Completing the Model Balance Sheet is a pivotal step for entities such as Adult Family Homes (AFH), Community Based Residential Facilities (CBRF), or Home Health Agencies (HHA) in the State of Wisconsin when they're in the process of submitting a license application. This detailed document, mandated by the Department of Health Services, Division of Quality Assurance, under the Chapter 50.02(2)(a), Wis. Stats, F-62674A (Rev. 07/08), serves multiple crucial functions. It meticulously categorizes an entity's financial assets and liabilities into current and fixed assets, current and long-term liabilities, alongside owner's equity or net worth, to paint a comprehensive financial "snapshot" of the business at a specific point in time. Not just a mere formality, this balance sheet emphasizes the importance of balancing total assets with the combination of total liabilities and owner’s equity, thereby reflecting the financial health and viability of the entity. With instructions expressly guiding its completion, the Model Balance Sheet ensures that all pertinent financial details are accurately captured, offering insights into the entity's ability to meet obligations, manage debt, and ultimately ascertain its financial stability. While the form suggests a standard format, flexibility in the presentation is allowed as long as the essential information requirements are met, thereby facilitating a standardized approach to financial reporting while allowing for individual nuances.

| Question | Answer |

|---|---|

| Form Name | Model Balance Sheet Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | balance suggested page sample, dhs model balance sheet, model balance sheet, model balance sheet format trial |

DEPARTMENT OF HEALTH SERVICES |

STATE OF WISCONSIN |

Division of Quality Assurance |

Chapter 50.02(2)(a), Wis. Stats. |

Page 1 of 2 |

MODEL BALANCE SHEET

•This form may be used when submitting a license application for an Adult Family Home (AFH), a Community Based Residential Facility (CBRF), or a Home Health Agency (HHA).

•Read instructions on page 2 before completing this form.

Name – Agency

Date Completed

Address

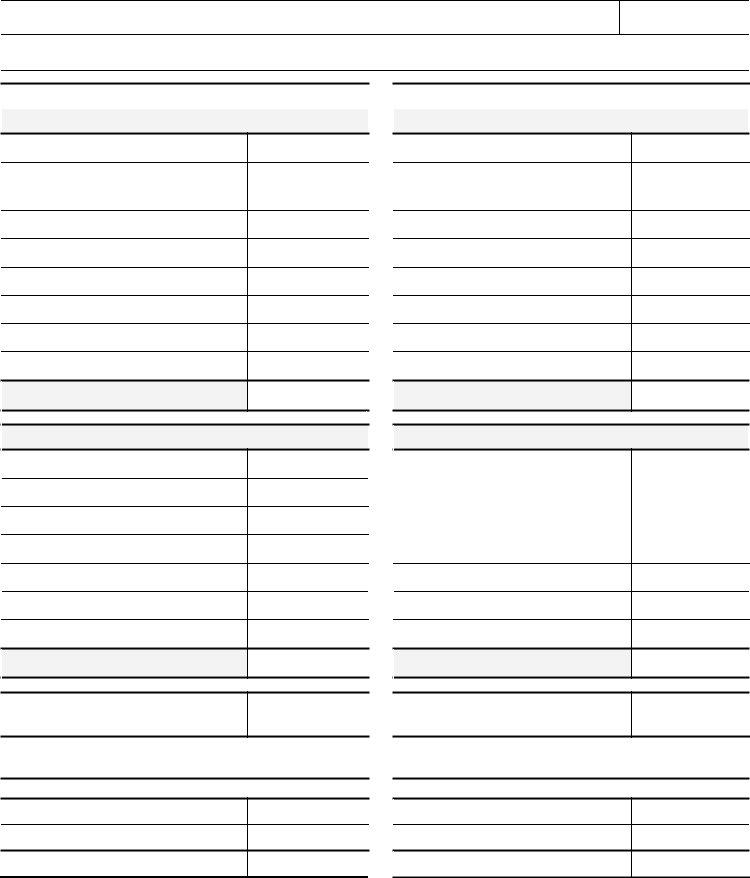

ASSETS |

|

LIABILITIES |

|

|

|

Current Assets

Cash in Bank

Other Short Term Investments

(e.g., money market, stocks, CDs)

Prepaid Expenses

Receivables

Other (Specify.)

Total Assets (Current)

Fixed Assets

Vehicles

Furniture and Equipment

Leasehold Improvements

Real Estate / Buildings

Other (Specify.)

Total Assets (Fixed)

TOTAL ASSETS

(Current plus Fixed)

Total Assets must equal the sum total of owner’s

OWNER’S EQUITY (NET WORTH)

Current Liabilities

Accounts Payable

Loans Payable (due within 12 months)

Accrued Payroll / Withholding

Taxes Payable

Current Portion of Long Term Debt

Other (Specify.)

Total Liabilities (Current)

Long Term Liabilities

Loans Payable (due after 12 months)

(e.g., land contract, mortgage, vehicles, bank loans, etc.)

Other (Specify.)

Total Liabilities (Long Term)

TOTAL LIABILITIES (Current plus Long Term)

total liability and owner’s equity (net worth).

TOTAL ASSETS

TOTAL ASSETS

TOTAL LIABILITIES

OWNER’S EQUITY

TOTAL LIABILITIES

OWNER’S EQUITY

TOTAL ASSETS

Page 2 of 2 |

MODEL BALANCE SHEET

This balance sheet is used when submitting a license application for an Adult Family Home (AFH), a Community Based Residential Facility (CBRF), or a Home Health Agency (HHA). The Model Balance Sheet is a suggested format; however, the same basic information is required when using another format. Other balance sheet formats containing the required information will be accepted.

A.What is a balance sheet? What is it used for?

A balance sheet is a financial “snapshot” of you or your business at a given date in time. The balance sheet provides information on what you or your business own (assets), what you or your business owe (liabilities), and your net worth or the value of the business (equity). The term “balance sheet” is derived from the fact that these accounts must always be in balance. Assets must always equal the sum of liabilities and equity. By analyzing your balance sheet, one can assess your financial status and examine the following:

•Can you or your business meet short term obligations?

•Can you or your business pay all current and long term debts as they come due?

•Are you or your business overly indebted, i.e., do your liabilities exceed your assets?

B.Terms

1.Current Assets are assets that are usually converted to cash within one year. They include, but are not limited to:

•Cash – On hand and/or on deposit and is available

•Short Term Investments – Generally converted easily into cash, e.g., money market funds, U.S. Government securities

•Receivables – Money that customers owe to you or your business

•Prepaid Expenses – Items like insurance premiums or rentals which you have already paid but have not yet “used”.

2.Fixed Assets are tangible assets with a useful life greater than a year. They include, but are not limited to:

•Vehicles

•Furniture and Equipment

•Leasehold Improvements – improvements on a leased asset that increase the value of the asset

•Land

•Buildings

3.Total Assets is the sum total dollar value of current and fixed assets.

4.Current Liabilities are those obligations that are usually paid within 12 months. They include, but are not limited to

•Accounts Payable

•Taxes Payable

•Loans Payable (due within one year)

•Current Portion of Long Term Debt

•Accrued Payroll and Withholding (includes any wages or withholdings owed to or for employees that have

not yet been paid)

5.Long Term Liabilities are any debts owed that are due more than one year out from the current date, including loans payable, e.g., mortgage, vehicle loan, bank loan.

6.Total Liabilities is the sum total dollar value of current and long term liabilities.

7.Owner’s Equity is the amount left when you subtract total liabilities from total assets. Examples:

Total Assets |

$ |

100,000 |

|

Total Assets |

$ 60,000 |

Total Liabilities |

- $ |

50,000 |

OR |

Total Liabilities |

- $ 75,000 |

Owner’s Equity |

$ |

50,000 |

(+) |

Owner’s Equity |

$ 15,000 |

C. Total Assets must equal the sum total of owner's total liabilities and owner’s equity (net worth). Examples:

Total Liabilities |

$ |

50,000 |

|

Total Liabilities |

$ 75,000 |

Owner’s Equity |

+ $ |

50,000 |

OR |

Owner’s Equity |

- $ 15,000 |

Total Assets |

$ |

100,000 |

|

Total Assets |

$ 60,000 |