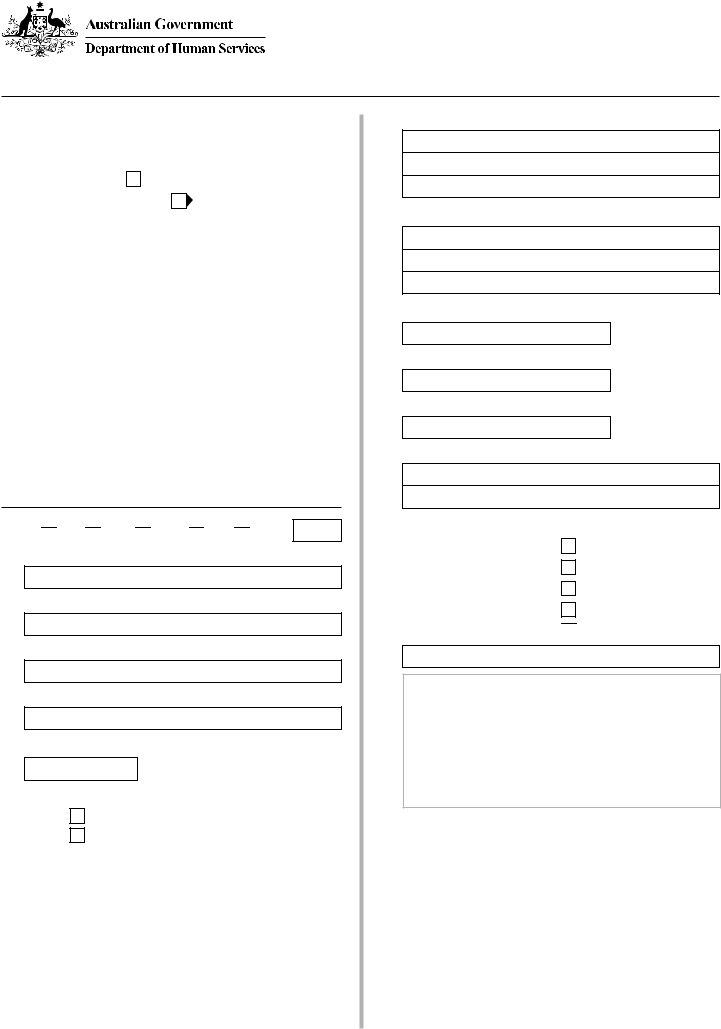

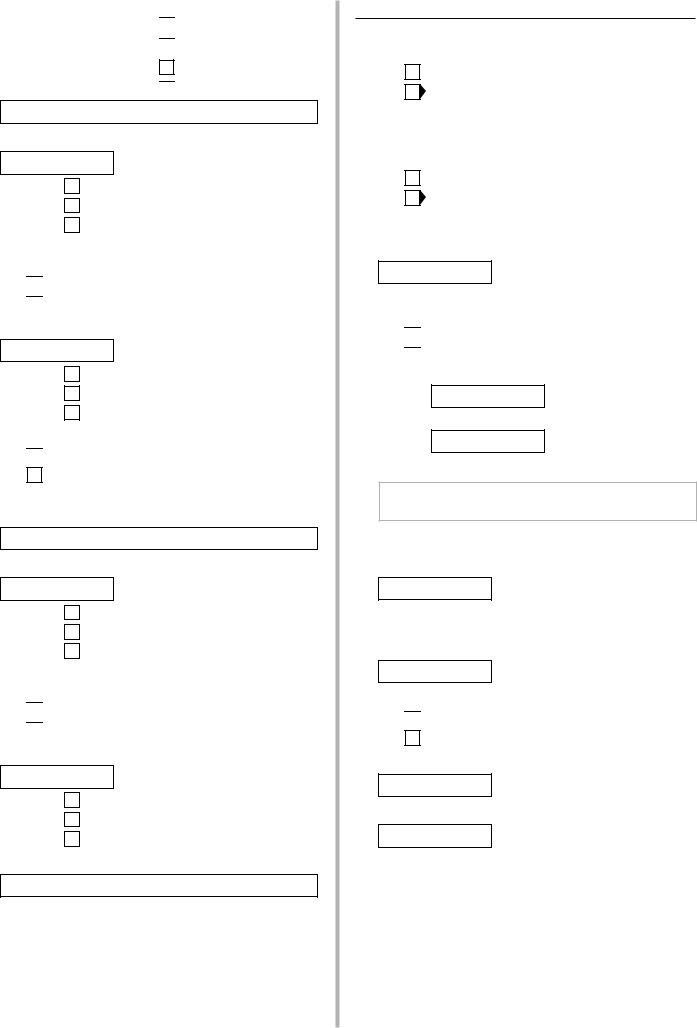

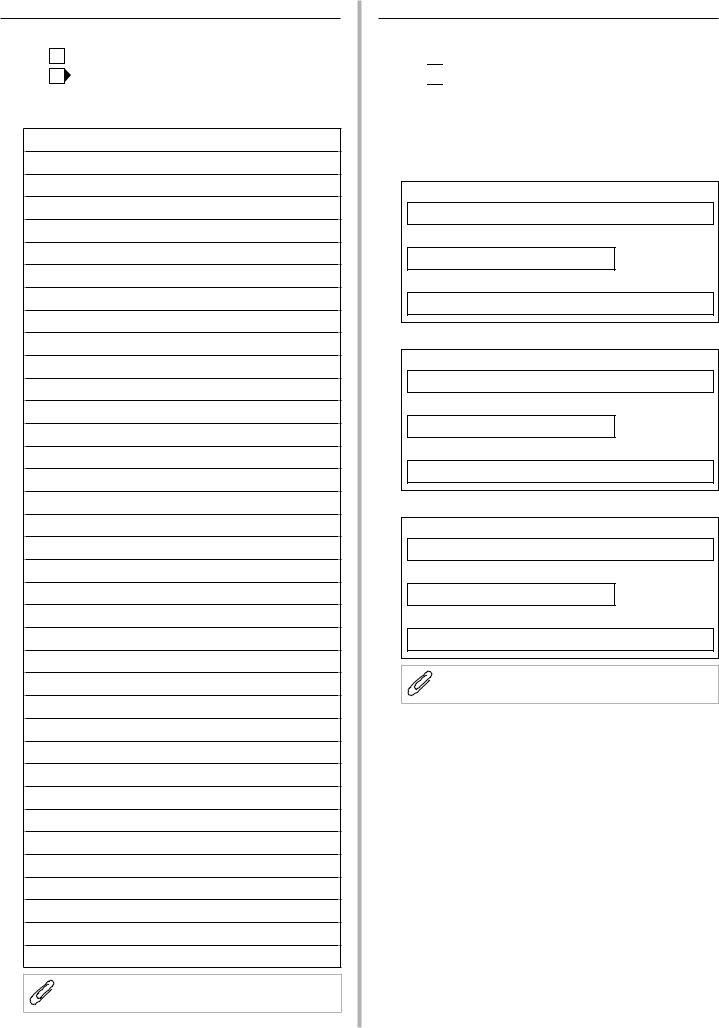

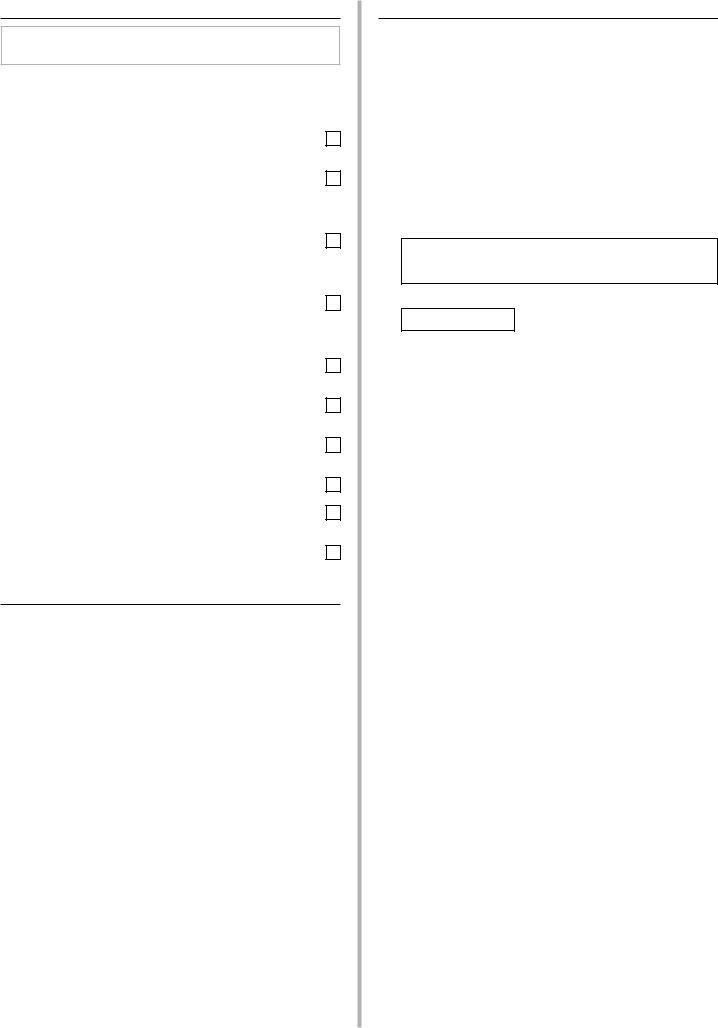

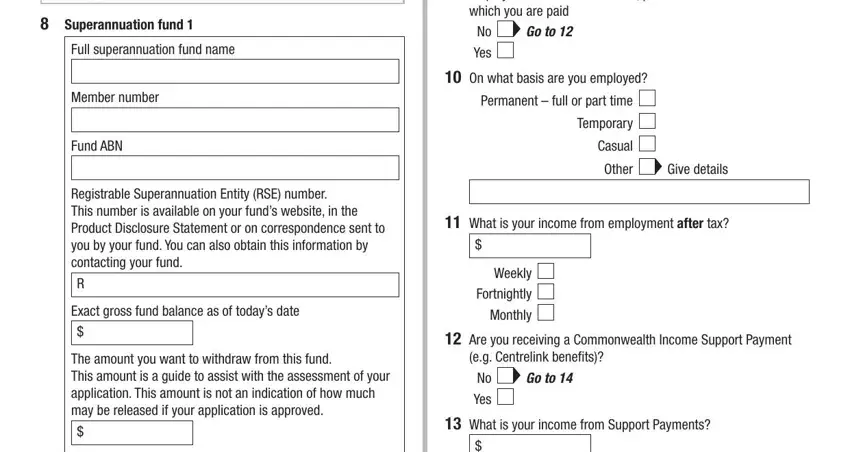

3. The following step is normally fairly uncomplicated, Superannuation fund, Full superannuation fund name, Member number, Fund ABN, Registrable Superannuation Entity, Exact gross fund balance as of, The amount you want to withdraw, Employment can mean full time part, Go to, Yes, On what basis are you employed, Permanent full or part time, Temporary, Casual, and Other - each one of these blanks needs to be completed here.

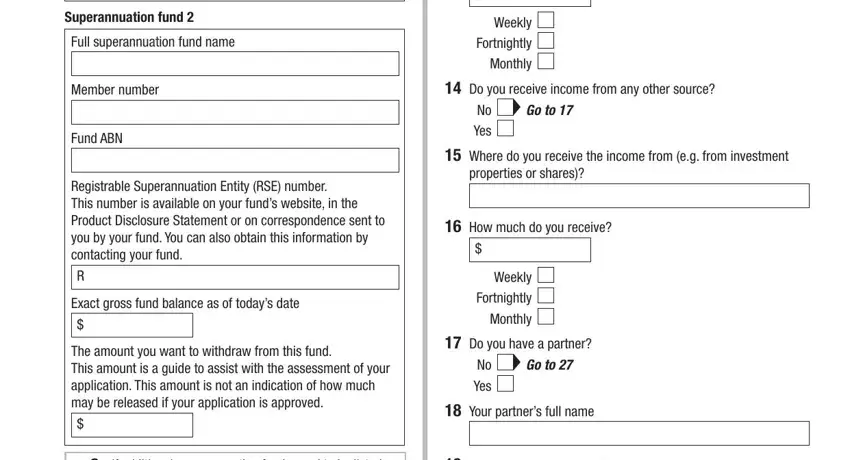

4. The form's fourth section arrives with the next few blanks to enter your specifics in: Superannuation fund, Full superannuation fund name, Member number, Fund ABN, Registrable Superannuation Entity, Exact gross fund balance as of, The amount you want to withdraw, Weekly, Fortnightly, Monthly, Do you receive income from any, Go to, Yes, Where do you receive the income, and properties or shares.

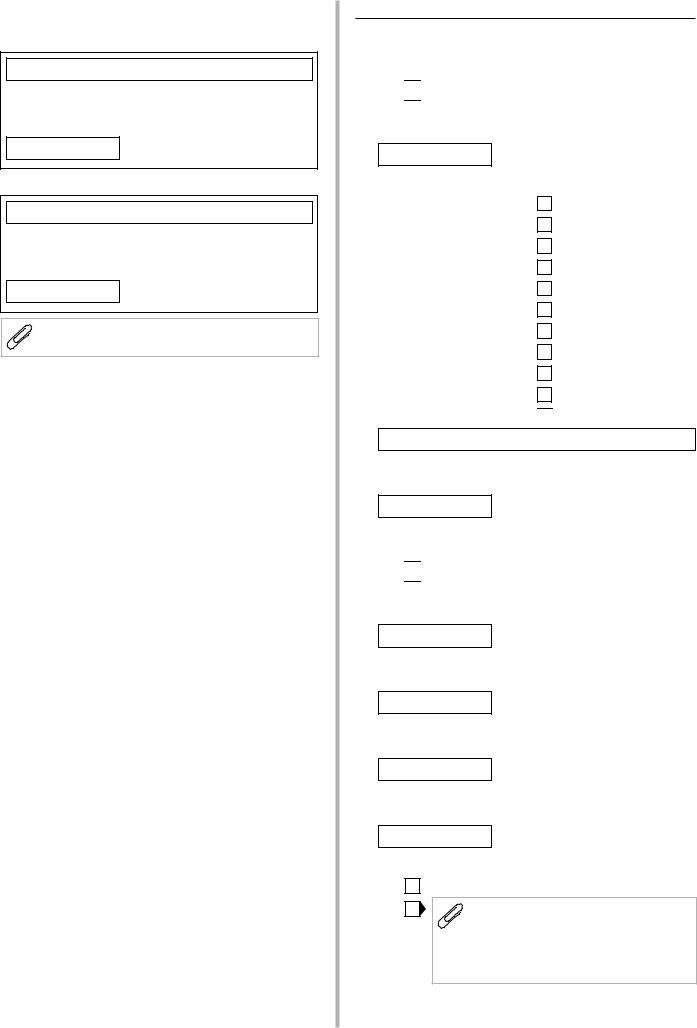

5. The final step to complete this form is critical. You'll want to fill out the required blanks, for example If additional superannuation funds, Employment can mean full time part, Go to, Yes, and MO formerly, prior to using the document. If not, it may end up in an unfinished and possibly incorrect form!

Regarding If additional superannuation funds and MO formerly, ensure you get them right in this current part. Those two are certainly the most important fields in this document.

Step 3: Once you've glanced through the details in the document, simply click "Done" to conclude your form at FormsPal. Acquire your form specified transport after you subscribe to a free trial. Quickly access the pdf in your personal cabinet, with any edits and adjustments conveniently kept! We do not share or sell any details that you enter whenever working with documents at FormsPal.